Bank Basic Information

Bank

TypePostBank Uganda is a commercial bank that is fully owned by the Ugandan government and is committed to providing financial services to the mass market, especially in the area of financial inclusion. It was granted a Tier-1 banking license by the Central Bank of Uganda in December 2021 and was previously classified as a non-bank credit institution.

Name & Background

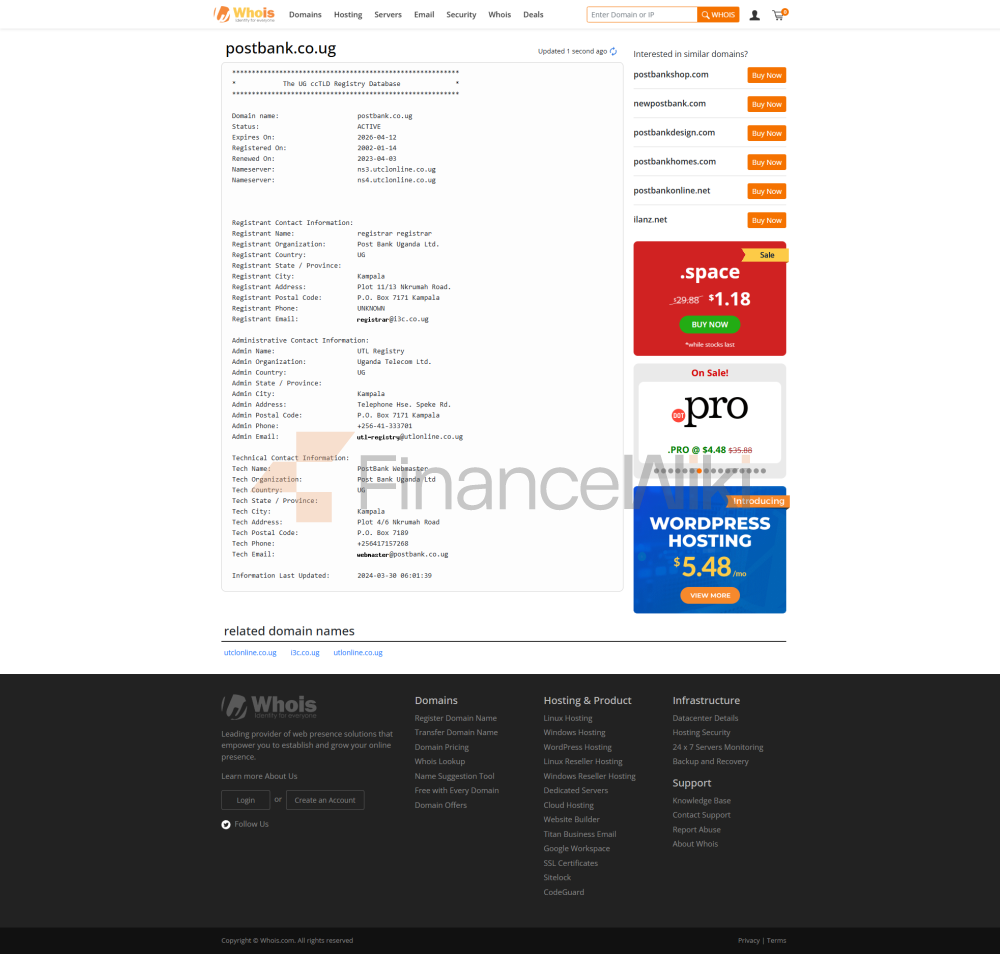

full name:P when ostBank Uganda Limited

was foundedIn 1926, it was initially operated as the savings department of the Uganda Post Office, and in February 1998, it was registered as a limited liability company under the Communications Act 1997 and took over the business of the former postal savings department.

Head Office: 4-6 Nkrumah Road, Kampala, Uganda, P.O. Box 7189。

Shareholder Background:P ostBank Uganda is an unlisted bank that is 100% owned by the Ugandan government, reflecting its strategic positioning as a state-owned bank.

Coverage <

ul style="list-style-type: disc" type="disc">coverage areas:P ostBank Uganda's services cover the entire Uganda, with a focus on the mass market, including rural and underdeveloped areas.

Number of offline branches: As of February 2021, the bank has 33 fixed branches and 17 mobile banking units, with a total of 50 service points. According to the latest information, the number of branches has increased to more than 43, covering several regions of the country.

ATM distribution:P ostBank Uganda offers an extensive ATM network that supports deposits and withdrawals, and customers can transact through smart ATMs, branches, and agent points. In addition, banks are providing services to remote areas through mobile banking vehicles, enhancing financial accessibility.

Regulatory & Compliance

regulator:P ostBank Uganda is regulated by the Bank of Uganda and complies with the Financial Institutions Act 2004.

Deposit Insurance Program: The bank participates in the Deposit Protection Fund of Uganda, which protects customer deposits of up to 10 million Ugandan shillings (approximately US$2,730).

Recent compliance records: No recent public records involving significant violations have been found, indicating good compliance. As a highly regulated state-owned bank, PostBank Uganda is required to submit regular compliance reports to the Central Bank of Uganda.

Financial Health

Key IndicatorsSince

the specific financial ratio data is not disclosed, the following is based on the average data of the Ugandan banking sector in June 2022 for reference:

Capital Adequacy Ratio (Capital Adequacy Ratio (CAR): The average capital adequacy ratio of Uganda's commercial banks is 22.8%. PostBank Uganda has a paid-up capital of 129 billion Ugandan shillings, exceeding the central bank's temporary requirement of 120 billion, indicating a solid capital base.

Non-Performing Loan Ratio (NPL): The average non-performing loan ratio of Uganda's commercial banks is 5.3%. PostBank Uganda has a loan balance of 603 billion Ugandan shillings.

Liquidity Coverage Ratio (LCR): The average liquidity coverage ratio of commercial banks in Uganda is 184.5%, indicating that the industry is fully liquid.

Financial PerformanceAs

of December 2023, PostBank Uganda's financial data is as follows:

Metrics Amount (Ugandan shilling) Amount (USD, approx. 1 USD = 3,660 UGX) Total assets 1.071 trillion $289.62 million Shareholders' equity $163.8 billion $44.3 million Customer deposits $790 billion $213.6 million Loan balance 603 billion US$163 million In

2022, the bank achieved a net profit of 15.1 billion Ugandan shillings, an increase of 19.3% year-on-year, and total income increased by 10.2% to 159.2 billion from 144.5 billion in 2021. These figures indicate good financial health, with significant growth in assets and deposits.

Deposit & Loan Products

DepositsPostBank

Uganda offers a variety of deposit products to meet the needs of different customers:

demand deposits: Includes Ordinary Savings Account, Personal Current Account, and Youth Savings Account. The opening balance of the regular savings account is 8,000 Ugandan shillings (about $2.19) and comes with free text message reminders and monthly e-statements.

Fixed Deposits: This includes a "Fixed Deposit Account" with a minimum deposit amount of 1,000,000 Ugandan shillings for a period of up to 12 months and a competitive interest rate (check with your bank for specific rates).

High Yield Savings Account:

Save As You Earn Account: Designed for customers with a stable income, up to 6% APR, no monthly management fees, free deposits and SMS alerts.

Student Accounts: Low-cost accounts are available for students, with undisclosed interest rates.

Large Certificates of Deposit (CDs): Fixed deposit accounts can be considered large certificates of deposit, allowing customers to borrow up to 90% of their deposits at attractive interest rates.

LoansPostBank Uganda offers a wide range of loan products with a focus on financial inclusion:

payroll loans: For salaried employees, the loan amount can be up to 10 times the salary, the repayment period is 6 to 48 months, and the interest rate is competitive (the specific interest rate needs to consult the bank). There are no prepayment penalties and insurance coverage is provided.

Real Estate Loans: These include the "Home & Land Loan" and the "Kyapa Loan", which help clients convert land ownership into freelance or leasehold properties with a loan amount of up to 30 million Ugandan shillings and a repayment period of up to 3 years.

Agricultural loans: Supporting the financing needs of the agricultural value chain, providing flexible repayment terms and grace periods, requiring PostBank accounts and demonstrating the profitability of agricultural activities.

Other loans: including education loans, asset-financed loans, SME loans and micro-enterprise loans, the specific interest rate and threshold need to consult the bank.

Flexible repayment options: Most loan products offer flexible repayment terms, such as 6 to 48 months for payroll loans, grace period for agricultural loans, etc.

Digital

Service Experience

APP & Online BankingPostBank

Uganda provides a mobile banking app (PostApp), which can be downloaded on Google Play and App Store, and supports iOS 14.0 and above and Android 13.0.

core function:

real-time transfer: support real-time transfer between accounts.

Bill management: Pay utility bills, school fees, taxes, and more.

Investment Instrument Integration: Support for the purchase of Treasury bills and bonds.

Other features: Online banking self-registration, loan application, ATM/branch locator, card management, device and PIN reset.

Technological innovation

PostApp features enhanced security and a user-friendly interface that supports real-time notifications and a "favorite" feature for frequently traded transactions.

Banks provide USSD codes (2631#) and mobile banking vehicles to enhance financial accessibility in rural areas.

The "Wendi" mobile wallet platform (Wendi) supports financial inclusion by allowing customers to conduct financial transactions without the need for a bank account.

Quality of customer service

Service channels

24/7 telephone support: toll-free (0800 217200) and non-toll-free (+256 417) are available 157711)。

Live chat: Support is provided through a chatbot on the website.

Social Media Response: Respond quickly to customer inquiries via Facebook, LinkedIn, and X platforms.

Other channels: WhatsApp (+256 707 993930) and email (customerservice@postbank.co.ug)。

Multi-language support

the main language of service is English, which meets the official language requirements of Uganda. Local languages (e.g., Luganda) may be supported, but no specific information was found. Cross-border customers may need to check with their bank to confirm multilingual support.

Security measures

Security ofFunds

Deposit Insurance: Customer deposits are protected by the Uganda Deposit Protection Fund with a maximum protection amount of 10 million Ugandan shillings (approximately $2,730).

Anti-fraud technology: Banks use firewalls, intrusion prevention systems (IPS), VPNs (IPSec and SSL VPNs), anti-virus and anti-spyware, anti-spam, web filtering, and other technologies to ensure transaction security. Customers are advised to access online banking through the official website and avoid suspicious links.

Data security

mobile banking apps do not support jailbreaking or rooting devices, and the original unmodified software is required. Authentication is done via phone number or one-time password (OTP).

Featured Services & Differentiation

Segments

Student Accounts: "Student Accounts" are available, designed for students, with some fees waived, Please consult your bank for specific terms.

Women's Account: A "Smart Women Account" is available to support female customers.

Agricultural Loans: Supporting the agricultural value chain through agricultural loans, for which it won the "Best Agricultural Finance Financial Institution Award" in 2019.

Wendi Mobile Wallet

the "Wendi" platform (Wendi) is an innovative service of PostBank Uganda that allows customers to save through their mobile wallets. Payments and investments, without the need for traditional bank accounts, are particularly suitable for rural and low-income groups.

Market Position & Accolades

Industry Ranking

PostBank Uganda is one of the leading commercial banks in Uganda. With total assets of 1.071 trillion Ugandan shillings (approximately US$289.62 million), it occupies an important position in the field of financial inclusion.

With more than 43 branches and an extensive ATM network, the bank is one of the most extensive banks in Uganda, with a competitive advantage, especially in rural areas.

Awards

2019: Winner of the "Best Agricultural Finance Financial Institution" award for excellence in the Central Bank of Uganda's Agricultural Credit Facility (ACF) programme.

2023: CEO Julius Kakeeto receives the "Best People-Centric CEO/MD" award at the HR Reveal Awards for his leadership in employee well-being and bank development.

Other achievements: Ranked in the top 5 in the bancassurance sector, demonstrating its competitiveness in the sale of insurance products.

Conclusion

PostBank Uganda is a state-owned commercial bank with financial inclusion at its core, supporting the Ugandan mass market through its extensive service network and innovative products since 1926. Its solid financial performance, diversified deposit and loan offerings, advanced digital services, and focus on rural and low-income groups make it uniquely positioned in Uganda's banking sector. The bank continues to drive socio-economic development through special services such as the "Wendi" mobile wallet and agricultural loans. Although specific interest rate and fee information needs to be consulted further, PostBank Uganda has earned it a good reputation in the market for its customer service and security measures. Whether it's a student, a farmer, or an SME, PostBank Uganda is committed to meeting the needs of its customers through innovative and inclusive financial solutions.