Bank

of Nigeria Limited (First Bank) is a long-established commercial bank, not a state-owned or joint venture, but a listed bank with a diversified shareholder structure through its parent company, First HoldCo Plc (formerly FBN Holdings Plc). As one of the largest banks in Nigeria, FirstBank occupies a central position in the West African financial markets with its robust brand and extensive service network.

name and backgroundFull

name: First Bank of Nigeria Limited

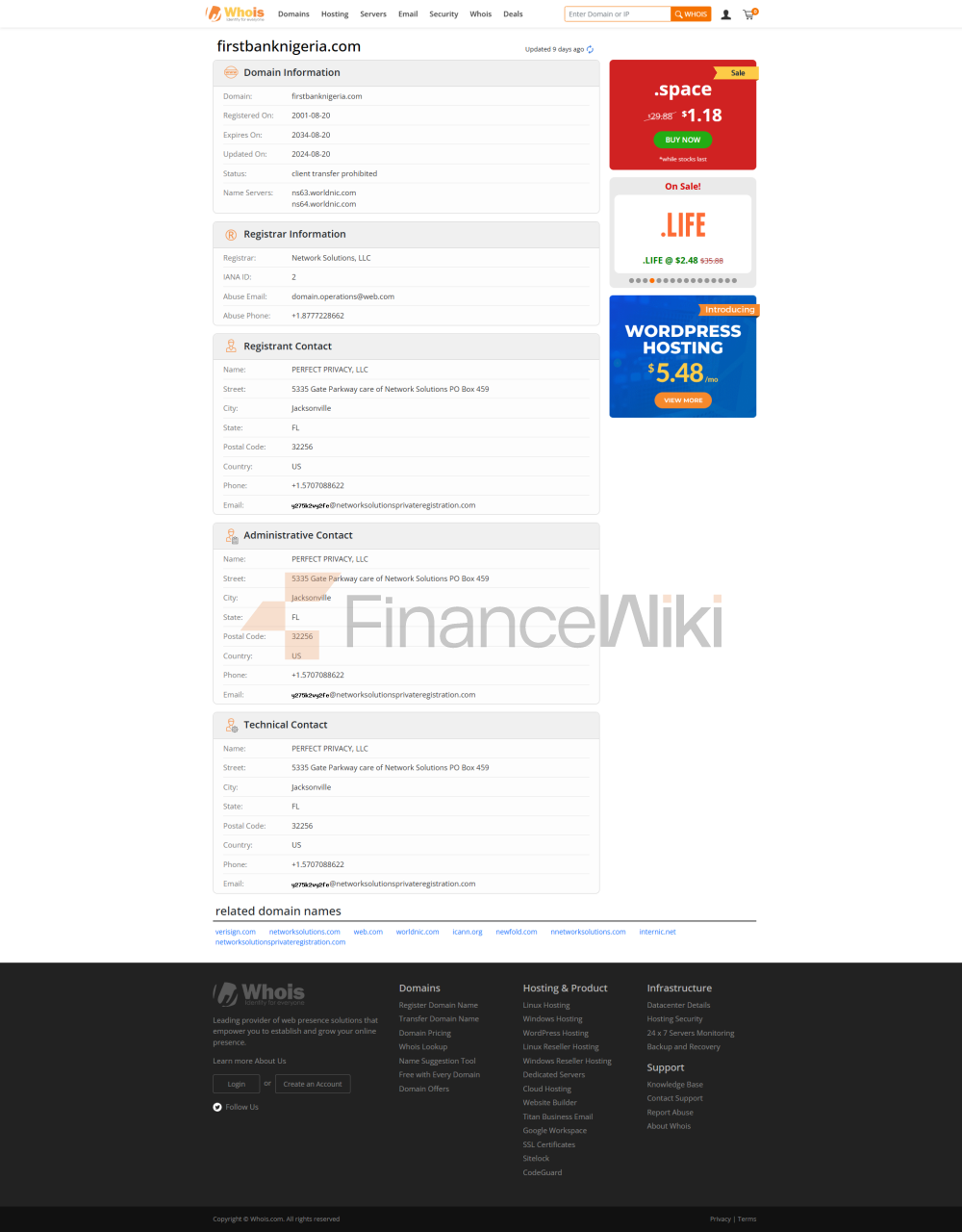

was founded: Founded in 1894 by British shipping magnate Sir Alfred Jones, it was originally known as Bank for British West Africa, and later changed its name several times, changed its name to First Bank of Nigeria Plc in 1991, and changed to its current name in 2012 to adapt to the holding company structure.

Head Office: Lagos, Nigeria, Samuel Asabia House, 35 Marina, Lagos.

Shareholder background: FirstBank is a subsidiary of First HoldCo Plc, with more than 1.3 million shareholders, with no single shareholder holding more than 5% of the shares, and the employee pension fund holds the largest stake (about 3.35%). The company is listed on the Nigerian Stock Exchange (NSE), has one of the highest market capitalisations, and has an unlisted Global Depositary Receipt (GDR) scheme. In 2024, Femi Odédola was appointed Chairman of First HoldCo Plc, further enhancing its market presence.

Background Highlights: FirstBank is one of the oldest banks in West Africa, having witnessed Nigeria's economic transition from colonial to modern times for 130 years, providing long-term loans to colonial governments and promoting local credit access after independence.

service

coverage area: FirstBank takes Nigeria as the core, and its business covers Africa (Ghana, Democratic Republic of the Congo, Gambia, Guinea, Sierra Leone, Senegal), Europe (Britain, France), Asia (China, United Arab Emirates) and South Africa, with a global strategic layout.

Offline outlets: With more than 750 branches in Nigeria and more than 820 outlets worldwide as of 2024, FirstBank has the widest branch network in Nigeria. In addition, its correspondent banking network covers 233,500 locations in Nigeria.

ATM Distribution: Operating more than 2,600 ATMs, FirstBank was the first to introduce ATMs in Nigeria in 1991 and launched the first biometric and cash deposit ATM in 2011, driving the adoption of convenient banking services.

Regulatory and compliance

regulators: FirstBank is strictly regulated by the Central Bank of Nigeria (CBN) and its UK subsidiary, FBN Bank (UK), is regulated by the Financial Conduct Authority (FCA).

Deposit Insurance: FirstBank participates in the Nigerian Deposit Insurance Corporation (NDIC) Deposit Insurance Scheme to protect customers' deposits in accordance with NDIC standards (usually 500,000 naira, approximately US$300, depending on the account type).

Compliance Record: In 2021, CBN publicly pointed out that FirstBank had corporate governance issues, including exposure to two long-term related party loans. However, the risks have been significantly mitigated through internal capital generation and rectification, and in 2022 Fitch Ratings upgraded its long-term IDR to reflect improved compliance.

Financial Health

Capital Adequacy Ratio: FirstBank maintains a solid capital adequacy ratio, and its 2022 annual report shows that its Tier 1 capital adequacy ratio is about 16%, which is higher than the minimum CBN requirement (10%), showing strong risk resistance.

Non-performing loan ratio: In the first half of 2022, the non-performing loan ratio fell to 5.4%, close to the upper limit of CBN regulation (5%), and is expected to be further optimized in 2024, reflecting continued improvement in asset quality.

Liquidity Coverage Ratio: The liquidity coverage ratio remained at a comfortable level, with 2022 data showing ample liquidity in both local and foreign currencies, with a high proportion of retail deposits (64%) and low-cost funding (81% in current and savings accounts) supporting its fund stability.

Verdict: FirstBank's financial indicators show that it is a solid player in the Nigerian banking sector, suitable for customers looking for safety and reliability, but need to pay attention to whether the non-performing loan ratio continues to decline.

Deposit & Loan ProductsDeposit

Class:

current account: flexible access and low interest rate (about 0.5%-1%) , suitable for everyday trading.

Fixed deposits: The term is from 30 days to 1 year, the interest rate fluctuates according to the amount and term, about 3%-6%, and large deposits can negotiate higher returns.

High-yield savings account: For example, First Savings Plus requires a minimum balance and an interest rate of up to 4%, which is suitable for customers with some savings ability.

Large Certificates of Deposit: Provide fixed-term (1-5 years) high-yield products with interest rates up to 7%, suitable for long-term savers.

Loans:Mortgages: FirstBank, through its subsidiary FBN Mortgages, offers mortgages with interest rates of around 10%-15%, depending on the loan term and credit score, with down payment requirements typically ranging from 20%-30%.

Car loan: The interest rate is about 12%-18%, the term is 1-5 years, the vehicle is required as collateral, and a flexible monthly payment plan is available.

Personal Line of Credit: Unsecured loans have higher interest rates (15%-22%), are capped on income-based assessments, are quick to approve and are suitable for urgent funding needs.

Flexible repayment options: Some loans offer early repayment without penalty or adjustment of repayment schedule, but you need to apply in advance.

Features: FirstBank's deposit products focus on flexibility and localization, while loan products focus on small and medium-sized enterprises and individual customers, and the approval process is relatively efficient.

List of common expenses

Account management fee: Monthly fee of about 1,000-2,000 naira (about 0.6-1.2 USD) for regular current accounts, no monthly fee for premium accounts such as First Premium but high balance.

Transfer fee:

- Domestic

transfer: Free via FirstMobile App, about 100-500 naira per over-the-counter transfer.

Cross-border transfers: Fees are about 0.5%-1% of the transaction amount, with a minimum of $10.

Overdraft Fee: The overdraft interest rate is approximately 20%-25% annualized, depending on the account type.

ATM inter-bank withdrawal fee: about 50-100 naira per transaction, free of charge at FirstBank ATM.

Hidden Fee Reminder: Please be aware of the minimum balance requirement (approximately 5,000 naira for a regular account), below which a penalty of 50-100 naira may apply. Premium accounts are free of commissions but require a higher initial deposit (e.g. 500,000 naira).

Digital Service Experience

APP & Online Banking:

FirstMobile App: Google Play has a score of about 4.2/5, App Store has a score of about 4.5/5, and it has more than 7.8 million users.

Core functions: support face recognition login, real-time domestic/cross-border transfers, bill payment (such as electricity bills, telephone bills), and investment product purchase (such as treasury bonds, funds).

Technological innovation:AI customer service: FirstBank has introduced an AI chatbot to provide account inquiries and FAQs, and the response time is usually within 1 minute.

Robo-advisors: Provide personalized investment advice through the FBNQuest platform, suitable for high-net-worth clients.

Open banking API: Support third-party developer access, making it easy for corporate customers to integrate payment and account management functions.

User Experience: FirstMobile is popular in Nigeria for its intuitive interface and versatility, especially in card-not-present transactions and USSD services (*894#), with 15 million subscribers.

customer service

quality service channels: provide 24/7 telephone support (+234-1-905-2000), live chat (through the official website and App), social media (X, Instagram) quick response, the average response time is about 1-2 hours.

Complaint handling: The complaint rate is low, with 2024 data showing an average resolution time of 3-5 working days and a user satisfaction rate of about 85%.

Multi-language support: Mainly in English, some outlets provide services in Hausa, Yoruba and Igbo, and cross-border customers can get support in French through FBN Bank (UK).

Features: FirstBank has established a good reputation among Nigerian customers for its strong localization services and quick response, but cross-border multilingual support still needs to be expanded.

security measuresFunds

security:

deposit insurance: NDIC guarantees the safety of deposits, Covers up to 500,000 naira for ordinary accounts and 2 million naira for business accounts.

Anti-fraud technology: Real-time transaction monitoring, SMS/email transaction alerts, and biometric authentication (such as fingerprint and facial recognition) to reduce fraud risk.

Data Security:ISO 27001 Certification: FirstBank is ISO 27001 certified, demonstrating that its information security management system meets international standards.

Data breaches: No major data breaches have been recorded in the past five years, and data protection measures are relatively sound.

User trust: FirstBank's security measures make it a reliable choice for the safety of funds and data, especially for privacy-conscious customers.

Featured Services & Differentiation

Segments:

Student Account: First The HIFI account is fee-free and suitable for customers under the age of 18, with a low threshold for savings and digital services.

Exclusive financial management for the elderly: Provide a low-risk investment portfolio through FBNQuest, suitable for retirees.

Green financial products: Supporting ESG investment, winning the "Best ESG Bank in Nigeria" award in 2024, launching green bonds and sustainable agricultural loans.

High Net Worth Services:Private Banking: FirstBank Private Banking provides customized wealth management for clients with assets of more than N50 million (approximately US$30,000), including global asset allocation and trust services.

Threshold: A minimum deposit of N1,000,000 is required, and services include a dedicated financial advisor and priority loan approval.

Differentiation Highlights: FirstBank's outstanding performance in SME financing and green finance has won multiple awards in 2025, demonstrating its social responsibility and innovation capabilities.

Market position and accoladesIndustry

ranking: FirstBank is Nigeria's largest bank by assets, with assets of 27.4 trillion naira (about US$16.5 billion) in 2024, accounting for 11% of the assets of the domestic banking system. In the global ranking, it ranks among the top 20 African banks.

Awards:

2025: The Asian Banker "Best SME Bank in Nigeria" and "Best SME Bank in Africa".

2024: Euromoney 'Best ESG Bank in Nigeria' and 'Best Corporate Bank'

2011-2018: Best Retail Bank in Nigeria by The Asian Banker for eight consecutive times.

Market Reputation: Known as "Nigeria's Most Trusted Banking Brand" for its long history, robust finances and innovative services, FirstBank has a benchmark position in the West African financial market.