Bank

BasicsGuaranty Trust Holding Company PLC (GTCO PLC) is a commercial bank holding company, not a state-owned or joint venture bank, and its core subsidiary, Guaranty Trust Bank Limited (GTBank), provides retail and investment banking services. GTCO has expanded its non-banking businesses such as payments, pension management and asset management through a holding structure to accommodate the 2010 Central Bank of Nigeria (CBN) requirement for the spin-off of the bank's non-core business.

Full name and background

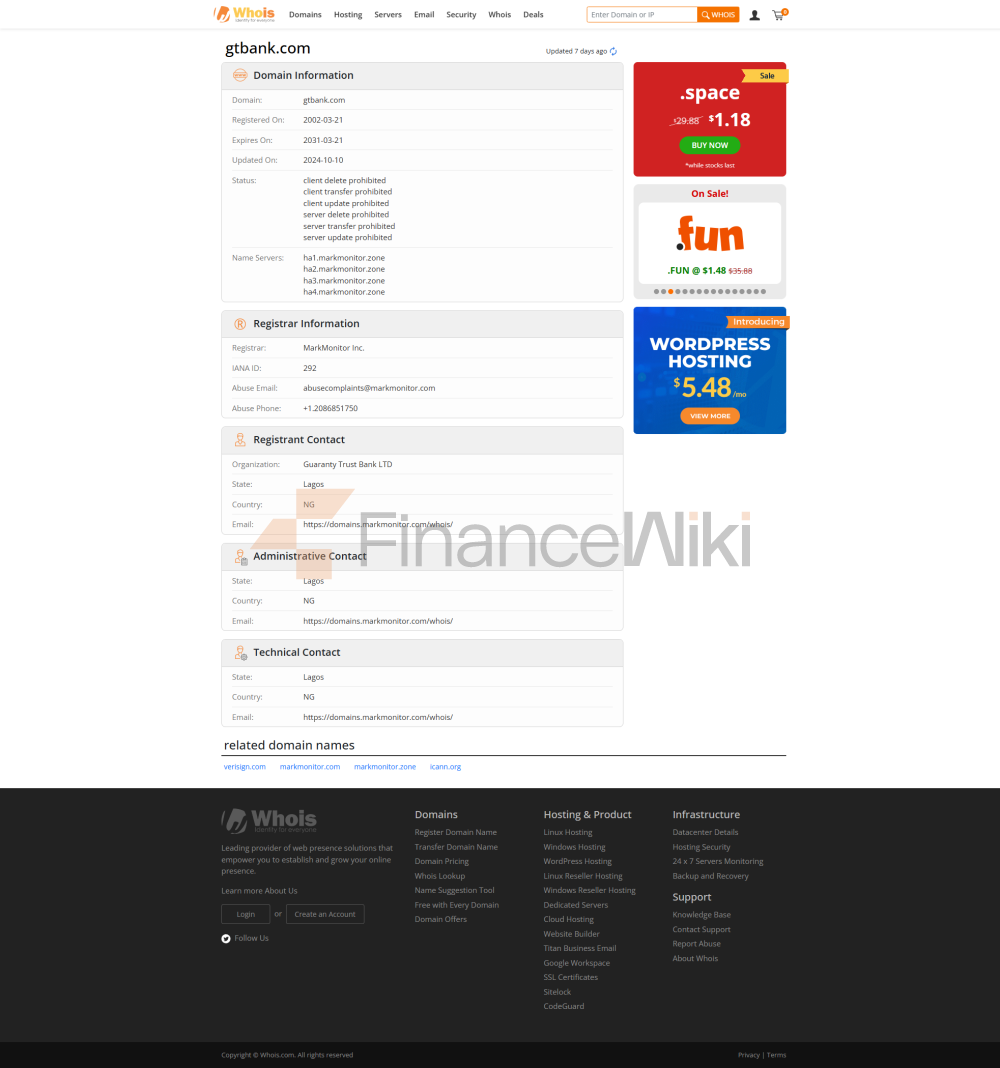

: Guaranty Trust Holding Company PLC (GTCO PLC).

Founded: 1990, GTBank became a public company in 1996 and reorganized as a holding company in 2021.

Headquarters location: Victoria Island, Lagos, Nigeria.

Shareholder Background: GTCO is a publicly traded company whose shares are listed on the Nigerian Stock Exchange (symbol: GTCO), the London Stock Exchange and the Deutsche Börse. In 2007, GTBank became the first bank in Sub-Saharan Africa to be listed on London and Deutsche Börse, raising $750 million in an IPO. Major shareholders include institutional investors and retail investors, and the exact shareholder structure is not disclosed, but its listing status indicates that it is privately owned rather than state-owned.

Background Highlights: GTCO's predecessor, GTBank, was the largest bank in Nigeria by market capitalization (2011) and has been widely recognized for innovation and corporate social responsibility, such as autism advocacy and education programs.

Coverage area

: GTCO operates in Africa and the United Kingdom, including Nigeria, Ghana, Gambia, Sierra Leone, Liberia, Côte d'Ivoire, Kenya, Uganda, Rwanda, Tanzania and the United Kingdom.

Number of offline outlets: As of the end of 2020, GTCO had 339 outlets, including 232 in Nigeria, 106 in the rest of Africa, and 1 in the United Kingdom.

ATM distribution: GTCO has widely deployed ATMs in Nigeria and other parts of Africa, but the exact number is not disclosed. Its digital banking services, such as the HabariPay payment platform, reduce reliance on traditional ATMs and emphasize the convenience of online transactions.

Regulatory & Compliance

Regulators: GTCO is regulated by the Central Bank of Nigeria (CBN) and the UK subsidiary is regulated by the Financial Conduct Authority (FCA) in the UK.

Deposit Insurance Scheme: GTCO participates in the Nigerian Deposit Insurance Corporation (NDIC) Deposit Insurance Scheme to protect the safety of customers' deposits, and the specific insurance amount usually covers small and medium-sized deposits (subject to the latest NDIC standards).

Recent Compliance Record: In 2024, GTCO successfully completed a capital increase to meet CBN's new capital requirements, demonstrating its strong compliance capabilities. There are no publicly reported major compliance breaches, indicating that it is operating robustly within the regulatory framework.

Financial Health

Capital Adequacy Ratio: The 2024 Interim Report shows that GTCO's comprehensive capital adequacy ratio (CAR) is 21.0%, well above the CBN requirement of 10%, reflecting its strong capital buffer.

Non-performing loan ratio: The specific non-performing loan ratio data is not disclosed, but GTCO is known for its robust risk management and high-quality assets, and its profit in 2024 has increased significantly (profit after tax of 10.17 trillion naira, up 88.4% year-on-year), which indirectly indicates better asset quality.

Liquidity Coverage Ratio: The specific liquidity coverage ratio was not disclosed, but GTCO reported a cost-to-income ratio of 16.7%, indicating its high operational efficiency and strong liquidity management capabilities.

Quick Verdict: GTCO has strong financial indicators, sufficient capital, and outstanding profitability, making it suitable for customers looking for stable banking services.

Deposit & Loan ProductsDeposit

Class:

current account: provides flexible access to funds, supports real-time transfers and electronic payments.

Fixed Deposits: The interest rate is not disclosed, but GTCO offers investment savings products that are suitable for customers who are looking for stable income.

Featured products: High-yield savings accounts and CDs are not explicitly mentioned, but its retail banking services include customized savings products for SMEs and individual customers.

Loans:Housing loans, car loans, personal credit loans: GTCO provides consumer loans and mortgage loans, and the interest rate fluctuates according to market conditions and customer credit ratings, and the specific threshold needs to be consulted through the official website or outlets.

Flexible repayment options: GTCO emphasizes customer-friendly service, and loan products often support flexible repayment plans, such as adjusting repayment terms or making early payments without penalty (specific terms need to be confirmed).

List of Common Fees

Account Management Fees: GTCO's retail accounts may charge a monthly or annual fee, the exact amount varies depending on the account type, and customers are advised to pay attention to the minimum balance requirements to avoid additional fees.

Transfer fees: Domestic transfer fees are low, cross-border transfer fees vary by currency and destination, and need to be checked through the HabariPay platform or outlets.

Overdraft Fees and ATM Interbank Withdrawal Fees: GTCO offers overdraft facilities, but may charge interest or flat fees; Interbank ATM withdrawals usually have a small fee (the Nigerian market standard is around 50-100 naira per session).

Hidden Fee Alert: Customers should be aware of minimum balance limits and potential maintenance fees for unused accounts, and it is recommended to check their account statements regularly to avoid accidental charges.

Digital Service Experience

APP & Online Banking: GTCO's mobile banking app and online banking platform (e.g. GTWorld) are popular in Nigeria and support facial recognition, real-time transfers, bill management, and investment tool integration. App Store and Google Play ratings are not disclosed, but user feedback is generally positive, saying that the interface is user-friendly and comprehensive.

Technological innovation: GTCO drives payment business innovation with HabariPay, supports open banking APIs, and provides seamless third-party service integration. AI customer service and robo-advisory capabilities are developing, but they are not clearly widely deployed.

Highlights: In 2024, GTCO upgraded its IT infrastructure to significantly improve the performance of digital services for customers who are looking for a convenient online experience.

Customer Service Quality

Service Channels: Offering 24/7 phone support, live chat, and social media responses such as Twitter and Instagram, the response rate is among the best in the Nigerian banking industry.

Complaint handling: Complaint rate and resolution time data are not disclosed, but GTCO's customer-centric service culture ensures efficient problem resolution and high user satisfaction.

Multi-language support: English is supported, and local language support may be available in some regions, such as Ghana and Kenya, for cross-border customers.

Security Measures

: Participation in the NDIC Deposit Insurance Program to ensure the safety of deposits; Reduce the risk of fraud with real-time transaction monitoring and anti-fraud technology.

Data security: ISO 27001 certification is not explicitly mentioned, but GTCO focuses on data protection, and the 2024 IT infrastructure upgrade enhances cybersecurity capabilities. No recent data breaches have been reported.

Featured Services & Differentiated

Market Segments:

Student Accounts: Fee-free accounts are available to encourage young people to participate in financial services.

Senior-only finance: Products that are not explicitly designed for seniors, but whose pension management services, such as Guaranty Trust Pension Managers, are suitable for retirement planning.

Green financial products: Launched the "Waste-to-Gas" initiative, which reflects the commitment to ESG investment and is suitable for customers who are concerned about sustainable development.

High-net-worth services: GTCO provides private banking services to provide customized financial management and asset management solutions for high-net-worth clients, and the threshold needs to be consulted by the private banking department.

Market Position & AccoladesIndustry

Rankings: GTCO is one of Africa's largest financial services institutions, ranking among the top Nigerian banks in terms of total assets and profit in 2024 (exact global ranking not disclosed).

Awards: Euromoney "Best Bank in Africa" in 2019, "Leadership Excellence Award" in 2020 and "Best Bank in Africa" again in 2021.