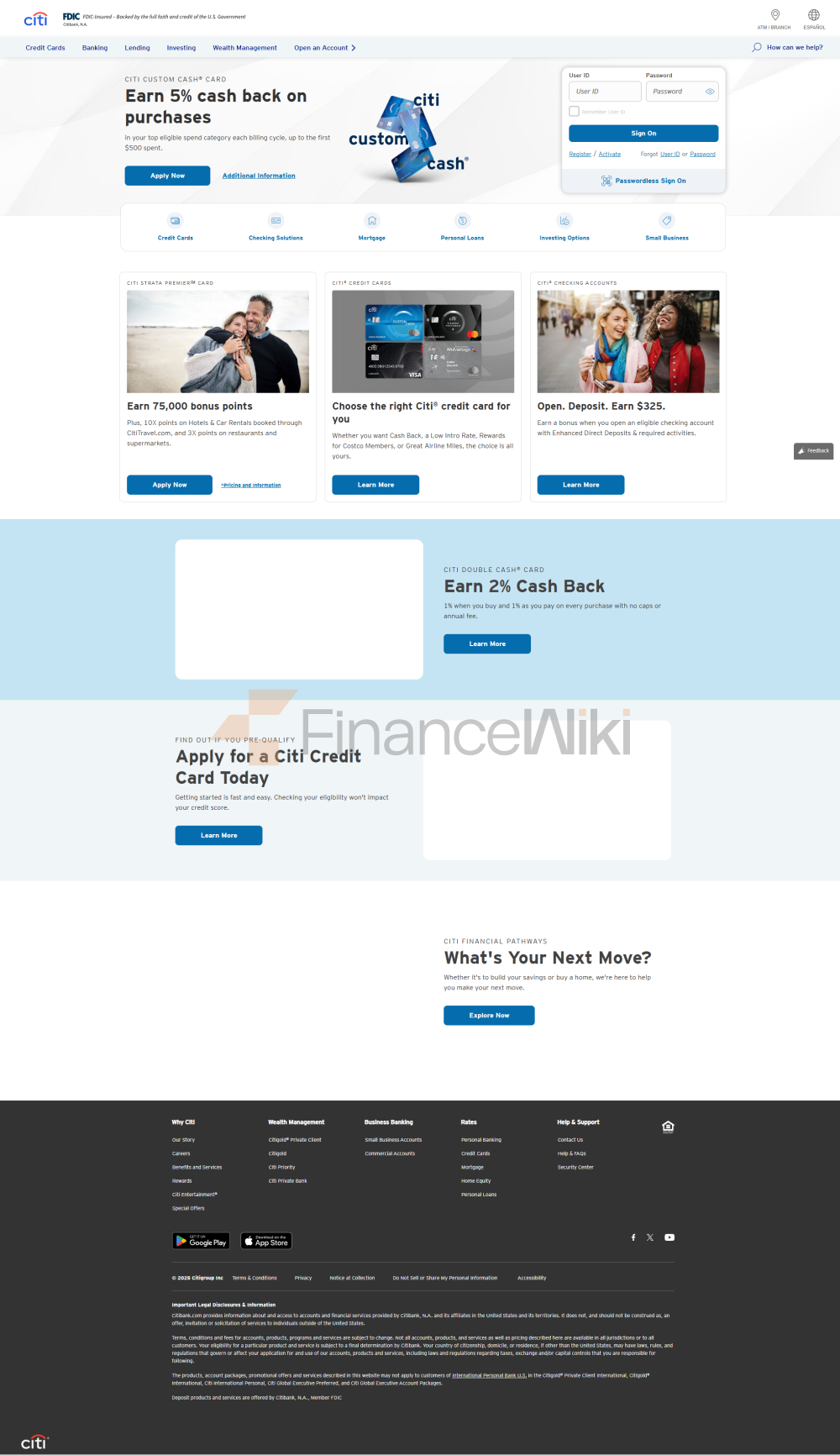

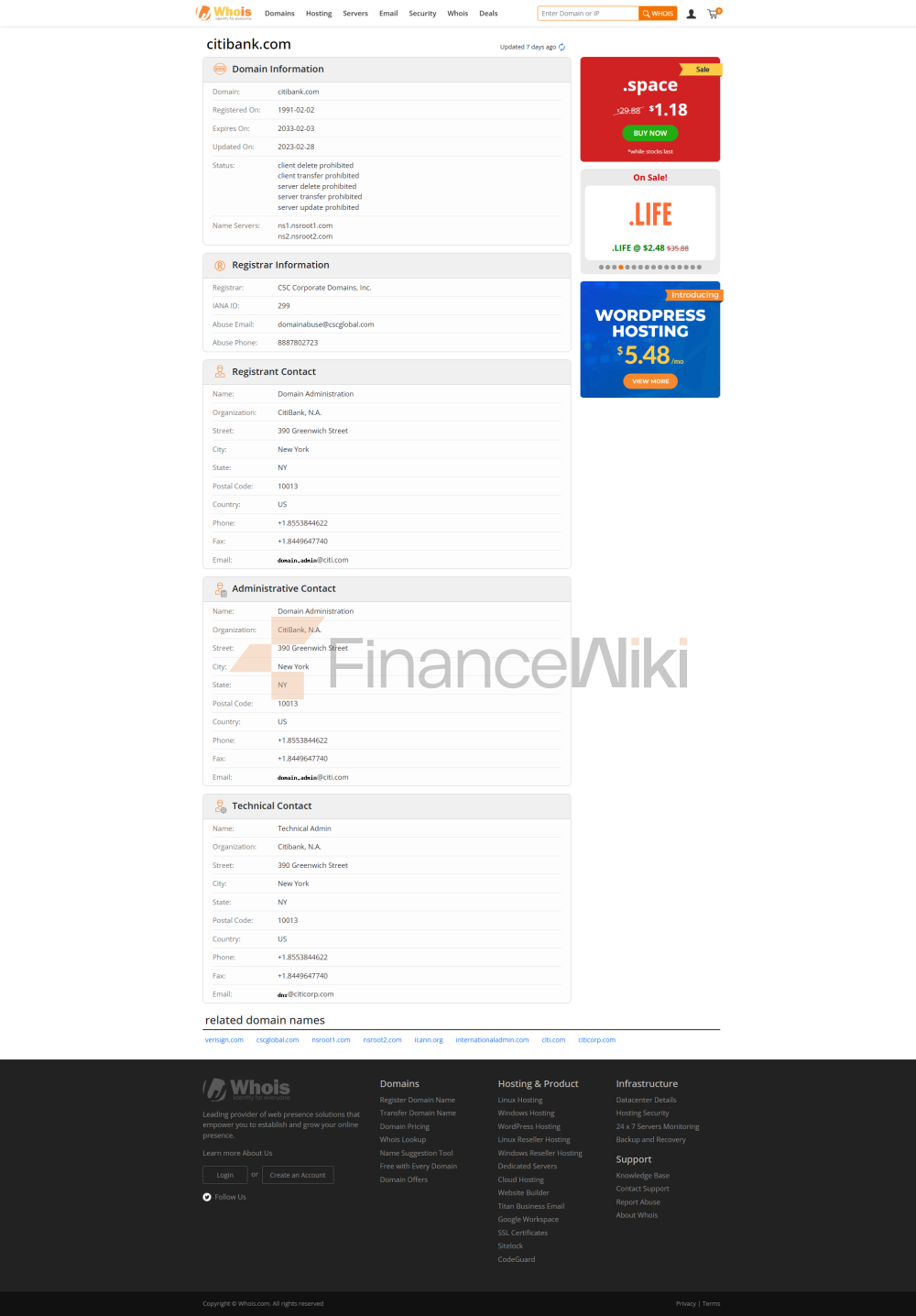

Citibank, N.A. is the world's leading international commercial bank, founded in 1812 and headquartered in New York City, USA. Citibank is a core banking subsidiary of Citigroup Inc., which is listed on the New York Stock Exchange (ticker symbol: C) and is franchised by the U.S. federal government. Its shareholder structure includes institutional investors (e.g., BlackRock, Vanguard Group) and public shareholdings, and there is no single controlling shareholder.

Citibank has a global network of nearly 100 countries and territories, with more than 2,700 branches and more than 65,000 ATMs in North America, Europe, Asia and Latin America. Among them, the Asia-Pacific region (such as Singapore, Hong Kong, Chinese mainland) is an important strategic market, providing a comprehensive range of retail banking, corporate banking and wealth management services.

Regulation &

ComplianceCitibank is subject to multiple regulatory bodies, including the Office of the Comptroller of the Currency (OCC), the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and local financial regulators (e.g., the Hong Kong Monetary Authority, the Monetary Authority of Singapore). As an FDIC member, its deposit accounts are protected by deposit insurance of up to $250,000. In recent years, Citibank has continued to strengthen its compliance management, and in 2023, it was recognized by the OCC for upgrading its anti-money laundering system, but in 2022, it was fined US$400 million for some internal control deficiencies.

Financial HealthAs

of the fourth quarter of 2023, Citibank's key financial indicators were solid:

capital adequacy ratio: 13.4% (Basel III requirement of 10.5%)

Non-performing loan ratio: 1.5% (lower than the industry average).

Liquidity Coverage Ratio: 128% (far exceeding regulatory minimum requirements)

Net profit for the full year of 2023 will reach US$18.7 billion, and the total global assets will exceed US$2.4 trillion, ranking among the top 10 global banks.

Deposits & LoansDeposit

Products:

Citi Accelerate Savings: High yield savings account, 4.25% p.a. Time Deposit (CD) (with a minimum balance of $5,000

): 12-month interest rate of 4.8%, additional 0.25% markup for large certificates of deposit (from $100,000

) Multi-currency account: support 12 currencies such as US dollar, euro, British pound, etc., foreign exchange fee free

Loan products:

Mortgage: 30-year fixed interest rate of 6.2% in the U.S. market (April 2024 data), FHA loans with a minimum down payment of 3%

Car loans: New car loan interest rates start from 3.99%, used cars start from 4.5%.

Citi Flex Loan: Personal credit limit of up to $100,000, annual interest rate from 5.99%, support the list of common fees for borrowing and repaying

Citibank adopts a transparent charging strategy

Account Management Fee: $12 per month for Citi Basic Banking account (waiver: $1,500 average monthly balance)

Cross-border transfers: $35 for wire transfers (waived for preferred customers).

ATM inter-bank withdrawal: $2.5 per transaction in the United States, $5 per transaction in the United States, $5 per transaction in the international

hidden fee Reminder: A 1% handling fee is charged for deposits and withdrawals of some foreign currency notes, and a monthly fee

digital service experience may be triggered if the balance is lower than the minimum balance

The Citi Mobile® App has a high rating of 4.7 on the App Store and Google Play (2024 data), and its core features include:

biometric login: support for Face ID, Touch ID and voiceprint authentication

Real-time global transfers: Citi Global Transfers supports instant arrival in 50+

countriesAI wealth assistant: Citi Wealth Insights provides personalized investment advice

Open banking ecosystem: API interface has been connected to PayPal, Customer service quality of 300+ third-party platforms such as QuickBooksCitibank

is known for its efficient service:

- 24/7 multilingual customer service: English, Spanish, Mandarin and other 15 languages are supported

Social Media Response: Average response time on Twitter/X platform 23 minutes (2023 Customer Report)

Complaint handling: 85% of complaints resolved within 5 working days, customer satisfaction rating 8.2/10

safety and security measures

Adopt multi-layer protection system:

real-time anti-fraud system: monitor 5,000+ transactions per second, and intercept suspicious transactions with an accuracy rate of 99.3%

Data security certification: ISO 27001, PCI DSS compliance, In 2023, the zero trust architecture will be audited

, and the fund guarantee will be guaranteed: FDIC deposit insurance + exclusive account fraud full compensation commitment

, special services and differentiated <

ul style="list-style-type: disc" type="discStudent Financial Solution: Citi Student Account No Monthly Fee, with 1% Cashback

PurchasesHigh-end Customer Service: Citigold Private Bank Threshold $200,000, Provide Global Tax Planning

ESG Investment Products: Green Bond Fund Annualized Return of 6.5%, Supporting the United Nations SDG Goals

Immigration Financial Services: Exclusive New to Country packages to help newcomers build their credit history quickly

Market Position & AccoladesCitibank

has long held a leading position in the industry:

Global Finance 2024 rankings: the world's best digital bank, the best cross-border financial service provider

in terms of asset size: 8th Global Bank (S&P Global 2023 data)

Innovation Awards: Celent Model Bank Award 2023 (Blockchain Trade Finance Applications).