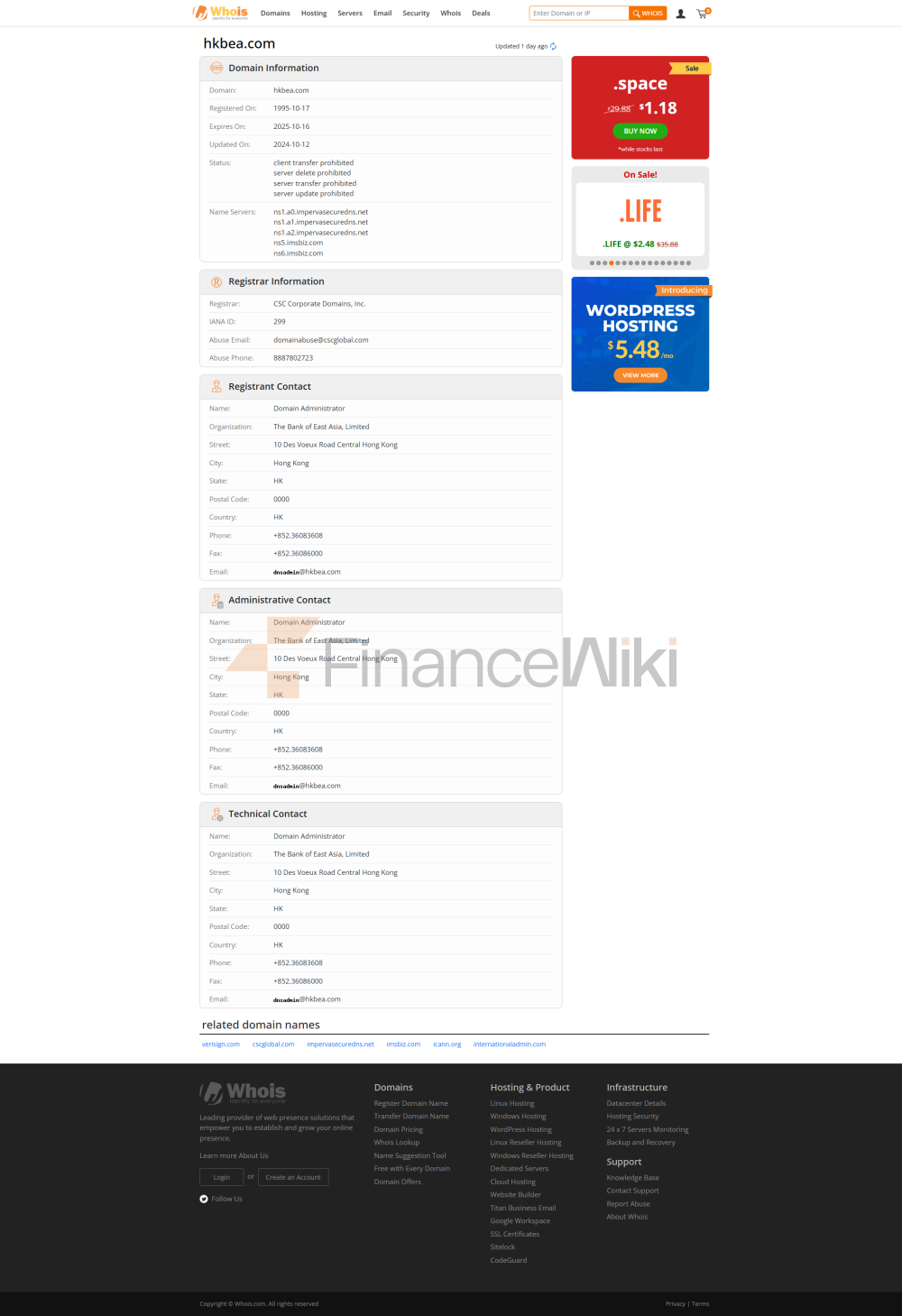

The Bank of East Asia, Limited (BEA) is the oldest local commercial bank in Hong Kong, with a century-old heritage and innovative spirit at the forefront of Hong Kong and global financial markets. Founded in 1918 by Hong Kong business leaders such as Kan Tung-po, the Lai Brothers (Lai Koon Chun, Lai Tsz-fong) and Sir Chow Sho-chan, it aims to provide modern financial services to local citizens and businesses, and to fill the gap between the big British banks and traditional banks. The third generation of the Lee family, Sir Lee Kwok Po, is the chairman, and its fourth generation members, Lee Man Kiu and Li Man Bun, are the co-chief executive officers, and the headquarters is located at 10 Des Voeux Road Central, Central, Hong Kong. Serving more than 5 million customers, BEA has become an evergreen pillar of Hong Kong's financial sector with its outstanding performance in retail banking, corporate banking and cross-border services.

Basic Information

The Bank of East Asia is a commercial bank, not state-owned or joint venture, established on November 14, 1918 and officially opened for business on January 4, 1919, headquartered at 10 Des Voeux Road Central, Central, Hong Kong. The bank is listed on the Hong Kong Stock Exchange (stock code: 0023) and its major shareholders include the Lee family, Sumitomo Mitsui Banking Corporation of Japan (about 18%), CaixaBank of Spain and Guoco Group of Malaysia. BEA is strictly regulated by the Hong Kong Monetary Authority (HKMA) and deposits are protected by the Hong Kong Deposit Protection Scheme (DPS) with a maximum protection of HK$500,000 per depositor. The Bank of East Asia (China) Limited, a wholly-owned subsidiary in mainland China, covers 38 cities and branches in Southeast Asia, the United Kingdom and the United States, with more than 130 outlets and more than 8,000 employees worldwide.

Deposit & Loan Products

depositsBEA

offers a wide range of deposit products to meet the savings needs of individual and corporate customers:

demand deposits: Including Statement Savings and Supreme accounts, the minimum opening amount is HKD 5,000, and the base annualized rate of return (APY) is 0.025%, please consult the bank to confirm the latest interest rate.

Time deposit: Support 12 currencies such as HKD, USD, RMB, etc., with deposit tenors ranging from 7 days to 24 months, and the minimum deposit amount is HKD 10,000. During the 2025 promotion period, preferential interest rates will be available for incremental balances in designated currencies, which can be enquired via Internet Banking.

Featured Products:

SupremeGold Account: Designed for high-end clients, it provides exclusive interest rate and wealth management services and needs to maintain an average balance of HK$500,000.

Mortgage-Link Savings Account: Linked to a mortgage loan, the savings interest rate is equal to the loan interest rate, and the balance is capped at 50% of the loan principal, which can be offset against the loan interest.

Large Certificates of Deposit (CDs): Support flexible tenors, suitable for customers with large amounts of funds, and the interest rate needs to be queried through the branch or app. Customers can check the "Cloud Interest Rate" offer through BEA App or Internet Banking, and some deposit products can be opened and calculated instantly.

loansBEA offers a comprehensive range of loan products, including home loans, car loans and personal lines of credit:

mortgages: Fixed and variable rate mortgage loans with a loan amount of up to 90% of the value of the property and a term of up to 30 years. In 2025, the floating rate is based on HIBOR (1-month HIBOR +1.5%) or Prime Rate (5.0%-2.5%), with cash rebates and insurance discounts. Featured products such as e-Mortgage support online application.

Car Loan: Support new and used car financing, with a loan amount of up to HK$3 million, a term of up to 60 months, an annualized interest rate (APR) as low as 1.88%, and a good credit history required.

Personal Line of Credit: includes Personal Instalment Loan (APR as low as 1.88% and amount up to HK$3 million) and Asset Link Secured Overdraft (up to 95% of the collateral market value), with a monthly salary of HK$20,000 or above or proof of assets.

Flexible repayment options: Mortgage and personal loans offer no penalty for early repayment, weekly or bi-weekly payment plans, and reborrowing of overdraft facilities, giving customers the flexibility to manage their debts. All loans are subject to bank approval, the "Rule of 78" is used to calculate the interest and principal ratio, and the customer is required to provide credit history and financial documents, the specific terms of which are subject to the loan agreement.

Digital Service

ExperienceBEA's mobile banking app, "BEA App", is the core of its digital services, which is available for download on iOS 14.0 and above and Android 9.0 and above, with an App Store rating of 4.5 and a Google Play rating of 4.3, with users praising its smooth experience and versatility. Core features include:

Face recognition: supports biometric authentication (such as Face ID and Touch ID), combined with strong encryption technology to ensure transaction security.

Real-time transfer: Support instant transfer between HKD and RMB through the Faster Payment System (FPS), with a daily limit of up to 500,000 HKD, and support Alipay and UnionPay payments.

Bill management: Provide online bill payment, automatic deductions, and e-statements, and classify transactions in real time.

Investment Tool Integration: Support stocks, funds, bonds, foreign exchange and precious metals trading, provide real-time market data and investment advisory services. The online banking platform provides similar functionality and supports multiple browsers, allowing customers to open an account within 5 minutes through the app or official website. While some users have reported that the app is updated frequently, BEA continues to optimize the user experience to ensure that the accessibility features are compatible with visually impaired and hearing-impaired customers.

Technological

InnovationBEA excels in the fintech sector:

AI customer service: The self-developed Intelligence-led Financial Crime Prevention (ILFCP) system, which uses AI to detect fraudulent accounts and send real-time warnings, won the 2023 "Regtech Excellence Award". The virtual assistant is planned to be launched in 2025 and supports 24/7 inquiries and financial advice.

Robo-advisor: Provide AI-based investment management services through BEA Wealth, recommend funds and stock portfolios according to customers' risk appetite, with a minimum investment of HK$1,000.

Open Banking API: Follows the Hong Kong Monetary Authority's Open Banking Framework and integrates with third parties such as PingAn OneConnect to optimize SME credit assessment and account management.

Other innovations: support for the eTradeConnect platform to simplify trade finance applications; Pioneered Hong Kong's digital bond repurchase transaction, and invested US$196 million in 2024 to build a fintech and wealth management center in the Greater Bay Area to strengthen its digital capabilities.

Distinctive Services and DifferentiationBEA

is known for its localized services and cross-border financial capabilities:

Guangdong-Hong Kong-Macao Greater Bay Area layout: 48 branches in Hong Kong, There are 42 Supreme Gold Centers and 3 i-Financial Centers, with more than 100 outlets in 38 cities in mainland China, providing seamless services to cross-border customers.

SME support: Partnered with the Hong Kong Monetary Authority's Commercial Data Interchange (CDI) to streamline SME loan approvals and launch 250 fund products by 2024 to enrich wealth management options.

Green Finance: Supporting green bonds and sustainable finance, in response to the United Nations Principles for Responsible Banking, it won the "Green Bank Pioneer Award" in 2023.

Wealth Management: SupremeGold and Private Banking services provide exclusive investment and insurance products to high-net-worth clients, with a partnership with Blue Cross to launch a diversified insurance plan.

Community Contributions: Supporting financial education and philanthropic projects through the BEA Foundation, and winning the "Hong Kong Outstanding Corporate Citizenship Award" in 2023.

Market Position & Accolades

TheBank of East Asia is the largest independent local bank in Hong Kong, with total assets of HK$860.4 billion in 2023 and a deposit market share of about 7%, ranking the fifth largest bank in Hong Kong. Its cost-to-income ratio (approximately 35%) reflects efficient operations, with resource sharing with the HSBC Group further reducing costs. BEA has an extensive network in the Guangdong-Hong Kong-Macao Greater Bay Area, and its mainland subsidiary, BEA (China), serves cross-border corporate and individual customers. In 2024, the bank won the "Best SME Bank in Hong Kong" by The Asian Banker and the "Best Wealth Management Bank in Hong Kong" by The Banker in 2023. In 2022, Fitch Ratings assigned its long-term credit rating of "A" with a stable outlook, highlighting its financial soundness.

ConclusionThe

Bank of East Asia, Limited is a century-old leader in Hong Kong's financial markets, with a long history and innovative capabilities in the retail banking, corporate finance and wealth management sectors. It offers a wide range of deposit and loan products, including high-yield savings accounts, term deposits, and flexible mortgages and personal loans, to meet the diverse needs of its customers. In terms of digital services, the BEA App is well received for its efficient real-time transfer and investment management functions. Technological innovations, including an AI-driven ILFCP system and open banking API support, demonstrate its forward-looking approach to digital transformation. With its services in the Guangdong-Hong Kong-Macao Greater Bay Area, its commitment to green finance and its 2024 industry accolades, BEA continues to demonstrate strong competitiveness and influence in the Hong Kong and regional financial markets.