Institutional OverviewAmana

Bank PLC is a private commercial bank established on February 5, 2009 and headquartered at 486 Galle Road, Colombo, Sri Lanka. As the first bank in Sri Lanka to fully follow Islamic banking principles, all of its transactions do not involve interest (RIBA) and are based on Islamic financial models such as profit sharing and leasing. The bank is listed on the Colombo Stock Exchange and its major shareholders include IDB Group (29.97%), IB Growth Fund (Labuan) LLP (23.65%) and Seylan Bank PLC/Senthilverl Holdings (Pvt) Ltd (10.00%). With 33 branches and over 5,400 ATMs across Sri Lanka, Amana Bank provides convenient deposits and withdrawals through the LankaPay network.

Regulation &

ComplianceAmana Bank is regulated by the Central Bank of Sri Lanka (CBSL) and is subject to the Banking Act No. 30 of 1988. Its deposits are protected through the Sri Lanka Deposit Insurance Scheme (SLDIS) with a maximum compensation of Rs 1.1 million per depositor. The bank has a strong compliance record and has not identified recent major breaches, with a BB+ (lka) rating from Fitch Ratings in 2021 with a stable outlook.

Financial healthAlthough

specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed, Amana Bank was ranked as one of the top 50 Islamic banks in the world by The Asian Banker in 2021 and rose to 37th in 2023, indicating its strong financial position. In Q1 2024, the bank recorded total revenue of about Rs.46 crore and net profit of Rs.456 crore, up 5.12 per cent year-on-year, reflecting its resilience amid economic challenges.

Deposit & Financing

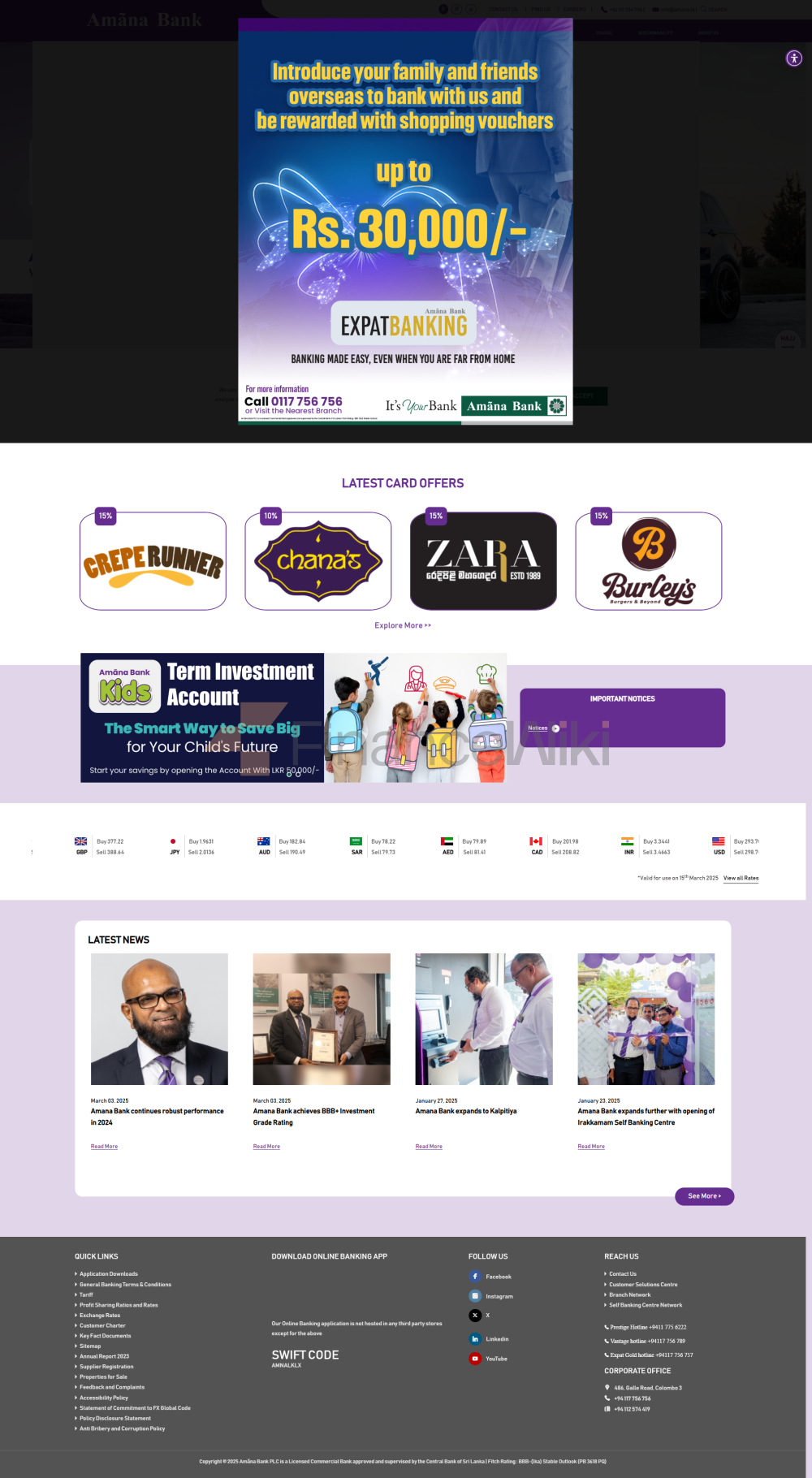

ProductsAmana Bank offers profit-sharing-based deposit products, including General Savings Account, Amana Kids, Ladies Savings, Senior Citizen Savings, Payroll Savings Account, Amana Savings Plan and Amana Retirement Savings Account. The profit margin is determined based on the performance of the investment pool, and the customer can estimate the return through the online profit calculator. Financing products include home finance (up to 20 years), vehicle finance, personal asset finance, solar finance, education finance, travel finance and condo finance, all of which follow Islamic finance principles and support flexible repayment and early settlement with no additional fees.

List of fees

is specific to the bank and needs to be checked directly with the bank, but common fees include account management fees (minimum balance requirement of INR 1,000), domestic and cross-border transfer fees, overdraft fees, and non-Amana Bank ATM withdrawal fees. Banks emphasize fee transparency, and customers should read the account terms carefully to avoid hidden fees.

Digital Service

ExperienceAmana Bank provides convenient digital services through the "UBgo" mobile app (available for iOS and Android) and online banking platform, supporting account management, real-time transfers, bill payments and investment management. The app uses biometric sign-in and two-factor authentication, but user feedback shows sign-in issues. The bank attracted 22,720 users through WhatsApp banking services in 2024 with a digital transaction value of Rs 11,246 crore.

Customer Service Quality

Bank offers 24/7 customer service by phone (+94 117 756 756), email (info@amanabank.lk) and WhatsApp (+94707756756) support customers. Complaints can be submitted through the Contact Centre and unresolved issues can be escalated to the Quality Assurance Manager or the Financial Ombudsman. Services are mainly provided in English, Sinhala and Tamil to meet the linguistic diversity needs of Sri Lanka.

Security measures

Deposits are protected by SLDIS up to Rs 1.1 lakh. Banks use real-time transaction monitoring and two-factor authentication to prevent fraud. Data security measures include SSL encryption and multi-factor authentication (MFA), and no major data breaches have been reported.

Featured Services & DifferentiationAmana

Bank addresses market segments with children's accounts, senior accounts, green finance (e.g., solar financing) and Prestige Banking high-net-worth services. The bank is actively involved in community projects such as the Financial Literacy Program and OrphanCare as part of its social responsibility.

Amana Bank is the only Islamic bank in Sri Lanka with a market capitalization of around Rs 108 crore in 2024 and a share price of Rs 2.60 crore (as of June 3, 2025). In 2021, the bank was ranked as one of the top 50 Islamic banks in the world by The Asian Banker, rising to 37th in 2023. In 2024, it was awarded the Euromoney "Best Domestic Islamic Bank in Sri Lanka" award for excellence in digital innovation and customer service. The bank was also awarded the SLIBFI Gold Award for "Spirit of Islamic Finance", highlighting its leadership in the field of Islamic finance.

Going forward, Amana Bank will continue to drive digital transformation and plan to solve the challenge of 30% of Sri Lanka's population being unbanked through fintech. The Bank is committed to achieving the United Nations Sustainable Development Goals (SDGs) through innovation and community engagement, particularly in the areas of green finance and financial inclusion.

Amana Bank PLC has become a benchmark in Sri Lanka's financial sector with its Shariah-compliant financial products, extensive service network and innovative digital services. Whether it is a retail customer, an SME or a high-net-worth customer, banks offer a wide range of financial solutions to meet different needs. Despite technical issues with its mobile app, Amana Bank continues to enhance the customer experience through strong customer service and market position. In the future, with its continued efforts in the areas of technological innovation and sustainability, Amana Bank is expected to further consolidate its position as an industry leader.