Basic Information

of the BankSterling Bank Ltd. is a national commercial bank authorized by the Central Bank of Nigeria (CBN) and is positioned as a full-service commercial bank rather than a state-owned or joint venture bank. With retail and consumer banking, trade services, corporate banking, investment banking and non-interest banking services as its core businesses, the bank serves individuals, small businesses and large corporations.

Full name and background

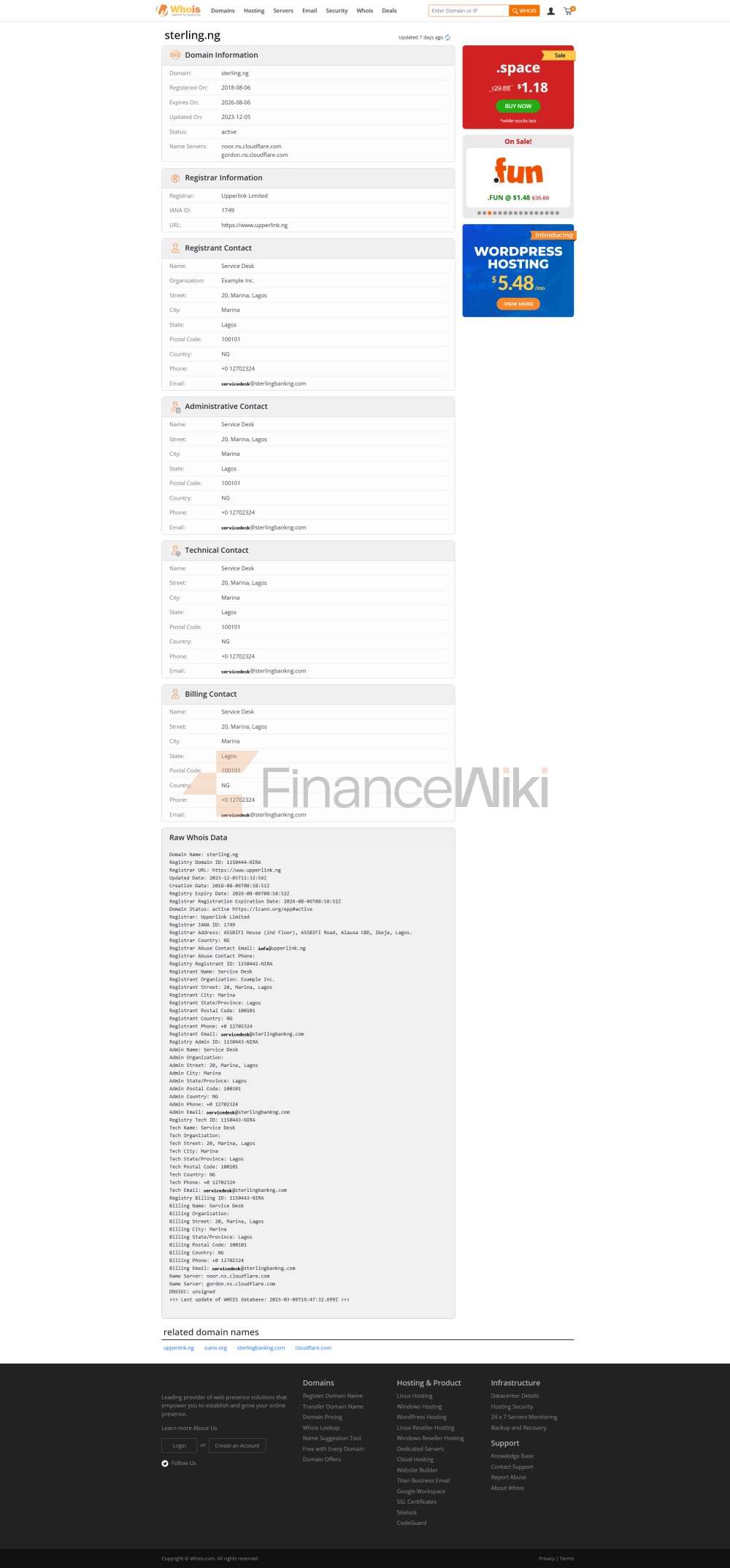

: Sterling Bank Limited

was established in 1960 as Nigeria Acceptances Limited (NAL) and became Nigeria's first investment bank in 1969.

Head Office: Sterling Towers, 20 Marina, Lagos Island, Lagos, Nigeria.

Shareholder Background: Sterling Bank is a public company listed on the Nigerian Stock Exchange (NSE) (symbol: STERLNBANK). It was fully owned by the government in 1972 due to the Nigerian Localization Act, and was partially privatized in 1992, and is now controlled by Sterling Financial Holdings Company Plc and is privately owned. The management includes CEO Abubakar Suleiman, who has been in office since September 19, 2022.

Scope of

ServicesSterling Bank operates primarily throughout Nigeria and has no clear global footprint. As of December 2022, the bank has 140 branches, covering major cities and regions in Nigeria. In addition, the bank operates approximately 241 ATMs and 3,000 POS terminals to provide customers with convenient cash deposit and payment services.

Regulation &

ComplianceSterling Bank is regulated by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC) and is subject to strict financial regulations. The bank participates in the Nigerian Deposit Insurance Corporation's deposit insurance scheme to safeguard the safety of customers' deposits. Recent compliance records show that CBN was fined 135 million naira in early 2025 due to cash shortages at ATMs, but this is a common problem in the industry, with non-systematic violations and stable overall compliance performance.

Financial healthAlthough specific financial metrics are not fully disclosed, Sterling Bank has demonstrated a strong financial position through its recapitalization. In 2023, the bank completed an equity offering of N1.25 billion and a private placement of US$120 million, significantly enhancing its capital strength. The non-performing loan ratio fell to 2% (2023 data), which is better than the industry average. The 2013 annual report showed a 29% increase in deposits and a 36% increase in loans, reflecting good liquidity management. Overall, the bank's financial health is good and suitable for customers looking for stable service.

Deposits & LoansDeposit

Class:

current account: provides flexible access and low interest rates (usually less than 1%), suitable for day-to-day money management.

Fixed deposits: maturities from 30 days to 5 years, interest rates of around 3%-7% (subject to specific market conditions).

Featured products: High-yield savings accounts are targeted at young people, and microcredit products such as Specta support the need for small savings and loans. There is no clear large certificate of deposit (CD) product.

Loans:

Mortgages: support for home purchases, with an interest rate of about 15%-20%, credit evaluation and collateral required.

Car loans: Covering new and used cars, the interest rate is similar to that of a mortgage, and a guarantee is required.

Personal Line of Credit: Provide fast approval loans through the Specta platform, with an interest rate of about 18%-25%, and a low threshold.

Flexible repayment: Specta Loans offer customized repayment plans, and some loans allow for early repayment without penalty.

List of common expenses

Account management fee: Monthly fee for current accounts is about 100-500 naira, depending on the account type.

Transfer fees: From April 2025, local online transfers and ATM card issuance will be completely free, and cross-border transfer fees will be around 0.5%-1%.

Overdraft fee: Approximately 1%-2% surcharge of the loan interest rate.

ATM interbank withdrawal fee: about 50-100 naira per transaction.

Hidden Fee Reminder: Be aware of the minimum balance requirement (usually 5,000-10,000 Naira), failure to meet the target may trigger a penalty.

Digital Service Experience

App & Online Banking: Sterling Bank's mobile app and online banking platform are fully functional, supporting facial recognition login, real-time transfers, bill management, and investment tool integration. Google Play and App Store users have a user rating of around 4.0/5, reflecting a better user experience.

Technological innovation: Banks use the Specta platform to automate loan approvals, use basic AI customer service to handle common problems, and support open banking APIs to facilitate collaboration with fintech companies. There is no clear robo-advisory service, but the pace of digital transformation is steady.

Customer Service Quality

Service Channels: 24/7 phone support (hotline: 0700 822 0000), live chat and social media quick response (e.g. @Sterling_Bankng on the X platform).

Complaint handling: The complaint rate is low, the average resolution time is about 3-5 working days, and the user satisfaction is high (based on the 2021-2022 Great Place to Work certification).

Multi-language support: The service is mainly in English, and local languages such as Yoruba and Hausa are supported in some regions, and cross-border users may face insufficient language support.

Security Measures

: Deposit protection of up to N500,000 through the Nigerian Deposit Insurance Corporation. Banks use real-time transaction monitoring and multi-factor authentication to reduce the risk of fraud.

Data security: ISO 27001 certification is not clearly disclosed, but data protection measures are emphasized. There have been no public data leakage incidents recently, demonstrating strong data security management capabilities.

Featured Services & Differentiated

Market Segments:

Student Accounts: Commission-free accounts are available to attract younger customers.

Exclusive wealth management for the elderly: Retail banking services cover the needs of elderly customers, but there is no specific exclusive product.

Green financial products: Actively participate in ESG investment and support environmental and social sustainability projects, such as green loans and community development programs.

High-net-worth services: Provide private banking services for high-net-worth clients, with a threshold of about N5 million, including customized investment advisory and wealth management solutions, suitable for high-end clients.

Market Position & AccoladesSterling

Bank ranks in the upper middle and upper reaches of Nigeria's commercial banks, with assets exceeding 1.85 trillion naira in 2022, and has not yet entered the top 50 banks in the world. The bank is known for its innovation and workplace culture, and has received several awards:

2019 CBN and NIBSS "Innovative Bank of the Year" Awards.

2020-2022 Great Place to Work Certification (Best Place to Work, Large Enterprise Category)

2022 GPTW "Best Millennial Workplace" and "Five Years of Legend Awards".

These awards highlight the bank's leadership in digital transformation and employee satisfaction.