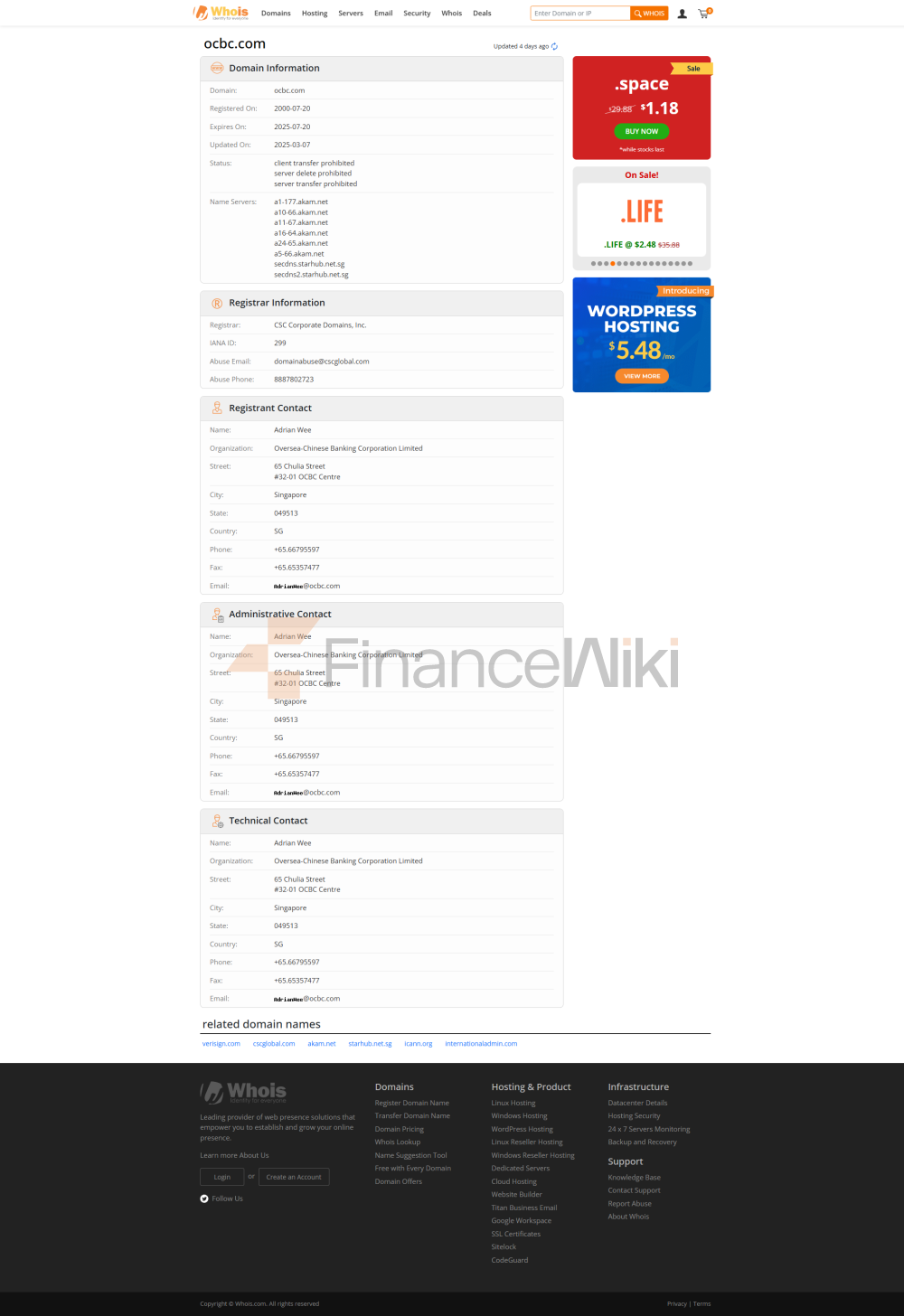

Oversea-Chinese Banking Corporation Limited (OCBC) is Singapore's second largest bank, established in 1932 by Tan Kah Kee's son-in-law, Lee Kong Chian, through the merger of three banks. The full name of the company is Oversea-Chinese Banking Corporation Limited, the stock code is SGX: O39 and OTCBB: OVCHY. As of 2023Q3, the company has more than 630 branches and representative offices in 18 countries or regions around the world, of which more than 337 are operated by its Indonesian subsidiary, OCBC NISP.

Regulatory

InformationOCBC Securities is a Singapore-based brokerage firm incorporated on 3 December 1999 and registered in Singapore. As of 2023Q3, OCBC Securities is not fully regulated by the Monetary Authority of Singapore (MAS), which also means that it has certain risks in terms of security and compliance. Investors should exercise caution when choosing such services.

Trading

ProductsOCBC Securities offers a wide range of trading products covering the following markets:

- Securities: including stocks and exchange-traded funds (ETFs).

- Bonds: This includes government bonds and corporate bonds.

- Leveraged Futures: Covers stock indices, currencies, commodities, energies, metals, and interest rates, among others.

- Leveraged Forex: More than 40 currency pairs are available, including spot gold and spot silver.

- Precious Metals: Includes spot trading of gold and silver.

- Stock Financing and Stock Lending: Leveraged trading by pledging stocks or cash.

Trading software

OCBC Securities offers the following trading software:

- iOCBC Trading Platform: Designed for trading securities, exchange-traded funds (ETFs) and bonds.

- iOCBCfx forex trading platform: provides foreign exchange and precious metal trading, supporting more than 40 currency pairs, including spot gold and spot silver.

- iOCBCfx Pro forex trading platform: supports leveraged forex and precious metal trading, with leverage up to 5 times.

- Futures Trading Platform: Futures trading is available, covering interest rates, stock indices, currencies, metals, energies, and commodities.

Deposit and withdrawal

methodsOCBC Securities offers a variety of deposit and withdrawal methods, including:

- Bank Transfer: Funds transfer through local and international banks.

- Cash Deposits and Withdrawals: Cash deposits and withdrawals are made through their branches.

- Electronic payment: It supports a variety of electronic payment methods to facilitate customers to carry out capital operations.

Customer

SupportOCBC Securities offers the following customer support options:

- Telephone Support: Local at 1800 338 8688 and Overseas at +65 6338 8688.

- Email support: The mailbox is cs@ocbcsec.com.

- Social media interactions: Provide customer service through Facebook, Twitter, YouTube, and LinkedIn.

- Language support: English is available to meet the needs of customers around the world.

Core Business &

ServicesOCBC Securities' core business includes:

- Securities & Bond Trading: Providing trading services for equities, ETFs and bonds.

- Leveraged futures and foreign exchange trading: Provide leveraged futures and foreign exchange trading to meet the needs of customers with high risk and high return.

- Precious Metals Trading: Includes spot trading of gold and silver.

- Stock Financing & Borrowing: Leverage trading by pledging stocks or cash to help clients amplify their investments.

Technical

InfrastructureOCBC Securities' technical infrastructure includes the following aspects:

- Trading Platforms: iOCBC Trading Platform, iOCBCfx Forex Trading Platform,iOCBCfx Pro forex trading platform and futures trading platform to meet the different trading needs of customers.

- Trading system stability: Ensure the smooth operation of trading through stable technical support and regular system maintenance.

- Security: Through multi-layer encryption technology and strict authentication mechanism, the security of customers' transactions is guaranteed.

Compliance and Risk Control SystemAlthough

OCBC Securities is not fully regulated, the company has established the following compliance and risk control systems:

- Risk Management System: Reduces transaction risks through strict risk assessment and monitoring mechanisms.

- Compliance Statement: The company declares that it complies with relevant laws and regulations to ensure the legality of trading activities.

- Operational risk management: Reduce operational risks through standardized operating procedures and strict internal audits.

Market Positioning & Competitive

AdvantagesOCBC Securities has the following competitive advantages in the Singapore market:

- Rich trading products: covering multiple markets such as securities, bonds, leveraged futures, leveraged foreign exchange and precious metals.

- Diverse trading platforms: Provide different types of trading platforms to meet the needs of different customers.

- Flexible fund management: Help customers manage their funds flexibly through stock financing and stock borrowing services.

Customer Support &

EmpowermentOCBC Securities empowers clients by:

- Multi-channel customer support: Offering a variety of support methods such as phone, email and social media.

- Educational Resources: Educational trading videos are available through YouTube and LinkedIn to help clients improve their trading skills.

- Personalized service: Provide personalized trading and investment advice according to customer needs.

Social Responsibility and ESG

Although OCBC Securities does not explicitly publish a social responsibility report, the company pays attention to the following aspects in its day-to-day operations:

- Environmental protection: Reducing environmental impact through electronic transactions and reducing the use of paper documents.

- Corporate Governance: Ensure the transparent and efficient operation of the company through a standardized corporate governance mechanism.

- Social Contribution: Giving back to society by supporting community activities and philanthropy.

Strategic Cooperation Ecology

OCBC As a large banking group, it has established strategic partnerships with a number of institutions:

- Financial Institutions: Cooperate with a number of domestic and foreign banks and financial institutions to expand the scope of services.

- Technology companies: Enhance technology and innovation capabilities through partnerships with technology companies.

- Industry associations: Participate in multiple industry associations to promote the development and implementation of industry standards.

Financial HealthAs

of 2023Q3, OCBC's financial position is healthy, with capital adequacy ratios and asset quality above the industry average. The company ensures financial stability and sustainability through diversified business and sound financial management.

Roadmap for

the futureOCBC Securities' future roadmap includes the following areas:

- Product Innovation: Launch more innovative trading products to meet customer needs.

- Technical upgrades: Through continuous technical upgrades, the stability and user experience of the trading platform will be improved.

- Market Expansion: Further expansion of the business presence in Asia and other emerging markets.

The above provides a comprehensive understanding of OCBC Securities' corporate profile, core business, and future growth plans.