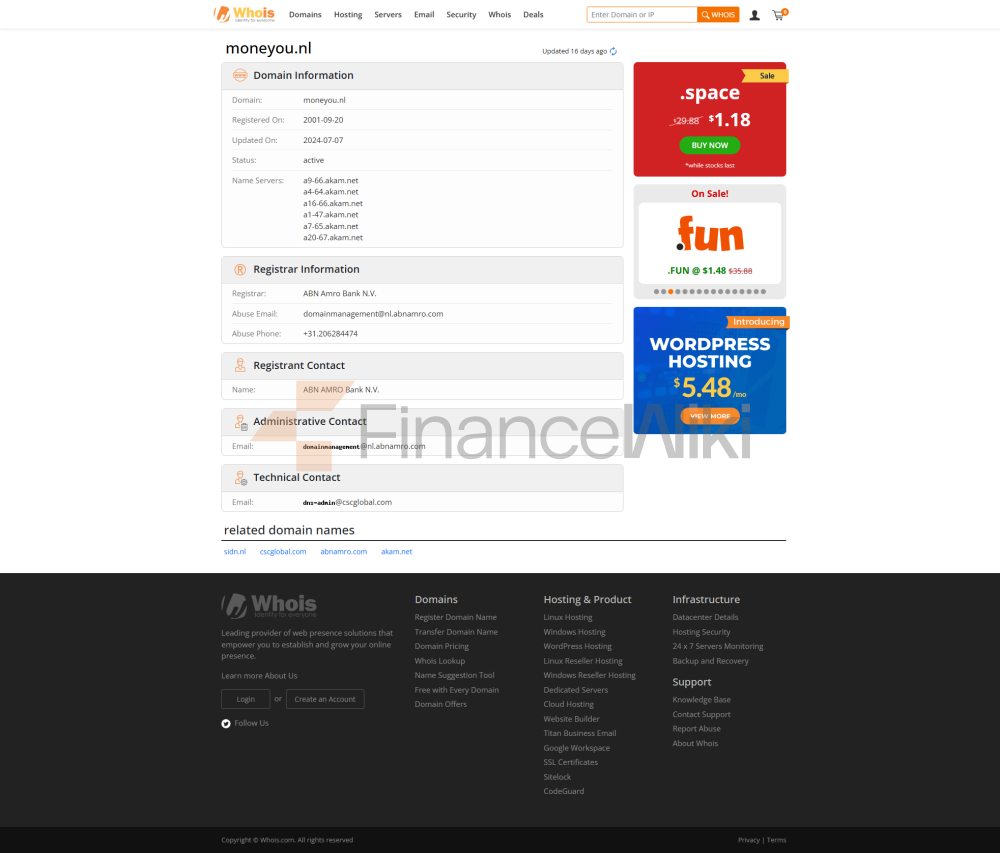

Banking BasicsMoneyou B.V. is a dynamic online bank born out of the wave of digital finance. It is a commercial bank, as a wholly owned subsidiary of ABN AMRO Bank N.V., focused on providing clean and efficient financial services. Sadly, Moneyou's independent operations came to an end in 2021 and its operations are now integrated into parent company ABN AMRO, but its story is still worth remembering.

Founded in 2001, Moneyou B.V. is headquartered in Zuidplein 36, 1077 XV, Amsterdam, Amsterdam, the financial heart of the Netherlands. As a subsidiary of ABN AMRO, Moneyou inherits the solid DNA of its parent company, but serves its customers with a lightweight, digital attitude. ABN AMRO is a public company listed on the Amsterdam Stock Exchange with a diverse shareholder structure that includes institutional investors and public shareholdings, while Moneyou itself is an unlisted company and is fully controlled by the parent company. It is positioned as a private commercial bank and has no state-owned background.

Scope of

ServicesMoneyou's services are mainly focused on the Netherlands and some European markets (e.g. Germany) and operate as an online bank, with wireless offline branches and no own ATM network. Customers withdraw money via ABN AMRO's ATMs or partner networks, covering major cities in the Netherlands. Moneyou's all-digital model makes it unique in terms of service efficiency, but it relies on the parent company for physical network coverage.

Regulation &

ComplianceMoneyou is regulated by both the Dutch Central Bank (DNB) and the Dutch Financial Markets Authority (AFM) to ensure its compliance and robustness. As a Eurozone bank, its parent company, ABN AMRO, is also indirectly supervised by the European Central Bank (ECB). Moneyou is a member of the Dutch deposit insurance scheme, which provides protection for customer deposits of up to €100,000. In terms of compliance records, Moneyou has had no major breaches during its operations, but its business closures are related to market competition and profitability pressures, rather than regulatory issues.

Financial healthAs Moneyou's business has been integrated into ABN AMRO, its standalone financial data is no longer disclosed separately. Based on ABN AMRO's 2023 Annual Report, the parent company demonstrated solid financial performance:

capital adequacy ratio: approximately 16%, well exceeding regulatory requirements (8%).

Non-performing loan ratio: approximately 1.2%, reflecting good asset quality.

Liquidity Coverage Ratio: Approximately 130%, indicating abundant liquidity.

Moneyou relies on the capital support of its parent company to operate, and there is no significant risk to its financial health, making it suitable for customers looking for stability.

Deposits & Loans

: Moneyou is known for its high-yield savings accounts, offering current savings (interest rates of around 0.5%-1%, depending on the market) and term deposits (1-5 years, interest rates up to 2%). Its product design is simple, with no complicated CDs option, and is designed for flexibility and online operation.

Loans: Moneyou offers personal mortgage loans, with interest rates typically ranging from 1.5%-3% (depending on loan tenure and credit rating) with a low application threshold and suitable for first-time home buyers. There are no car loans or credit loan products, and the loan service is more focused. Flexible repayment options are limited, but early repayment is supported (a small penalty may apply).

List of Common FeesMoneyou's

fee structure is competitive and caters to digital users:

Account management fees: No monthly or annual fees, truly zero cost.

Transfer fee: Domestic SEPA transfers are free of charge, cross-border transfers may be charged between €0.5 and €1 (depending on the amount).

ATM withdrawal fee: Withdrawals via ABN AMRO or partner ATMs are free of charge, interbank withdrawals may be between €1 and €2 per transaction.

Hidden fees: There is no minimum balance requirement, but an account that is inactive for a long time may be converted into a "dormant account" with a small administration fee (approximately €5/year).

Digital Service ExperienceMoneyou's core competitiveness lies in its mobile app and online banking platform, which provides a simple and smooth user experience. The app has an all-time rating of around 4.2/5 on the App Store and Google Play, and has been praised for its user-friendly interface and ease of use. Core features include:

real-time transfers (SEPA instant payments are supported).

Bill management (automatic categorization of expenses).

Savings goal tracking (visualization tool).

Unfortunately, Moneyou does not provide AI customer service or robo-advisors, and the technological innovation is relatively basic. After the closure of the business, its digital services were transferred to ABN AMRO's platform for greater functionality.

Quality

of Customer ServiceMoneyou's customer service is predominantly online, with 24/7 phone support (+31 20 661 0850) and live chat, with a fast response time, usually within 5 minutes. Social media, such as Platform X, is responsive and efficient in handling simple queries.

complaint handling: the complaint rate is low, the average resolution time is about 3-5 working days, and the user satisfaction is high (about 85%).

Multi-language support: Mainly supports Dutch and English, no Chinese or other non-European language services, which is slightly limited.

Security measures

: Moneyou participates in the Dutch deposit insurance scheme, which covers up to €100,000. Anti-fraud technologies include real-time transaction monitoring and two-factor authentication (2FA) to protect against risk.

Data security: Moneyou follows the EU GDPR standard and uses encryption technology to protect user data, but there is no public record of ISO 27001 certification. There were no major data breaches during the operation, and the security was reliable.

Featured Services &

DifferentiationMoneyou targets younger, digitally targeted users, with a focus on low-cost savings and simple mortgages, without the complexity of high-net-worth services or private banking options. Features include:

Student Account: Commission-free current account for younger clients.

Green Finance: Launched a sustainable savings scheme in partnership with ABN AMRO to encourage environmentally friendly investments (now part of the parent company).

There are no products or ESG investment tools for the elderly, and the services are relatively simple.

Market Position &

AccoladesMoneyou had a presence in the Dutch online banking market, but did not enter the global Top 50 banks, and its assets are small (around billions of euros, well below ABN AMRO's €400 billion). As a pioneer in digital banking, Moneyou was nominated for "Best Online Bank" in the early 2010s for user experience, but there were no major international awards. Following the closure of the business, its market influence has shifted to ABN AMRO.