Basic Information

type: Listed commercial

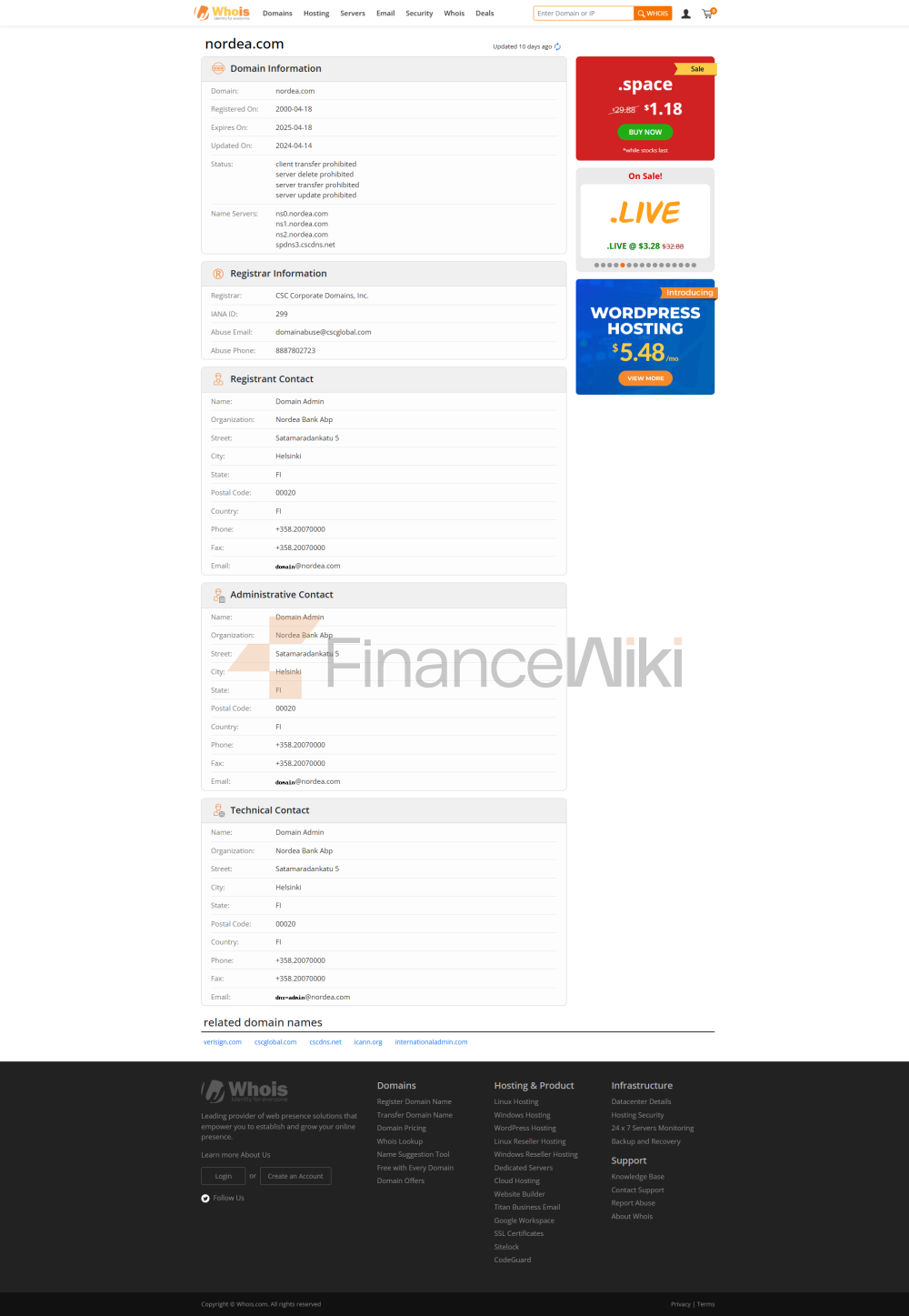

bankFull name: Nordea Bank Abp

Founded: 2000

Headquarters location: Helsinki

, FinlandShareholder background: The main shareholder is the Sampo Group of Finland, holding about 20% of the shares; Listed on the Helsinki, Stockholm and Copenhagen stock exchanges<

Coverage areas: mainly in the Nordic countries (Finland, Sweden, Denmark, Norway), but also in Germany, the United Kingdom,

Number of branches in Singapore, China (Shanghai), the United States (New York) and other places

: More than 1,400 branches in 19 countries around the

worldATM distribution: Extensive ATM network

regulatory and compliant

regulator: Deposit insurance directly supervised by the European Central Bank (ECB):

Participation in the EU's deposit insurance schemeRecent

compliance record: 2024, Danish authorities have accused the bank of anti-money laundering violations, one of

Financial health

capital adequacy ratio: Q3 2024, Common Equity Tier 1 Capital Adequacy Ratio (CET1) of 15.8%

Non-Performing Loan Ratio: Net loan loss of €51 million in 2024Liquidity

Coverage Ratio: Data not disclosed, but overall capital position is strong

for deposits and loan products

Deposit class: Demand and time deposit accounts are available, interest rates are adjusted according to market

conditionsLoan classes: housing loans, car loans, and personal lines of credit are available, and interest rates and thresholds vary

List of common fees

Account management fee: Depending on the account type, a monthly or annual fee may applyTransfer

fees: Domestic transfers are usually free, cross-border transfers may be charged

Overdraft Fees, ATM Interbank Withdrawal Fees: May apply, depending on the region and account type

Hidden Fee Alert: Some accounts may have a minimum balance requirement and may be charged if it is not met

Digital Service Experience

APP & Online Banking: Provide full-featured mobile applications and online banking services, and support functional technology innovations such as face recognition, real-time transfers, and bill management

: Invest in technologies such as AI customer service, robo-advisors, and open banking APIsCustomer

service quality

- service channels: 24/7 phone support, live chat, and social media response

Complaint Handling: Committed to quickly resolving customer complaints and improving user

satisfactionMulti-language support: Provide multilingual services to facilitate cross-border user

security measures

Security of funds: Participation in the EU's deposit insurance scheme, use of advanced anti-fraud

technologyData security: ISO 27001 certified, no major data breaches

Featured services and differentiation

market segments: provide high-net-worth services such as student accounts, exclusive wealth management for the elderly and green financial products

: provide private banking services and customized financial solutions

Market Position & Accolades

Industry ranking: Leading position in the Nordic

regionAwards: Winner of several "Best Digital Bank", "Most Innovative" awards

Nordea Bank Abp occupies an important position in the Nordic and global financial markets thanks to its strong capital strength, extensive service network and continuous technological innovation.