basic bank information

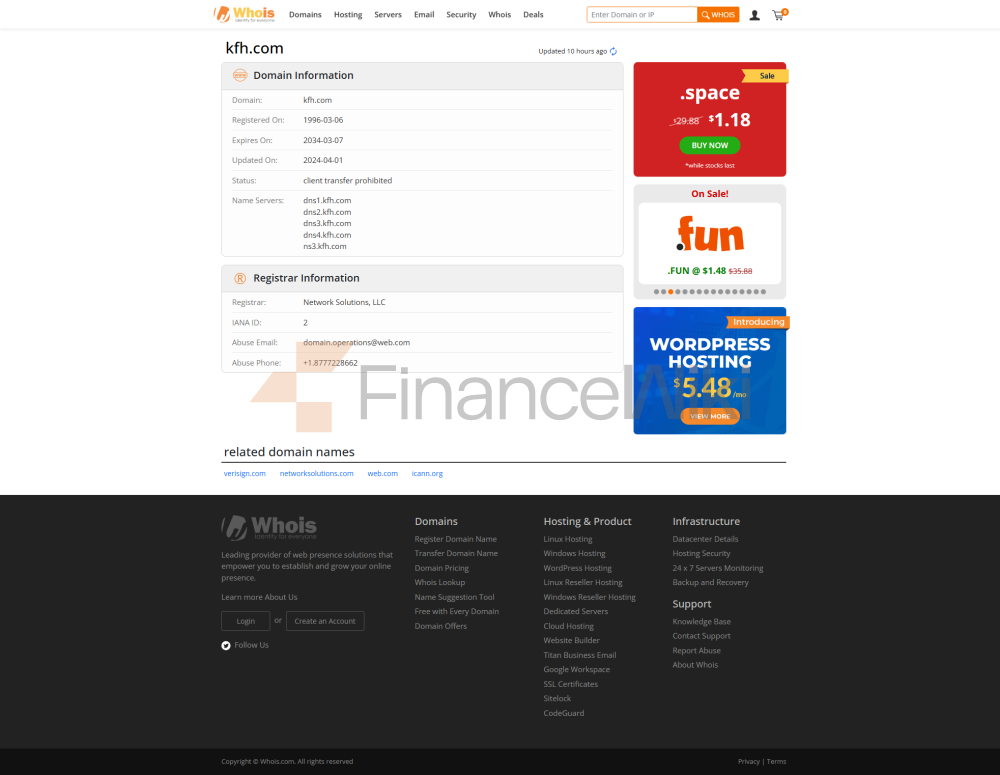

Kuwait Finance House K.S.C.P. (KFH) is a commercial bank, specifically an Islamic bank, and all its financial products and services are Shari'a. KFH was established in Kuwait in 1977 as the country's first Islamic bank and is headquartered in Kuwait City, Kuwait City, Kuwait City, Abdullah Al Mubarak Street, Al Mirqab Area, Safat, P.O. Box 24989, Safat, Al Asimah, 13110. KFH is listed on the Kuwait Stock Exchange (KSE) and the Bahrain Stock Exchange, with the government holding 44% of the shares, demonstrating its importance in the country's economy. In addition, KFH, through its subsidiary, KFH Capital Investment Company (formerly known as Almuthana Investment Company, founded in 1999), invests in equities, bonds and real estate globally, with operations in the United States, Europe, Southeast Asia and the Middle East. KFH is regulated by the Central Bank of Kuwait and strictly adheres to the principles of Islamic finance, and its deposits are protected by the Kuwait Deposit Insurance Scheme with a maximum coverage of KWD 300,000.

deposit and loan products

deposits KFH offers a wide range of deposit products to meet the needs of different customers. Demand Deposit Accounts include "My First Account" and "Al Najma Account", with a minimum opening amount of KWD 0 and a base annualized rate of return (APY) of approximately 0.1%-0.5%, subject to bank confirmation. The Al Najma account stands out for its unique reward system, where clients have the opportunity to participate in daily raffles of up to 1 million KWD. Fixed deposits are available in multiple currencies with tenors ranging from 1 month to 5 years, a minimum deposit of KWD 1,000 and an interest rate of up to 4.0% (2-5 years) in 2025. Featured products include the high-yield savings account "Al Najma Account", which offers an interest rate of up to 2.0% per annum, combined with lucky draw prizes, and a large certificate of deposit (CD) with flexible tenors, suitable for customers with large amounts of money, the interest rate needs to be checked by the bank, and the early withdrawal penalty is 90 to 180 days of interest.

the loan class

KFH's loan products are also Shariah-compliant and offer a variety of financing options. Mortgage products include fixed rate and variable rate mortgages with a loan amount of up to 80% of the value of the property and a repayment period of up to 30 years. In 2025, the fixed interest rate will be as low as 3.5% (3-year tenor), the floating rate will be based on the benchmark rate of the Central Bank of Kuwait (about 4.0%), and green mortgage discounts will be provided for energy-efficient properties, and the application will require an annual income of KWD 5,000 or more. Car loans support new and used car financing with a maximum loan amount of KWD 25,000, a term of up to 7 years, and an annualized interest rate (APR) of approximately 4.0%-7.0%. Personal lines of credit range from KWD 1,000 to KWD 25,000 with a term of 1 to 5 years and an annualized interest rate (APR) of approximately 5.99%-10%. KFH's loan products offer flexible repayment options, including no penalty for early repayment, monthly or bi-weekly repayment plans, and a revolving line of credit.

digital service experienceKFH

excels in digital services, with its CBK Mobile app supporting iOS 14.0 and above and Android 9.0 and above, with a score of about 4.7 on the App Store and 4.5 on Google Play. The app offers a number of core features, including:

Face recognition: supports biometric authentication (such as Face ID and Touch ID), combined with 256-bit end-to-end encryption to ensure transaction security.

Real-time transfers: Support real-time transfer of Kuwaiti dinars through the Kuwait interbank clearing system, with a daily limit of up to 100,000 Kuwaiti dinars.

Bill management: Support online bill payment, automatic deduction and e-statement, and classify transaction records in real time.

Investment Tool Integration: Support stocks, funds, bonds, and ETFs through the Al Tijari Financial Brokerage platform, providing real-time market data and investment advisory services.

KFH also supports mobile payment methods such as Apple Pay, Google Pay and Samsung Pay, as well as mobile check deposits, further simplifying customer operations.

technological innovation

KFH is at the forefront of technological innovation. Its AI-powered customer service system automates 80% of customer inquiries by analyzing transaction behavior and detecting fraud risks in real-time. KFH follows the Central Bank of Kuwait's Open Banking Framework, integrating with third-party service providers through Open Banking APIs to provide account management and financial services interoperability. In addition, KFH launched CBK Vision, which leverages augmented reality (AR) technology to allow customers to view account balances, transaction history, and portfolios through AR glasses or mobile phones, greatly enhancing the user experience. KFH is also actively exploring blockchain technology to enhance transaction transparency and security.

Featured Services & DifferentiationKFH

stands out in the market through a number of featured services:

SME supportParticipation in the Kuwait Government's SME Financing Guarantee Program through CBK Corporate Banking, which provides customized loan and cash management services.

Trade Finance: Letters of credit, bill discounting and export finance to support energy, infrastructure and trade projects in Kuwait.

Al Najma Rewards Program: Enhance customer engagement with a daily KD 1 million raffle prize draw through Al Najma accounts.

Green Finance: Issuing green bonds to support renewable energy and low-carbon projects in response to the global trend of sustainable development.

Community Contribution: Demonstrate social responsibility by supporting educational, healthcare, and philanthropic projects through the CBK Foundation.

In addition, KFH has partnered with talabat to launch an exclusive campaign where customers can redeem KFH Rewards points for a 6-month or 12-month free subscription to talabat pro and enjoy free shipping.

market position and accolades

KFH is one of the largest financial institutions in Kuwait, with total assets of approximately KWD 7.2 billion (approximately USD 24 billion) in 2024 and market capitalization of approximately KWD 120 million. As a leader in Islamic finance, KFH has a strong presence in the international sukuk market, with a trading volume of US$11.4 billion in 2016. KFH's presence in Kuwait, Bahrain, Saudi Arabia, the United Arab Emirates, Turkey, Malaysia, Germany, the United Kingdom, Egypt, Iraq, Oman and Libya demonstrates its strong regional and international presence. Recent accolades include:

Global Finance's 2024 "Best Retail Bank" award.

Kuwait Green Finance Pioneer Award 2023.

The Banker 2022 "Best Trade Finance Bank" award.

Kuwait Financial Housing (KFH) has become a pioneer in Kuwait's financial market with its nearly 50-year heritage, deep cultivation of Kuwait's localized services and innovative financial products. It offers a wide range of deposit and loan products to meet customer needs through local branches and digital platforms. The digital service is centered on the "CBK Mobile" app, which provides efficient real-time transfer and investment management functions. Technological innovations include AI customer service, open banking APIs, CBK Vision visual banking, and blockchain technology, demonstrating its forward-looking digital transformation. With its SME support, trade finance, Al Najma awards scheme, green finance and a number of industry accolades, KFH continues to demonstrate strong competitiveness and influence in the Kuwaiti and regional financial markets.