basic bank information

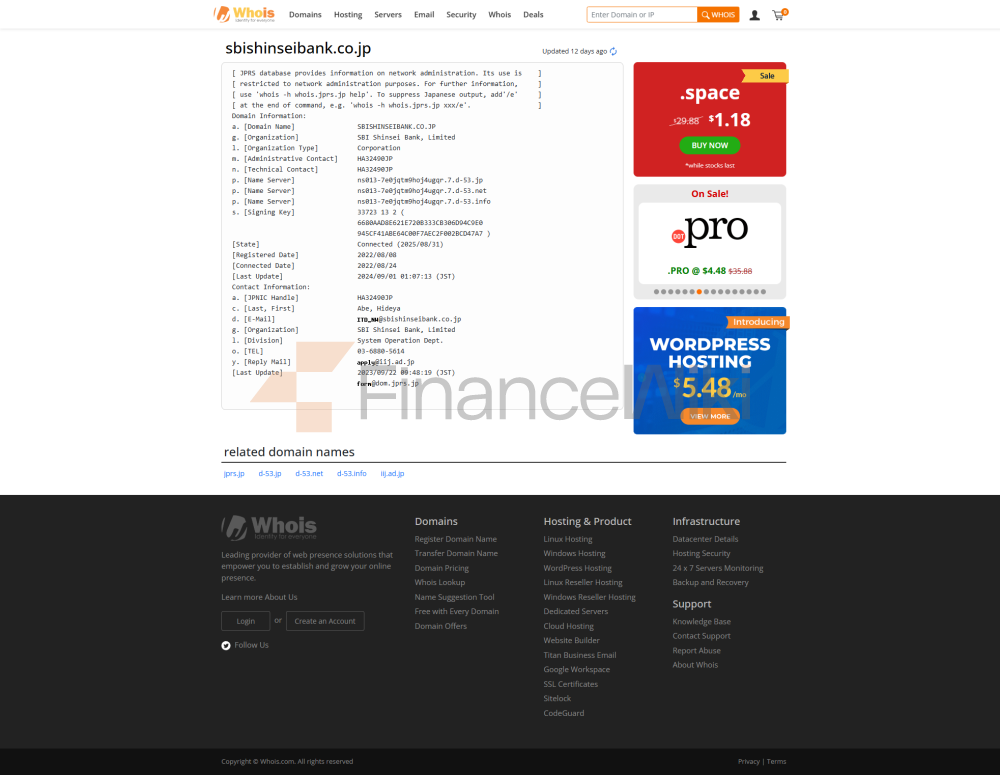

Ownership: Belongs to SBI Group, whose parent company, SBI Holdings, Inc., is listed on the Tokyo Stock Exchange (stock code: 8473) and has no state-owned or joint venture background.

type: commercial bank

SBI Shinsei Bank, as a commercial bank, focuses on retail and institutional banking, and provides diversified financial solutions based on the integrated financial ecosystem of the parent company.

name and background<

ul style="list-style-type: disc" type="disc">full name: SBI Shinsei Bank, Limited<

span style="font-family: sans-serif; Color: black" > was founded in 1952 (formerly known as Japan Long-Term Credit Bank, LTCB), renamed Shinsei Bank in 2000, and changed its name to SBI Shinsei Bank on January 4, 2023.

Headquarters: Nomura Building, Nihonbashi Muromachi, 2-4-3, Nihonbashi, Chuo-ku, Tokyo

Shareholder Background: The parent company, SBI Holdings, Inc., is a publicly traded company with a market capitalization of approximately $9.71 billion in 2024, and its shareholders include institutional investors and the general public.

SBI Shinsei Bank, formerly known as the Long-Term Credit Bank of Japan (LTCB), was taken over by the government in 1989 due to non-performing loans after Japan's asset price bubble burst, and was nationalized in 1998. In 2000, LTCB was acquired by an international consortium led by Ripplewood Holdings of the United States for 121 billion yen (about 1.2 billion U.S. dollars), becoming the first foreign-controlled bank in Japanese history. In 2019, the Japanese government acquired a stake in the Christopher Flowers Fund, marking its further integration into the SBI Group.

service scope

Coverage area: Mainly serving the Japanese market, covering the whole country, and some international business is supported by the parent company.

Number of offline branches: number of branches undisclosed, but customer-friendly financial center, some branches staffed by English.

ATM distribution: Free ATM network available, the exact number of which is not disclosed, but allows customers to withdraw cash nationwide, and ATM usage hours may vary depending on building hours and system maintenance.

SBI Shinsei Bank ensures that customers have easy access to its services through its network of branches and ATMs, with a particular focus on the convenience of foreign residents.

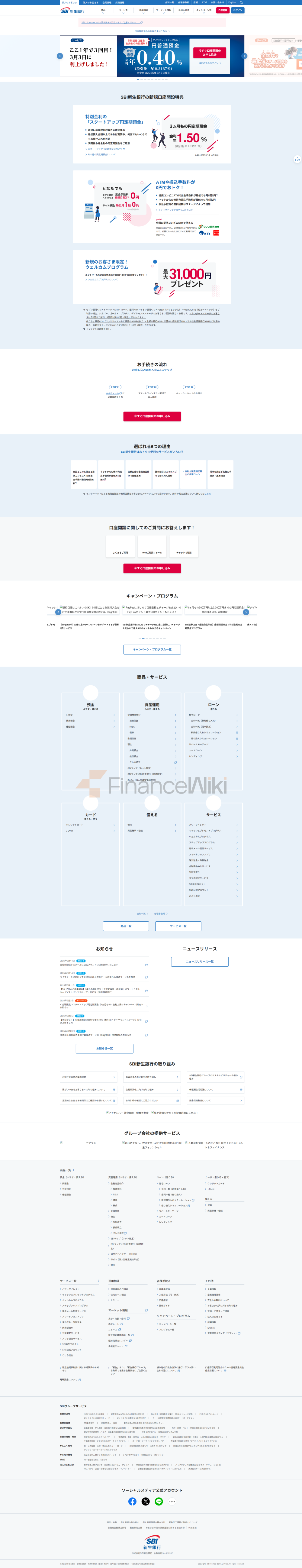

services and products

for individuals:

> deposit account: PowerFlex account is available, including JPY and foreign currency deposits, attractive interest rates and flexible deposit terms.

loans: Unsecured loans, home loans, and credit card services are available.

investment products: through a partnership with SBI Securities, which provides investment trust and securities account management.

payment services: credit cards, shopping credit, and payment services are supported for everyday purchases.

for business:

Corporate Loans: Providing commercial loans, asset finance and structured finance services.

Institutional Business: Serving mid- and large-sized enterprises through the Global Markets segment of commercial loans and equity investments.

Other services: support start-up incubation, provision of loans and management solutions such as HR and business planning support.

SBI Shinse's personal services are centered on deposits and loans, supplemented by investment and payment products. Corporate Services focuses on commercial financing and institutional needs, reflecting the strength of its integrated financial group.

regulatory and compliance<

ul style="list-style-type: disc" type="disc">regulated: Financial Services Agency (FSA) of Japan, which oversees banks' capital adequacy ratios, risk management, and compliance.

Deposit Insurance Scheme: Yes, insured by the Japan Deposit Insurance Corporation (DICJ), covering the principal and interest of deposits, up to 10 million yen (about 72,000 USD) per person per bank.

Recent compliance records: Records are not publicly available, but as a regulated bank, strict regulations apply. In May 2023, the Tokyo Stock Exchange listed its shares as supervised securities, showing concern for its governance, but did not involve specific violations.

SBI New Life Bank is subject to multi-layered supervision, and the security of deposits is guaranteed by DICJ to ensure the safety of customer funds.

financial health

key metrics:

> Capital adequacy ratio: According to the bank database, the capital asset ratio is 8.5%, which meets the Japanese regulatory requirements (minimum 8%), but the specific capital adequacy ratio under the Basel III standard is not disclosed.

Non-performing loan ratio: Specific data is not disclosed, but Japanese banks generally maintain low non-performing loan ratios, estimated to be in the range of 1-2%.

Liquidity Coverage Ratio: No specific data is disclosed, but as a Bank of Japan, it is required to maintain a liquidity coverage ratio of at least 100%, and studies have shown that it is liquid healthy.

overall assessment: total assets of approximately US$42.2 billion, pre-tax profit of US$200 million, and Tier 1 capital of US$3.6 billion in 2024, indicating financial soundness. Return on assets was 0.4%, return on capital was 4.7%, cost-to-income ratio was 55.3%, loan-to-asset ratio was 65.2%, and loan-to-deposit ratio was 75.3%, indicating a balance between risk management and profitability.

digital service experience<

ul style="list-style-type: disc" type="disc">APP & BANKING:

> user ratings: 4.7 (based on 90,600 reviews) and 4.5 (based on 32,400 reviews) on Google Play for the mobile app.

core features: support real-time transfers, bill management, mobile check deposits, foreign currency deposit transactions, and securities account balance inquiry. Biometric logins (such as fingerprint or facial recognition) are supported, and two-factor authentication is provided.

technical innovation:

AI customer service: provides 24/7 live chat, which may include AI-driven features, details are not disclosed.

robo-advisor: provides investment advice through cooperation with SBI Securities, but the specific robo-advisory service is not specified.

Open Banking API: Not explicitly supported, but the digital platform may integrate with the parent ecosystem.

SBI New Life Bank's digital service experience is fully functional and user-friendly with its mobile app and online banking (PowerDirect) at its core.

customer service

channel:

phone: English-language customer support is available, via webform and Call Back Reservation Form, specific phone number is not disclosed.

e-mail: sent via the contact page of the website.

Live chat: 24/7 support, may include AI-driven features.

Comments: Branches are mainly in Japanese, and some have English-speaking staff, but they may not be permanently stationed. Users report the ease of online support, especially for foreign residents.

SBI Shinsei Bank embodies its international service philosophy by providing customer support through multiple channels to ensure that customers can get help at any time.

safeguards

Technical security: Data encryption, two-factor authentication and smartphone authentication are used to prevent unauthorized operations.

Deposit security: DICJ insurance, up to 10 million yen/person.

Other: Secure your online banking with a secure keypad and advice on changing your password regularly.

SBI Shinsei Bank uses industry-standard security measures to ensure the safety of customer data and funds, and enhance user trust.

featured services and differentiations

PowerFlex account: Offers unique services such as cashback for overseas ATM withdrawals, extended business hours until 7 p.m. (Japanese banks usually close earlier), and standard accounts for foreign currency deposits (unique to Tokyo Star Bank and Jibun Bank).

Foreign Resident Friendly: Attractive to foreign customers by offering online banking and phone support in English, opening an account without a personal seal.

Integrated Financial Group: As part of the SBI Group, it provides seamless integration of securities, insurance and banking services to enhance the customer experience.

innovative services: Partnering with non-financial sectors to develop new services, such as the launch of FamiPay lending services in partnership with Famima Digital One.

Social Responsibility: In 2021, the Group published its Sustainability Management and Human Rights Policy as part of its commitment to social responsibility.

SBI Shinsei Bank is different from traditional banks with its innovative services and international features, and is suitable for customers who are looking for diversified financial services.

conclusion

SBI Shinsei Bank is an innovative Japanese commercial bank known for its PowerFlex accounts, foreign currency deposits, and foreign-resident-friendly services. Part of the SBI Group, its integrated financial ecosystem provides customers with a diverse range of financial solutions. Financial health and stability, excellent digital service experience, and highly rated mobile apps for customers looking for efficient and low-cost banking services. Although the branch office is primarily in Japanese, its online support and English-speaking services make up for this limitation. Through innovation and internationalization, SBI Shinsei Bank has demonstrated the flexibility and competitiveness of modern banking services.