📋 Basic Bank Information

OCBC Indonesia is a commercial bank, not a state-owned or joint venture bank. It is controlled by OCBC Bank in Singapore, a foreign-backed commercial bank that focuses on providing retail banking, SME banking and corporate banking services, with small and medium-sized enterprises (SMEs) as its main customer base. With its robust operations and extensive service network, OCBC Indonesia occupies an important position in the Indonesian banking industry.

🏛️ Name and background

full name :P T Bank OCBC NISP Tbk

was founded on April 4, 1941 as "NV Nederlandsch Indische Spaar en Deposito Bank" The name was established in Bandung, Indonesia.

Head Office Location: OCBC Tower, Jl. Prof. Dr. Satrio Kav. 25, Jakarta 12940,

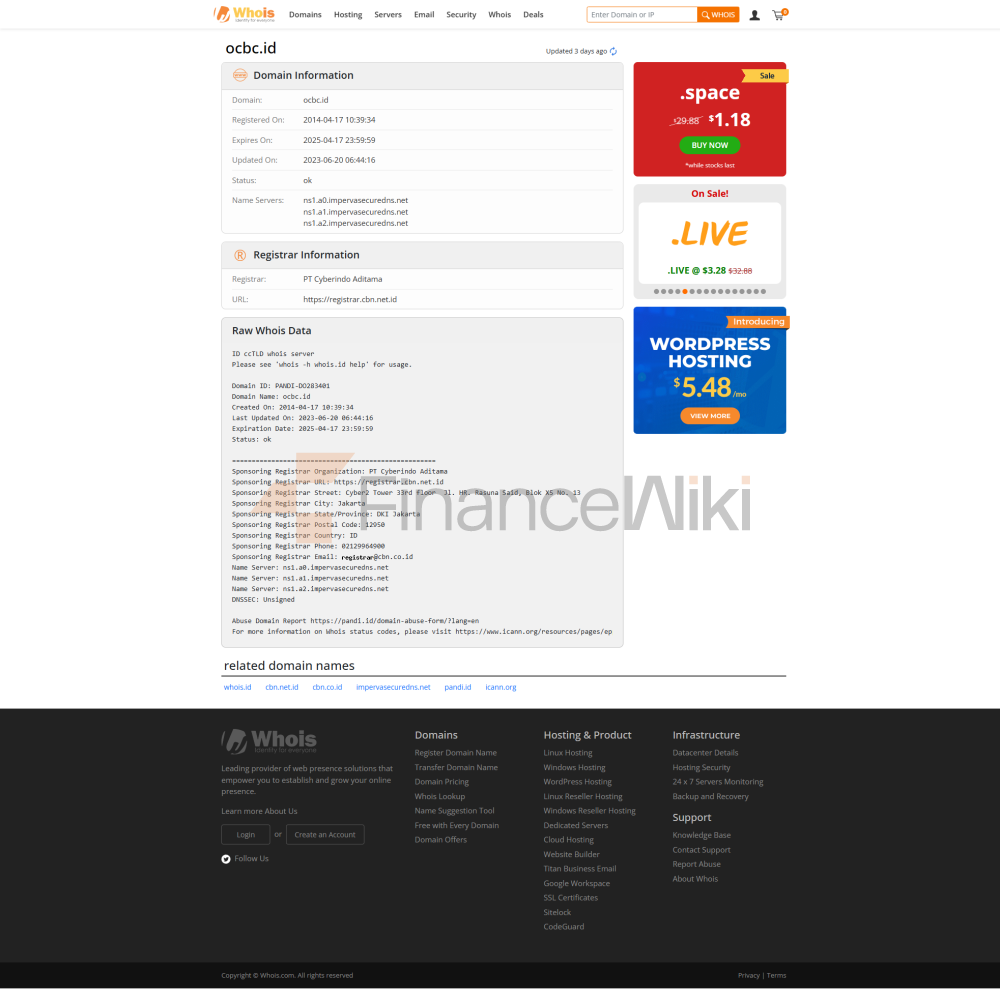

IndonesiaShareholder Background: OCBC Bank (Singapore) holds 85.1% of the shares, with the remainder held by the public. OCBC Indonesia is a listed company on the Indonesia Stock Exchange (IDX) under the ticker symbol "NISP", which is a privately owned, non-state-owned bank. Its parent company, OCBC Bank, is the second-largest bank in Southeast Asia, with high ratings of Aa1 (Moody's) and AA- (Standard & Poor's).

History: Changed its name to PT Bank Nilai Inti Sari Penyimpan (Bank NISP) in 1981, changed its name to PT Bank OCBC NISP Tbk after being acquired by OCBC Bank in 2008, and unified its brand name as OCBC Indonesia in November 2023.

🌍 Scope of

services

Coverage area: Mainly serving the whole of Indonesia, covering 54 cities, it is a regional bank, and indirectly touches the global market such as Singapore, Malaysia, and China through the network of its parent company OCBC Bank.

Number of offline outlets: As of 2024, it has about 337 branches and offices in major cities in Indonesia, such as Jakarta, Bandung, Surabaya, etc.

ATM distribution: It has 780 self-owned ATMs and shares more than 37,500 ATMs through ATM Bersama, Bank Central Asia and other networks, covering the whole of Indonesia, greatly facilitating customer withdrawal and inquiry services.

⚖️ Regulatory & Compliance

regulator:

Otoritas Jasa Keuangan (OJK): Indonesia's Financial Services Authority, Responsible for the supervision of banking business.

Bank Indonesia (BI): Indonesia's central bank, responsible for monetary policy and part of banking supervision.

Deposit Insurance Program: OCBC Indonesia is a member of Lembaga Penjamin Simpanan (LPS) (Indonesia Deposit Insurance Corporation), and customer deposits are protected up to a certain limit (up to IDR 200 million, about US$13,000).

Recent Compliance Record: No material breaches, signed an agreement with the Commonwealth Bank of Australia (CBA) in November 2023 to acquire a 99% stake in PT Bank Commonwealth, and the transaction is pending OJK approval, indicating aggressive expansion and compliance with regulatory requirements. OCBC Indonesia has a AAA(idn)/stable credit rating assessed by PT Fitch Ratings Indonesia, indicating its compliance and financial soundness.

💰 Financial health

Capital Adequacy Ratio (CAR): As of 2023, it is approximately 21.8%, well above the minimum standard of 8% required by OJK, demonstrating its strong capital strength and ability to effectively withstand risks.

Non-Performing Loan Ratio (NPL): Approximately 1.5%, which is lower than the Indonesian banking industry average (approximately 2.5%), reflecting the high quality of its loans.

Liquidity Coverage Ratio (LCR): Approximately 150%, well above the 100% required by OJK, indicating that it is liquid enough to meet short-term funding needs.

Quick Verdict: OCBC Indonesia is in a sound financial position, with ample capital and liquidity, and well-controlled non-performing loans, making it suitable for customers looking for stable banking services.

💵 Deposit & Loan

Products

deposit class:

demand deposits: e.g. "Tabungan OCBC", the annualized interest rate is about 0.25%-0.50% , with no minimum balance requirement, suitable for day-to-day money management.

Fixed Deposits: Available with maturities ranging from 3 months to 36 months, with interest rates ranging from 2.5% to 4.5% (depending on the deposit amount and tenor).

High-yield savings account: such as "Tabungan Berencana", the annual interest rate can reach 5%, and a fixed monthly deposit is required, which is suitable for long-term savers.

Large Certificate of Deposit (CD): Offering high-value deposit products with interest rates of up to 5.5% and a minimum deposit of IDR 100 million (about US$6,500).

Loans:

Mortgages: Annualized interest rate of about 6.5%-8.5%, loan tenure of up to 20 years, minimum loan amount of IDR 100 million. Fixed and variable rate options are available, and flexible repayment supports early repayment (1%-2% processing fee applies).

Car loan: The annualized interest rate is about 5.5%-7.5%, the loan term is up to 7 years, and the down payment is as low as 20% for new and used cars.

Personal Line of Credit: Such as "Kredit Tanpa Agunan (KTA)", with an annualized interest rate of 8%-12%, a maximum loan amount of IDR 200 million, no collateral, and the approval time is about 3-5 working days.

Flexible repayment options: Early repayment, adjustment of repayment plan (application required), and deferred principal payments (interest-only) are allowed on some loan products.

💸 List of common expenses

account management fee: about IDR 10,000-20,000 (about 0.65-1.3 USD) per month for current accounts, and no monthly fee for high-end accounts (such as priority banks).

Transfer fee:

Domestic transfers: Free via online banking or APP, about IDR 25,000 (about US$1.6) per over-the-counter transfer.

Cross-border transfers: approximately $20-$50 per transaction, depending on the amount and destination.

Overdraft fee: Current account overdraft is calculated with interest on a daily basis, with an interest rate of about 15%-18%/year.

ATM interbank withdrawal fee: Approximately IDR 6,500 (approximately US$0.4) per transaction through the ATM Bersama network, free of charge at its own ATM.

Hidden Fee Alert: Some accounts require a minimum balance (e.g. IDR 500,000, about USD 32), otherwise a penalty of IDR 10,000-25,000 per month will be deducted. It is advisable to review the terms of your account regularly to avoid accidental charges.

📱 Digital service experience

APP & Online Banking:

OCBC Mobile Banking: Rated 4.5/5 on Google Play (based on 100,000+ reviews), 4.7/5 on the App Store, user-friendly interface, and supports Indonesian and English.

Core functions: support face recognition login, real-time transfer (free in China), bill management (utility bills, mobile phone recharge), investment tools (such as fixed deposit purchase, fund investment).

Technological innovation:

AI customer service: Provide 24/7 chatbots to deal with common problems (such as balance inquiry, transfer status), and complex problems can be transferred to human.

Robo-advisors: Fund and stock investment advice through OCBC Sekuritas, suitable for retail investors.

Open banking API: Supports interconnection with third-party fintech platforms, such as payment gateways and e-commerce platforms, to improve the service ecosystem.

🤝 Customer service quality

service channel:

24/7 phone support: +62-21-25533888 with round-the-clock customer service.

Online chat: Provide real-time chat through the APP and official website, and the response time is about 1-3 minutes.

Social Media: Active on Instagram and Twitter with a response time of about 1-2 hours.

Complaint handling:

complaint rate: below the industry average (about 0.5% of customers submit formal complaints).

Average resolution time: 1-3 business days for simple issues and 7-14 working days for complex issues (such as loan disputes).

Customer satisfaction: Approximately 85% of customers are satisfied with the handling of complaints (based on internal research).

Multi-language support: Indonesian and English services are available, and some high-end customers can enjoy Chinese support, which is suitable for cross-border users.

🔒 security measures

security of funds:

deposit insurance: Deposits of up to IDR 200 million are guaranteed through LPS, covering current, term and high-yield accounts.

Anti-fraud technology: real-time transaction monitoring, OTP (one-time password) verification, abnormal login warning, reduce fraud risk.

Data Security:

ISO 27001 certification: OCBC Indonesia's data centers are ISO 27001 certified to ensure information security management compliance.

Data breaches: There have been no publicly reported major data breaches in the past five years, indicating strong data protection capabilities.

🌟 Featured services and differentiation

Market Segments:

student accounts: such as "Tabungan Pelajar", no management fee, minimum balance requirement of only IDR 100,000, suitable for the student group.

Senior-only banking: SeniorCare is a combination of high-yield deposits and insurance products to meet the needs of retirees.

Green financial products: Support ESG (environmental, social, governance) investments, such as green bonds and sustainable SME loans, to attract environmentally conscious customers.

High-net-worth services:

Private banking threshold: minimum assets of IDR 50 million (about US$3,200), providing customized wealth management, global investment portfolios and dedicated relationship manager services.

Customized financial solutions: including offshore investment, trust services and family wealth planning, suitable for high-net-worth customers.

🏆 Market position and accolades

Industry rankings: OCBC Indonesia is the 8th largest bank in Indonesia by assets, and its parent company, OCBC Bank, is ranked in the top 50 among global banks (Global Finance).

Awards:

- won

the "Best SME Bank in Indonesia" award by The Asian Banker in 2023.

In 2022, it won Euromoney's "Best Digital Banking Innovation" award for the user experience of its mobile banking platform.

Market reputation: Known for robustness and SME services, especially in digital transformation and customer experience.