Bank

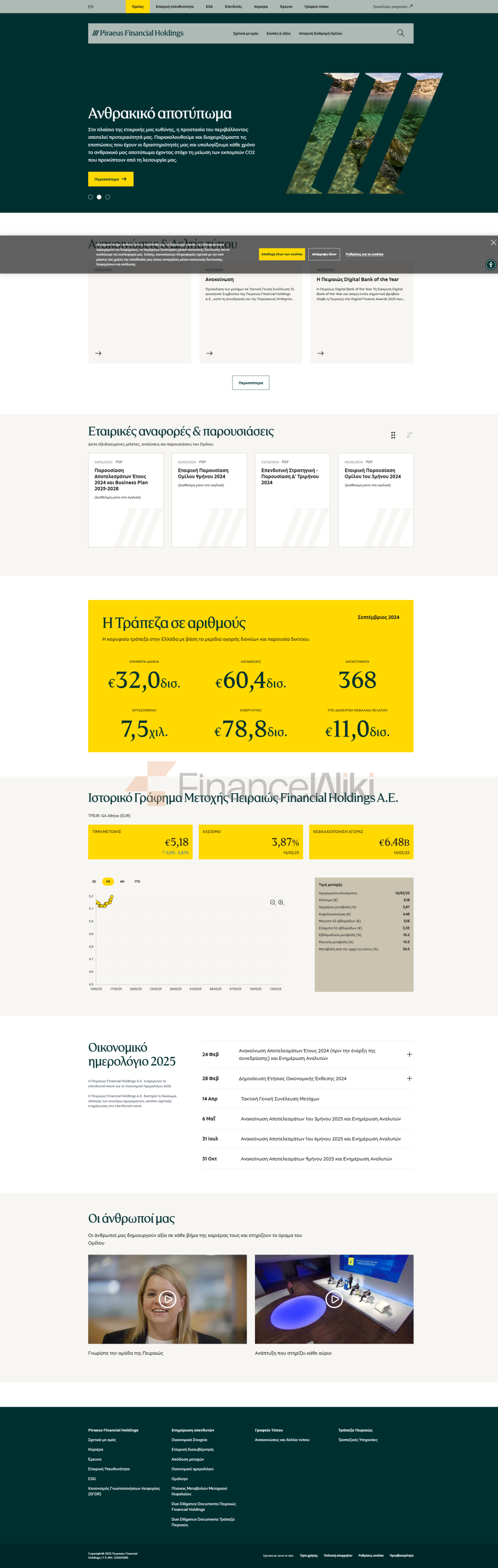

ClassificationPiraeus Bank S.A. is a Systemic Commercial Bank headquartered in Greece with a parent company of Piraeus Financial Holdings S.A., listed on the Athens Stock Exchange (Ticker: TPEIR). Its capital structure is predominantly private, but after the Greek sovereign debt crisis, the state-established Hellenic Financial Stability Fund (HFSF) became one of its major shareholders, so it has a certain national background. It is not a state-owned bank or a foreign-owned joint venture bank, but a privately held bank deeply embedded in the Greek national financial stability system.

Name & Background

full name of the bank:P iraeus Bank S.A

Founded: 1916

Headquarters address: 4 Amerikis Street, 10564 Athens, Greece

From an early-stage agricultural finance institution to the largest bank in Greece by assets, Piraeus Bank has experienced key historical milestones such as privatization, mergers of domestic banks, and restructuring during the financial crisis. Since 2015, banks have returned to sustainability through large-scale divestitures, recapitalization programs, and a shift to digital operations. As a listed entity, Piraeus Bank's shareholder structure includes government funds, international financial institutions and retail investors.

Scope of

ServicesPiraeus Bank's nationwide network with a focus on local customers in Greece and limited international support:

offline outlets: around 500 branches in urban and rural areas

ATM network: more than 1,800 ATMs with 24/7 self-service

international branches: Maintain a small operation in Cyprus and Ukraine, focusing on corporate trade finance and transitional customer

supportCustomer base: serving retail customers, small and medium-sized enterprises (SMEs), Regulation and Compliance for Agricultural Users and High Net Worth Clients (HNWIs)

Piraeus Bank is one of the most important members of the Eurozone banking supervision system:

regulator:

Bank of Greece

European Central Bank

Regulatory system: under the Single Supervisory Mechanism (SSM), in accordance with the capital adequacy and risk regulations of EU banks such as Basel III, CRR/CRD IV

Deposit Insurance Scheme: Hellenic Deposit Guarantee Scheme, one of the members, Maximum insured amount of €100,000 per

clientTrack record: No major breaches since 2015, reflecting significant improvements in its corporate governance, anti-money laundering and capital adequacy

managementPiraeus Bank's

core financial indicators reflect the effectiveness of its restructuring and robust capital structure

CET1 (Tier 1 capital adequacy ratio): Approximately 16.1%

Total capital adequacy ratio: Approximately 18.8%

NPL ratio: Decreased to approximately 6.0%, passed Sunrise Project, Phoenix and others plan to achieve

a liquidity coverage ratio (LCR) of more than 150%, well above the regulatory bottom line

(end of 2024): about €80 billion, the highest in the Greek banking system

These indicators indicate that it has successfully recovered from the shadow of the financial crisis and has a good risk buffer.

Deposits & Loans

:

Sight Deposit: Approximately 0.01% per annum

Fixed-term Deposit: 6 months of about 1.5%, 3 years up to 2.5%

High Yield Products: such as CD (Large Certificate of Deposit) and AXIZEI package combination can provide about 3% annualized income

loan class:

mortgages: Fixed-rate loans start at about 3.5%; Variable interest rate by Euribor plus 1.5%-2.75%

Personal loans: Starts at about 9% depending on credit scoreCar

loans: annual interest rates range from 6%-8%

SME loans: can be attached with government guarantees, and variable repayment periods and grace period options are available

Green Loans: EU Green Taxonomy compliant, with preferential interest rates

Common

feesPiraeus Bank's fee structure is transparent, but the fee rules vary significantly from product to product:

account maintenance fee: €2–5 per month, waived if certain conditions are met (e.g. high balance).

Transfer fee:

local online transfer €0.50–€2

SEPA cross-border transfer €5–15

ATM interbank fee: Withdrawals from non-private ATMs approx. €2

Overdraft fee: approx. €10 per overdraft + Hidden Fees for Daily Interest Accrual

Alert: Some Premium accounts require a minimum balance of €2000, and a €10–20 administration fee

digital service experience

The bank's digital platform is based on winbank:

user rating:

App Store: 4.5/5

Google Play: 4.3/5

Key features:

Biometric login (facial recognition, fingerprint).

Real-time bill payments and transfers (including SEPA)

Real-time synchronization

of spending categories and budgeting

toolsInvestment

accountsTechnical highlights:

The AI-driven customer service bot

Robo-Advisor is

advancing Open Lending support for primary financial recommendations, and has partnered with a number of fintechs to pilot interface cooperation on

customer service quality

Contact: 24/7 Phone +30 210 328 8000, online chat support, fast social media response (mostly Twitter & LinkedIn)

Complaint response: average resolution time 5–7 Weekdays, customer satisfaction up to 85%

Language services: Greek and English support available, there is still room for improvement for foreign

residentsLocal service experience: Branches in large cities are efficient and professional, and township branches have localized affinity, but there may be congestion

periodsSafety measures

Piraeus Bank invests significant resources in data and fund security:

Security of funds: €100,000 per customer under the Greek National Deposit Protection System

Security of information:

ISO 27001 certified

, enabling 2FA (two-factor authentication),

implementing an AI-powered real-time monitoring system for transactions

Data breach history: No major data leakage has been disclosed in the past five years, and the network security management is mature

Featured Services & Differentiation

Student services: Free accounts, low-interest education loans, campus cooperative financial instruments,

retirement and senior services: exclusive pension accounts, priority counters, targeted savings

Agricultural Support Program: Rural sub-branches provide exclusive agricultural loans, linked to the EU CAP program,

green financial products: including green housing loans, ESG investment funds

, private banking

Service brand: Piraeus Wealth

ManagementThreshold assets: from €500,000

Scope of services: portfolio customization, tax planning, cross-border estate structuring advice

Market Position & Honor

Greek banking status: asset size, number of outlets, number of customers are the first

international status:

representatives of European medium-sized banks

are not included in the global top 50, but are on the Eurozone systematic watch list

Honorable Awards:

Euromoney "Best Bank in Greece 2023"

Global Finance "Most Innovative Digital Bank 2022 ”

Capital.gr “Best CSR Bank 2024”