basic bank information

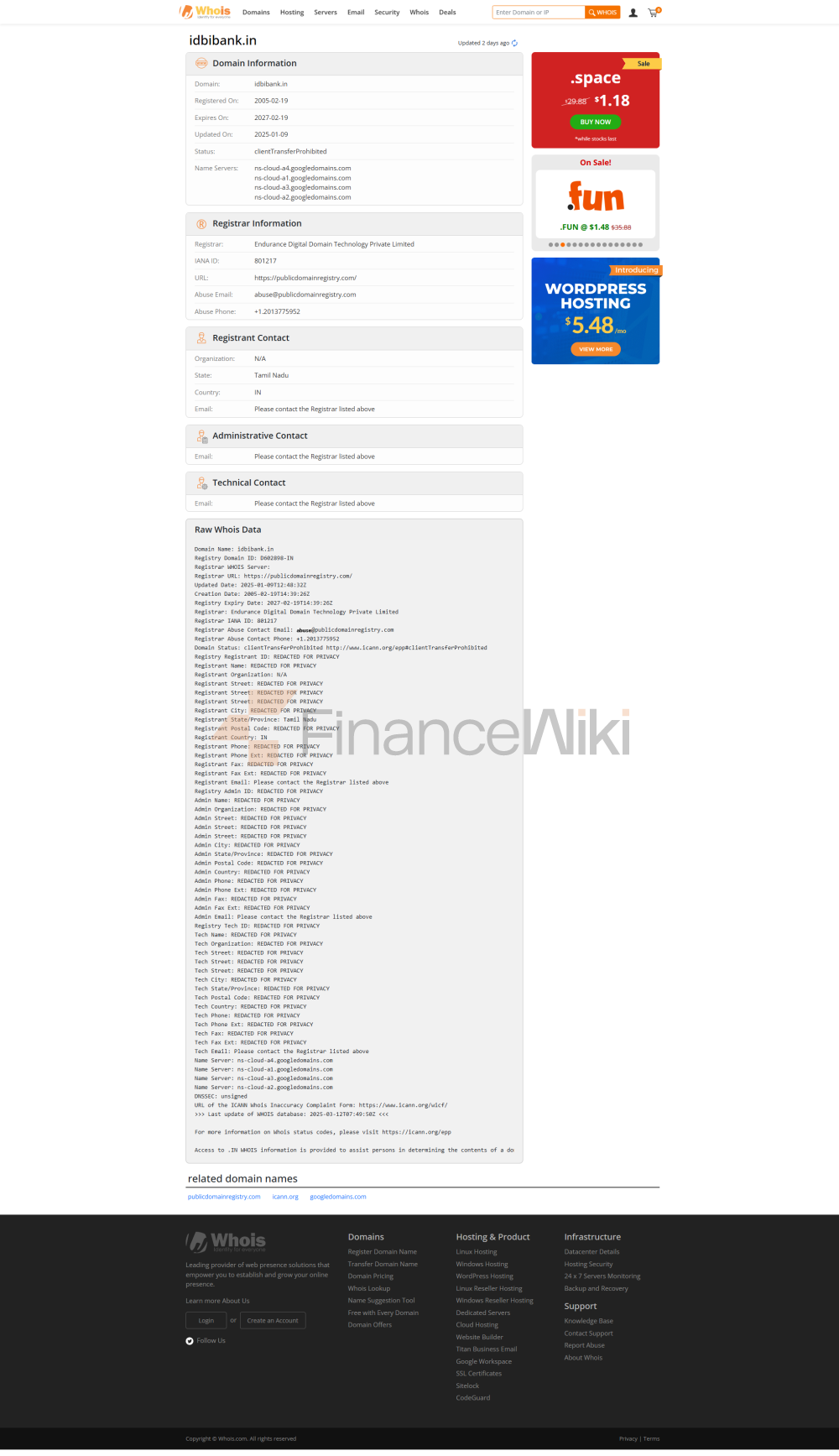

IDBI Bank is a well-known state-owned financial services company in India, formerly known as "Industrial Development Bank of India", established in 1964 and headquartered in Mumbai. The bank is controlled by the Government of India, is a state-owned banking system, and has a significant presence in the Indian financial market.

IDBI Bank's service scope is mainly concentrated in India, with an extensive network of offline outlets and ATM distribution, ensuring that customers can easily deposit and withdraw money and handle various banking services across the country.

regulatory and compliance

As a state-owned bank of India, IDBI Bank is regulated by the Reserve Bank of India (RBI) and follows the Indian Banking Regulatory Standards. The bank has joined the Deposit Insurance Corporation of India (DICGC) under the Deposit Insurance and Credit Guarantee Corporation of India (DICGC) and is insured up to Rs 500,000 per depositor.

financial health

IDBI Bank's capital adequacy ratio is in line with the RBI's regulatory requirements, ensuring that it has sufficient capital buffers to cover potential risks. Key indicators such as non-performing loan ratio (NPA) and liquidity coverage ratio (LCR) are disclosed on a regular basis to reflect the quality of its assets and its short-term solvency.

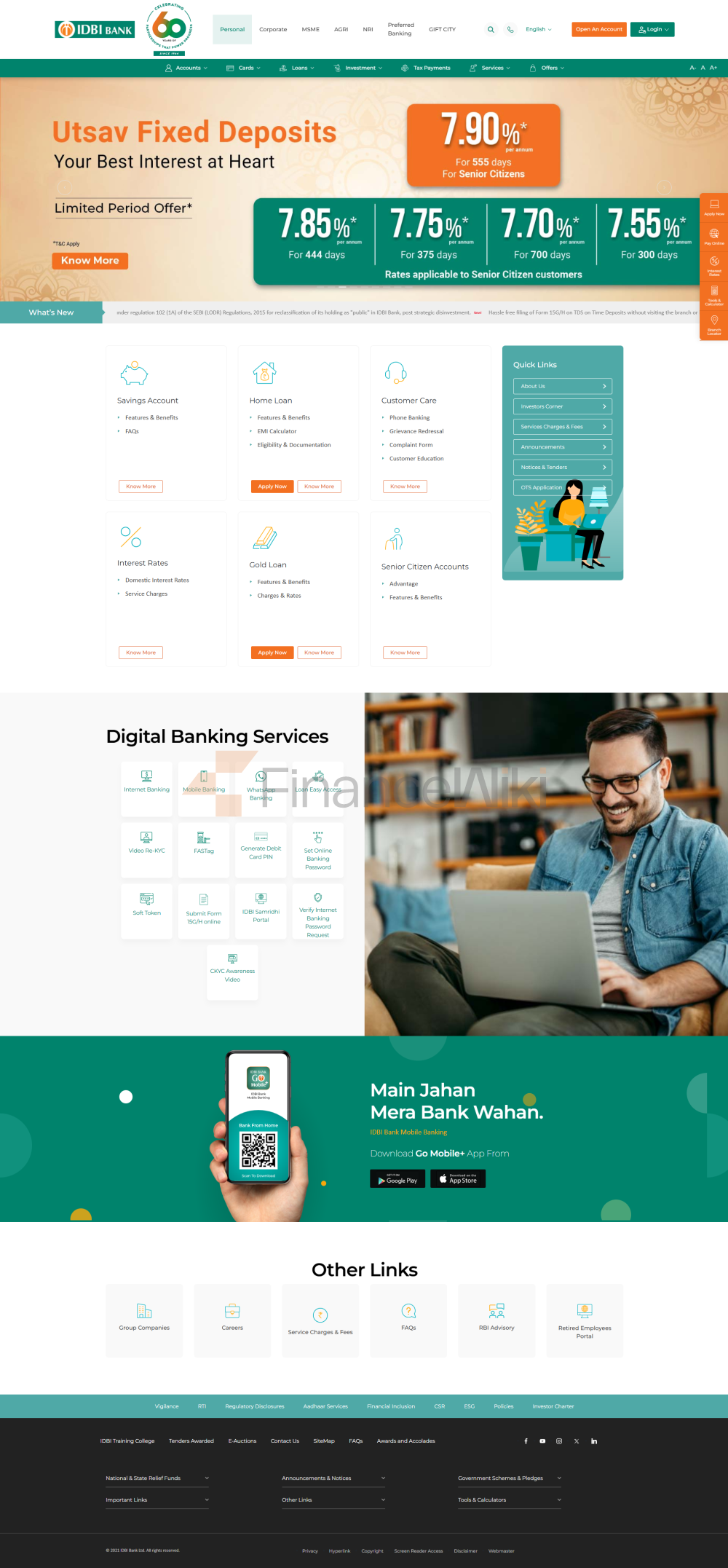

deposit and loan products

deposits: IDBI Bank offers a wide range of deposit products, including demand deposits, term deposits (FD) and high-yield savings accounts. Its 700-day special fixed deposit program offers up to 8.00% APR for seniors and 7.25% for regular customers.

loans: The bank offers mortgages, car loans and personal lines of credit, with interest rates adjusted according to market conditions, and flexible repayment options, such as equal principal and interest and interest-after-principal repayment options.

a list of common expenses

IDBI Bank charges an account management fee (if the account balance is below the minimum requirement), an inter-bank ATM withdrawal fee (2-4 yuan per transaction) and a transfer fee (depending on the type of transaction). Clients should be aware of the minimum balance limit to avoid additional fees.

digital service experience

IDBI Bank's mobile app and online banking platform support face recognition, real-time transfers, bill management, and investment tool integration, and the user experience score is high. The bank has also introduced AI customer service and robo-advisors to improve the efficiency of digital services.

customer service quality

IDBI Bank provides 24/7 phone support, live chat and social media customer service, with high complaint handling efficiency and short average resolution time. In addition, the bank supports multilingual services for the convenience of non-Hindi users.

security measures

IDBI Bank uses advanced anti-fraud technologies such as real-time transaction monitoring and complies with international data security standards (such as ISO 27001). To date, no major data breaches have been reported.

featured services and differentiations

IDBI Bank launched the "IDBI Naman Senior Deposit" program to provide additional interest rates to senior customers. In addition, the bank also has high-net-worth clients and provides customized financial solutions.

market position and honors

IDBI Bank is a leading among India's state-owned banks and was named to Forbes Global 2000. In recent years, the bank has gained industry recognition for its innovative deposit products and digital services.