SBS (Southland Building Society Bank) is one of New Zealand's oldest financial institutions, known for its client-owned model of mutual aid, community-based service philosophy and commitment to sustainability. As a mutual bank, SBS Bank is 100% owned by its customers, and profits are used to improve the quality of services and support community development. Founded in 1869 and headquartered in Invercargill, SBS Bank offers a diverse range of financial products including deposits, loans, credit cards and insurance to more than 100,000 customers through its 15 branches and advanced digital platform. The following is a comprehensive analysis of SBS Bank, covering its underlying information, financial health, products and services, fee structure, digital experience, customer service quality, security measures, unique services and market position.

Basic Information

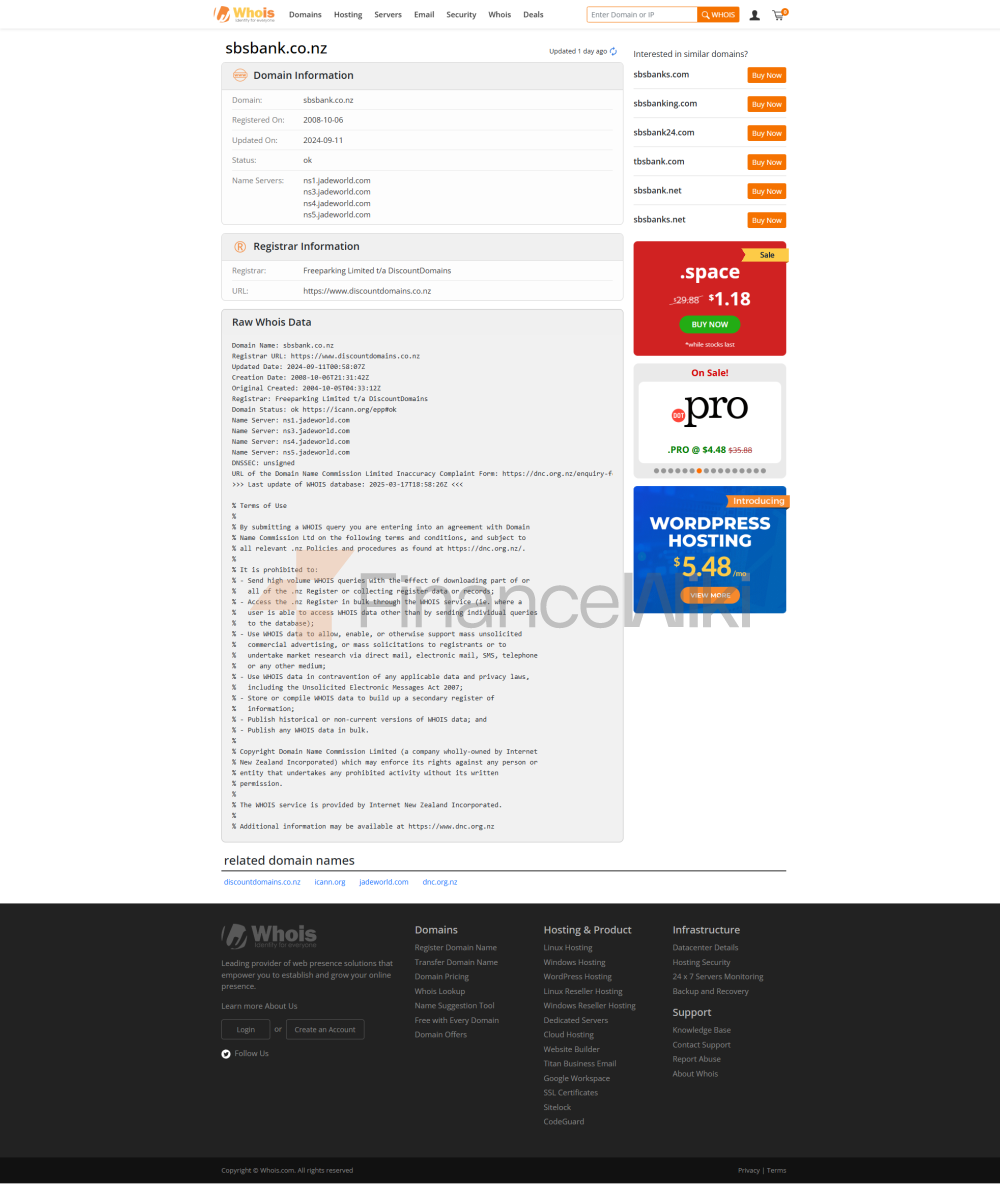

SBS Bank is a mutual bank, the full name is SBS Bank Limited, which was established in 1869 and was originally known as Southland Building, Land and Investment Society. In October 2008, the bank was licensed by the Reserve Bank of New Zealand (RBNZ) and officially changed its name to SBS Bank. SBS House is headquartered at Invercargill in the South Island of New Zealand, with a mailing address of PO Box 835, Invercargill 9840. SBS Bank is owned by its customers, unlisted, non-state-owned, non-private, and operates with the goal of providing quality services to customers and giving back to the community. The bank is led by CEO Shaun Drylie and has a total of more than 200 employees.

SBS Bank has a nationwide service and 15 branches in Southland, Auckland, Wellington, Christchurch and other major cities. The bank offers a wide range of ATM services through the rediATM network, making it easy for customers to deposit and withdraw money across the country. SBS Bank also offers 24/7 digital services through online banking and mobile apps, expanding its service coverage to support cross-border customers in international payments and investments.

Regulatory, SBS Bank is regulated by the Reserve Bank of New Zealand (RBNZ) and the New Zealand Financial Markets Authority (FMA) and is designated as a Systemically Important Financial Institution (SIFI) and is subject to strict capital adequacy, liquidity and risk management requirements. There is currently no deposit insurance scheme in New Zealand, but banks are required to maintain sufficient capital to ensure financial stability. In terms of compliance records, SBS Bank has maintained a strong track record of compliance by strengthening its Anti-Money Laundering (AML) and Customer Due Diligence (KYC) measures. In 2025, the bank partnered with INTERPOL to further enhance its anti-money laundering and anti-financial crime capabilities, without reporting new significant compliance issues.

Financial health:

SBS Bank's financial health reflects its robustness as New Zealand's leading mutual bank. Here are the key financial indicators for 2022:

- Capital adequacy ratio: The core Tier 1 capital adequacy ratio (CET1) was 13.1% and the total capital adequacy ratio was 15.4%, both above the minimum requirements of RBNZ (CET1 4.5% plus 2.5% buffer, total capital of 8%), showing a strong capital base.

- Non-performing loan ratio: Specific data is not provided directly, but in 2022, individually impaired assets were NZ$1.209 million (NZD), with total assets of approximately NZD 6.556 billion, indicating a low level of non-performing loans and good asset quality.

- Liquidity Coverage Ratio: Not directly disclosed, but banks maintain sufficient liquidity through customer deposits and capital market borrowings. The liquidity ratios for 2022 include a one-week mismatch ratio of 7.0%, a one-month mismatch ratio of 11.0% and a core funding ratio of 93.2%, all of which are in line with RBNZ's BS13/BS13A liquidity policy requirements.

In 2022, SBS Bank's total assets were approximately NZD 6.556 billion and net profit was approximately NZD 26.51 million, with return on assets (ROA) and return on equity (ROE) showing solid profitability. Banks have successfully navigated economic challenges through their mutual aid structures and stable customer base. In 2023, banks continued to enhance liquidity through bond issuance, further consolidating financial stability.

Deposit & Loan

ProductsSBS Bank offers a wide range of deposit and loan products to meet the financial needs of individuals and businesses.

Deposits:

- Demand deposits: such as Everyday accounts, which are suitable for daily transactions and have a lower interest rate (about 0.05%).

- Fixed Deposits: Fixed interest rates are available with tenors ranging from 1 month to 5 years, deposit amounts starting from 10,000 NZD, and a maximum interest rate of approximately 5.55% per annum. Customers can choose to pay interest monthly or at maturity, with 31 days' notice required for early withdrawal, otherwise interest rate adjustments may be faced.

- High-yield savings accounts: For example, the Bonus Saver account offers a base interest rate of 0.10% plus a bonus interest rate (subject to monthly deposit and other conditions), up to a maximum of 5.05%.

Loans:

- Mortgages: Fixed and variable rate mortgages are available, with a minimum floating rate of about 5.99% (in May 2025, the loan-to-value ratio is ≤70% to LVR, and the minimum is 20% deposit). Support flexible repayment options, such as early repayment or redrawdown ([mortgage].

- Car loans: Interest rates start from 7.99% up to 100,000 NZD and green vehicle loan discounts are supported.

- Personal Line of Credit: Interest rates start from 7.99% and are suitable for consumer needs, with early repayment support.

- Green loans: Support energy and renewable energy projects, such as green home loans, with sustainable financing support in 2024, subject to bank consultation on interest rates.

Digital Service

ExperienceSBS Bank's digital services are centered on its mobile banking app (SBS Mobile Banking App), which is available for iOS and Android platforms, with an App Store rating of approximately 4.7 stars (based on 1,200 reviews) and a Google Play rating of approximately 4.2 stars (based on 1,300 reviews). Core features include:

- Bill payment and real-time transfers (PayID and BSB account transfers are supported).

- Account management (view balances, transaction history, manage cards).

- Investment tool integration (manage investment accounts, view market data).

- Apple Pay, Google Pay, and MobilePay are supported, providing fast and secure payment methods ([Mobile Banking]).

In terms of technological innovation, the bank has adopted AI-powered virtual assistants to provide quick queries and personalized budget recommendations, and has supported open banking APIs to allow third-party service integration. In 2024, SBS Bank will launch Apple Pay, which enhances the convenience of payment. The bank's online daily payment limit is 10,000 NZD, which can be adjusted by contacting the call center.

Quality of Customer

ServiceSBS Bank provides customer service through multiple channels, ensuring that customers receive support at all times:

- Service channels: Phone support (0800 727 2265, 24/7 to respond to emergencies such as lost cards). Live chat is available through mobile apps and online banking ([Online Banking]. Social media response: Respond quickly to customer inquiries via Facebook ([SBS Bank](https://www.facebook.com/SBSBank)). 15 branches offer face-to-face support ([Find a Branch](https://www.sbsbank.co.nz/contact)).

- Complaint handling: The Bank has a customer feedback mechanism in place where customers can submit complaints through an online form and contact the Financial Services Complaints Limited (FSCL) if they are not satisfied. In 2024, customer satisfaction is high, with customers praising quick responses and professional services, but some customers complain about long waiting times for calls.

- Multilingual support: Services are primarily provided in English and support Māori for cross-border customers.

Safety and Security

MeasuresSBS Bank has a number of measures in place to protect customer funds and data:

- Security of funds: New Zealand does not have a deposit insurance scheme, but banks are regulated by RBNZ and are required to maintain sufficient capital. Fraud prevention with real-time transaction monitoring, SBS Secure Code and Visa Secure, enhanced anti-fraud education in 2024

- Data Security: Comply with the Privacy Act 2020 with data encryption, firewalls and access controls, and may be ISO 27001 certified (not explicitly disclosed). No major data breaches were reported, and the bank conducted regular security audits.

- Anti-fraud technology: including multi-layered access control, intrusion detection, and security operations center monitoring.

Features & DifferentiationSBS

Bank is unique in the New Zealand financial market with its mutual aid model and community-oriented services:

- Student Accounts: Youth Saver accounts offer students a no-monthly fee account, a free Visa card and discounts, suitable for younger customers ([Student Bank]( https://www.sbsbank.co.nz/everyday/savings-accounts))。

- Exclusive wealth management for the elderly: Provide retirement planning resources, and consult banks for specific products.

- Green financial products: Supporting green loans and ESG investments, providing sustainable financing support by 2024, and targeting 2 billion NZD by 2030.

Market Position & Accolades

SBS Bank is one of New Zealand's largest mutual banks, with total assets of approximately NZD 6.556 billion in 2022, dominating the South Rand region. The bank has a strong reputation in the New Zealand financial markets through its customer-oriented operating model and support for the community. SBS Bank has received several awards, including:

- Canstar Awards: Winner of the "Best First-Time Home Buyer Client Owning Institution" award multiple times.

- Mozo Experts' Choice Award: Recognized for discounted car loan products.

- Sustainability Award: Recognised for supporting green finance and community projects.