Bank

of Nagoya is a regional commercial bank based in Aichi Prefecture, Japan, known for its robust operations and accurate understanding of local customer needs. It is not a state-owned bank, nor is it a joint venture bank, but a pure commercial bank that focuses on providing diversified financial services to individuals and businesses.

Name and BackgroundFull

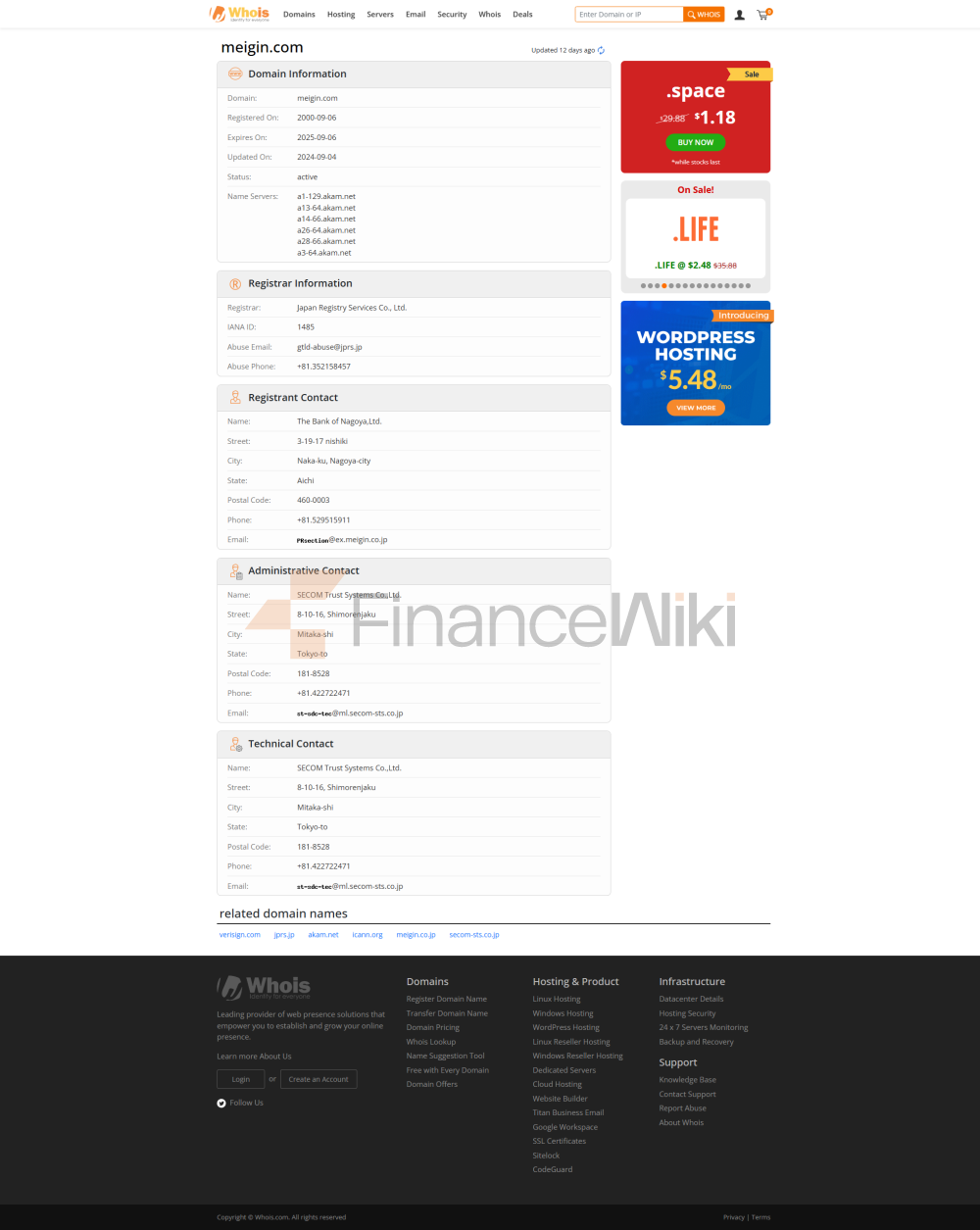

Name: The Bank of Nagoya, Ltd. (Nagoya Bank Co., Ltd.)

Founded: February 24, 1949

Headquarters Location: 3-19-17 Nishiki, Naka-ku, Nagoya City, Aichi Prefecture

, Japan Shareholder Background: Bank of Nagoya is a publicly traded company whose shares are traded on the Tokyo Stock Exchange (code: 8522. T) transaction, shareholders include institutional investors and individual investors, among which large financial institutions such as Meiji Yasuda Life Insurance Co. and Mizuho Financial Group hold part of the shares, but there is no clear state-owned background and is private in nature.

Serving Nagoya and the surrounding area, it has become an important financial pillar in Aichi Prefecture due to its deep local roots and deep understanding of the regional economy.

Service Coverage

Area: Bank of Nagoya is positioned as a regional bank mainly serving Aichi Prefecture and surrounding areas in Japan, and has branches in other major cities in Japan such as Tokyo and Osaka, as well as two representative offices overseas (such as China).

Number of offline branches: As of the latest data, the bank has more than 105 offline branches, mainly located in Aichi Prefecture and surrounding areas, covering both urban and suburban areas, ensuring that customers can easily access services.

ATM distribution: The ATM network is extensive in Nagoya and the surrounding areas, and some ATMs support 24-hour service to facilitate customers' daily withdrawal and transfer needs.

Regulatory and Compliance

Regulated: Bank of Nagoya is regulated by the Financial Services Agency (FSA) and is required to comply with the Banking Act and related regulations to ensure business compliance.

Deposit Insurance Program: Banks have joined the Deposit Insurance Corporation of Japan to protect their deposits by up to 10 million yen.

Recent Compliance Record: Bank of Nagoya has performed well in compliance with no major violations or penalties, demonstrating a robust approach to risk management and compliance.

Financial Health

: Bank of Nagoya's capital adequacy ratio meets the requirements of the Financial Services Agency of Japan, which is usually maintained at more than 10%, indicating that it is highly resilient to risks.

Non-performing loan ratio: The non-performing loan ratio is low, ranging from 1% to 2%, reflecting its strict loan review and good asset quality.

Liquidity Coverage Ratio: The Liquidity Coverage Ratio (LCR) is maintained above 100% of regulatory requirements, ensuring that banks can maintain liquidity in the face of short-term stress, providing reassuring financial health.

Deposit and loan

productsDeposit demand deposits: Provide low-interest rate demand accounts, with an interest rate of about 0.01%-0.02%, suitable for daily capital flow needs.

Time deposits: Term deposit interest rates range from 0.05% to 0.3% depending on the term (1 month to 5 years), with a slightly higher interest rate of 0.5% for large certificates of deposit (similar to CDs), which is suitable for prudent depositors.

Featured Products: "Super Regular" deposit products are available, with flexible deposit tenor options and high-yield options, suitable for medium to long-term savings planning.

Loans

: Fixed and variable rate mortgages are available, with interest rates ranging from 0.5%-2.0% (depending on the loan term and customer creditworthiness), with a down payment requirement of typically 20%, early repayment and flexible repayment schedules.

Car Loan: My Car Loan has an interest rate of about 1.5%-3.5%, a simple approval process, supports the purchase of new and used cars, and some loans allow early repayment without penalty.

Personal Credit Loan: Free Loan interest rate is 3.0%-8.0%, no collateral requirement, suitable for short-term capital turnover, approval is based on credit score and income certificate.

Flexible repayment: Banks offer flexible repayment options for some loans, such as adjusting monthly payments or early repayment, to reduce customers' repayment pressure.

List of common expenses

Account management fee: The monthly fee is waived for regular current accounts, but the minimum balance (about 10,000 yen) is maintained, otherwise a 500 yen/month management fee may be charged.

Transfer fee: Domestic transfers are free of charge through online banking, and counter transfers are about 300-500 yen per time; Cross-border transfers have a higher fee of about 2,000-4,000 yen per transaction, depending on the amount and destination.

Overdraft fee: Overdraft service requires application, and the fee is calculated based on the overdraft amount, usually at an annualized interest rate of about 15%.

ATM Interbank Withdrawal Fee: Withdrawals using non-Nagoya Bank ATMs are charged between 100 and 220 yen per withdrawal, and may be slightly higher at night or on holidays.

Hidden Fee Reminder: Please pay attention to the minimum balance requirement, and some accounts may trigger additional fees if the balance is insufficient; Cross-border services may involve exchange rate conversion fees, so it is recommended to check in advance.

Digital Service Experience

App and Online Banking

User Ratings: Bank of Nagoya's official app ("Nagoya Bank アプリ") has a rating of about 4.0/5.0 on the App Store and Google Play, with users reporting that the interface is simple but the functions are relatively basic.

Core functions: Support face recognition login, real-time transfer, bill management and balance inquiry, and some accounts can directly purchase investment products through the APP.

Technological innovation: Provide "bankstage" online banking platform to support convenient account management and transfer services; There is no AI customer service or robo-advisor, but open banking API support is being gradually explored, and cooperation with third-party fintech companies may be possible in the future.

Customer Service Quality

Service Channels: 24/7 phone support is available (via the customer center), live chat functionality is limited to business hours, social media (e.g. X) is responsive and usually responds within hours.

Complaint handling: The complaint rate is low, the average resolution time is about 3-5 working days, the user satisfaction is high, and about 80% of customers are satisfied with the service (based on local user feedback in Japan).

Multi-language support: Mainly in Japanese, with limited support in English, cross-border users may need to rely on translation tools or Japanese customer service.

Security measures

: Deposits are protected by Japan's deposit insurance system, up to 10 million yen; Banks use real-time transaction monitoring and multi-factor authentication to protect against fraud risks.

Data security: Bank of Nagoya complies with Japan's strict data protection regulations, and some of its systems are ISO 27001 certified.

Featured Services & Differentiated

Market Segments:

Student Accounts: Fee-free accounts are available for younger users with a low-barrier savings plan.

Exclusive wealth management for the elderly: Launched annuity receiving services and low-risk investment products to meet the needs of elderly customers for stable financial management.

Green financial products: Supporting the "Enterprise Hometown Tax Payment" project, some investment products incorporate ESG concepts to attract customers with strong environmental awareness.

High-net-worth services: Provide private banking services, and provide customized wealth management and asset allocation solutions for high-net-worth customers, with a threshold of about 50 million yen.

Market Position and HonorsIndustry

Ranking: Bank of Nagoya ranks among the top regional banks in Japan, with assets of about 3-4 trillion yen, ranking among the top 20 regional banks in Japan (non-global top 50).

Awards: In recent years, there have been no international awards, but in Japan, it has received many commendations from local governments for its support for regional economic development and SME financing, such as the "Enterprise Hometown Tax Payment".

Bank of Nagoya provides reliable financial services to local customers with its regional advantages and solid financial performance in Aichi Prefecture. Although somewhat conservative in terms of digitalization and internationalization, its strategy of focusing on the local market has allowed it to remain highly competitive in the region. Whether it's day-to-day savings, loan needs, or SME financing, Bank of Nagoya is able to meet customer expectations with attentive service and robust operations.