Name and

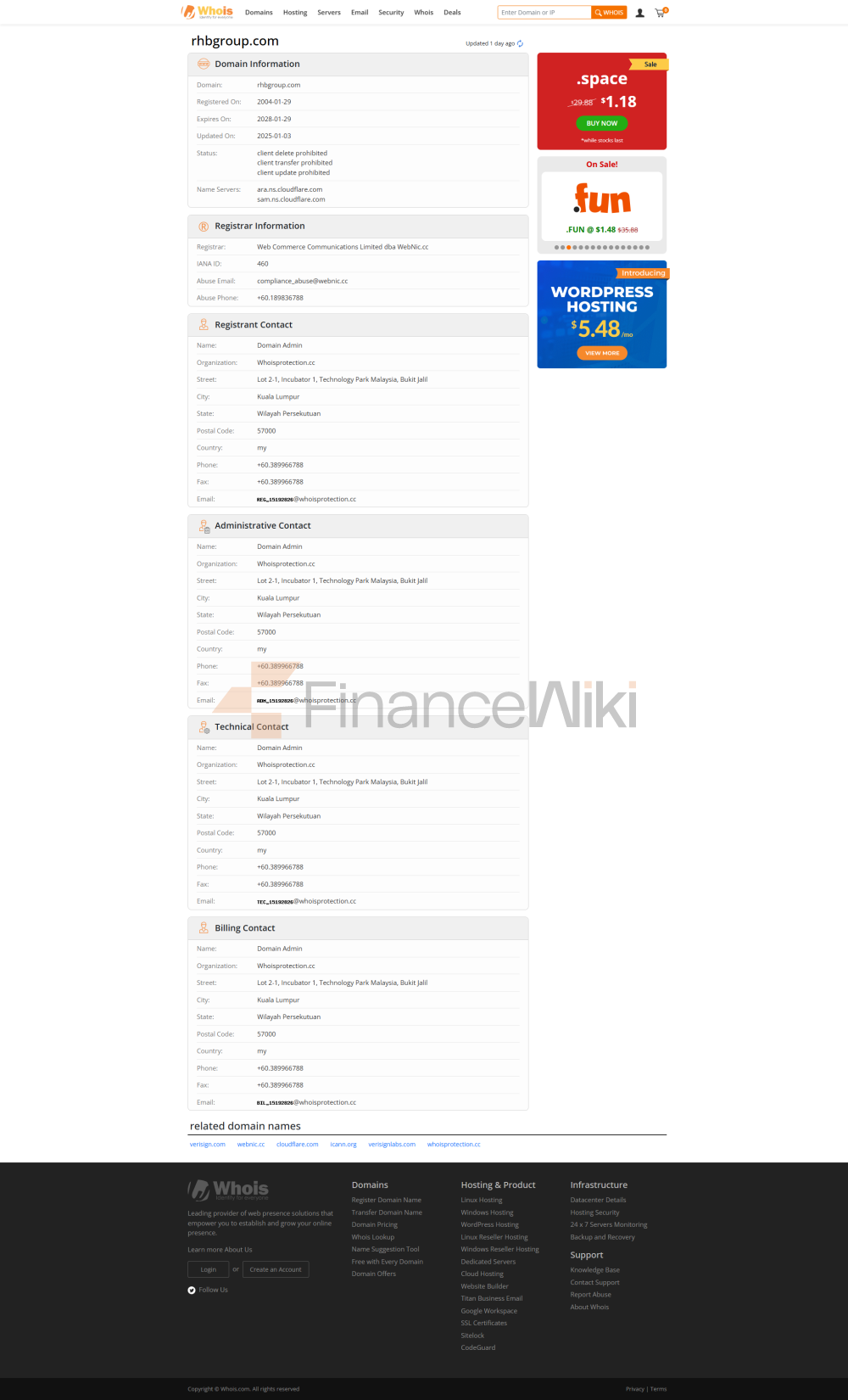

BackgroundRHB Bank was founded in 1902 and is headquartered in Kuala Lumpur, Malaysia. As a comprehensive commercial bank, RHB Bank was originally founded by Chinese entrepreneurs, and after years of development, it has become a well-known financial institution in Malaysia and Southeast Asia. RHB Bank is a listed company with shares listed on Bursa Malaysia and its shareholders are mainly local and international institutions, which has a strong market influence. Although it is a listed company, the bank's management retains strong local control.

Scope of

ServicesRHB Bank has a wide range of services, covering Southeast Asian countries such as Malaysia, Thailand, Singapore, Indonesia and Vietnam. The bank has hundreds of offline outlets in these regions and provides cross-border financial services in international markets. RHB's dense network of ATMs in Malaysia spans both urban and rural areas, ensuring that customers can enjoy convenient banking services wherever they are.

Regulation &

ComplianceRHB Bank is strictly regulated by Bank Negara Malaysia as well as other relevant financial regulators. As a bank primarily operating in the Malaysian market, RHB Bank participates in Malaysia's deposit insurance scheme, which is protected by the Malaysian Deposit Insurance Corporation (PIDM) to ensure the safety of customers' funds. In recent years, RHB Bank has performed well in terms of compliance, with no record of major violations, and has actively responded to financial regulatory and compliance requirements.

RHB Bank, a key indicator of financial health, has a robust capital adequacy ratio, which meets regulatory requirements and is able to effectively withstand the risks of market volatility. The bank's non-performing loan ratio remained low, indicating its good credit risk control capabilities. With its high liquidity coverage ratio, the bank excels in meeting its day-to-day operations and unexpected funding needs, ensuring its robust operations in a complex economic environment.

Deposits &

LoansDepositsRHB

Bank offers a wide range of deposit products, including demand deposits, time deposits, and high-yield savings accounts. Its fixed deposit interest rate is competitive in the market, and customers can choose deposit products with different tenors according to their needs. In addition, banks have launched special savings products such as Large Certificates of Deposit (CDs), which are designed to attract large deposit customers and provide higher rates of return.

LoansRHB

Bank offers a wide range of loan products, including home loans, car loans, and personal lines of credit. Mortgage interest rates are competitive in the market, and banks offer flexible repayment options to meet the needs of different customer groups. The threshold for car loans and personal lines of credit is low, the application process is simple, the approval speed is fast, and the interest rate is transparent. Personal loan products also offer flexible repayment options to help customers make sound loan decisions based on their financial situation.

List of common

feesRHB Bank's account management fees include monthly and annual fees, depending on the type of account and the content of the service. There is a clear fee standard for domestic and cross-border transfers. For overdraft fees and ATM interbank withdrawal fees, banks have a reasonable fee structure and provide detailed fee explanations. There is a minimum balance requirement for RHB Bank's account management, and customers who do not meet the set minimum balance will incur management fees.

Digital Service Experience

App and

RHB Bank's mobile app are highly rated on the App Store and Google Play, offering features such as real-time transfers, bill payments, facial recognition and asset management. The bank's app is designed to be simple and intuitive, allowing users to easily complete various financial transactions in a few steps. The online banking service is also excellent, allowing customers to easily check their account balances, transfer money and make a variety of investment operations.

Technological

InnovationRHB Bank continues to increase its investment in technological innovation, especially in artificial intelligence and digital services, and has launched AI customer service and robo-advisory services to help customers manage their wealth more efficiently. The bank also provides open banking APIs, which allow third-party developers to build more financial tools, enriching the bank's service ecosystem.

Service Quality

Service

ChannelRHB Bank offers 24/7 phone support, live chat, and social media response services to ensure that customers can get help at any time. Especially on social media, the response speed is very fast, and users can interact with the bank through platforms such as Facebook and Twitter to get instant services. RHB Bank's customer service team has won high praise from customers for its efficient and professional service attitude.

Complaint

HandlingRHB Bank's complaint handling system is efficient, and the bank is usually able to respond quickly to customer feedback and provide solutions. The complaint rate is low, and the average resolution time is also at a low level in the industry. According to customer feedback, RHB Bank has a high level of customer satisfaction, especially in terms of speed of problem resolution and service attitude.

Safety and Security

MeasuresFunds SecurityRHB Bank protects customer funds by participating in the Deposit Insurance Program. In addition, banks use advanced anti-fraud technologies, including real-time transaction monitoring, transaction risk assessment, and identity verification, to ensure the security of customer accounts. All fund transfers are encrypted to prevent potential cybersecurity risks.

Data

SecurityRHB Bank has obtained ISO 27001 certification, ensuring that its information security management complies with international standards. The bank has implemented strict data protection measures, including firewalls, encryption technology, and multi-factor identity authentication, to ensure that customers' personal information is not leaked. To date, RHB Bank has not had a major data breach.

Featured Services & Differentiated

SegmentsRHB Bank focuses on providing exclusive financial products for students and seniors, such as fee-free student accounts and pension wealth management products designed for elderly customers. In addition, the bank has launched green financial products to support investment projects that meet environmental, social and governance (ESG) standards, attracting more customers interested in sustainable development.

High-net-worth

servicesRHB Bank provides private banking services for high-net-worth clients, with a high threshold, suitable for clients with strong assets. The bank's private banking services include customized wealth management solutions, tax planning, estate planning, etc., to provide customers with a full range of financial services. High-net-worth clients also have access to exclusive investment advice and customized financial services to help them achieve wealth growth and asset protection.

Market Position & AccoladesRHB

Bank is one of the leading companies in Malaysia's banking industry, with a strong market position in retail banking and corporate financial services. According to the latest asset size rankings, RHB Bank has a place among financial institutions in the Southeast Asia region.

AwardsRHB Bank has won several industry awards such as "Best Digital Bank" and "Best Consumer Bank". These awards demonstrate the bank's outstanding performance in financial innovation, customer service, and digital transformation, proving its leading position in the industry. Strategic Business Group (SBG)