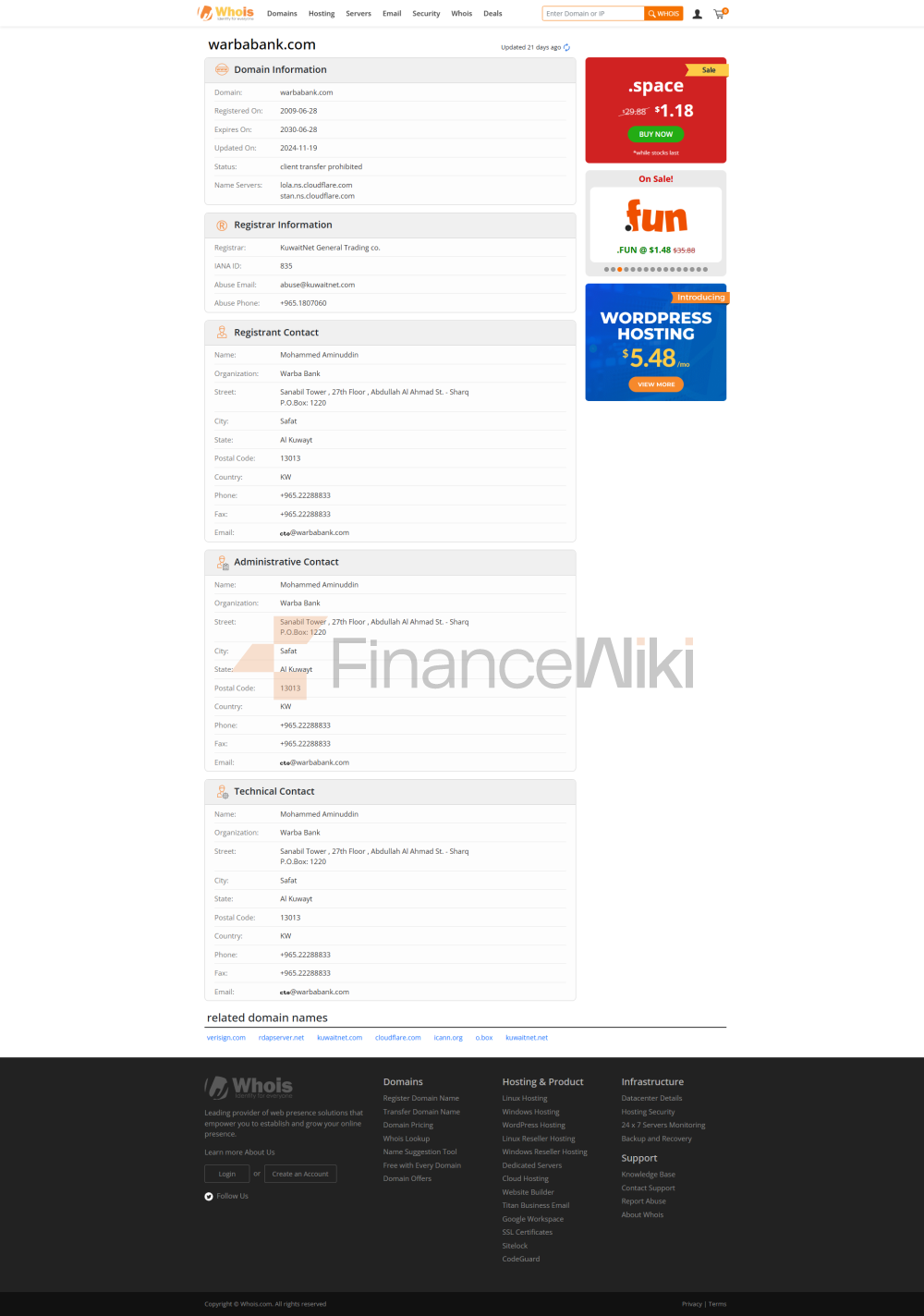

Warba Bank K.S.C.P. (Warba Bank) is a pioneer in Kuwait's financial markets, with a vision of "Beyond Banking, Empowering the Future", with a Shariah-compliant retail banking, corporate banking, investment banking and digital finance sector. Established on 17 February 2010 by Amiri Decree to revitalize the Kuwaiti economy, the headquarters is located at the Joint Banking Centre, Al Mirqab, Kuwait City. As a listed company on the Kuwait Stock Exchange (ticker symbol: WARBABANK), Valbarb Bank is backed by institutional and public shareholders such as the Kuwait Investment Authority and serves more than 100,000 customers, making it one of the most dynamic Islamic banks in Kuwait due to its innovative ability and rapid growth.

basic bank information

Valbar Bank is a commercial bank, privately owned, established on February 17, 2010 and headquartered in Kuwait City, Kuwait. The Bank was established by the Amiri Decree and was added to the Islamic Banking Register of the Central Bank of Kuwait on 7 April of the same year, marking its official status as a Shari'a compliant financial institution. The Valbar Bank was launched by the Government of Kuwait and private investors to address Kuwait's economic challenges in the wake of the 2008 global financial crisis. The Kuwait Investment Authority is one of its major shareholders and has a broad public shareholder base, making it one of the local banks with the largest number of shareholders in Kuwait. Banks are strictly regulated by the Central Bank of Kuwait (CBK) and are required to comply with the Kuwait Banking Act and international financial standards to ensure operational transparency and the safety of customer funds. Its deposits are protected by the Kuwait Deposit Insurance Scheme, with a maximum of KWD 300,000 (approximately US$1 million) per depositor. The SWIFT code for the bank is WRBAKWKW and the Legal Entity Identifier (LEI) is 5493003NOCSC6LUWUF03. Valbar Bank has 13 branches in Kuwait and has a total of approximately 500 employees in 2024.

deposit and financing products

deposits Valbard Bank offers Shariah-compliant deposit products based on a profit-sharing (Mudaraba) or correspondent investment (Wakala) model, based on an expected rate of return (EPR) rather than traditional interest, to meet the savings needs of individual and corporate customers:

Fixed Deposits: Support Kuwaiti dinar, US dollar, euro and other currencies, deposit terms from 1 month to 5 years, the minimum deposit is KWD 1000. In 2025, the expected profit margin varies according to the maturity, e.g. 1.5% for 1 month, 2.0% for 3 months, 2.5% for 6 months, 3.0% for 12 months, and 4.0% for 2-5 years (term deposits). Invest in low-risk ethical transactions (e.g. real estate, sukuk), and the profits are shared by the bank and the client in an agreed proportion.

Featured Products:

High Yield Savings Accounts: such as "Sunbula Account", offering an expected profit margin of up to 2.0% and a cash prize of KWD 1,000,000 through weekly sweepstakes, subject to maintaining a balance of more than KWD 100, No monthly fees (Sunbula account).

Wakala Investment: Supports flexible tenors, suitable for customers with large amounts of funds, the expected profit margin needs to be queried through the branch or app, and the early withdrawal penalty is 90 to 180 days of profit.

Customers can check the expected profit margin through the "Warba Mobile" app or online banking, deposit products can be opened and calculated instantly, and some accounts offer free transaction fees.

Demand Deposits: including instant access accounts, such as "Youth Account" and "Sunbula Account", with a minimum account opening amount of KWD 0 and an expected profit margin of about 0.1%-0.5%, subject to confirmation of the latest rate through branch or online banking. The account supports flexible deposits and withdrawals, no monthly fees, and the Sunbula account provides weekly lucky draw opportunities with a maximum reward of KWD 1 million, which only needs KWD 100 to participate, which is suitable for young customers and daily money management (deposit services).

financingValbard

Bank offers Shariah-compliant financing products based on the Murabaha (cost-plus), lease (Ijarah) or commodity Tawarruq model as an alternative to traditional loans:

Private Housing Finance: Lease or Tavaruk financing up to 80% of the value of the property for a period of up to 30 years. In 2025, the annualized profit margin will be as low as 3.5% (fixed or floating, based on the value of the property), green financing discounts will be offered (energy-efficient properties), and the application will require a credit score of 700 or more and an annual income of more than KWD 5,000 (housing financing).

Auto Finance: Support new and used car financing, with a financing amount of up to KWD 25,000, a term of up to 7 years, an annualized profit margin (APR) of about 4.0%-7.0%, and a credit score of 660 or more (car loan services).

Consumer Finance: Financing amounts from KWD 1,000 to KWD 250,000 (e.g. Express Finance Against Cash) for a period of 1 to 5 years, with an annualized profit margin (APR) of approximately 5.99%-10%, and the application threshold is an annual income of KWD 3,000 or more and a good credit history, and the customer needs to be at least 21 years old (consumer financing).

Flexible payment options: Home finance and consumer finance support early payment without penalty, monthly or bi-weekly payment plans, giving customers the flexibility to manage payment contributions.

All financing is subject to bank approval, and customers are required to provide credit history, proof of income and asset information, the specific terms of which are subject to the financing agreement. The bank's corporate finance services (e.g. letter of credit, Eastna, Murabaha) provide additional support (corporate finance) to SMEs.

digital service experience

Valba's mobile banking app "Warba Mobile" is at the heart of its digital services, available for download on iOS 14.0 and above, Android 9.0 and above, with an App Store rating of around 4.7 and a Google Play rating of around 4.5, with users praising its quick launch (within 2 seconds), personalized interface and multi-language support (Arabic, English) (Warba Mobile). The app attracts many users, customer engagement will increase 8x in 2023, and core features include:

Face recognition: support for biometric authentication (such as Face ID and Touch ID), combined with 256-bit end-to-end encryption, to ensure transaction security.

Real-time transfers: Instant transfers in Kuwaiti dinars are supported via K-Net, SWIFT and Western Union, with a daily limit of up to 100,000 Kuwaiti dinars, international money transfers in more than 30 countries, and Super Transfer services that allow tracking of payments and full transfers with no operating costs (transfer service).

Bill Management: Supports online bill payments, auto-debits, and e-statements, classifies transactions in real-time, allows up to five bills to be paid at a time, and customers can pay through the BookeeyPay digital wallet.

Investment Tool Integration: Support Sukuk, real estate investment and fund trading through an investment platform that provides real-time market data and advisory services.

The online banking platform "Warba Online" supports multiple browsers and provides similar functions, customers can open an account in 5 minutes through the app or official website, and Sunbula accounts can be opened quickly by non-customers through the "Customer Onboarding" function (Warba Online). The app supports accessibility features such as dynamic font adjustment and VoiceOver compatibility for visually impaired and hearing-impaired customers. In 2023, about 60% of customers completed transactions through digital platforms, significantly improving the user experience.

technological innovationValbard

excels in the fintech sector, driving technological advancement through its Innovation and Partnerships division:

AI customer service: Introduce an AI-driven customer service system to analyze transaction behavior and detect fraud risks in real time, automate 80% of customer inquiries by 2023, and plan to launch a virtual assistant in 2025 to support 24/7 inquiries and personalized financial advice.

Open Banking API Support: Follows the Central Bank of Kuwait's Open Banking Framework, integrates with third-party service providers, provides account management and financial services interoperability, and supports 35 deposit, credit card, and financing service APIs by 2024.

Blockchain trade finance: In 2023, a blockchain-based trade finance platform will be launched to simplify the L/C process and improve transaction efficiency and security.

Digital Loyalty Program (Pocket): Launched in partnership with Open Loyalty in 2020, the Pocket Program allows customers to earn points by paying bills, making credit card purchases, transferring salaries or inviting friends, which can be redeemed for goods, services or Kuwait Airways Oasis Club miles, with a 15% increase in points redemption rate in 2023 (Pocket Program).

Electronic KYC (eKYC): Introducing electronic identity verification in 2022, allowing customers to apply for financing, credit cards and accounts online through "KIB Mobile" without visiting a branch, with full rollout (digital services) in 2024.

Other innovations: Apple Pay, Google Pay and BookeeyPay support, and mobile check deposit for simplified operations; In 2022, Kuwait's first AR virtual recruitment platform was launched; In 2024, it will invest KWD 50 million to upgrade cloud technology and data analysis platforms to improve operational efficiency.

Featured Services & DifferentiationValbard

Bank is known for its Shariah-compliant financial services and innovative digital solutions:

Shariah-compliant: All products are certified by an independent Shariah Supervisory Board, investment activities involving alcohol, tobacco, gambling and other industries are prohibited, ensuring ethical investment and attracting a wide customer base (About Us).

Sunbula Rewards Program: Weekly KD 1 million raffle rewards through Sunbula accounts, with a low threshold (KWD 100) to attract customers, with participating customers accounting for 25% of the retail customer base in 2023 (Sunbula accounts).

Youth Banking App: In 2020, the region's first Youth Banking App was launched, offering customized offers, discounts, and features, with a user experience-focused (UX) interface, which is well received by young customers (Youth Bank).

SME support: Provide customized financing and cash management services through corporate banking, participate in the Kuwait Government SME Financing Guarantee Program, financing approval is as fast as 10 seconds, the amount is up to KWD 1 million, and the SME financing balance will increase by 12% in 2023 (corporate banking).

Green Finance: Issued green sukuk to support sustainable real estate and energy projects, in response to the United Nations Principles for Responsible Banking, with a cumulative green financing of KWD 50 million in 2023, and won the "Kuwait Green Finance Pioneer Award".

Community Contribution: Support educational, environmental and charitable projects through the Valbar Bank Foundation, such as the "Free Planting" initiative, donate KWD 5 million for community development in 2023, hold financial literacy seminars, and improve the financial literacy skills of young people (social responsibility).

market position and honors

Valbar Bank is one of the leading Islamic banks in Kuwait, with total assets of approximately KWD 2.8 billion (approximately US$9.3 billion) in 2024, accounting for nearly 10% of the assets of Islamic banks in Kuwait and ranking high among the 38 banks in Kuwait. With 13 branches serving more than 100,000 customers (including 80,000 individual customers and 20,000 corporate customers), the bank has a strong position in retail, corporate and investment banking. In 2023, banks reported a 10% increase in deposit balances, an 8% increase in financing balances, and a non-performing financing ratio of less than 0.2%, indicating that they are operating soundly. Valbard's innovations in digital services and green finance have enabled it to remain competitive in regional markets. Its Sukuk issuance totaled US$898 million, accounting for a significant share of the Kuwaiti market. In 2023, Valbard Bank won the "Most Innovative Banking Technology" award from International Finance for its outstanding digital transformation and innovation performance. Key accolades include:

2023 International Finance "Most Innovative Banking Technology" award.

2022 International Finance "Best Digital Savings App (Hassala)" Award.

Global Business Outlook 2022 Award for "Most Innovative Islamic Digital Corporate Banking Service".

With 15 years of rapid development and innovation, Valbar Bank Limited has become a pioneer in the Kuwaiti financial market. It offers a wide range of deposit and financing products, all Shariah-compliant, and meets the needs of its customers through 13 branches and advanced digital platforms. The digital services are centered around the "Warba Mobile" app, which provides efficient real-time transfers, bill management, and investment capabilities. Technological innovations include AI customer service, open banking APIs, blockchain trade finance, and Pocket's digital loyalty program, demonstrating its digital-first strategy. With its Sunbula Awards Program, Youth Banking Application, Green Finance, SME Support and a number of industry accolades, Valbar Bank continues to demonstrate strong competitiveness and influence in the Kuwaiti and regional financial markets.

Note

specific expected profit margins and financing details may vary depending on market changes, please check the Valbard website or check with the bank directly for the latest information.