New Zealand Home Loans (NZHL) is a client-focused mortgage advisory firm that has been around since 1996 and has been helping New Zealanders achieve financial freedom, particularly in mortgage management. Unlike traditional banks, NZHL works with a number of banks and non-bank lenders to tailor mortgage solutions for customers, optimize repayment structure, reduce interest expenses, and shorten loan tenure. This article will provide insights into the characteristics and advantages of NZHL in terms of institutional profile, financial health, products and services, fee structure, digital services, customer service quality, security, unique services, and market position, providing insights for potential clients and researchers.

Institutional Overview and BackgroundNew

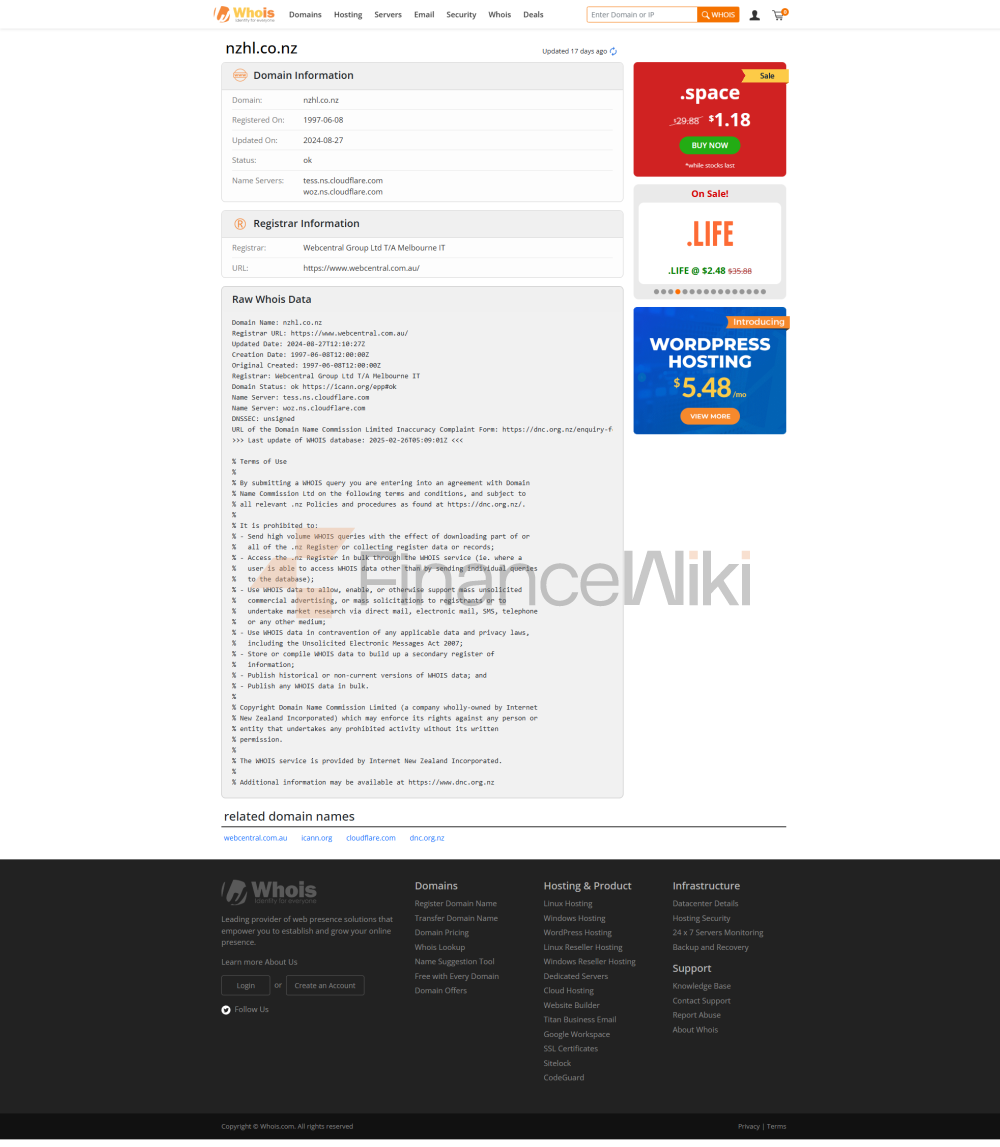

Zealand Home Loans (NZHL) is a privately owned mortgage advisory firm founded in 1996 and headquartered in New Zealand (exact address is not disclosed, it may be located in major cities such as Auckland or Wellington). As a non-listed, non-state-owned company, NZHL is wholly owned by local New Zealand shareholders and focuses on providing mortgage advisory and financial planning services to clients. Its core philosophy is to help clients pay off their mortgages faster and achieve financial freedom through "smart mortgage structures" and personalized consultations. NZHL's services cover the whole of New Zealand, providing localised support through Mortgage Mentors across the country. These consultants can communicate with clients face-to-face or provide services over the phone and online platforms, ensuring flexibility and convenience.

NZHL works with a number of banks and non-bank lenders, including possible mainstream banks such as ANZ, BNZ, ASB, Westpac and Kiwibank, as well as non-bank lenders such as First Mortgage Trust. NZHL provides clients with access to a wide range of loan options for first-time home buyers, investment properties, or refinancing. While NZHL does not have a physical branch of a traditional bank, it does provide ATM services (if related to partner banks) through the CO-OP network, ensuring that customers have easy access to financial services when they need them.

NZHL is regulated by the New Zealand Financial Markets Authority (FMA) and is subject to the Financial Markets Conduct Act 2013 and the Anti-Money Laundering and Counter-Terrorism Financing (AML/CFT) regulations. FMA ensures that NZHL follows the principles of fair treatment of consumers and protects the interests of its clients when providing financial advice. From July 2025, New Zealand's Depositor Compensation Scheme will provide protection of up to NZ$100,000 for deposits with partner banks, but this does not directly apply to NZHL's services. Currently, NZHL has a strong compliance record and has not identified any recent major breaches, demonstrating its robust performance in regulatory compliance.

Financial

HealthNZHL has been in continuous operation for nearly 30 years since its inception in 1996, serving tens of thousands of customers, indicating its financial stability. As a mortgage advisory firm, NZHL's main source of income is from commissions from its cooperation with lenders (usually 0.8% of the loan amount), rather than directly issuing loans, so its financial risk is low. NZHL's long-term success relies on its reputation, quality of service and customer satisfaction, which further supports the reliability of its financial health.

Loan Products

NZHL's core service is to help customers choose the most suitable mortgage products from a number of lenders, and its main loan types include:

- First home loans: NZHL has partnered with Kāinga Ora to offer a "First Home Loan" program that allows first-time buyers to purchase a home with a minimum down payment of 5% (usually banks require 20%). Customers can use the deposit from their KiwiSaver account as part of their down payment and may receive a first-time home purchase grant from Kāinga Ora (up to NZ$10,000 per person). The eligibility criteria include:

- New Zealand Citizen, Permanent Resident or Habitual Resident visa holders.

- The individual has an annual income of not more than NZ$95,000 (without dependents) or NZ$150,000 (with dependents or multiple persons buying a home).

- The property purchased must be the primary residence and the applicant must not own any other property.

- Second Home Loan: For customers who want to upgrade their home, buy an investment property, or vacation home. NZHL optimizes the distribution of customers' income and savings through intelligent loan structures, reduces interest expenses, and accelerates repayment.

- Refinancing Loans: NZHL helps customers with existing mortgages to reapply for a lower interest rate or more flexible repayment terms, which is suitable for customers who need to adjust their financial plan.

: Although it does not provide investment vehicles directly, Debtnav helps clients plan their finances as a whole.

Quality of Customer

ServiceNZHL is known for its personalised service, and its service channels include:

- Telephone support: NZHL consultants can be contacted on 0800 322 837 Monday to Friday from 8:00 am to 5:00 pm, with 24/7 support in case of emergencies (e.g. lost or stolen card).

- Online consultation: Communicate with an advisor via the Debtnav platform or email.

- Local Advisors: NZHL has mortgage advisors across New Zealand who provide face-to-face or remote support.

- Complaint Handling: NZHL has a three-stage complaint handling process, customers can submit feedback through the official website, and the consultant will confirm the complaint within 2 working days and make a final decision within 10 working days.

- Multilingual support: Mainly in English, but other languages may be available in diverse areas such as Auckland, subject to request.

Safety and Security

MeasuresSecurity of Funds

NZHL does not provide deposit services and therefore does not involve deposit insurance. The banks it works with (e.g. Kiwibank, ASB) are protected by the Depositor's Compensation Scheme and cover up to NZ$100,000. NZHL ensures the safety of its clients' loan funds by partnering with regulated lending institutions.

Data Security

The Debtnav platform uses industry-standard encryption technology and multi-factor authentication (MFA) to keep customer data safe. NZHL reminds customers to be wary of scams and avoid revealing passwords over the phone or via email.