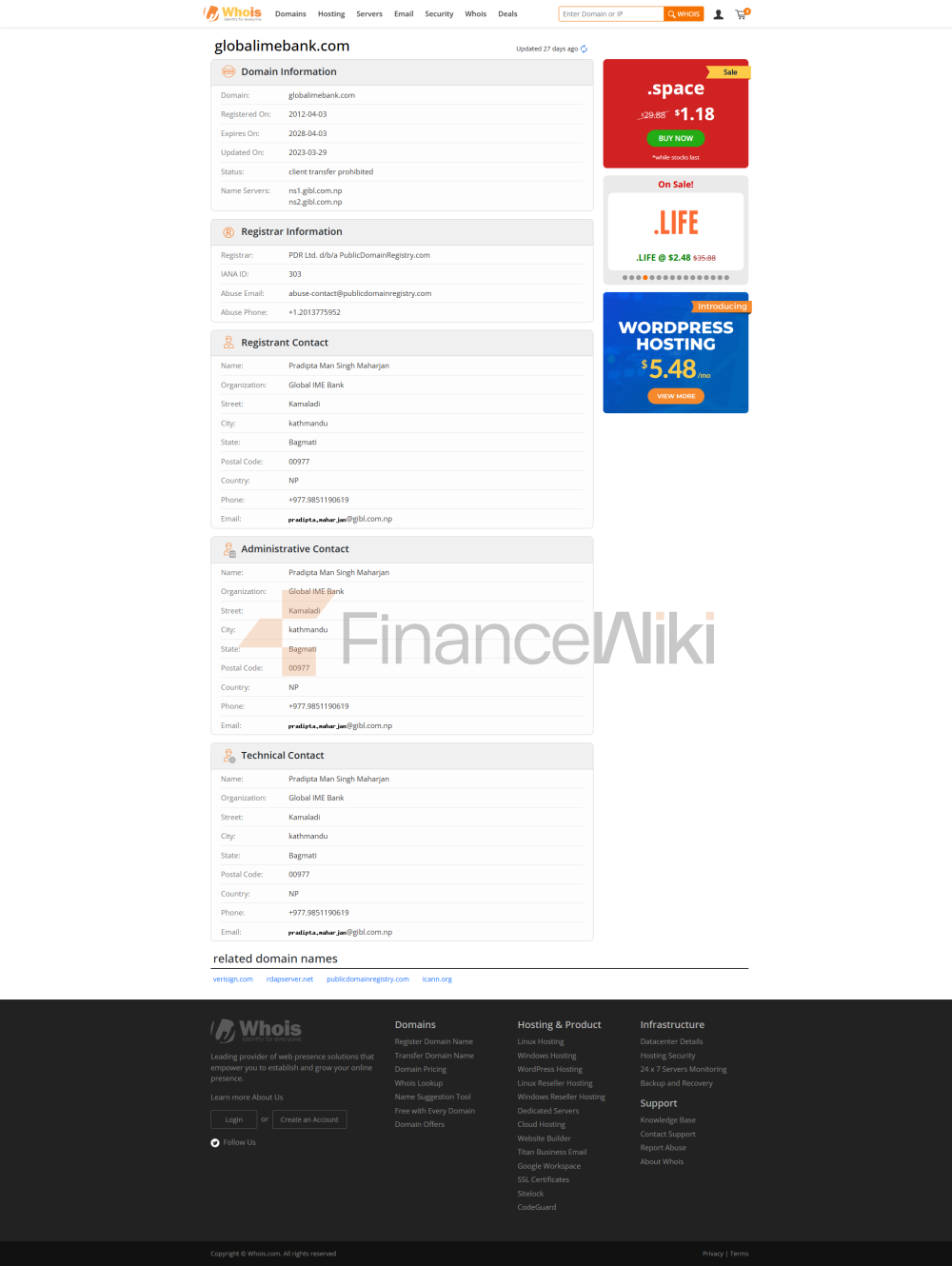

Name and BackgroundGlobal

IME Bank Limited (Global IME Bank) is a leading commercial bank in Nepal, established in 2007 and headquartered in Kathmandu. The bank is a private bank founded by a number of local Nepalese companies and individual investors, and is listed on the Nepal Stock Exchange. With its strong capital background and development potential, Global IME Bank is gradually becoming a significant player in Nepal's banking industry. As a bank with a local identity, Global IME Bank is committed to providing a full range of financial services and has established brand advantages in multiple areas.

Scope of

ServicesGlobal IME Bank's service network covers the whole of Nepal and has opened branches in several cities and townships. With more than 200 outlets, the bank offers traditional banking services and operates multiple automated teller machines (ATMs) in and outside Nepal. In addition, Global IME Bank has expanded its customer reach through its online and mobile banking services, ensuring that customers can enjoy convenient financial services wherever they are. Although its main business is concentrated in the Nepalese market, banks also have a certain penetration in the field of cross-border payments and international trade.

Regulation & ComplianceGlobal

IME Bank is strictly regulated by the Central Bank of Nepal (NRB) and other financial regulators to ensure that its operations comply with laws and financial industry standards. The bank has also joined the Nepal Deposit Insurance Scheme to provide capital protection to depository customers. In recent years, Global IME Bank has maintained a strong track record of compliance, with no major compliance issues, and is committed to following domestic and international regulatory requirements to maintain transparency and compliance in its operations.

Financial HealthGlobal

IME Bank's capital adequacy ratio is relatively robust, maintaining compliance requirements for many years, typically between 11% and 12%, indicating that it has good capital reserves. The bank's non-performing loan ratio is relatively low at less than 2%, reflecting its robust risk management and loan approval process. In terms of liquidity coverage ratio, Global IME Bank also meets regulatory standards to ensure adequate protection in terms of liquidity.

Deposit & Loan ProductsGlobal

IME Bank offers a variety of deposit products, including demand deposits and time deposits. The interest rate on demand deposits is relatively low, but customers can withdraw their money flexibly. The interest rate of time deposits is relatively high, and customers can choose a suitable time deposit plan according to different tenors. In addition, the bank also offers special deposit products such as high-yield savings accounts and large certificates of deposit (CDs) to meet the needs of different customers.

In terms of loan products, Global IME Bank offers a variety of options such as home loans, car loans and personal lines of credit. Mortgage interest rates are competitive in the market, and the loan threshold is relatively reasonable. Interest rates for car loans and personal lines of credit are also relatively moderate, and banks offer flexible repayment options to help customers adjust their repayment plans according to their financial situation.

List of Common Fees

Global IME Bank's account management fees are moderate, and the monthly or annual fees are more transparent. In terms of transfer fees, domestic transfers are cheaper, while cross-border transfers will incur higher fees, especially when foreign exchange transactions are involved. Bank overdraft fees and ATM interbank withdrawal fees are also within the normal range of the industry. The bank does not set an excessively high minimum balance limit, and customers can manage their account funds flexibly.

Digital Service ExperienceGlobal

IME Bank's digital services are relatively complete, with convenient features on mobile banking and online banking platforms, and most user ratings are at the upper middle level in Google Play and App Store. Its core features include real-time transfers, bill payments, money management, and more, meeting day-to-day banking needs. To enhance the customer experience, banks are also providing users with more efficient services through innovative features such as facial recognition technology, intelligent customer service, and investment tool integration. While banks are gradually following up in terms of technological innovation, there is still room for further development, especially in AI and open banking APIs.

Quality of Customer

ServiceGlobal IME Bank offers 24/7 phone support and prompt response to customer needs via live chat and social media. The bank's complaint handling mechanism is more efficient, the average resolution time is short, and the overall customer satisfaction is high. In addition, the bank also provides multilingual services, especially for cross-border customers, to ensure that customers can enjoy localized services.

Security MeasuresIn

terms of fund security, Global IME Bank provides deposit insurance protection to its customers, while also employing advanced anti-fraud technologies, including real-time transaction monitoring and multi-factor identity verification. In terms of data security, the bank is committed to protecting customers' personal information and taking strict measures to prevent data breaches.

Featured Services and DifferentiationGlobal

IME Bank has launched a number of subdivided services in the market, such as fee-free accounts designed for students and exclusive wealth management products for the elderly, to meet the needs of different age groups and customer groups. To attract high-net-worth clients, banks also offer customized private banking services to help clients manage their wealth and achieve their long-term financial goals.

Market Position & AccoladesDespite its

small asset holdings in the global market, Global IME Bank has a strong position in Nepal's domestic market and is an important part of Nepal's financial market. In recent years, the bank has received several industry awards for its innovative services and sound operations, especially in the areas of "Best Banking Service" and "Best Digital Bank".