Basic Information

Name and Background

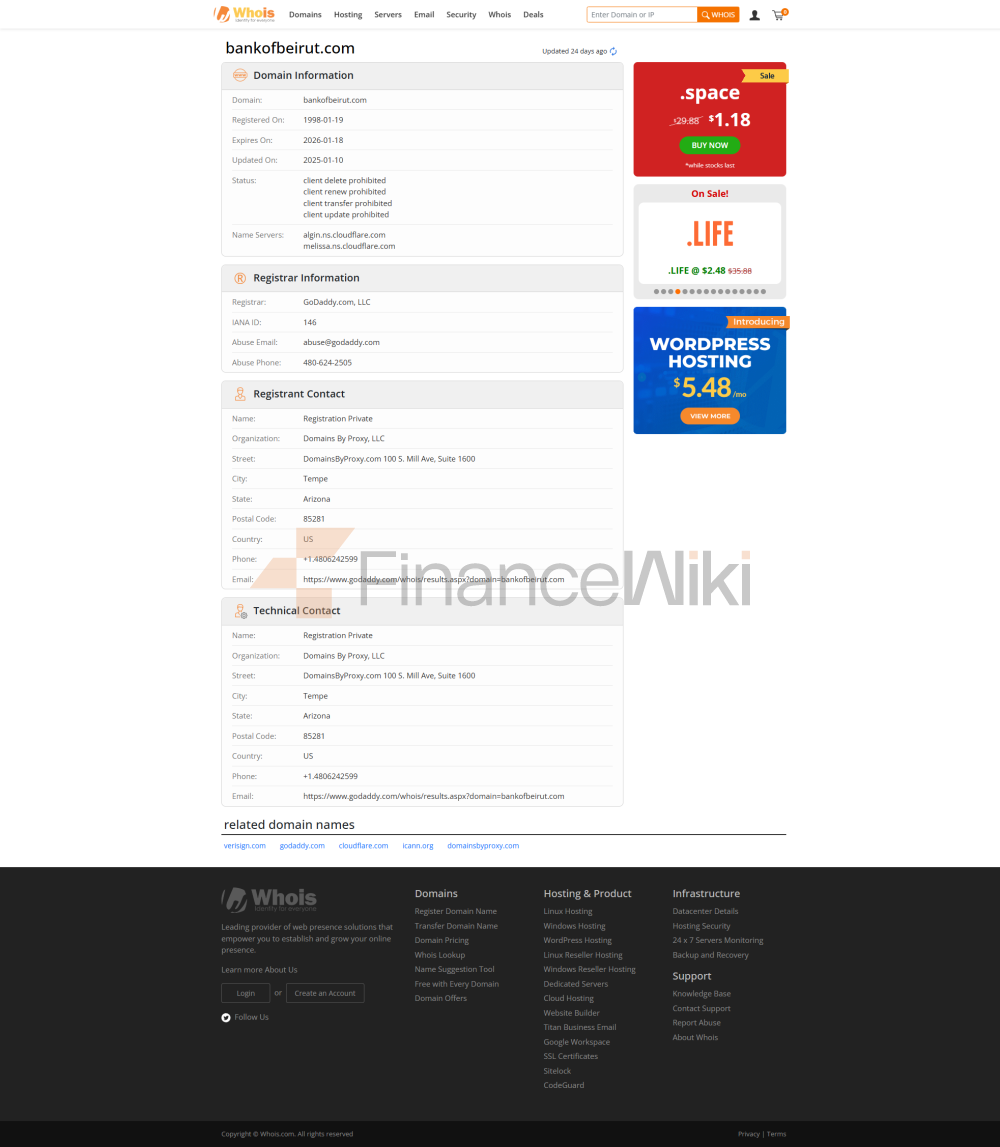

Bank of Beirut S.A.L. is a commercial bank founded in 1963 and headquartered in Beirut, Lebanon. Listed on the Beirut Stock Exchange in 1997. The bank is headed by Salim Sfeir, who has served as Chairman and CEO since 1993.

Scope of ServicesBank

of Beirut has more than 90 branches in Lebanon and subsidiaries, branches or representative offices in the United Kingdom, Germany, Cyprus, the United Arab Emirates, Oman, Australia, Nigeria and Ghana. Its services cover corporate, commercial, personal and private banking

supervision and compliance,

and the Bank of Beirut is regulated by the Banque du Liban and participates in the National Deposit Insurance Scheme. In 2023, the liquidity coverage ratio (LCR) of Bank of Beirut (UK) Ltd, a UK subsidiary, was 390.70%, well above the 100% minimum standard required by the UK Prudential Regulation Authority (PRA).

key indicators

of financial healthAs of December 31, 2023, Bank of Beirut's CET1 common equity tier 1 ratio (CET1) was 7.48%, up from 3.23% in 2022. However, the Tier 1 capital adequacy ratio and total capital adequacy ratio declined to 8.80% and 9.66%, respectively. economics.creditlibanais.com

Deposits &

LoansDepositsIn

Oman, Bank of Beirut offers fixed deposit products with an interest rate of 1.75% per annum. bankofbeirut.com.om

Loan category:

The Bank of Beirut offers personal loans up to 12 times your monthly salary, with a loan term of up to 5 years and competitive interest rates for both the Lebanese pound (LBP) and the US dollar (USD). yallacompare.com

list of common expenses

account management fee

in Oman, the monthly fee for a standard account is $2.

Transfer fee

: OMR 0.2 for transfers between accounts via Oman Net.

ATM fees

are in Oman, and cash withdrawals using ATMs are free.

Digital Service Experience

APP and

Bank of Beirut's mobile banking app provide a seamless banking experience with an upgraded design and new features that support simple and intuitive navigation.

Technological innovationThe

bank offers the Instacash service, which allows users to transfer money instantly through mobile banking and online services without the involvement of a third party.

customer service

quality service channel

Bank of Beirut's customer service center "BoBDIRECT" is available around the clock and is staffed by professionally trained consultants and on-site agents to provide high-quality assistance and customer satisfaction.

Complaint HandlingCustomers

can submit their complaints through the online form, and the bank promises to respond as soon as possible.

security

measuresFunds securityBank of

Beirut participates in the National Deposit Insurance Program to ensure the safety of customer deposits.

Data

SecurityThe bank's Chief Information Security Officer holds ISO/IEC 27001 certification, demonstrating its expertise in information security management.

Featured Services & Differentiated

SegmentsBank

of Beirut offers a variety of loan products, including home loans, car loans, and personal loans, to meet the needs of different customers.

High Net Worth ServicesThe

Bank provides private banking services to provide customized financial solutions for high net worth clients.

Market Position & AccoladesIndustry

RankingAs

of December 31, 2021, the Bank of Beirut had total assets of $12.09 billion, ranking seventh among Lebanese banks.

AwardsBeirut

has won several awards, including "Fastest Growing Bank in Lebanon", "Best Retail Bank", "Best Commercial Bank" and "Best Transaction Bank".