Name

and Background

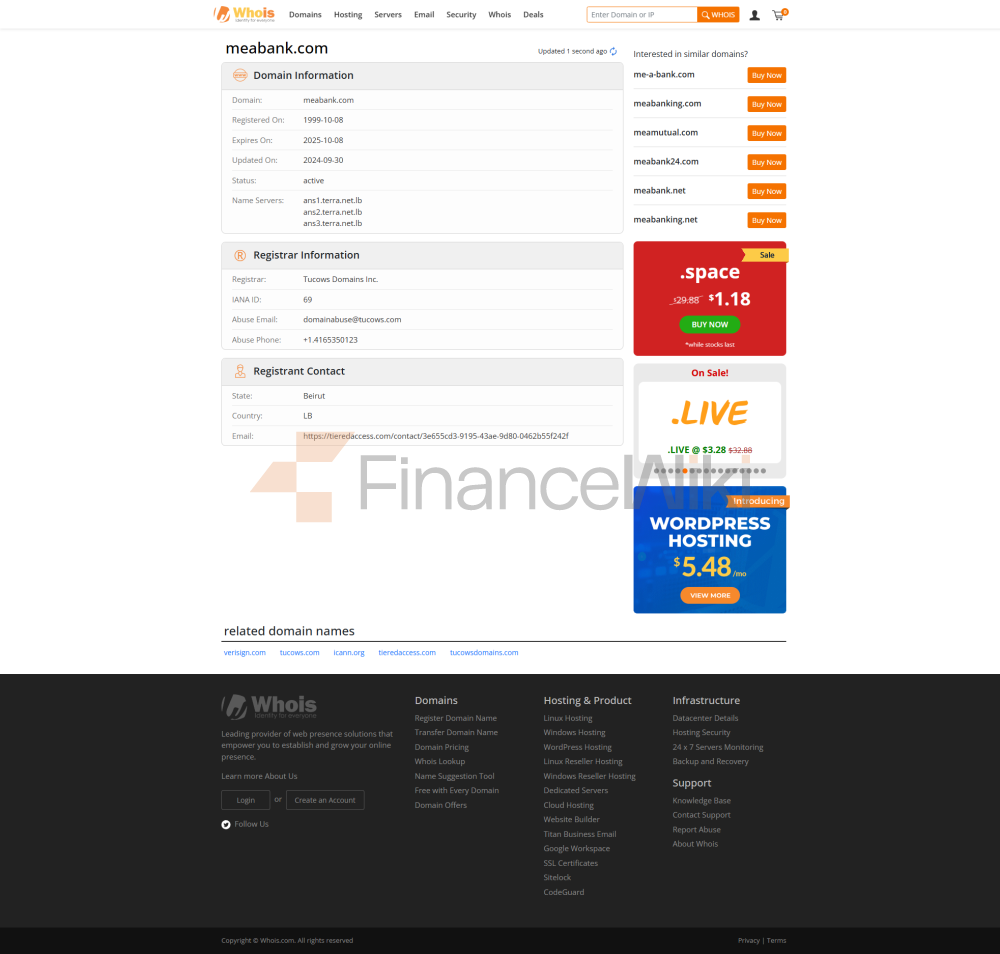

of the BankMiddle East and Africa Bank S.A.L. (MEAB) is a private commercial bank headquartered in Beirut, Lebanon. Since its inception, MEAB has grown from a small business bank to a full-service bank with more than 20 branches in Lebanon and two branches in Iraq.

Scope of Services

: MEAB's services mainly cover Lebanon and Iraq, offering a wide range of personal and corporate banking services. Its extensive branch network in Lebanon ensures full coverage of local customers.

Regulation &

ComplianceMEAB is regulated by the Central Bank of Lebanon (Banque du Liban) and the Commission for Banking Supervision. The bank follows an AML and CFT compliance manual that clarifies the responsibilities for implementing a compliance program and is followed by all bank staff.

financial health

, capital adequacy ratio

As of 2016, MEAB increased its capital from 156 billion Lebanese pounds (US$103.48 million) to 186 billion Lebanese pounds (US$123.38 million), enabling capital expansion through the issuance of 3 million ordinary shares with a par value of 10,000 Lebanese pounds.

The non-performing loan ratio and liquidity coverage ratio of

MEAB are not publicly disclosed at this time. Users who are interested in learning more are advised to contact their bank directly for the latest information.

Deposit & Loan ProductsDeposit

products

MEAB offers a variety of personal banking services, including current and term deposit accounts. In addition, the bank also provides safe deposit box services to ensure the safety of customers' valuables.

Loan products

: MEAB provides a wide range of loan services to individual customers, including home loans, car loans, and personal lines of credit. The specific interest rate and application conditions may vary depending on the type of product and the customer's background, so it is recommended to consult the bank directly for details.

a list of

common expenses

MEAB's service fees may include account management fees, transfer fees, overdraft fees, and ATM interbank withdrawal fees. The specific fee standard has not been disclosed in public channels, and customers are advised to consult the bank for relevant fee information in detail before opening an account or using specific services to avoid unnecessary expenses.

digital service experience

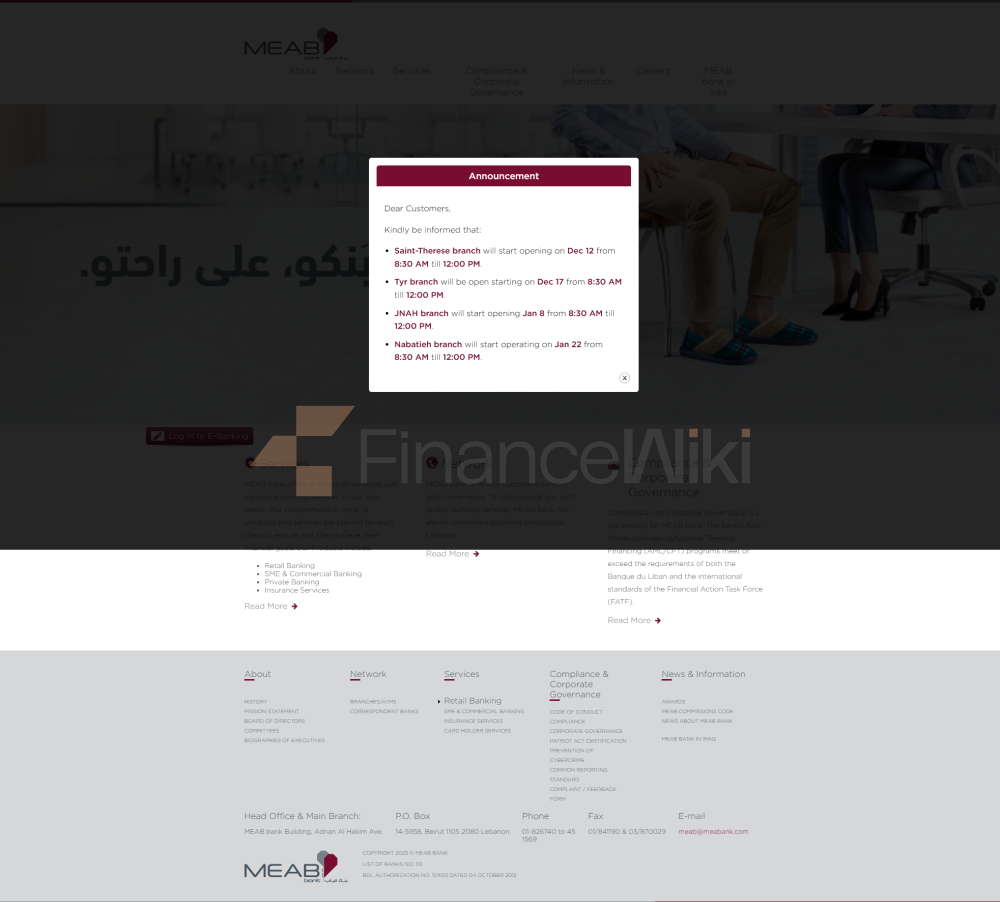

APP and online banking

MEAB offers online banking services that customers can access and manage their accounts through their official website. At this time, no specific information about its mobile application (App), including user ratings and core features, can be found in public channels. Interested users are advised to visit the bank's official website directly or contact customer service for the latest digital service details.

Technological innovations

: There is currently no public disclosure of MEAB's technological innovations in AI customer service, robo-advisors, or open banking API support. It is advisable to keep an eye on the bank's official announcements or press releases to stay up-to-date on technological developments.

customer

service quality

service channel

MEAB has a round-the-clock customer service hotline (phone: 1569) to provide 24/7 support to customers.

Complaint Handling & Multilingual SupportThere

is currently no public information on the efficiency of complaint handling, user satisfaction, and whether MEAB offers multilingual services. Customers with specific needs are advised to contact the bank directly to find out what it is capable of doing in these areas.

security measures

: security offunds

MEAB follows Lebanese banking regulations, maintains statutory reserves, and implements an Asset Liability Management Committee (ALCO) to manage the bank's portfolio.

Data securityThere is

currently no public information on whether MEAB is ISO 27001 certified or whether there has been a data breach. It is advisable to pay attention to the bank's official announcement or contact customer service for relevant information.

featured services and differentiations

MEAB offers a diverse range of personal banking services designed to meet the needs of different customer segments. However, there is no public disclosure on whether it offers special products for students, seniors or high-net-worth clients. Customers with specific needs are advised to consult the bank directly for specific details of their products and services.

market

position and honors

MEAB has a presence in the Lebanese banking sector, offering a comprehensive range of banking services. However, there is no public disclosure about its global or domestic asset size rankings, and whether it has won accolades such as "Best Digital Bank" or "Most Innovative Award".