Bank

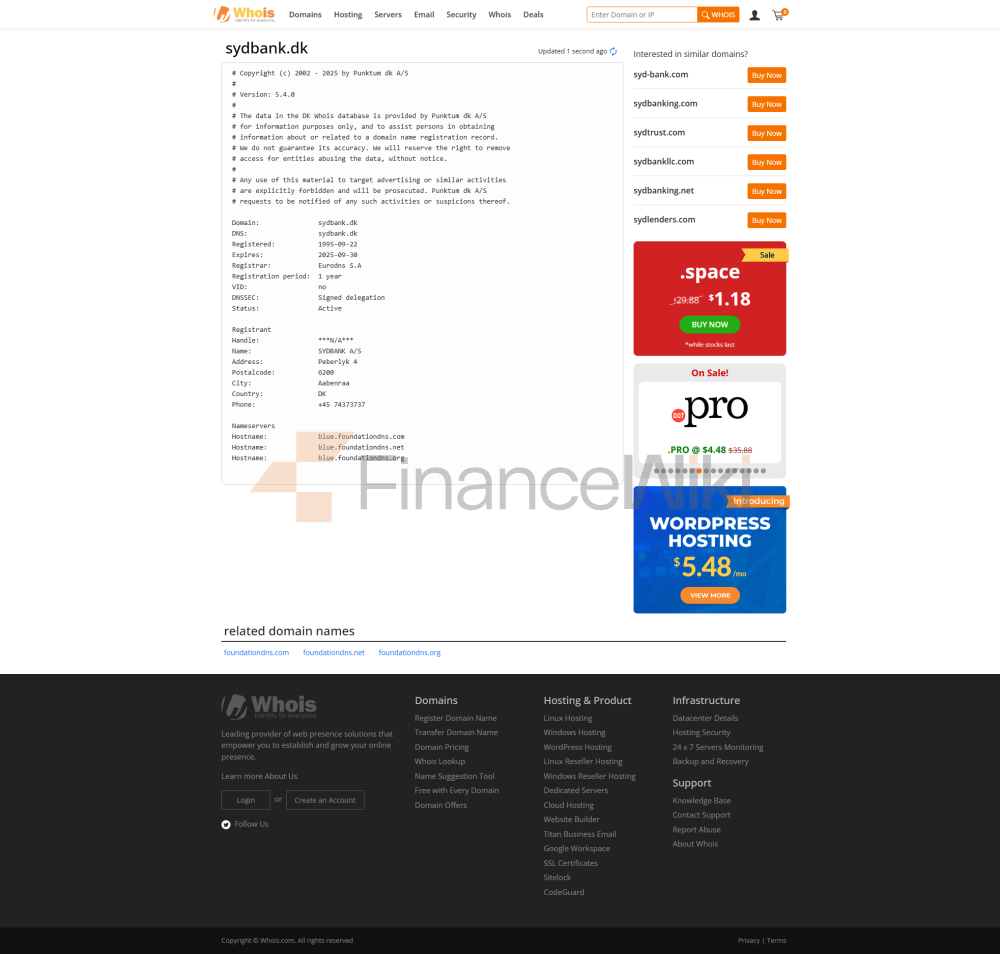

BasicsSydbank is a commercial bank, known as Sydbank A/S, founded in 1970 through the merger of four regional banks in South Jutland: Den Nordslesvigske Folkebank, Graasten Bank, Folkebanken for Als og Sundeved and Tønder Landmandsbank (Tanne). The headquarters are located at Peberlyk 4, Abenla, Denmark. Sydbank is a publicly traded company listed on the Copenhagen Stock Exchange (Nasdaq Copenhagen) ticker symbol SYDB.COMajor shareholders include institutional investors (e.g., pension funds, insurance companies) and retail investors. As of 2024, Sydbank has a market capitalization of approximately DKK 36.8 billion and has more than 600,000 shareholders.

Sydbank's services mainly cover Denmark and Germany, and its business covers personal, commercial and institutional clients. In Denmark, Sydbank has a market share of around 6-12% (depending on the customer base); In Germany, banks offer their services through 3 branches. As of 2024, Sydbank has 60 branches (57 in Denmark and 3 in Germany) and offers an extensive ATM network through the Global ATM Alliance, making it easy for customers to deposit and withdraw money. The exact number of ATMs is not disclosed, but they are usually located in branches and major business centers. Sydbank also has a subsidiary in Switzerland (Sydbank (Schweiz) AG in Liquidation) and supports cross-border business through an international representative office.

Sydbank is regulated by the Danish Financial Supervisory Authority (DFSA) and the Danish National Bank (DNB) and is designated as a Systemically Important Financial Institution (SIFI) and is subject to stricter regulatory requirements. The bank participates in the Danish Deposit Protection Fund (Garantiformuen) with a deposit insurance limit of up to 100,000 euros per person per bank, ensuring the safety of customer funds. In terms of compliance records, Sydbank has maintained a strong compliance record by strengthening anti-money laundering (AML) and customer due diligence (KYC) measures. In 2025, Sydbank partnered with INTERPOL to further enhance its anti-money laundering and anti-financial crime capabilities, without reporting new significant compliance issues.

Financial health:

Sydbank's financial health is a key reflection of its position as a leading bank in Denmark. The following are the key financial indicators for 2024:

- Capital adequacy ratio: The core Tier 1 capital adequacy ratio (CET1) was 17.8% and the total capital ratio was 21.4%, both of which were higher than the DFSA's SIFI requirements, indicating a strong capital base.

- Non-performing loan ratio: Non-performing loan losses of DKK 595 million in 2024 and total loans of DKK 8.25 billion, indicating good asset quality.

- Liquidity Coverage Ratio: Sydbank maintains strong liquidity through diversified financing sources such as customer deposits and international borrowings, with total assets of approximately DKK 698.7 billion in 2024.

In 2024, Sydbank reported a profit before tax of DKK 3,645 million, down DKK 636 million year-on-year, mainly due to an increase in non-performing loan losses of DKK 622 million. Net profit amounted to DKK 2,762 million and a return on shareholders (ROE) of 18.6%. The bank demonstrated confidence in its capital strength by returning DKK 2,727 million to shareholders through a dividend of DKK 26.88 per share (50% of profits) and a share repurchase program of DKK 1.35 billion.

Deposit & Loan

ProductsSydbank offers a wide range of deposit and loan products to meet the financial needs of individual and corporate customers.

Deposits:

- Demand deposits: such as Sydbank Basis accounts, which are suitable for daily transactions and have a lower interest rate (about 0.25%, for example, in Denmark).

- Fixed deposits: fixed interest rates are available for maturities from 1 month to 5 years, with deposits ranging from DKK 5,000 to DKK 2,000,000 and a maximum interest rate of 4.10% per annum. Customers can choose to pay interest monthly or at maturity, with 31 days' notice required for early withdrawal, otherwise interest rate adjustments may be faced.

- High-yield savings accounts, such as Sydbank Ung accounts, offer up to 4.65% interest rate for customers aged 18-29 (subject to monthly deposit and other conditions).

-

Loans:

- Mortgages: Fixed and variable rate mortgages are available with a minimum annual interest rate of 2.73% (April 2025, based on a 12-month Euribor plus 0.6% spread). Support flexible repayment options, such as early repayment or adjustment of repayment schedule.

- Personal Line of Credit: For example, Sydbank FlexiCredit, with interest rates starting from 7.99%, is suitable for consumer needs and supports early repayment.

List of common

feesSydbank's fee structure includes the following common fees:

- Account Management Fee: No monthly fee for Sydbank Basis accounts, subject to conditions (e.g. students or customers aged 18-29). Other accounts may be charged 5 DKK/month.

- Transfer fee: Domestic transfers are usually free of charge, international transfers cost DKK 20 (sent in euros via online banking).

- ATM interbank withdrawal fee: DKK 2.50 per trip using non-Sydbank ATMs and 3% foreign exchange transaction fee for overseas withdrawals.

Quality of Customer

ServiceSydbank provides customer service through multiple channels, ensuring that customers receive support at all times:

- Telephone support: customers can call +45 74 37 37 37 (8:00-20:00 daily, including weekends) and +45 70 10 78 79 for emergencies (e.g. lost card).

- Live chat: Live support via Sydbank Mobilbank and online banking.

- Social Media Response: Respond quickly to customer inquiries via Platform X (https://x.com/SydbankDK)).

- Branch services: 60 branches provide face-to-face support.

Complaints handling: Sydbank has a complaints officer (tel. +45 74 37 20 < a target="_blank" rel="noopener noreferrer nofollow" href="mailto:90, e-mail klageansvarlig@sydbank.dk" >90, email klageansvarlig@sydbank.dk), customers can submit complaints through the online form, if they are not satisfied, they can contact the Danish Financial Appeals Board. In 2024, customer satisfaction with digital services is high.

Multi-language support: The service is mainly provided in Danish, with support for German and English, which is suitable for cross-border customers.

Security

MeasuresSydbank has implemented a number of measures to protect customer funds and data:

- Security of funds: participation in the Danish Deposit Protection Fund up to €100,000. Prevent fraud with real-time transaction monitoring, Sydbank ID two-factor authentication, and Visa Secure.

- Data security: GDPR compliance, data encryption and access control, no major data breaches reported, and regular security audits by banks.

- Anti-fraud technology: including real-time transaction monitoring, employee security training, and third-party privacy agreements.

Featured Services &

DifferentiationSydbank caters to market segments with the following services:

- Student Accounts: Sydbank Privat Ung offers customers aged 18-29 a no-monthly fee account, free Visa/Dankort or Mastercard Ung Debit cards, free ATM withdrawals, and ISIC card discounts.

- Green financial products: Supporting green loans and ESG investments, with a target of DKK 10 billion in green financing by 2027.

Market position and accoladesSydbank

is the fourth largest bank in Denmark with a market share of around 6-12% in 2024 (depending on the customer base). Globally, Sydbank is ranked 125th in the "Global 2000" (2024) and 53rd in terms of assets (2019). The bank has received several awards:

- Danish Digital Awards 2021: recognized for the "Sydbank x Veo" project.

- Erhvervs Awards: sponsorship of Klima-og Miljøpris in Slagelse, which recognises climate and environmental contributions.

- Sustainability Award: Recognised for supporting green finance and community projects.