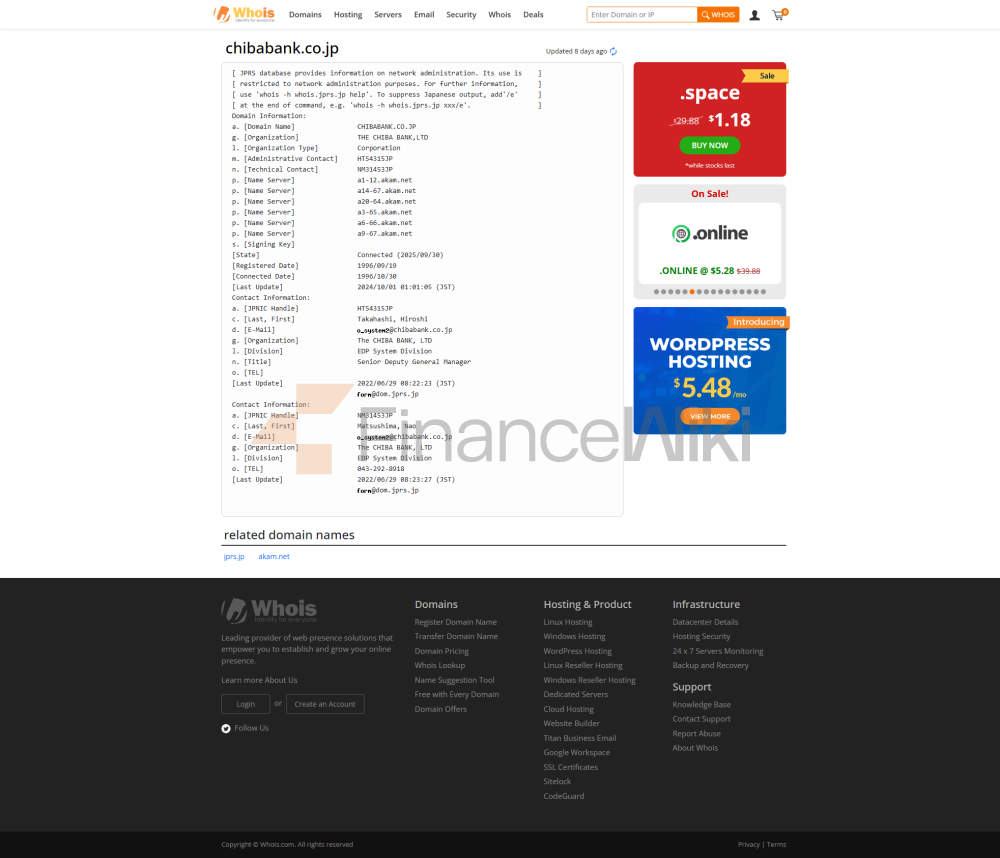

name and background

full name of the bank: The Chiba Bank, Ltd

Founded: March 1943

Headquarters location: Chuo-ku, Chiba City, Chiba Prefecture,

JapanShareholder background: It is a listed company, and its main shareholders include Japan Life Insurance Company (holding 3.52% of the shares), Daiichi Life Insurance Company (holding 3.44% of the shares), etc

Service

coverage: Chiba Bank mainly serves the Kanto region of Japan, especially Chiba Prefecture, and its business scope radiates to Tokyo, Kanagawa, Saitama and other surrounding areas. Although its core business is concentrated in Japan, as a modern commercial bank, some of its business may also be indirectly involved in international financial activities, but its main market and customer base are still in Japan.

Number of offline outlets: Chiba Bank has an extensive network of offline outlets, mainly in and around Chiba Prefecture. Up to now, it has more than 150 branches in Japan, including head offices, branches, sub-branches, etc.

ATM distribution: As a bank based on traditional retail banking, Chiba Bank has a large number of ATMs in various branches and convenience stores to facilitate customers to make daily financial transactions such as deposits, withdrawals, and transfers. Its ATM network covers its main service areas, providing customers with convenient self-service.

services

and productsChiba Bank provides a comprehensive range of financial services and products to meet the diverse needs of individuals, corporations and local public bodies.

For individual customers:

deposit service: Provide a variety of deposit products such as ordinary deposits, time deposits, savings deposits, etc.

Loan services: including personal housing loans, car loans, education loans, consumer loans, etc., to meet the needs of individuals for house purchase, car purchase, education and daily consumption.

Investment and wealth management: Provide a variety of investment products such as stocks, bonds, investment trusts, foreign exchange, etc., as well as professional financial consulting services to help customers achieve asset appreciation.

Insurance services: Acting as an agent for the sale of various life insurance, property insurance and other products.

Payment and settlement: Provide bank cards (debit cards, credit cards), electronic payments, automatic transfer and other services to facilitate customers' daily payment and fund management.

Pension Services: Provide personal pension accounts and related consulting services.

For corporate customers:

corporate deposits: Provide demand deposits, time deposits and other corporate deposit products.

Enterprise loans: including short-term working capital loans, medium and long-term equipment investment loans, project financing, etc., to support the production, operation and development of enterprises.

Trade Finance: Provide international trade settlement and financing services such as letters of credit, collections, and letters of guarantee.

Cash Management: Provide account management, fund collection, bill settlement and other services to help enterprises optimize cash flow management.

Investment banking services: including M&A advisory, equity financing, bond issuance and other services to support corporate capital operation.

Foreign exchange services: Provide foreign exchange exchange, foreign exchange hedging and other services to meet the international business needs of enterprises.

Small and Micro Enterprise Finance: Provide customized financing and consulting services for small and micro enterprises to support local economic development.

regulatory and compliance

regulator: regulated by the Financial Services Agency of Japan

Deposit Insurance Program: Participation in the Deposit Insurance Corporation of Japan program to ensure the safety of customer

depositsRecent compliance records: No major violations or penalties recorded

digital service experience

APP and online banking: Provide full-featured online banking and mobile banking services, supporting account inquiry, transfer, payment and other functions

Core functions: Support face recognition login, real-time transfer, bill management, investment tool integration and other

technological innovations: Actively introduce new technologies such as AI customer service, robo-advisor, and open banking API to improve customer experience

customer service

provides a variety of customer service channels such as telephone, email, online chat, etc., to facilitate customer consultation and business <

using multi-factor authentication, encrypted communication, firewall and other technical means to ensure the security of customer information and funds

special services and differentiation

As the largest local bank in Chiba Prefecture, it deeply cultivates the local market, understands customer needs, provides customized financial services,

actively participates in local economic development, and supports small and medium-sized enterprises and local projects

to excel in digital transformation. Committed to providing customers with convenient and efficient financial services

, Chiba Bank has become a leading regional bank in Japan with its sound business strategy, extensive service network and continuous technological innovation.