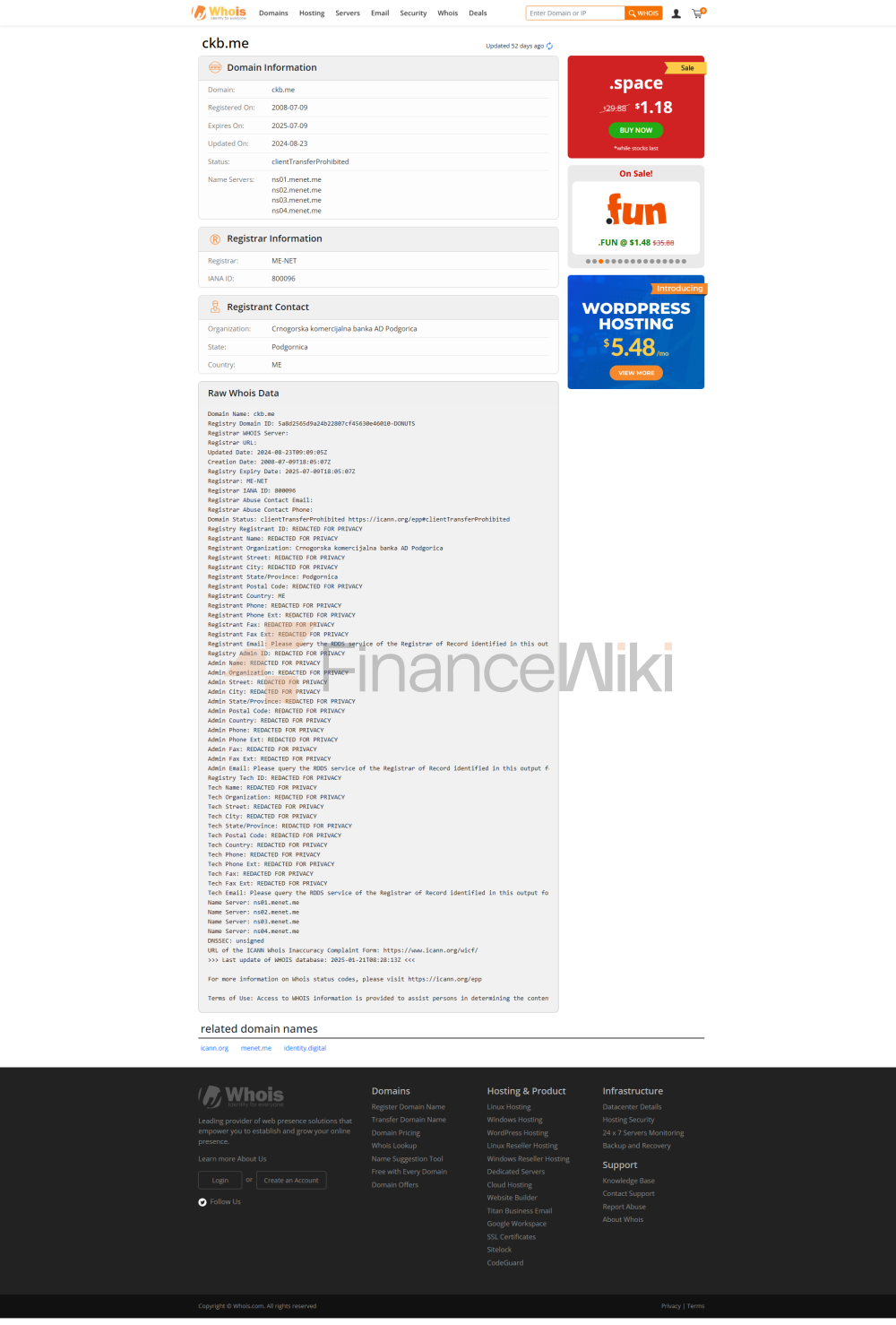

Basic Bank Information

Crnogorska Komercijalna Banka (CKB) was established in 1997 and is headquartered in Podgorica, the capital of Montenegro. As a commercial bank, CKB is currently the largest banking institution in Montenegro. Originally a local bank, it was acquired by the Hungarian OTP Bank Group in 2007 as one of its wholly owned subsidiaries. OTP Group is a leading financial group in Central and Eastern Europe, listed on the Budapest Stock Exchange and dominated by private and institutional investors. Therefore, CKB is a foreign-controlled private bank, which is not listed separately and is not a state-owned bank. After years of development and M&A expansion, including the acquisition of Société Générale's subsidiary in Montenegro in 2019, CKB is now a leading player in the Montenegrin banking sector.

Scope of Services

CKB's business services mainly cover the whole of Montenegro. The bank has an extensive offline service network in various regions of Montenegro, with about 35 business outlets (including sub-branches) and more than 115 ATMs, the largest number of outlets and ATM coverage in the country. Whether in the capital, coastal tourist cities, inland towns, you can find CKB branches that provide face-to-face banking services. In terms of international business, CKB does not have branches outside Montenegro, but relies on the regional network of its parent company, OTP Group, to provide cross-border financial services to its customers 。 For example, customers with CKB cards can withdraw money free of charge at more than 4,000 ATMs in countries where the OTP Group is located, such as Hungary, Croatia, and Serbia. In terms of cross-border remittance and foreign exchange exchange, CKB also has the corresponding capabilities to facilitate the flow of funds between local customers and Europe and other regions. In addition, the CKB welcomes foreign nationals to open an account with the bank, providing services such as English to meet the needs of international people and businesses in Montenegro. In general, CKB is based in Montenegro and radiates to the surrounding areas, combining online and offline to provide comprehensive banking services for customers across the country.

Regulation & Compliance

CKB is regulated and authorized by the Central Bank of Montenegro (Centralna banka Crne Gore). As a member of Montenegro's financial system, CKB must comply with Montenegro's laws and regulations on banking, anti-money laundering, anti-terrorist financing regulations, etc., and be subject to regular prudential regulatory inspections by the Central Bank. The CKB also participates in the Montenegro Deposit Protection Mechanism: according to the country's deposit insurance regulations, a single customer is protected up to 50,000 euros in the total principal and interest of deposits with each bank. In the event of a bank problem, the Deposit Protection Fund will pay the insured amount to the customer, enhancing the security of the deposit. In terms of internal compliance, CKB has established a sound compliance management and risk control system, formulated internal systems such as the Code of Ethics, Anti-Corruption Policy, and Sanctions Compliance Policy, and learned from OTP Group's compliance standards for employee training and business supervision.

Financial health

As the largest bank in Montenegro, CKB is among the best in the industry in terms of financial soundness. In terms of capital adequacy ratio, according to the latest disclosed data, CKB's total capital adequacy ratio is approximately 19.5% (Q1 2024), well above the regulatory requirement of 8% (Montenegrin regulatory minimum standard) and the local recommended level of 12%. The core Tier 1 capital adequacy ratio (CET1) is also above 19%, indicating ample capital buffers. This means that the bank has strong risk resilience and room for expansion. In terms of non-performing loan ratio (NPL), CKB's non-performing loans (NPLs) to total loans are at a low level. In recent years, the overall NPL of the banking sector in Montenegro has gradually declined, reaching around 4% as of mid-2024. As a market leader, CKB has passed strict credit approval and active non-performing asset collection, and its non-performing asset ratio is basically the same as or lower than that of the industry, maintaining a low single-digit percentage range, and there is no excessive burden of non-performing assets. The Liquidity Coverage Ratio (LCR) also performed well. As of the first quarter of 2024, CKB's LCR is about 243%, significantly exceeding the regulatory requirement of 100%. This indicates that the bank has abundant and highly liquid assets and can easily cope with short-term large withdrawals and capital fluctuations.

In terms of profitability and operational efficiency, CKB's indicators are also very impressive. In 2024, the bank's total assets increased by about 9.2% year-on-year, accounting for more than 26% of the industry's market share. The net profit of that year ranked first among domestic banks, driving the return on assets (ROA) to about 3.3% and the return on equity (ROE) to about 20.9%, much higher than the average level of the banking industry in Montenegro. The high profitability supported the bank's continued capital replenishment and provision level, further consolidating its financial health. On the whole, CKB has sufficient capital, good asset quality and abundant liquidity, and is in a leading position in Montenegro in terms of financial soundness, providing a solid guarantee for the safety of customers' funds and the sustainable development of business.

Deposit & Loan Products

Deposit Products: CKB provides a variety of deposit products for individuals and enterprises, including demand deposits and time deposits. Demand deposits (current savings/demand accounts) typically have very low interest rates that are almost negligible (close to 0 per annum) and are primarily focused on providing the on-demand convenience of funding. In terms of fixed deposits, the bank offers a choice of tenors ranging from short-term to long-term (e.g. 1 month, 3 months, 6 months, 1 year or even longer). However, due to the low interest rate environment in the eurozone as a whole, the interest rate on CKB's fixed deposits is relatively low. The industry evaluates CKB's deposit interest rate as the lowest in the market. For example, a 6-month or 1-year fixed deposit may have an interest rate of less than 1% per annum, which is not competitive with a slightly higher interest rate for smaller banks. This also reflects that CKB, as a leading bank, does not rely on high-interest deposits. At the same time, CKB has launched special savings products for specific customer groups, such as children's savings accounts, to help parents save money for their children, and may give some incentives in terms of interest rates or gifts. For large deposit customers, banks usually do not disclose "large certificates of deposit" products with higher interest rates, but VIP customers can negotiate with banks to customize interest rates and term plans. Overall, CKB's deposit products are safe and stable, but the interest rate return is relatively average, which is suitable for customers who value the safety of funds over returns.

Loan products: CKB's loan business covers various areas of consumer finance and commercial loans. The main personal loan products include home mortgage loans, car loans, and unsecured consumer loans, as well as loans for specific groups. Mortgage loans (mortgages) are one of the important businesses of CKB, and the interest rate level is competitive in the Montenegrin market. The current mortgage interest rate is about 5% per annum, and there are two options: fixed interest rate and variable interest rate. For example, customers can choose a fixed interest rate of about 4.99% p.a., or a floating rate option of "Eurozone 6-month EUROIBOR rate + about 2.99%" (adjusted as the euro market interest rate changes). Loan terms can be up to 20 to 30 years, allowing for long-term repayment, and buyers are generally required to provide a down payment of around 20% and borrow up to 80% of the property's appraised value. For specific cooperative projects, CKB also launches co-branded mortgages, such as providing preferential mortgages in cooperation with large developers, to promote real estate business. In terms of car loans, CKB does not have a separate significant car loan product (some customers who need to buy a car may directly choose an unsecured consumer loan), but if you apply for a specific purpose loan to buy a car, the annual interest rate is usually around 6-8%**, and the term is mostly about 5 years, requiring a down payment ratio and vehicle mortgage protection. In some cases, CKB works with car dealers to offer activities such as preferential interest rates or interest-free installments to attract car buyers.

Security In

terms of capital and information security, CKB has taken multiple measures to provide customers with solid guarantees. First of all, CKB is one of the member banks of the Montenegro Deposit Insurance Program. Under the scheme, individual and SME deposits opened with the CKB are insured by the National Deposit Protection Fund for up to €50,000 in aggregate principal and interest of a single customer's deposits with the bank. In the event of an extreme situation, such as the bankruptcy of a bank, the client is entitled to compensation through this mechanism (in accordance with the proportions and procedures established by Montenegrin law). This system effectively protects the interests of the vast majority of ordinary depositors and enhances the public's confidence in depositing in CKB. Secondly, CKB attaches great importance to transaction security and anti-fraud. Relying on OTP Group's technology platform, CKB has deployed an advanced real-time risk control system to monitor account transactions 24/7. If you find an unusual large-value transfer, overseas card swiping or suspicious pattern transaction, the system will automatically mark a reminder, or even temporarily block the transaction and notify the cardholder for verification. In terms of payment verification, CKB's e-banking and card transactions both support two-factor authentication: for example, a password + SMS verification code is required to log in to online banking, and online card payment verifies the identity of the cardholder through 3D Secure (SMS OTP password). These measures greatly reduce the risk of account compromise. CKB also provides customers with free SMS notification or mobile app push service, which will notify customers immediately whenever there is any change in the account (withdrawal, consumption, transfer), and customers can immediately find out and contact the bank for disposal in case of unauthorized transactions.

Differentiated services: CKB leverages OTP Group's strong technology and resources to provide some services that are unique in Montenegro. For example, CKB is one of the few local banks to support contactless mobile payments, and in addition to Apple Pay, it has also launched its own digital wallet app, which can digitize multiple bank cards and manage payments on mobile phones in one place. In another example, CKB took the lead in deploying open banking interfaces in the local area, cooperating with some fintech apps to provide customers with novel services such as personal financial analysis and third-party investment platform docking, and is at the forefront of financial innovation. For those doing business across borders, CKB offers a bilingual online banking interface in English and Chinese as well as instant cross-border remittance services, enabling customers to conveniently move funds between Montenegro and neighbouring countries. CKB also often organizes customer feedback activities and value-added services: for example, credit card cashback and installment discounts are launched every summer for the peak tourist season to encourage local customers to spend in China; For families studying abroad, we provide a waiver or exemption of tuition fees for cross-border remittance fees; For corporate customers, it provides free employee financial quotient lectures, trade finance consultation, etc. All these initiatives increase the added value of CKB in the eyes of its customers and clearly distinguish it from its competitors.

Market Position & Accolades

CKB is one of the leading banks in Montenegro. CKB is the number one commercial bank in the country by asset size. At the end of 2023, CKB had total assets of approximately 1.733 billion euros, accounting for about 29% of the assets of the entire banking sector in Montenegro (about 26.1% in the first quarter of 2024), far exceeding the market share of the second-ranked bank. CKB is the industry leader in terms of both deposit balance and loan volume: its deposit scale accounts for about one-third of the country's bank deposits, and the loan balance accounts for more than a quarter of the industry's total loans. In terms of customer base, CKB has more than 300,000 individual and corporate customers, which is a very high penetration rate for Montenegro, a small country with a total population of less than 700,000. This means that almost one out of every two Montenegrins is a CKB customer. Through the acquisition and merger of the former Société Générale Black Mountain subsidiary in 2019, CKB further expanded its leading position, and its branch network and customer base became the largest in China in one fell swoop. According to the reports released by the Central Bank of Montenegro, CKB ranks first in all major bank indicators (assets, deposits and loans, market share, profitability, etc.) and is the mainstay of the country's banking system.