🏦 Basic Bank Information

BTPN is a commercial bank, not state-owned or joint venture banks. It is a subsidiary of Sumitomo Mitsui Banking Corporation (SMBC, Japan's second-largest bank) and is a privately owned commercial bank controlled by foreign capital. BTPN was formed in 2019 by the merger of PT Bank Tabungan Pensiunan Nasional Tbk and PT Bank Sumitomo Mitsui Indonesia and was renamed as PT Bank SMBC Indonesia Tbk in October 2024. Listed on the Indonesia Stock Exchange (IDX) under the ticker symbol BTPN, the bank is a fully private listed company with no state-owned component.

📜 Name and background

full name:P T Bank SMBC Indonesia Tbk (formerly PT Bank Tabungan Pensiunan Nasional Tbk).

Founded: Originally established in 1958 under the name Bank Pegawai Pensiunan Militer (BAPEMIL) to serve the administration of pensions for veterans. In 1960, it was converted into a commercial bank, and in 1986 it was renamed BTPN.

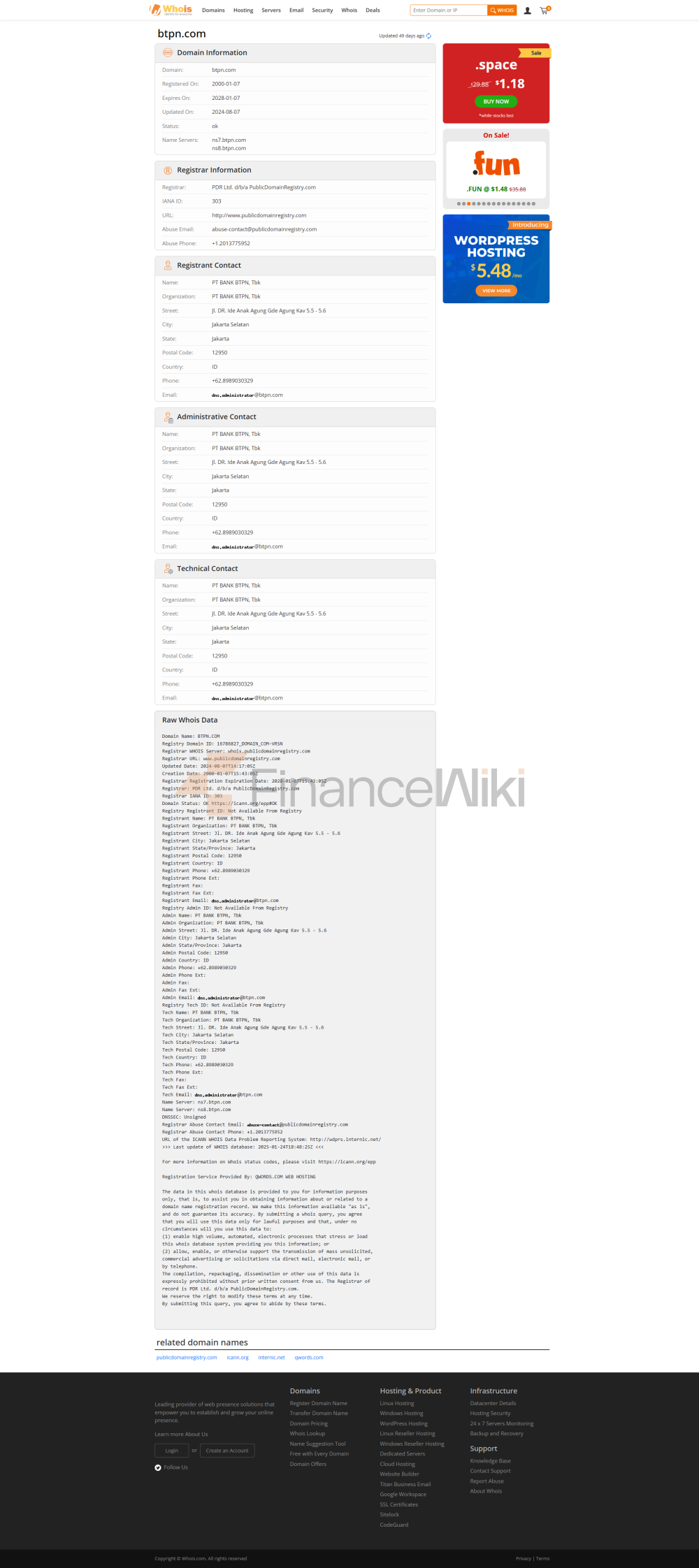

Head Office Location: Menara BTPN, CBD Mega Kuningan, Jl. Dr. Ide Anak Agung Gde Agung Kav. 5.5 – 5.6, Jakarta 12950, Indonesia.

Shareholder Background: The main shareholder is Sumitomo Mitsui Financial Group (SMFG), which is controlled by SMBC. In 2008, TPG Capital held a 71.6% stake, which was gradually acquired by SMBC. BTPN was listed on the Indonesia Stock Exchange in 2008 and is currently fully private with no government ownership.

Background: BTPN started as a service veteran and gradually expanded to include micro and small enterprise (MSME), retail and corporate customers, and in recent years, its integration with SMBC has strengthened its market competitiveness by gaining support from the international capital market.

🌍 Scope of services

Coverage area: Mainly serving Indonesia, business concentrated in China, no significant global business. The service area covers Java, Sumatra, Kalimantan, Sulawesi, Bali and Nusa Tenggara.

Number of offline outlets: As of 2020, BTPN has approximately 539 branches (including micro-enterprise service outlets), which may be adjusted due to mergers and optimizations.

ATM distribution: BTPN provides a wide range of ATM services through its partnership with the ATM Prima network, the exact number of ATMs is not disclosed, but it covers major cities and some remote areas to support the needs of traditional bank customers. In addition, BTPN has expanded its services to remote areas through branchless banking.

Features: BTPN's branch and ATM layout focuses on micro-enterprises and the mass market, combined with digital platforms such as Jenius to reduce reliance on physical outlets.

🛡️ Regulatory & Compliance

regulators:

Otoritas Jasa Keuangan(OJK , Indonesian Financial Services Authority): responsible for banking licensing and overall supervision.

Bank Indonesia (BI, Bank Indonesia): Regulates monetary policy and some banking activities.

Lembaga Penjamin Simpanan (LPS, Indonesia Deposit Insurance Institution): Provides insurance for deposits.

Deposit Insurance Program: BTPN is an LPS member, and customer deposits are protected with an insurance amount of up to IDR 2 billion (approximately USD 13,000, depending on the exchange rate) for eligible depositors.

Recent compliance records: No major violations recorded. BTPN strictly adheres to the regulatory requirements of OJK and BI, and regularly discloses financial and operational reports. After the name change in October 2024, the regulatory clearance has been renewed with good compliance. In 2023, BTPN received the Annual Report Award for its compliance performance in transparency and governance.

💰 Financial health

key metrics (based on September 2024 data):

Capital Adequacy Ratio (CAR) : 29.8%, well above the minimum standard of 8% required by OJK, indicating a strong capital buffer capacity.

Non-performing loan ratio (NPL): 2.16%, slightly higher than 1.47% in 2023, but lower than the industry average of 2.26%, with stable credit quality. Part of the NPL increase was attributed to the non-performing financing of its subsidiary, OTO Group.

Liquidity Coverage Ratio (LCR): 225.7%, far exceeding the regulatory requirement of 100%, indicating abundant liquidity and strong risk resistance.

Net Stable Funding Ratio (NSFR): 119.4%, indicating a healthy long-term funding structure.

Net Interest Margin (NIM): 6.82%, up from 6.44% in 2023, with solid profitability.

Analysis: BTPN's financial indicators are outstanding, with sufficient capital and strong liquidity, and the NPL is slightly higher but controllable. Net profit in the first three quarters of 2024 was IDR 19.94 trillion (about USD 130 million), down 4.8 percent year-on-year, mainly due to higher credit costs and operating expenses, but overall financial health.

💵 Deposit & Loan Products

Deposit

class

demand deposits: provide a basic current account (e.g. Jenius account), The interest rate is low (about 0-0.5%), which is suitable for daily trading.

Time deposits: The interest rate fluctuates according to the term and amount, and the interest rate of 1 month to 12 months time deposit is about 2.5%-4.5% (please consult the official website or outlets for details). Auto-renew is supported.

High Yield Savings Account: The Jenius platform offers "Flexi Saver" and "Maxi Saver" with an annualized yield of up to 5% (depending on the deposit amount and tenor).

Large Certificates of Deposit (CDs): BTPNs offer similar products for high-net-worth clients, with negotiable interest rates, usually higher than fixed deposits, and flexible tenors (3 months to 5 years).

Features: ESG deposit products that combine environmental, social and governance factors to attract clients who are focused on sustainable investing.

Loans

Mortgages: Housing loans (KPR) are available at interest rates of about 6%-9% (fixed or floating), The loan term is up to 20 years. The minimum down payment requirement is 10%-20%, depending on the type of property.

Car loans: Through the subsidiaries PT Oto Multiartha (four-wheelers) and PT Summit Oto Finance (two-wheelers), the interest rate is about 7%-12% with a term of 1-5 years. Support for new and used cars.

Personal Line of Credit: Including "Digital Mikro" and "Kredit Lintas Manfaat" with an interest rate of 8%-15%, loan amounts ranging from IDR 50 million to IDR 500 million. The approval is fast, the threshold is low, and proof of income is required.

Flexible repayment options: Early repayment is available (1%-2% fees may apply), and some loans allow for adjustment of repayment schedules, suitable for micro businesses and self-employed individuals.

Features: BTPN's lending products focus on micro- and micro-sized enterprises (MSMEs) and provide customized financing solutions, such as Sustainable Finance.

💸 List

of common fees

Account Management Fee:

current account: no monthly fee for Jenius account, Traditional accounts may charge IDR 5,000-10,000/month (about USD 0.3-0.7).

Annual fee: Some high-end accounts (e.g. Sinaya Wealth Management) may charge IDR 50,000-100,000 per year.

Transfer fee:

domestic: Intra-bank transfers through the Jenius platform are free of charge, and each interbank transfer is about IDR 6,500 (about USD 0.4).

Cross-border: Depending on the amount and destination, it is about $10-25 per transaction.

Overdraft fee: Depending on the account type, the overdraft interest rate is about 1.5%-2%/month.

ATM Interbank Withdrawal Fee: Interbank withdrawals through the ATM Prima network are approximately IDR 7,500 (approximately USD 0.5) per time.

Hidden Fee Reminder:

minimum balance requirement: Traditional accounts need to maintain a minimum balance (about IDR 50,000-100,000), otherwise a penalty of IDR 10,000/month may be deducted. There is no minimum balance requirement for a Jenius account.

Inactive Accounts: Accounts that have not been used for a long time may be charged a maintenance fee of around IDR 5,000-10,000/month.

Analysis: BTPN's fee structure is more user-friendly for digital bank users (e.g. Jenius), with slightly higher fees for traditional accounts, and it is important to be aware of the minimum balance and the potential cost of inactive accounts.

📱 Digital Service Experience

APP & Online Banking

Jenius platform: BTPN's flagship digital banking product, Support Android and iOS.

User Rating:

- App

Store: about 4.5/5 (based on user reviews in Indonesia).

Google Play: About 4.3/5, some users reported occasional system delays.

Core features:

Face recognition: support account opening and transaction verification.

Real-time transfer: Support inter-bank real-time transfer, integrated with BI-FAST system.

Bill management: water, electricity, telephone and other bill payment, automatic reminder function.

Investment Instrument Integration: Support for mutual funds and government bond purchases.

Online Banking: Aimed at corporate and high-end customers, the functions include cash management, trade finance and foreign exchange trading, with a simple interface but slightly less functional than Jenius.

technological innovation

AI customer service: Jenius provides basic AI chatbot to deal with common problems, Complex problems need to be transferred to manual work.

Robo-advisors: There are no full robo-advisors, but the Jenius platform supports investment advice and wealth management tools.

Open Banking API Support: BTPN explores open banking through SMBC's global network, with some APIs supporting third-party fintech integrations (such as payment and credit services).

Features: The BTPN Wow! platform supports simple mobile banking, allowing customers to complete account opening and transactions through the basic mobile phone, which is suitable for users in remote areas.

🤝 Quality of customer service

service channel:

24/7 phone support: +62 21 1500 365, round-the-clock customer service.

Live chat: The Jenius platform offers live chat with a response time of about 3-5 minutes.

Social Media: Quick response via Twitter (@JeniusConnect) and Instagram, with an average response time of 1-2 hours.

Complaint handling:

Complaint rate: No publicly available data, but customer feedback shows that the main problems are loan approval delays and system maintenance.

Average resolution time: 1-3 days for simple issues and 7-14 days for complex issues (e.g. loan disputes).

User satisfaction: Jenius has a high level of user satisfaction (about 80%), and a medium level of satisfaction with traditional banking services.

Multi-language support: English and Indonesian are available, and some high-end customers can get Japanese support (due to SMBC background). Non-local language services are limited, and cross-border users may rely on English.

Features: BTPN's customer service is mainly based on digital channels, and Jenius' response speed is better than that of traditional outlets.

🔒 Security measures

fund security:

- deposit

insurance limit: via LPS, Deposit insurance up to IDR 2 billion covers eligible accounts.

Anti-fraud technology: real-time transaction monitoring, abnormal transactions will trigger SMS or APP notifications. Jenius supports two-factor authentication (PIN + face/fingerprint).

Data security:

ISO 27001 certification: BTPN's official website declares compliance with data security standards, but does not explicitly mention ISO 27001 certification.

Data breaches: Significant data breaches that are not publicly reported, and data protection measures include encrypted storage and employee training.

Features: BTPN emphasizes the confidentiality of customer data, the Jenius platform has high security, and the physical security measures of traditional outlets are also in line with industry standards.

🌟 Featured Services & Differentiations

segments:

student accounts: No fees for Jenius accounts , suitable for younger users, and includes digital wallet functionality.

Exclusive banking for seniors: BTPN Purna Bakti offers customized savings and health services for retirees.

Green financial products: ESG deposits and sustainable financing to attract environmentally conscious customers.

High Net Worth Services:

Private Bank: Wealth management through BTPN Sinaya with an investment threshold of about IDR 500 million (about US$33,000).

Customized financial management: including mutual funds, government bonds and foreign exchange investments, with dedicated relationship manager services.

Features: BTPN enhances social impact by providing training and financing support to micro-enterprises and low-income groups through the Daya program.

🏆 Market Position & Accolades

industry ranking:

domestic: BTPN is ranked among the top 10 Indonesian banks by market capitalization, 5th by number of branches, and 6th by number of employees.

Global: It is not one of the world's top 50 banks, and its assets are about 1.3 trillion yen (about 9 billion US dollars, 2020 data).

Awards:

2023: Annual Report Award, recognizing transparency and governance.

Others: The Jenius platform has been recognized for digital banking innovation several times (the specific award is not disclosed).

Features: BTPN has a pioneering position in the digital banking sector in Indonesia, with a market positioning focused on the mass market and SMEs, and the support of SMBC has enhanced its international competitiveness.