Basic Information

Types and

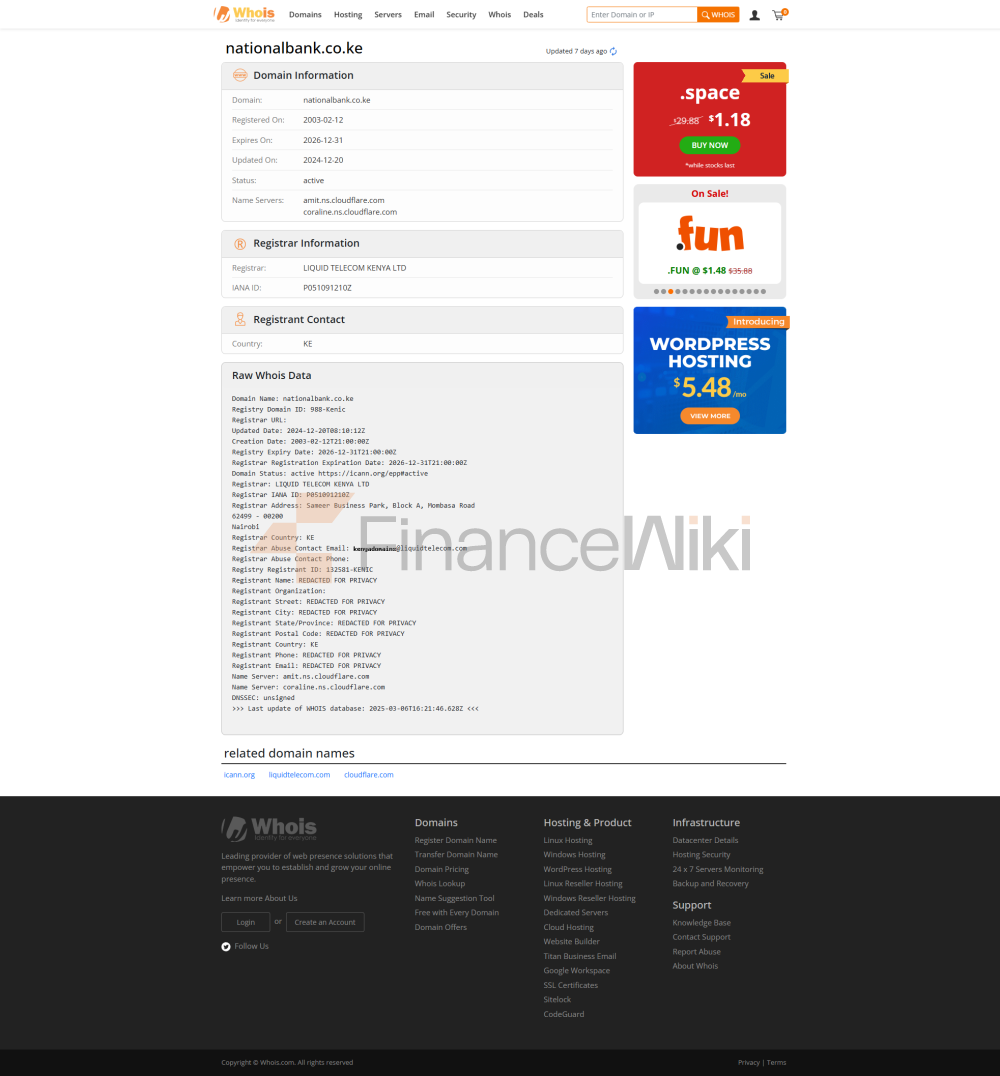

PositioningNBK is a commercial bank established in 1968 and originally wholly owned by the Government of Kenya. In 2019, Kenya Commercial Bank Group (KCB Group) completed the acquisition of NBK, making it a wholly owned subsidiary of KCB. Currently, NBK operates as an independent sub-brand of the KCB Group.

Name & Background

Full name of the bank: National Bank of Kenya

Founded: 1968Headquartered

location:National Bank Building, 2nd Floor, Harambee Avenue, Nairobi,

KenyaShareholder Background: It is now a wholly owned subsidiary of KCB Group. KCB Group is a financial holding company listed on the Nairobi Stock Exchange with operations in several countries in East Africa.

coverage

areaNBK's main service area is Kenya, providing diversified financial products such as personal banking, corporate banking, and investment services.

Offline Outlets & ATMs

NBK has a number of branches and ATMs in Kenya to facilitate offline transactions and cash withdrawals.

regulatory and compliance

regulatorNBK is regulated by the Central Bank of Kenya and complies with the country's banking regulations and standards.

Deposit Insurance SchemeAs

a commercial bank in Kenya, NBK's deposit business is covered by the National Deposit Insurance Scheme, providing customers with a certain degree of security of funds.

Recent Compliance RecordsSince

its acquisition by KCB Group, NBK has been committed to strengthening compliance management and risk control to improve overall operational efficiency.

key indicators

of financial healthcapital adequacy ratio: as of 2022, The average capital adequacy ratio of the Kenyan banking sector is 19.0%.

Non-performing loan ratio: The specific data is not disclosed, but NBK, with the support of KCB Group, actively manages the quality of loans and controls the proportion of non-performing loans.

Liquidity Coverage Ratio: The specific data is not disclosed, but NBK, as part of the KCB Group, enjoys the group's liquidity support and capital scheduling capabilities.

Deposit & Loan

ProductsDeposit

ProductsNBK provides a variety of deposit products, including demand deposits, time deposits, high-yield savings accounts, etc., to meet the savings needs of different customers.

Loan

productsNBK provides a variety of loan products, such as home loans, car loans, personal lines of credit, etc., to support customers' various financing needs.

list of common expenses

account management fee: Depending on the account type and service content, a monthly or annual fee may apply.

Transfer fees: Domestic and cross-border transfers may incur a fee, depending on the transaction amount and destination.

ATM Interbank Withdrawal Fee: Additional fees may apply for using non-NBK ATMs.

Hidden Fee Alert: Some accounts may have a minimum balance requirement, and failure to meet the requirements may result in additional fees.

Digital Service Experience

APP and Online Banking

NBK provide a comprehensive range of mobile banking applications and online banking services, supporting account management, transfer and payment, bill inquiry and other functions.

Technological

InnovationNBK actively adopts new technologies, such as facial recognition login, real-time transaction notifications, etc., to enhance the digital experience of customers.

customer service

quality service

channelsNBK offers a variety of customer service channels, including phone support, live chat, and social media platforms, so customers can get help at any time.

Complaint

HandlingNBK values customer feedback and has a dedicated complaint handling mechanism in place to improve customer satisfaction.

Multilingual

supportNBK's services are primarily in English, and some services may provide support in Swahili to meet the language needs of local customers.

security

measuresFunds are safeguardedNBK's

deposit business is protected by the national deposit insurance scheme, and customer funds have a certain degree of security.

Data

SecurityNBK uses advanced security technologies to protect customers' personal information and transaction data against potential cybersecurity threats.

Featured Services and Differentiated

Market Segment

ServicesNBK provides financial products for specific customer groups, such as student accounts, wealth management products for the elderly, etc., to meet the needs of different customers.

High Net Worth

ServicesNBK has private banking services to provide customized wealth management solutions to meet the investment needs of high net worth customers.

Market Position & AccoladesIndustry

RankingNBK

is one of the major commercial banks in Kenya with a broad customer base and market presence.

Awards & AccoladesNBK

has received several industry awards for its achievements in financial services, customer satisfaction, and innovation.