Basic information

Bank of Yokohama is a commercial bank positioned as a regional financial institution. As one of the largest regional banks in Japan, it mainly serves individuals and small and medium-sized enterprises in Kanagawa Prefecture and surrounding areas, and its operating model is completely market-oriented with a focus on supporting the local economy.

name and background<

span style="font-family: sans-serif; color: black">Full name: The Bank of Yokohama, Ltd.

Founded: 1920

Headquarters location: Nishi-ku, Yokohama City, Kanagawa Prefecture,

JapanShareholder Background: Bank of Yokohama is part of Concordia Financial Group, Ltd., which was established in 2016 by the merger of Bank of Yokohama and Bank of East Japan and listed on the Tokyo Stock Exchange (stock code: 7186.T). The nature of the bank is private, not state-owned.

service scope

coverage area: It mainly serves the surrounding areas such as Kanagawa Prefecture and Tokyo Metropolitan Government in Japan, and its business is concentrated in core cities such as Yokohama City and Kawasaki City, and has not expanded to the world.

Branches and ATMs: As Japan's leading regional bank, Bank of Yokohama has an extensive network of offline branches and ATMs in its service area, and although the exact number is not disclosed, the density of coverage is among the highest among local banks.

services & products

personal customers: provide savings accounts, personal loans, investment products, etc., to meet the daily financial needs of residents.

Corporate customers: Provide loans, financing, cash management and other services for small and medium-sized enterprises to help local economic development.

Features: The product design closely follows the economic characteristics of Kanagawa Prefecture and focuses on the precise satisfaction of regional market demand.

regulatory and compliance<

span style="font-family: sans-serif; color: black" > regulator: Regulated by the Financial Services Agency (FSA) to ensure compliance and stability.

Deposit Insurance: Participate in the deposit insurance system of Japan, which is guaranteed by the Deposit Insurance Corporation of Japan to protect the safety of depositors' funds.

Compliance Record: There are no recent compliance issues in public information, and banks, as mature institutions, generally strictly comply with Japanese financial regulations.

financial health

Bank of Yokohama's financial position is stable and is subject to market scrutiny as a core subsidiary of Concordia Financial Group. Specific indicators such as capital adequacy ratio, non-performing loan ratio, and liquidity coverage ratio are not disclosed in public information, but their market position indicates that the overall financial reliability is high.

digital service experience<

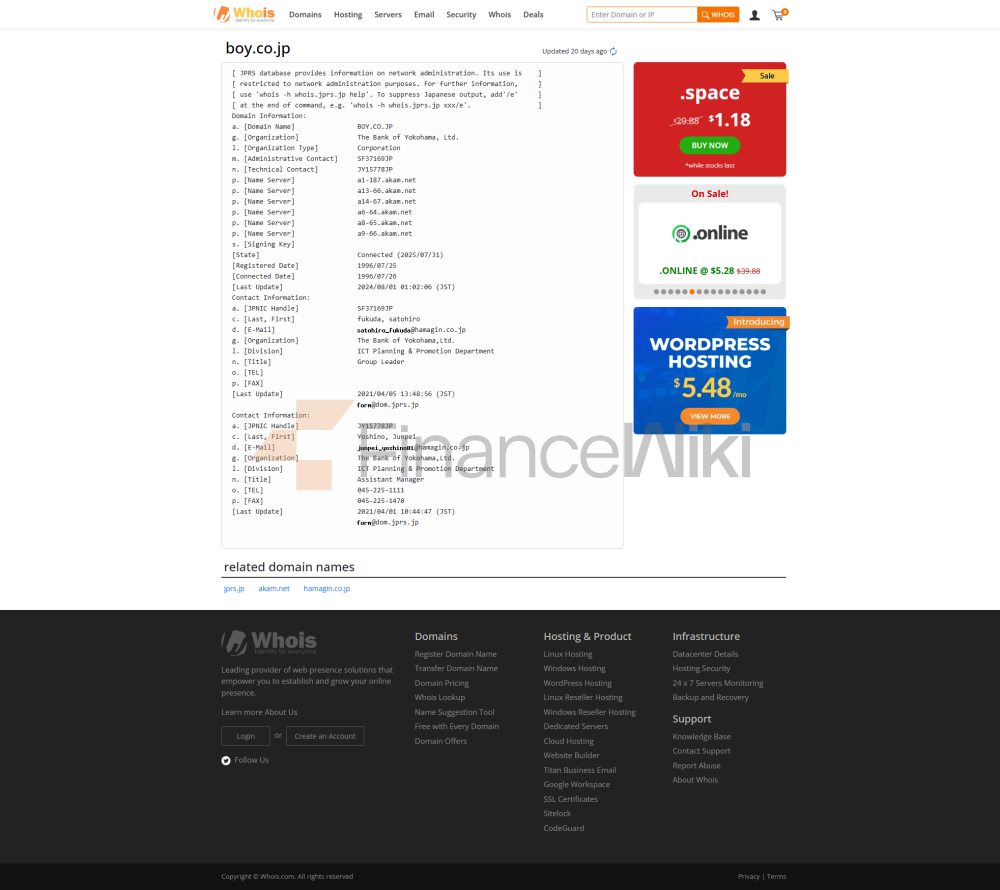

span style="font-family: sans-serif; color: black">Mobile Banking and Online Banking: Provide mobile banking and online banking services through the official website (https://www.boy.co.jp/) provides mobile banking and online banking services, supporting account management, transfers, bill payment and other functions.

Customer Service

support channels: provide telephone, email, online chat and other service methods to meet customer consultation needs.

Features: Aiming for an efficient and convenient service experience, especially for customers in Kanagawa Prefecture and surrounding areas.

security measures<

span style="font-family: sans-serif; "color: black" > security measures: data encryption, multi-factor authentication, real-time risk monitoring and other technologies are used to ensure the security of online banking, mobile banking and offline services.

Standard: Compliant with Japanese banking security regulations, technical details not disclosed.

featured services and differentiation<

span style="font-family: sans-serif; color: black" > Bank of Yokohama provides financial services tailored to the needs of its customers with a wide range of branches and a deep understanding of the local economy, based on its core strength in Kanagawa Prefecture and surrounding areas. In particular, it excels in SME support, and its ability to integrate Concordia Financial Group's resources has further strengthened its competitiveness compared to other small local banks.