Basic information

for banksBahrain Islamic Bank (BisB) is the first Islamic bank in the Kingdom of Bahrain and has been committed to providing Shariah-compliant financial services since its establishment in 1979. As a commercial bank, BisB is listed on the Bahrain Stock Exchange and its main shareholder is the National Bank of Bahrain (NBB) with a 78.81% stake, while the Awqaf Public Foundation in Kuwait holds a 7.18% stake. Headquartered in Al Salam Tower, Manama, BisB primarily serves the local Bahrain market.

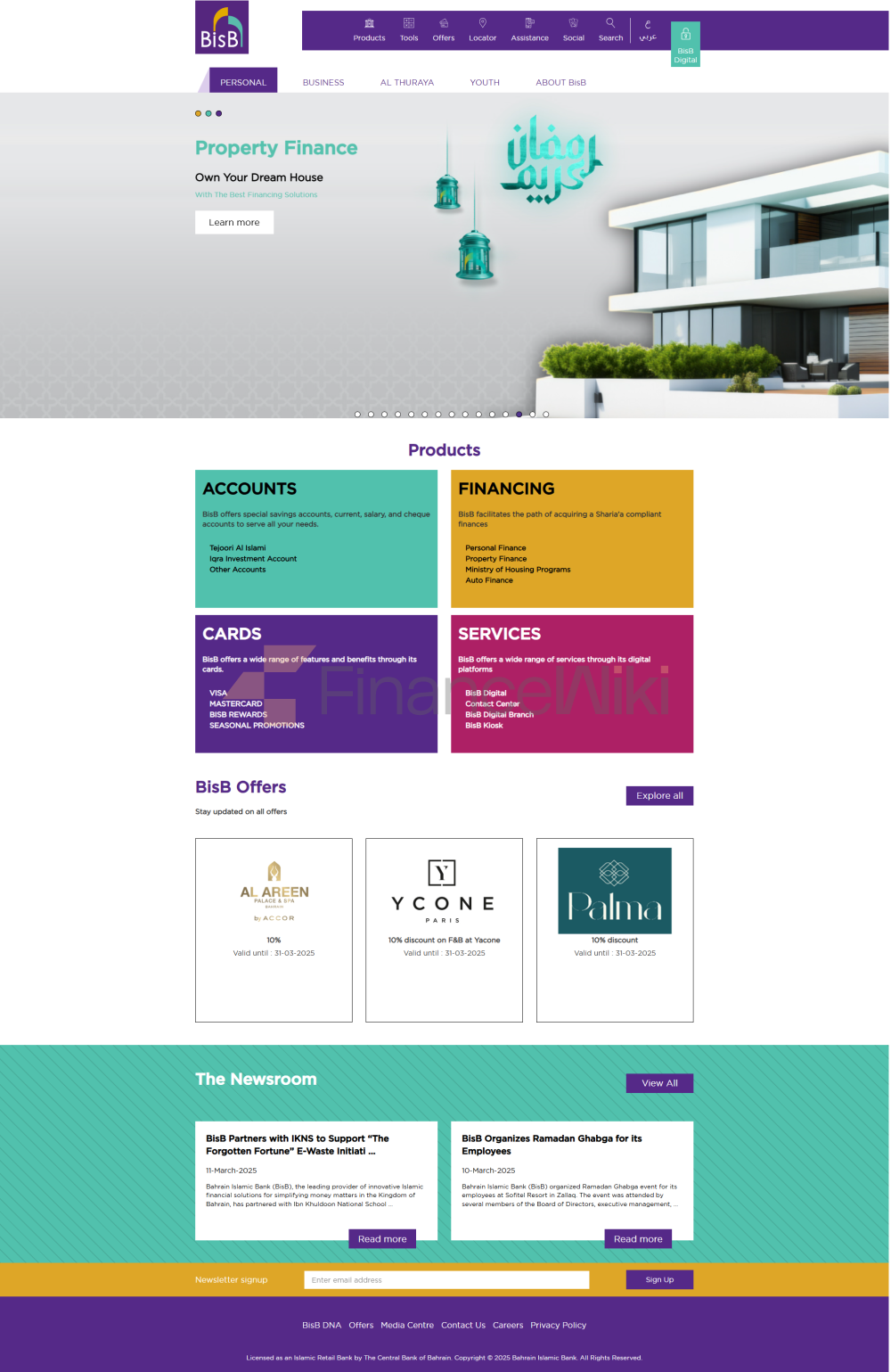

Scope of

ServicesBisB's services mainly cover the local market of Bahrain, providing retail and corporate banking services. While the exact number of offline outlets and ATMs is not disclosed, as one of Bahrain's major banks, BisB has several branches and ATMs across the country to facilitate customers to conduct their day-to-day banking operations.

Regulation &

ComplianceBisB is regulated by the Central Bank of Bahrain (CBB) and operates in accordance with Shariah principles. The bank has joined the Deposit Insurance Scheme to protect the safety of customers' funds. In terms of compliance, BisB actively responds to customer complaints, provides 24/7 customer service, and has a dedicated complaint handling process to ensure that customer issues are resolved in a timely manner.

Financial HealthAccording

to the June 2024 financial disclosure, BisB's capital adequacy ratio (CAR) is 17.4%, which is above the minimum requirement set by CBB. The net non-performing loan ratio (NPF) to capital ratio was 2.0%, indicating good asset quality. In addition, the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) both exceeded 100%, indicating that the bank has good liquidity management capabilities.

Deposit & Loan ProductsDeposit

Category: BisB offers a variety of deposit products, including the Al Wekala Investment Account, which has a two-year term with an estimated annual profit margin of 3.5% to 3.75% and monthly profit distribution.

Loans: In terms of loans, BisB offers products such as personal loans, car loans, and home loans. For example, Tasheel personal loans have an annual profit margin of 3% (for government employees) or 3.5% (for non-government employees), with a loan term of up to 7 years, and the salary needs to be transferred to the BisB account.

List of common feesBisB's

fee structure is transparent, common fees include:

account management fee: may be charged depending on the account type.

Domestic transfer fee: 0.440 Bahraini dinars for SWIFT transfers via RTGS.

Cross-border transfer fee: 5.500 Bahraini dinars for foreign currency personal account transfers.

ATM Interbank Withdrawal Fee: Fees may apply depending on the ATM used.

Hidden fee tips: such as minimum balance limits, depending on the account type.

Digital Service

ExperienceBisB provides a feature-rich mobile banking application that supports account management, real-time transfers, bill payments, financial goal setting, and more. In addition, the app supports fingerprint authentication for added security. BisB is also developing an AI-based Shariah consulting platform that aims to provide customers with more convenient Shariah guidance.

Customer Service

QualityBisB provides 24/7 customer service, and customers can get help through multiple channels such as phone, live chat, or visiting a branch. The bank has a dedicated complaint handling process in place to ensure that customer issues are responded to and resolved in a timely manner.

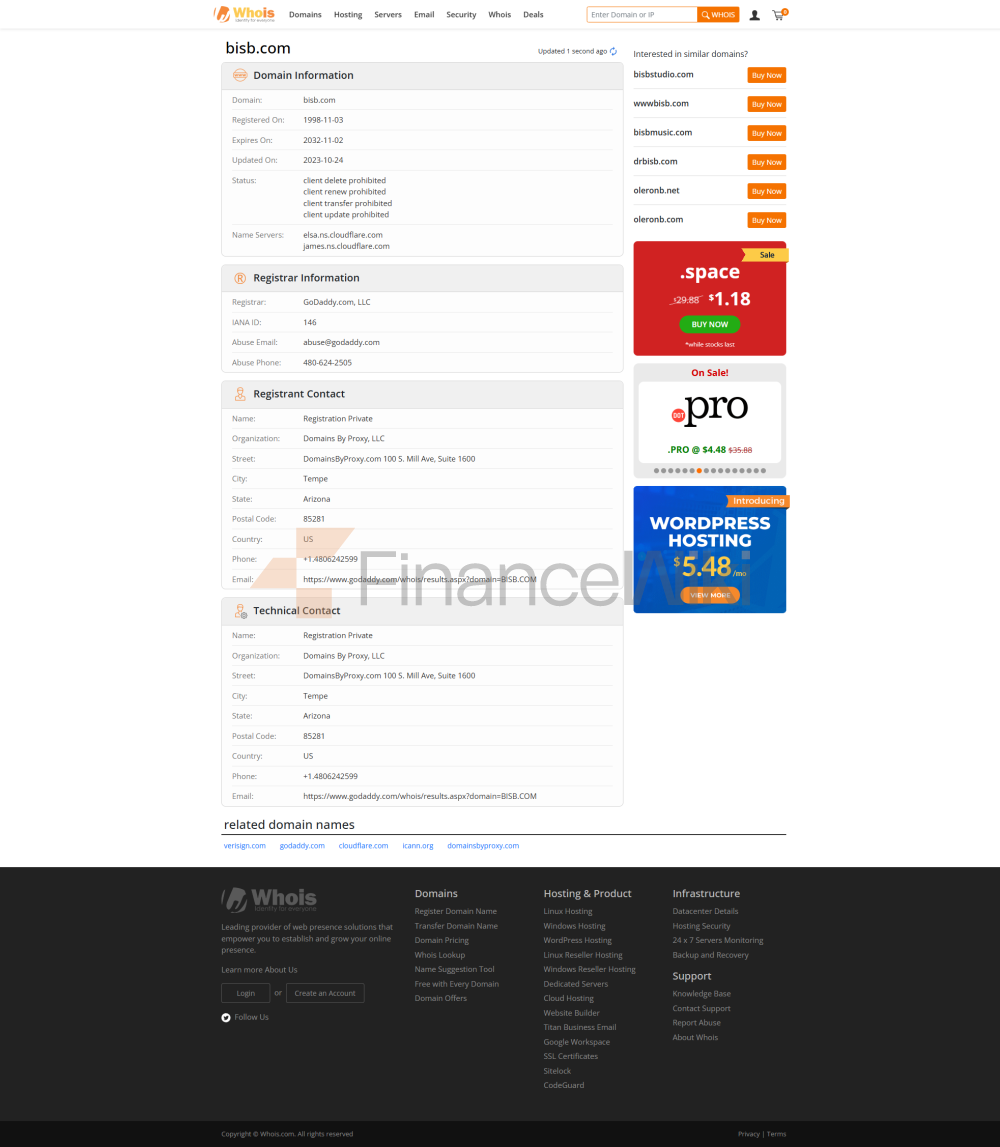

Security

MeasuresBisB attaches great importance to the security of customer funds and data, and has obtained ISO 27001 information security management system certification. In addition, the bank also uses real-time transaction monitoring and other technical means to prevent fraud and ensure the safety of customer funds.

Featured Services and DifferentiationBisB

is committed to providing customized services for different customer groups. For example, the "Future Leaders" smart bracelet for young people aged 7 to 18 has been launched to help young customers develop financial awareness. In addition, banks offer Shariah-compliant green financial products to support sustainable development.

Market Position & AccoladesBisB

has a strong presence in the Islamic banking sector, having received a number of accolades, including the title of "Best Islamic Bank in Bahrain" at the Euromoney Middle East Excellence Awards 2023. In addition, the bank also won the "Most Innovative Islamic Banking Product" award 2024 for its innovative digital products.