Basic Information of the BankName

and

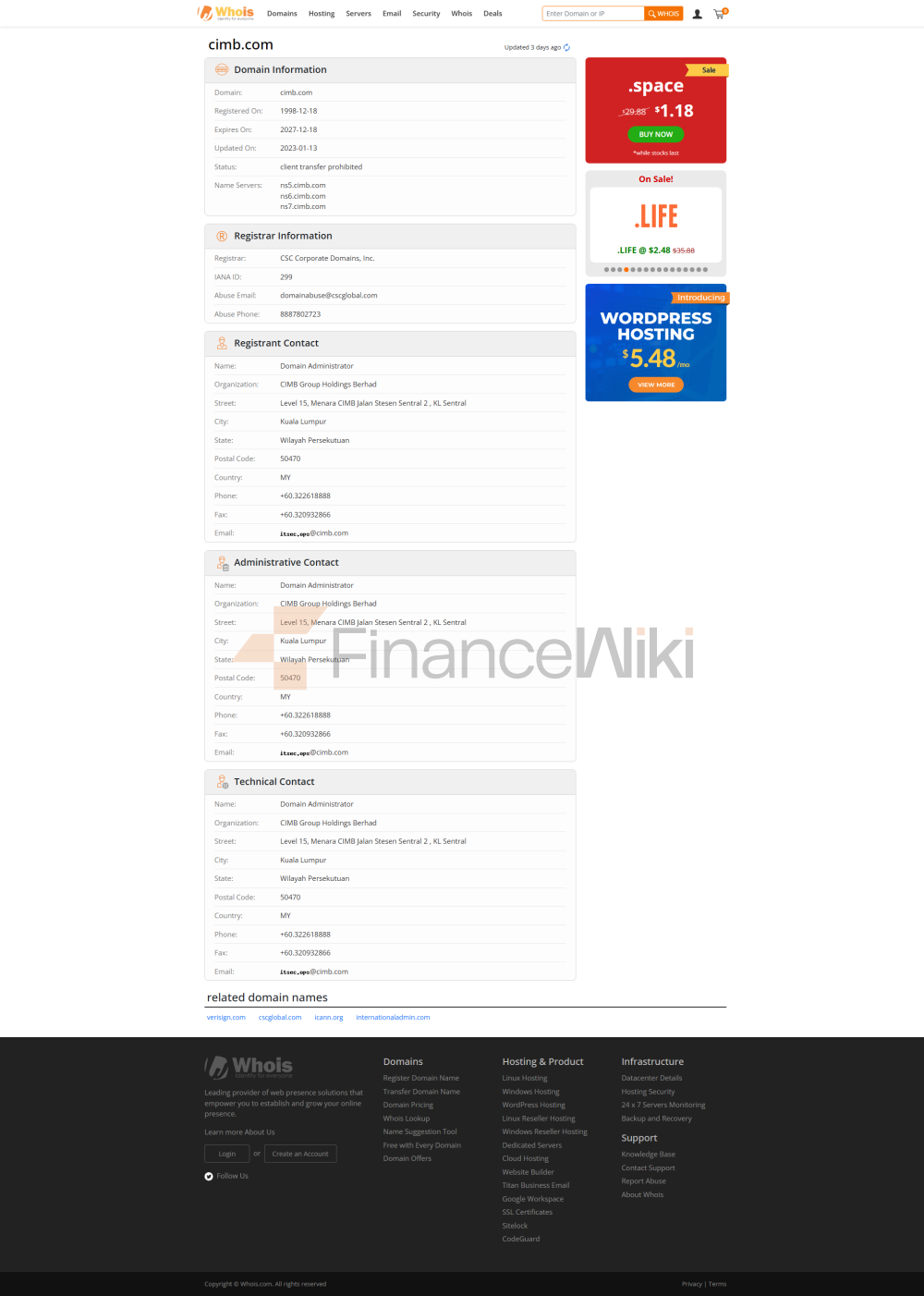

BackgroundCIMB Bank Berhad was founded in 1924 as "Cheng & Sons". The headquarters is located in Kuala Lumpur, Malaysia. CIMB is a multinational commercial bank with businesses in retail, corporate banking and investment banking. In 2013, the CIMB Group was consolidated to enhance its market position in Asia and expand its presence by merging with other institutions. Currently, CIMB is one of the four largest commercial banks in Malaysia and has branches in several countries in Southeast Asia. The bank is a listed company, its shares are traded on Bursa Malaysia, and its controlling shareholder is a relevant agency of the Malaysian government, which is state-owned.

Scope of

ServicesCIMB banking services cover the world, especially in Southeast Asia, with a strong market influence. Its business covers Malaysia, Singapore, Indonesia, Thailand, Vietnam, the Philippines and other countries and regions. CIMB offers convenient banking services through a wide range of branches and ATM distribution. CIMB has a large number of traditional offline outlets and is constantly expanding its digital business. Its ATM distribution network covers Malaysia and other Southeast Asian countries, making it convenient for users to withdraw money and complete other banking operations at any time.

Regulation &

ComplianceCIMB Bank is regulated by Bank Negara Malaysia and other regulators in Southeast Asian countries. As one of the major commercial banks in Malaysia, CIMB Bank has joined the Deposit Insurance Scheme to ensure the safety of customers' deposits. In addition, CIMB Bank has maintained a strong track record in compliance in recent years and has actively adhered to international anti-money laundering and compliance regulations, with an overall solid performance despite facing some compliance challenges from time to time.

CIMB Bank, a key indicator of financial health, is financially sound, with its capital adequacy ratio and liquidity coverage ratio in line with regulatory requirements and at a high level in the industry. The specific figures are adjusted according to market changes, but according to the latest financial report, CIMB's capital adequacy ratio remains above 13%, the liquidity coverage ratio is roughly 120%, and the non-performing loan ratio is below 2%, demonstrating its strong asset quality and risk management capabilities.

Deposits &

LoansDepositsCIMB Bank offers a variety of deposit products to meet the needs of different customers. Current and fixed deposit rates are competitive in the Malaysian market. For long-term savers, CIMB has launched a high-yield savings account, which allows customers to enjoy relatively high interest rates on their deposits. Banks also offer large certificates of deposit (CDs), which are suitable for customers who need to store large amounts of money, and usually have more favorable interest rates. CIMB has also launched a variety of special deposit products, including children's savings accounts, to meet the needs of different customer groups.

LoansCIMB

Bank's loan products cover housing loans, car loans, and personal credit loans. With relatively reasonable mortgage interest rates and flexible repayment options, customers can choose the right repayment plan according to their financial situation. Car loans and personal lines of credit also offer flexible repayment terms and preferential interest rates. In particular, CIMB Bank offers specialized low-interest loan options for first-time home buyers and specific groups.

List of common fees

: CIMB Bank's account management fees are relatively transparent. For basic accounts, the annual fee is lower, but some premium accounts charge a certain monthly or annual fee. In terms of transfer fees, domestic transfer fees are low, while cross-border transfer fees vary depending on the amount of transfer and destination. Overdraft fees and ATM interbank withdrawal fees are also among the middle in the industry. It is important to note that CIMB Bank has certain restrictions on the minimum balance of the account, and if the account balance falls below the requirement, there will be a monthly fee or other hidden fees.

Digital Service Experience

APP and Online

BankingCIMB Bank provides first-class digital services, especially in mobile banking and online banking. CIMB's apps have high ratings on user rating platforms such as Google Play and App Store, and have a wealth of features. Users can easily make real-time transfers, bill management, and purchase and investment in financial products. The bank's app also integrates face recognition technology and AI intelligent customer service to ensure the convenience and security of users' operations. In terms of technological innovation, CIMB also provides open banking API support and is committed to promoting the digital transformation of the banking industry.

Service Quality

Service

ChannelCIMB Bank offers 24/7 phone support and live chat services to ensure that customers can get help whenever they need it. Social media is responsive, and customers can interact directly with the bank through platforms such as Facebook and Twitter.

Complaint

HandlingCIMB Bank is proactive in handling complaints to minimise customer dissatisfaction. The bank uses a multi-channel monitoring and feedback system to ensure that user complaints can be resolved in a timely manner. According to recent customer feedback, CIMB has a low complaint rate and an average resolution time well below industry standards. User satisfaction is also at a high level, especially when it comes to quick response and problem solving.

Security MeasuresSecurity

of

FundsCIMB Bank provides strong security of funds and its deposits are secured by the Malaysian Deposit Insurance Corporation. In addition, CIMB protects client funds from the threat of fraud and theft through anti-fraud technologies such as real-time transaction monitoring.

Data

SecurityCIMB Bank strictly adheres to international data security standards and has passed ISO 27001 certification to ensure the security of customer data. Although there were no major data breaches, the bank continued to strengthen security and fix vulnerabilities to prevent potential security risks.

Featured Services & Differentiated

Market

SegmentsCIMB Bank pays special attention to the needs of different market segments, such as student accounts and senior citizen wealth management. For student accounts, the bank offers commission-free and special offers to help young customers establish good financial management habits. For the elderly, CIMB offers specialized wealth management products designed to help them better plan for retirement.

High Net Worth Services

CIMB's private banking business is aimed at high-net-worth clients, providing customized wealth management solutions and global investment opportunities. Private banking clients enjoy priority access and access to a dedicated investment advisor based on their individual needs.

Market Position &

HonorIndustry RankingsCIMB Bank occupies a solid position in the global banking industry and is one of the top 100 banks in the world. It is a leader in asset size and market share in Southeast Asia, especially in the local Malaysian market, where CIMB is one of the most trusted banks.

AwardsCIMB

Bank has won several awards such as "Best Digital Bank" and "Most Innovative Bank", proving its leadership in digital transformation and innovative services.