Isle

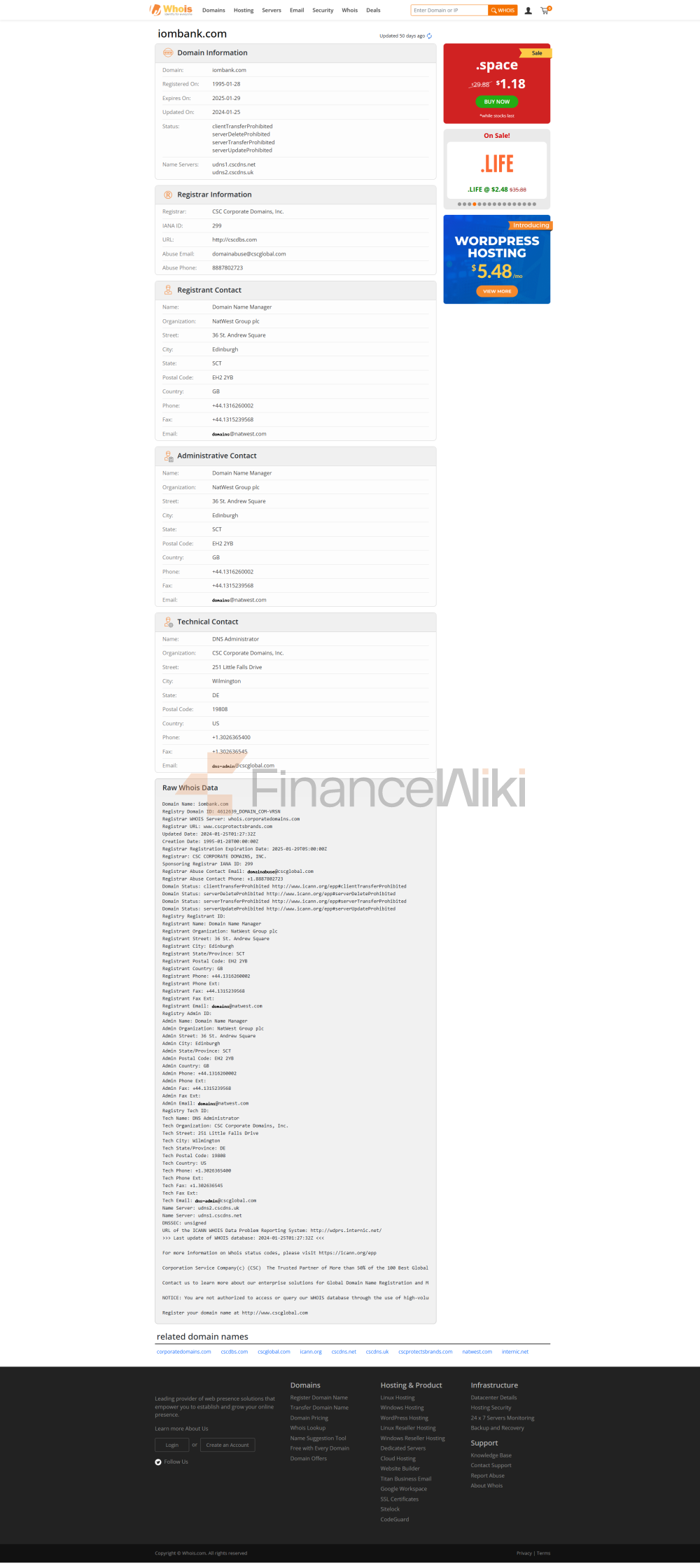

of Man Bank Limited (full name: Isle of Man Bank Limited) is a commercial bank, established on October 26, 1865, headquartered in Douglas, Isle of Man, with specific address at 1-3 Athol Street. As a wholly owned subsidiary of NatWest Group, NatWest Group is a financial group listed on the London Stock Exchange under the ticker symbol NWG. IOM Bank is the Isle of Man's first limited liability company bank, originally founded by Samuel Harris, Henry Noble, William Moore and William Callister to provide financial services to local residents and businesses.

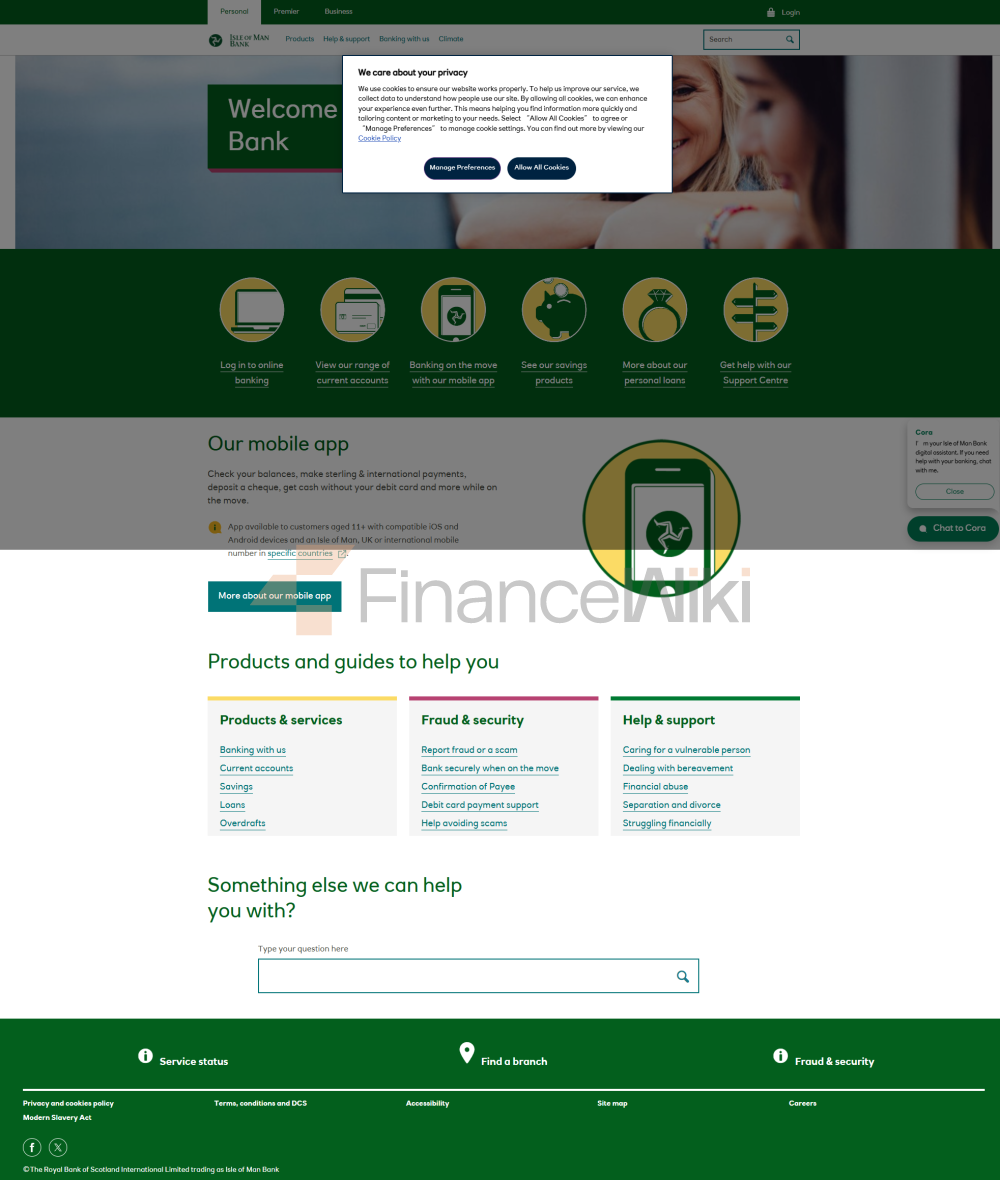

IOM Bank's services mainly cover the Isle of Man (Isle of Man) residents and provide personal, private and commercial banking services. As of 2023, the bank has four branches in the Isle of Man, located at Douglas Athol Street, Douglas Regent Street, Ramsay and Port Erin. In addition, the bank operates an innovative mobile branch, "Penny", to provide convenient services to customers in remote areas. Details of the distribution of ATMs have not been disclosed, but ATMs are expected to be available in branches and major regions to facilitate cash deposits and withdrawals for customers.

In terms of regulation and compliance, IOM Bank is strictly regulated by the Isle of Man Financial Services Authority and is licensed to carry on deposit taking, investment business and general insurance intermediary business. The bank participates in the Isle of Man's Depositors' Compensation Scheme Regulations 2010 to protect customer deposits, the exact amount of which is not disclosed. There have been no major compliance issues in the near future, but due to international sanctions and the impact of Brexit, banks' international business may be limited, and customers need to pay attention to relevant developments.

Financial health:

The Isle of Man banking sector as a whole has historically demonstrated strong capital adequacy. In 2005, for example, more than 20 banks on the island had capital adequacy ratios of more than 20 per cent, in line with Basel Accord requirements. As part of the NatWest Group, IOM Bank benefits from the Group's strong capital base and solid financial performance. In 2024, NatWest Group delivered a strong financial performance with a £1 billion increase in commercial loans, demonstrating the financial stability of the Group as a whole.

Deposit & Loan

ProductsIOM Bank offers a wide range of deposit products, including demand deposits, time deposits and high yield savings accounts, including:

- Instant Saver: A current savings account with high flexibility for daily access and withdrawal.

- Savings Builder: A regular savings account that encourages customers to make regular deposits to accumulate money.

- Premium Saver: A high-yield savings account that offers higher interest rates and is suitable for income-seeking customers.

- First Saver: An account designed for first-time savers and suitable for new customers.

- Card Plus: A savings account that is combined with a credit card for extra convenience.

In terms of loans, IOM Bank offers personal loans, home loans and car loans, including

-Personal loans: loan amounts range from £1,000 to £35,000 with a representative APR of 8.9% (for loans of £7,500-£35,000). The repayment period is from 1 to 8 years, and customers can get a monthly payment estimate through the loan calculator.

Loan products usually offer flexible repayment options, such as early repayment or adjustment of repayment period, and customers can apply for a loan through bank branches or online platforms, with further consultation on specific conditions.

Quality of Customer

ServiceIOM Bank provides multi-channel customer service to ensure that customers can get help at any time, including:

- 24/7 phone support: contact via [Support Center] (https://www.iombank.com/).

- Live chat: Provide real-time support through your bank's website or app.

- Social Media Response: Respond quickly to customer inquiries via Facebook, X, LinkedIn, and more.

Customers can submit questions or suggestions through the feedback form on the official website, and the bank promises to respond quickly. As the official language of the Isle of Man is English, customer service is mainly provided in English, and there is no clear multilingual support information, and cross-border customers need to confirm whether services are available in other languages.

Safety and Security

MeasuresIOM Bank's deposits are protected by the Isle of Man Depositor's Compensation Scheme, the exact amount of which is not disclosed, but provides security for customer funds. Banks employ advanced anti-fraud technologies, such as real-time transaction monitoring, to protect against financial risks. There have been no major data breaches in the history and customers should update their passwords regularly and pay attention to the bank's security tips

Market Position &

HonourIOM Bank is a significant player in the Isle of Man banking sector and has a strong market position as a subsidiary of NatWest Group. The Isle of Man banking sector is dominated by subsidiaries of major UK banks, and IOM Bank enjoys a strong reputation in the local market. The bank's history and the backing of NatWest Group make it one of the most trusted banks on the island.

SummaryIsle

of Man Bank is a commercial bank with a long history and comprehensive services, with a solid financial background and diversified financial services that occupy an important position in the Isle of Man financial market. The bank offers a wide range of deposit and loan products, advanced digital services, high quality customer service, and well-established security measures. Despite the challenges posed by international sanctions and the economic environment, IOM Bank's NatWest Group background and localization services keep it competitive. Clients should pay attention to the latest financial data and policies when making their choices to ensure they meet their personal or business needs.