name and background<

spanstyle="font-family: sans-serif; color: black" >Hokuriku Bank, which stands for "Hokuriku Bank Co., Ltd." (Kabushiki-gaisha Hokoriku Ginkō), was founded in 1877 and is one of Japan's oldest financial institutions. Headquartered in Toyama City, Toyama Prefecture, the city is not only the birthplace of banks, but also the core area of operation. In 2003, Hokuriku Bank restructured its management structure and established Hokugin Holding Company, which merged with Hokkaido Bank on September 1, 2004, and the holding company was renamed Hokuhoku Financial Group. Today, as a subsidiary of the Northland Financial Group, Hokuriku Bank occupies an important position among Japan's regional banks. The background of its shareholders is shown to be private in nature, and it is subject to market supervision through the listed parent company, and does not involve state-owned capital.

Scope of services

Hokuriku Bank's range of services

mainly covers the northern region of Japan, with the Hokuriku region of Toyama, Ishikawa, and Fukui Prefecture as its core market. At the same time, the bank has further expanded its service network with branches in Kyoto, Osaka, Niigata, Nagano, Tokyo, Kanagawa, Gifu, Aichi, and Hokkaido. In terms of internationalization, Hokuriku Bank has overseas representative offices in Shanghai, Singapore and New York City to support cross-border business needs.

the number of offline outlets and ATM distribution

Hokuriku Bank has 187 branches nationwide throughout Japan as of 2024, demonstrating its ability to reach a wide range of regional markets. In addition, the bank has an extensive network of ATMs, although the exact number is not disclosed. As a traditional bank, offline branches and ATMs play a vital role in serving customers, especially those in rural and remote areas.

services and products

Hokuriku Bank is committed to providing comprehensive financial services to individual and corporate customers, and its products are designed to closely match the economic characteristics of the Hokuriku region.

individual customer

Savings Account: Meet your daily savings needs and offer a variety of account options.

personal loans: including housing loans, consumer loans, etc., to support the improvement of residents' lives.

credit card: convenient for everyday purchases and payments.

investment products: provide financial management and investment options to help customers achieve wealth appreciation.

enterprise customers

cash management: optimize the efficiency of enterprise capital flow.

International trade support: Assist enterprises to carry out cross-border business through overseas representative offices.

Hokuriku Bank provides customers with accurate and efficient financial solutions based on its deep understanding of the regional market.

> Loans & Financing: Provide financial support to small and medium-sized enterprises to promote local economic development.

regulatory and compliance<

span style="font-family: sans-serif; color: black">Hokuriku Bank is regulated by the Financial Services Agency (FSA) of Japan to ensure that its operations comply with Japanese financial regulations and maintain financial stability. Banks participate in the Japan Deposit Insurance System, which is guaranteed by the Japan Deposit Insurance Corporation of Japan to protect depositors' deposits. In terms of recent compliance records, public information does not show that Hokuriku Bank has any material violations. As a well-established financial institution, it strictly adheres to regulatory requirements and maintains a good reputation in the market.

financial health

Hokuriku Bank's overall financial position is sound. As a regional bank, its financial performance is subject to market scrutiny and financial reports are regularly disclosed to the public through its parent company, Hokuhoku Financial Group. However, specific key indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not clearly listed in the publicly available information. For detailed data, users can check out Hokuhoku Financial Group's annual report for further insights. Overall, Hokuriku Bank has demonstrated stable operational capabilities among regional banks.

digital service experience

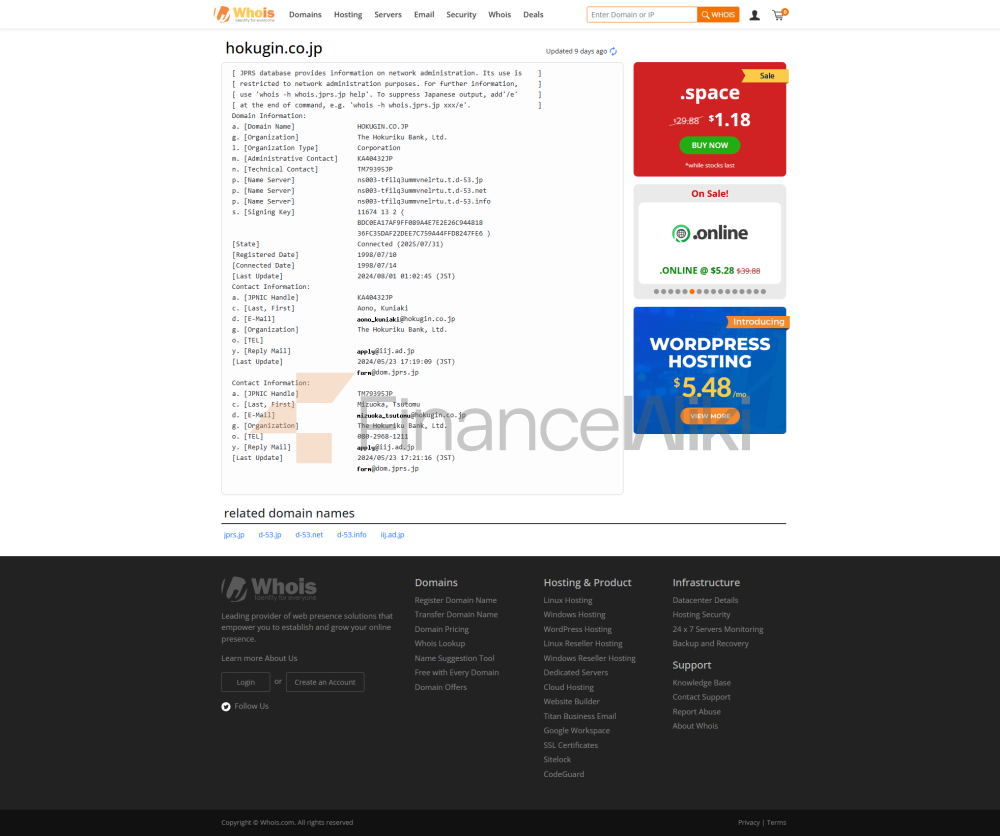

Hokuriku Bank offers mobile and online banking services in line with the digital trend, which can be accessed through its official website (https://www.hokugin.co.jp/).

core functionality

Account Management: View balances and transaction history at any time.

transfer: Facilitate the transfer of funds.

bill payment: to meet the needs of daily bill payment.

customer service

Hokuriku Bank supports customers through a variety of channels, including phone, email, and live chat, so that users can choose the right way to get advice and services according to their needs. The bank is committed to providing an efficient and convenient experience for customers in and around the Hokuriku region, especially in terms of face-to-face service and localized support.

security measures<

span style="font-family: sans-serif; color: black">Hokuriku Bank takes a number of measures to protect the security of customer funds and information, including:

Multi-factor authentication: Improves account security.

Real-time risk monitoring: Detect and respond to potential threats in a timely manner.

Although the specific technical details are not disclosed, as a leading regional bank in Japan, its security measures should comply with industry standards and provide customers with a trustworthy service environment.

>Data encryption technology: Ensures the confidentiality of transactions and data.

featured services and differentiation

Hokuriku Bank's unique strength lies in its strategic positioning in the Hokuriku region. With an extensive network of 187 branches and a deep understanding of the local economy, the bank is able to provide financial services that are close to the needs of its customers. In particular, in terms of financial support for small and medium-sized enterprises, Hokuriku Bank has demonstrated significant competitiveness by contributing to regional economic development through flexible loans and financing solutions. In addition, as part of the Hokuhoku Financial Group, the bank is able to integrate the group's resources and further enhance its service capabilities, differentiating it from other small local banks. This combination of regional focus and resource integration is what makes Hokuriku Bank unique among regional banks in Japan.

summary

Hokuriku Bank is a Japanese regional commercial bank founded in 1877, headquartered in Toyama City, Toyama Prefecture, and affiliated with the Hokuhoku Financial Group, a public company. The bank operates privately and does not involve state-owned or joint ventures, with a focus on the northern region of Japan, with 187 branches and an extensive network of ATMs. Hokuriku Bank provides a comprehensive range of financial services to individual and corporate customers, is regulated by the Financial Services Agency of Japan, participates in the deposit insurance system, and is financially sound. In terms of digitalization, banks offer mobile and online banking services and support customers through multiple channels. It is characterized by its deep presence in the Hokuriku region, its extensive network and in-depth knowledge of the local economy, and its ability to provide precise services to its customers, especially in the field of SME support.