Project OverviewThe

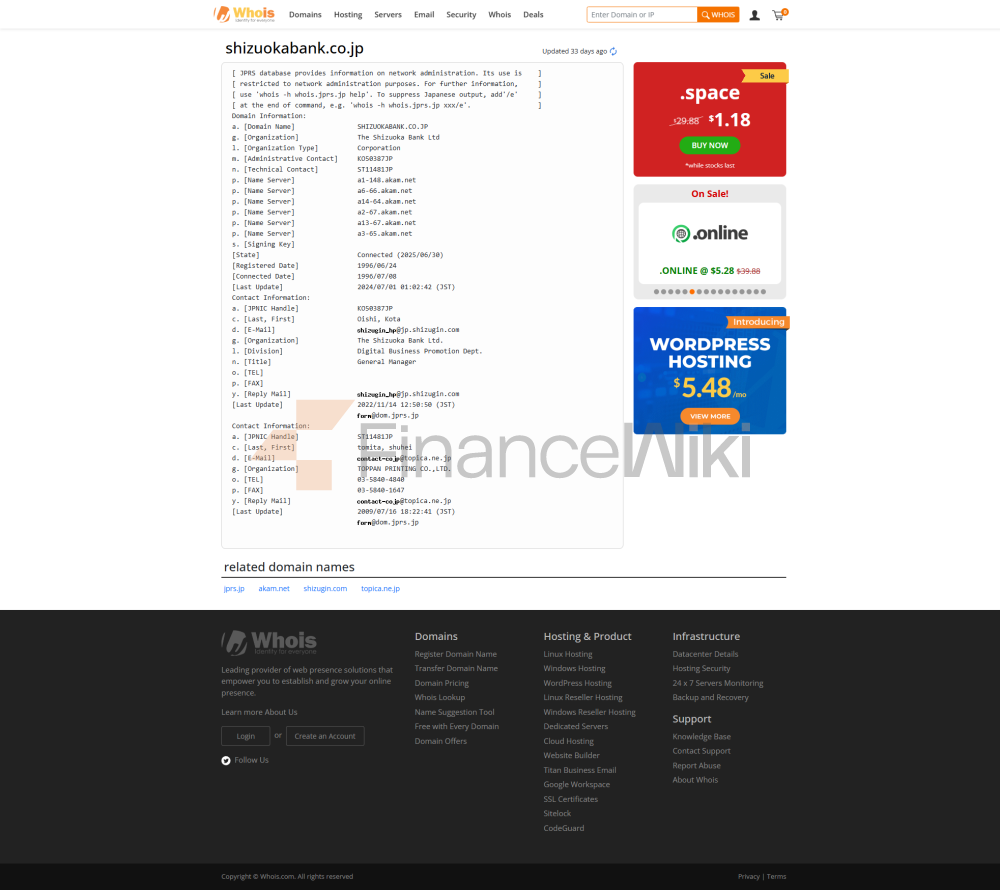

Shizuoka Bank Ltd. is a regional bank headquartered in Shizuoka Prefecture, Japan, founded on March 1, 1943 through the merger of Shizuoka Sango Bank and Enshu Bank. The bank was listed on the Tokyo Stock Exchange in October 1961 and is now a core subsidiary of Shizuoka Financial Group, Inc. Its headquarters are located at 1-10 Miyukicho, Aoi-ku, Shizuoka City.

The

Bank of Shizuoka has 177 branches and 26 sub-branches in Japan, mainly in Shizuoka Prefecture, and branches in major economic centers such as Tokyo, Osaka, and Nagoya. Overseas, the bank has branches or representative offices in New York, Silicon Valley, Brussels, Hong Kong, Shanghai and Singapore to support customers' international business needs.

Regulation & ComplianceShizuoka

Bank is regulated by the Financial Services Agency (FSA) of Japan and participates in Japan's deposit insurance system to ensure the safety of customer deposits. According to Fitch Ratings' assessment, the bank's risk management and asset quality remain robust, despite challenges to profitability.

Financial Health

Capital adequacy ratio: As of June 2022, the Common Equity Tier 1 (CET1) ratio was 15.5%, demonstrating a strong capital base.

Non-performing loan ratio: As of March 31, 2024, non-performing loans accounted for 0.95% of total loans, reflecting good asset quality.

Liquidity Coverage Ratio (LCR): Although the LCR of the Japanese banking sector as a whole has declined, Shizuoka Bank has maintained a high level and demonstrated good liquidity management capabilities.

Deposit & Loan Products

Deposits: Provide a variety of demand and time deposit products to meet the needs of different customers.

Loans: We provide a variety of loan products such as housing loans, car loans and personal lines of credit to support the diversified financing needs of customers.

List of common

feesShizuoka Bank's fee structure is transparent, and the specific fees vary depending on the type of account and the content of the service. Customers can obtain detailed information through the bank's official website or by contacting the customer service center.

Digital Service ExperienceShizuoka

Bank offers a full-featured online banking and mobile app that supports a variety of functions such as account management, transfer payment, and bill inquiry. In addition, banks are actively adopting AI technology to improve customer service efficiency.

Customer Service Quality

Bank offers a variety of customer service channels, including phone support, live chat, and social media interaction, and is committed to responding quickly to customer needs. At the same time, the bank pays attention to the handling of customer complaints and strives to improve customer satisfaction.

Security MeasuresShizuoka

Bank protects customer funds and data through a variety of measures, including participation in the deposit insurance system, the adoption of advanced anti-fraud technology and data encryption standards. The Bank is committed to maintaining the confidentiality and integrity of customer information.

Featured Services and Differentiated

Banks: Focusing on the needs of different customer groups, the Bank provides special services such as student accounts, wealth management products for the elderly, and green financial products. In addition, the bank provides customized private banking services to high-net-worth clients to meet their diverse wealth management needs.

Market Position & Accolades

Shizuoka Bank is a leading regional bank in Japan, with a strong market share and customer base. The bank has received high ratings from a number of credit rating agencies, reflecting its solid financial position and good risk management capabilities.

Overall, Shizuoka Bank is committed to providing high-quality financial services to its customers thanks to its solid financial position, extensive service network, and continuous digital transformation.