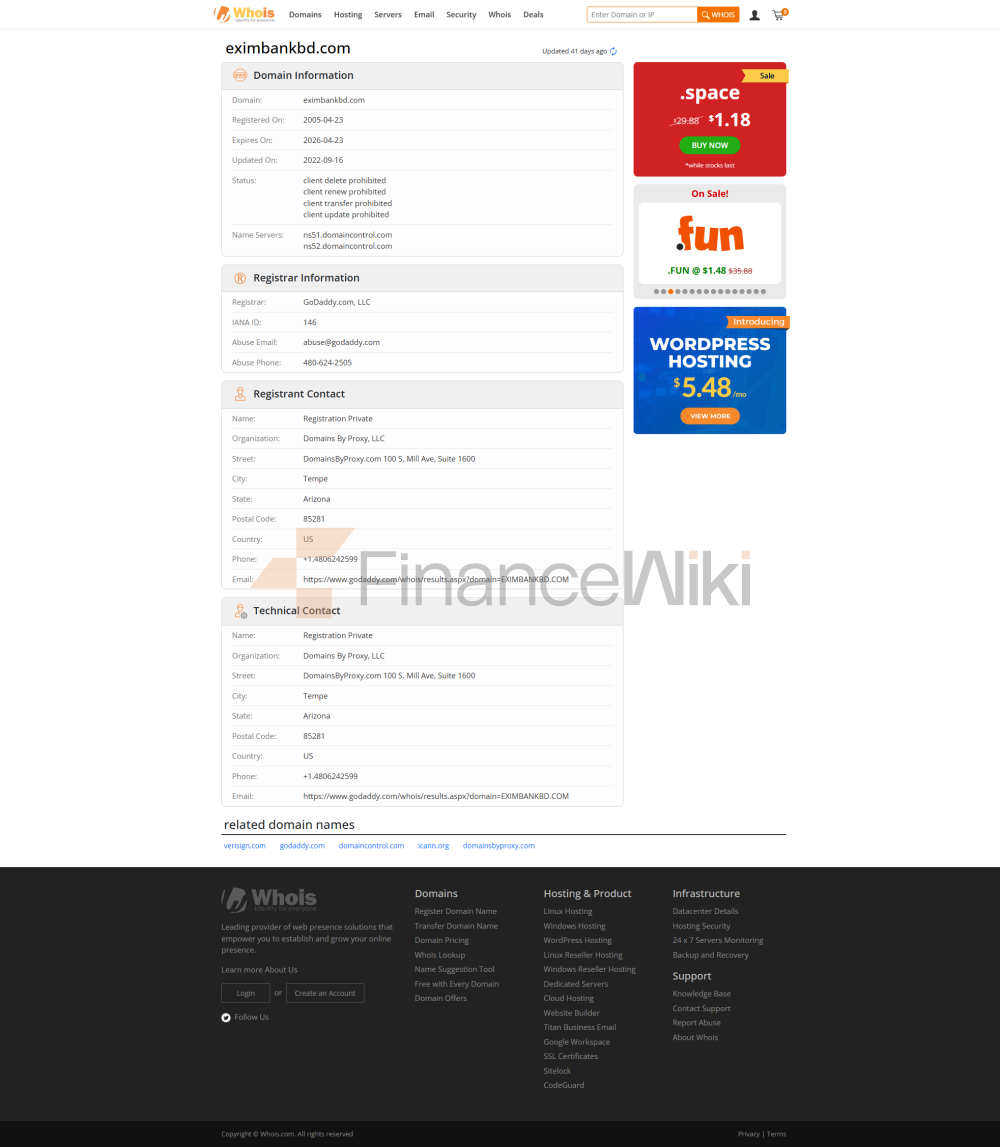

Name & BackgroundExport

Import Bank of Bangladesh (EXIM Bank) was established in 1999 and is headquartered in Dhaka, Bangladesh. As a commercial bank, EXIM Bank is funded by private shareholders and is not publicly listed. Its business focuses on providing financial support for Bangladesh's export and import trade and facilitating international trade between Bangladesh and other countries. The bank has always been committed to promoting the economic development of Bangladesh and has become a significant player in the domestic banking market by providing a range of financial products and services related to international trade.

Scope of services:

EXIM Bank's business is mainly concentrated in Bangladesh, but its international business also involves many countries and regions, especially those with which Bangladesh has economic and trade relations. The bank has a wide range of offline outlets and ATMs throughout Bangladesh to meet the needs of customers in different regions. EXIM Bank focuses on covering all major economic regions and is committed to expanding its service network in both urban and rural areas to ensure that its services are easily accessible to customers.

Regulation &

ComplianceEXIM Bank is regulated by the Central Bank of Bangladesh (Bangladesh Bank) and strictly abides by the relevant laws and regulations of the financial and banking sector in Bangladesh. The bank has joined the deposit insurance scheme to ensure that customers' deposits are protected in the event of banking problems. As a commercial bank, EXIM Bank has a robust compliance record and continuously improves its internal controls and risk management mechanisms to ensure compliance with all financial regulatory requirements.

Financial healthEXIM

Bank's capital adequacy ratio is maintained at the international standard level, which can effectively withstand market volatility and financial risks. The relatively low non-performing loan ratio of banks indicates that their loan business is effectively managed and their credit risks are properly controlled. In addition, the bank's high liquidity coverage ratio ensures that it is able to maintain sufficient liquidity to meet customer withdrawals and funding needs during periods of market volatility or economic uncertainty.

Deposit & Loan

ProductsEXIM Bank offers a range of deposit products, including demand deposits, time deposits, and high-yield savings accounts. The deposit interest rate has a certain degree of market competitiveness, especially for long-term deposit customers, banks provide higher interest rates and preferential conditions. In addition, EXIM Bank also offers Large Certificates of Deposit (CDs), which are suitable for customers who need fixed income.

In terms of loans, EXIM Bank offers a variety of loan options, covering home loans, car loans, and personal lines of credit. It offers reasonable mortgage interest rates and flexible repayment options to help customers choose the right loan plan for their personal situation. Car loans and lines of credit also have lower interest rates, more lenient loan terms, and customized repayment plans to meet the needs of different customers.

List

of Common FeesEXIM Bank's account management fees are relatively low, and for most customers, there are no monthly or annual fees. Transfer fees (including domestic and cross-border transfers) are clear, and there are certain preferential policies, especially for long-term customers or large-value transaction users. Fees such as overdraft fees and ATM interbank withdrawal fees are reasonable and transparent, and there are no additional hidden fees. Customers have a clear understanding of all expenses when conducting business and avoid unnecessary expenses.

Digital Service

ExperienceEXIM Bank continues to innovate in digital services and has launched a powerful mobile banking app, which has received high user ratings on both the App Store and Google Play. The core functions of the app include face recognition login, real-time transfer, bill management and intelligent investment tools, etc., and customers can manage their accounts at any time through the app.

In addition to mobile banking, EXIM Bank has also launched a comprehensive online banking platform, which allows users to perform more convenient operations through the PC terminal. Banks have also introduced AI customer service and robo-advisors to improve user experience and provide smarter financial planning services. The introduction of the Open Banking API has made EXIM Bank's financial services more flexible and innovative.

Customer Service

QualityEXIM Bank focuses on customer service, providing 24/7 phone support and online chat services to ensure that customers are able to solve problems at any time. In addition, the bank also provides services through social media platforms, which are more responsive and customers can get timely feedback. For the handling of complaints, EXIM Bank has a well-established mechanism to ensure that customer problems are resolved in a short period of time and a high level of customer satisfaction is maintained. The bank also supports multilingual services, especially for cross-border transactions, to meet the needs of customers in different countries.

Security

MeasuresEXIM Bank attaches great importance to the security of customer funds and data, and has joined the deposit insurance program to ensure that the interests of depositors are protected. Banks use advanced anti-fraud technology to monitor account and transaction activity in real-time to reduce potential fraud risks. In terms of data security, EXIM Bank is ISO 27001 certified, ensuring that its data storage and transmission comply with international standards. The bank has not had any major data breaches, ensuring the security of customer information.

Featured Services and DifferentiationEXIM

Bank has obvious differentiation in terms of characteristic services, especially in providing financial services for import and export enterprises, the bank provides specialized trade finance products, supports international settlement, letter of credit, bill of exchange and other services, and helps Bangladeshi enterprises expand the global market. In addition, EXIM Bank also provides customized wealth management services for individual customers, especially among high-net-worth customers, the bank provides private banking services to design personalized investment solutions for customers.

Market Position & Accolades

EXIM Bank occupies an important position in the domestic market of Bangladesh, especially in the field of trade finance, and has become one of the preferred banks for Bangladeshi enterprises and individuals with its strong export and import financing services. Although it has not been among the top 50 banks in the world in terms of assets, it has a solid presence in Bangladesh and the surrounding region. The bank has also received a number of industry awards, especially for customer service and innovative financial products, which have been highly recognized by the market.