name and background

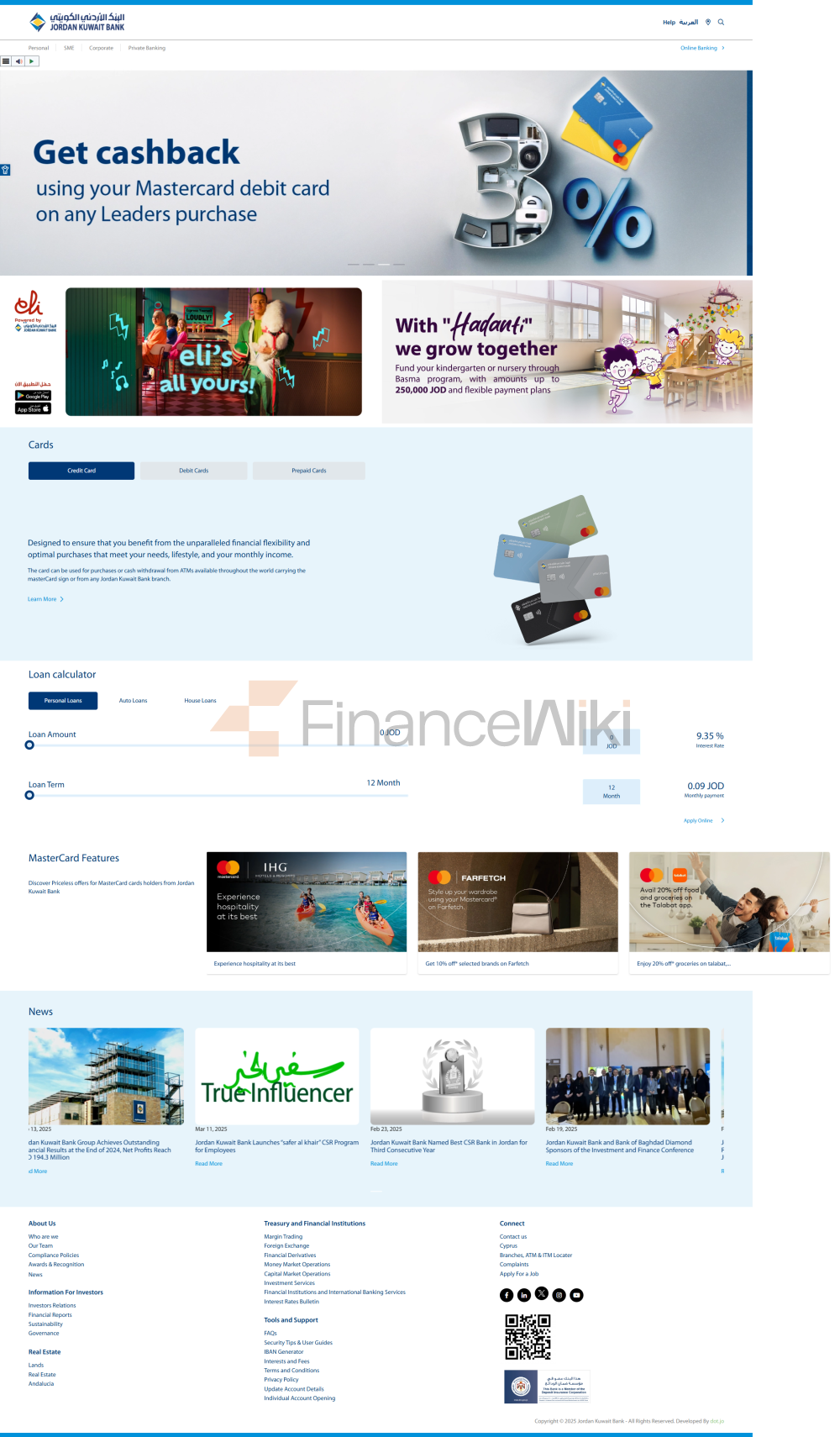

full name: Jordan Kuwait Bank Public Shareholding Company (Arabic: بنك الأردن الكويت)

founded in 1976 as a bank that attracted capital from Kuwait and other Arab countries to Jordan.

Headquarters at 62 Abmaya Bin Abed Shams Street, Abdali, Amman, Jordan.

Shareholder Background: JKB is a public joint-stock company listed on the Amman Stock Exchange (symbol: JOKB). Major shareholders include Al Rawabi United Holding Co. (a subsidiary of Kuwaiti investment project company KIPCO, which holds about 51 percent), the Jordanian Social Security Corporation and Odyssey Reinsurance Co. The bank is chaired by Sheikha Dana Nasar Sabah Al Ahmad Al Sabah as chairman of the board and Haethum Buttikhi as chief executive officer, reflecting its joint venture and private nature.

service scope

Coverage area: JKB mainly serves the whole of Jordan, covering major cities such as Amman, Irbid, and Zarqa, and has branches in Palestine (two branches each in Nablus and Ramallah) and Cyprus (International Banking Unit, IBU). Support global transactions through international payment networks such as Visa, Mastercard, and Middle East Payment Services (MEPS).

number of offline outlets: As of 2024, JKB operates 64 branches and offices in Jordan, 4 branches in Palestine, and 1 international banking unit in Cyprus.

ATM distribution: JKB operates about 100 ATMs in branches, commercial areas and shopping malls (such as City Mall and Kempinski Hotel), managed by MEPS, supporting cash deposits and withdrawals, contactless payments and interbank services.

services and products

JKB provides a comprehensive range of financial services, covering individuals, Corporate & Investment:

personal banking: Savings accounts, current accounts, fixed deposits, personal loans (housing, cars, education), salary advances, credit cards (Mastercard, 3-12 month instalment plans available, up to 2% cashback), debit cards and prepaid cards are available. Featured services include a 20% discount in partnership with talabat and Mastercard worldwide offers.

Corporate Banking: provides corporate credit, trade finance (letters of credit, guarantees), cash management, project finance and foreign exchange services to SMEs and large enterprises. JKB supports Jordan's manufacturing, trading and real estate sectors by providing financial leasing services through Ejara Leasing Company.

Investment Bank: Brokerage services, asset management and IPO underwriting through its subsidiary, United Financial Investments Company (UFICO, 78.3%). JKB also provides bond issuance and investment trust services to corporate clients.

e-banking: provides account management, transfers, bill payments and loan application services through JKB Online and JKB Mobile apps. Other electronic channels include SMS Banking, Phone Banking, and E-Fawateercom Bill Payment.

other services, including safe deposit boxes, currency exchange, tax collection and IBAN services.

> < regulatory and compliance

Regulatory Authority: JKB is regulated by the Central Bank of Jordan (CBJ) and follows the Jordanian Banking Act and international standards (such as the Basel Accord). Its Cyprus branch is regulated by the Central Bank of Cyprus and its Palestinian branch is regulated by the Palestinian Monetary Authority.

Deposit Insurance Program: JKB participates in the Jordan Deposit Insurance Program, which is protected by the Jordan Deposit Insurance Corporation (DIC) and insures up to 50,000 Jordanian dinars (approximately US$71,000) per depositor.

Recent compliance records: JKB has no record of major violations and strictly enforces Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations. In 2024, JKB partnered with Basata to acquire a 27.1% stake in MadfoatCom, which was approved by CBJ, demonstrating its compliance capabilities.

financial health<

span style="font-size: inherit">JKB ranks high in the Jordanian banking industry, The following are the key indicators as of September 30, 2024:

Capital Adequacy Ratio (CAR): 21.77%, well above the 10% required by CBJ, reflecting a strong capital buffer.

Non-performing loan ratio (NPL): Expected to be below the industry average (approximately 1%-2%), thanks to prudent credit management and IFRS 9Provisioning.

Liquidity Coverage Ratio (LCR): Expected to be 100% above regulatory requirements, assets grew by 10.2% to JOD 5.7 billion, indicating ample liquidity.

In the first nine months of 2024, JKB Group's net profit was 148.4 million Jordanian dinars, a year-on-year increase of 105.8%, with total assets of Jordanian dinars of 5.7 billion, shareholders' equity of Jordanian dinars of 847.9 million Jordanian dinars, and market capitalization of 561 million US dollars, indicating strong financial health.

digital service experience<

span style="font-size: inherit">App & Online Banking: The JKB Mobile app and JKB Online (www.jkb.com.jo) have a rating of around 4.3 stars (Google Play and App Store, out of 5 stars) and are well received for their user-friendly interface and diverse features. JKB was the first institution in Jordan to launch online banking.

core features:

real-time transfers: support domestic real-time transfers through CLIQ and MEPS networks, and international transfers through the SWIFT system.

Bill Management: E-Fawateercom supports payment of utility bills, university tuition, and taxes, as well as transaction history inquiry.

investment tool integration: support brokerage services and portfolio management through the UFICO platform.

> face recognition: Fingerprint login is supported, but face recognition is not explicitly supported.

technical innovation:

Open Banking API: Supports open banking APIs and integrates with fintech companies to improve payment and data sharing capabilities.

Card-not-present payments: Support QR code payments and ATM card-not-present withdrawals, catering to the digital trend.

> AI customer service : AI customer service is not explicitly provided, but real-time digital assistance is provided through JKB Online.

customer service

JKB offers multi-channel customer support with a focus on responsiveness and convenience:

email: Submit an inquiry through the official website (info@jkb.com.jo).

Live chat Live chat: JKB Mobile and JKB Online offer live chat capabilities.

branch services: 64 branches provide face-to-face consultations, working hours from Sunday to Thursday from 8:00 to 15:00, with some branches extended to 17:00.

> Phone: Customer Hotline +962-6-5200999 or 080022066, Round-the-clock support is available.

security measures

JKB adopts a multi-level security mechanism, Ensure the security of customer data and transactions:

Anti-Money Laundering & Anti-Fraud: Follow CBJ'S AML/CFT requirements to monitor suspicious transactions in real time and conduct regular risk assessments.

transaction security: a one-time verification code is required for large-value transfers, and prepaid cards support online balance inquiry.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel.

> Network security: use 256-bit SSL encryption, multi-factor authentication (password + OTP verification code), PCI DSS compliant.

featured services and differentiations<

span style="font-size: inherit">JKB is unique in the Jordanian banking industry with its regional presence and innovative services:

Mastercard offers: Attract younger customers with discounts of up to 20% (e.g. talabat shopping) and hotel bookings worldwide.

Fintech partnership: Expand e-payment capabilities with Basata's acquisition of MadfoatCom in 2024.

Social Responsibility: Supporting health, education and environmental projects in Jordan, won the Euromoney "Best Private Bank in Jordan" award in 2023.

Investment Services: Providing leading brokerage and IPO underwriting services through UFICO to manage Jordanian securities funds.

> regional expansion: Enhanced cross-border services through the Cyprus IBU and Palestine branches, with stakes in Bank of Baghdad (53.44%) and Gulf Bank Algeria (10%) to support the Iraqi and Algerian markets.

summary

Jordan Kuwait Bank (JKB) is a joint venture commercial bank established in 1976 and headquartered in Amman, Jordan, listed on the Amman Stock Exchange, primarily controlled by KIPCO. JKB operates 64 Jordanian branches, 4 Palestinian branches and 1 Cyprus IBU, managing approximately 100 ATMs, serving Jordan and supporting global transactions. The bank provides savings accounts, loans, credit cards, corporate finance and investment services, is regulated by the Central Bank of Jordan, participates in the deposit insurance program, and has a proven track record of compliance. In 2024, the net profit was JOD 148.4 million, the capital adequacy ratio was 21.77%, and the financial health was strong. The JKB Mobile app has a 4.3-star rating and supports real-time money transfer and bill management, and technological innovations include open banking APIs and cardless payments. Customer support is provided via phone, mail, and live chat, and security measures are in line with international standards. Unique in the Jordanian market with regional expansion, Mastercard offers and fintech partnerships, JKB is ideal for clients looking for integrated, digital and cross-border financial services.