The

Mauritius Commercial Bank Limited (MCB) is a long-established commercial bank with a leading position and regional presence in Mauritius. It is not a state-owned or joint venture bank, but a fully commercial bank, part of MCB Group Limited, which is committed to providing diversified financial services to individuals, businesses and institutions. With innovation and customer orientation at its core, MCB has become the backbone of the Mauritian financial system with nearly two centuries of robust operations.

Name & Background

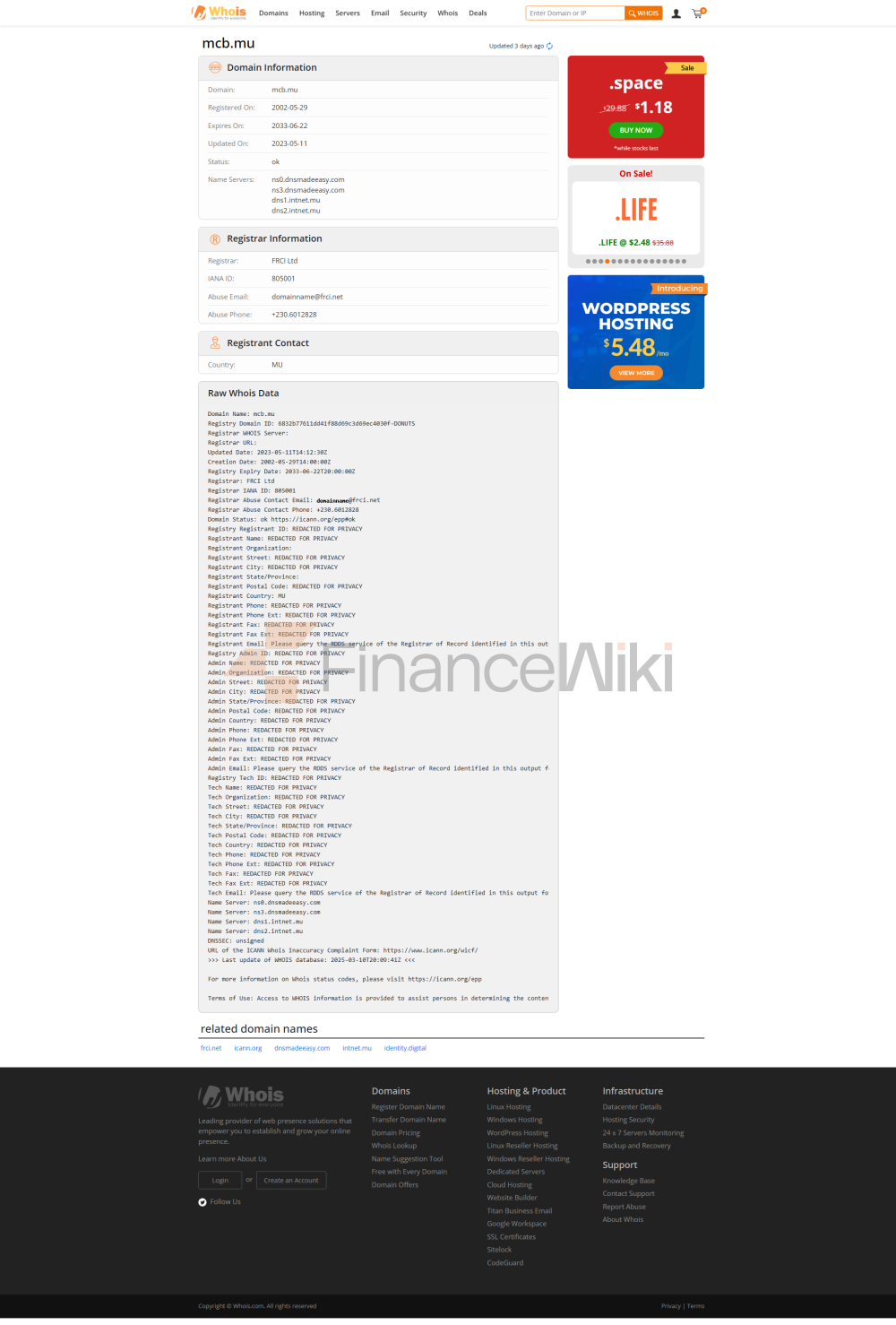

full name: The Mauritius Commercial Bank Limited

was founded on September 1, 1838

Head Office Location: 9-15 Sir William Newton Street, Port Louis, Mauritius

Shareholder Background: MCB is a wholly owned subsidiary of MCB Group Limited, which has been listed on the Stock Exchange of Mauritius since 1989 and is non-state-owned or privately owned in nature, with major shareholders including institutional investors and public shareholders such as Eastspring Investments. Founded by a group of businessmen, the bank received a royal charter from Queen Victoria in 1839 and became a limited liability company in 1955.

Scope of

ServicesMCB's services cover Mauritius as well as parts of the Indian Ocean and Africa, demonstrating its ambition as a regional bank. There are 42 modern branches and 10 foreign exchange points in Mauritius and Rodrigues, as well as about 150 ATMs to ensure convenient cash deposit and withdrawal services. The international business is present in Madagascar, Seychelles, Maldives, Mozambique, Reunion Island, France, etc., operating through subsidiaries and affiliates such as Banque Française Commerciale Océan Indien, with representative offices in Dubai, Paris, etc. MCB's "Bank of Banks" strategy has strengthened its cross-border financial services capabilities as the first SWIFT member concentrator in sub-Saharan Africa.

Regulatory & Compliance

regulator: MCB is regulated by the Bank of Mauritius (BoM) andMauritius Financial Services Commission (FSC)** dual regulation. The BoM is responsible for the regulation of the banking business, and the FSC oversees its listed and non-banking businesses. International operations (e.g. France, Seychelles) are supervised by local regulators.

Deposit Insurance: MCB participates in the Mauritius Deposit Insurance Scheme, which provides depositors with deposit protection of up to 500,000 MYRes (approximately US$11,000) in accordance with the Deposit Insurance Act to enhance customer confidence.

Compliance Record: MCB has a good overall compliance record but was fined INR 1.8 lakh by the Mauritius Anti-Corruption Agency (ICAC) in 2017 for inadequate anti-money laundering controls. The incident sparked widespread concern about bank governance, but the MCB has since strengthened its compliance measures and has not recorded any recent major violations.

Financial HealthMCB

demonstrated solid financial performance, reinforcing its leading position in Mauritius. As of June 2022, MCB managed Rs 518.7 billion (about $11 billion) in deposits and Rs 325.6 billion (about $7 billion) in loans. Key indicators are as follows:

Capital adequacy ratio: Basel III compliant, approximately 15%-17% (above the minimum 10% standard of BoM), indicating an adequate capital buffer.

Non-performing loan ratio: Approximately 3%-5%, which is lower than the industry average and reflects prudent credit management.

Liquidity Coverage Ratio: Far exceeds the 100% required by the BoM, usually above 150%, ensuring worry-free short-term liquidity. These indicators indicate that MCB is financially healthy and resilient, making it suitable for customers looking for a stable bank.

Deposit & Loan Products

deposit class:

Demand Deposits: Provide flexible deposits and withdrawals with low interest rates (about 0.5%-1%), suitable for daily money management.

Fixed Deposits: With tenors ranging from 3 months to 5 years and interest rates up to 3.5%-4.5% (depending on the amount and term), Fixed Deposits are suitable for customers who are looking for a stable income.

Featured products: "Junior Savings Account" for children, no management fee; "High Yield Savings" offer higher interest rates and require a minimum balance.

Loans:

Mortgages: Fixed or variable interest rate (approx. 4.5%-6%), loan tenure up to 25 years, loan-to-value ratio (LTV) up to 80%, proof of income and credit history required for approval.

Car Loan: The interest rate is about 5%-7%, the term is 3-7 years, new and used cars are supported, and the down payment ratio is flexible.

Personal Line of Credit: Unsecured loan with interest rate of 7%-10% and an amount of up to Rs.500,000 for short-term funding needs.

Repayment Options: Early repayment without penalty options are available, and some loans support deferrals or adjustments to repayment plans. MCB's products are designed with flexibility in mind to meet the diverse needs of students to high-net-worth clients.

List of common fees

Account management fee: Approximately ₹20-50 per month for regular current accounts and no monthly fee for high-end accounts (e.g. private banks).

Transfer fee: Free or as low as Rs 10 for domestic transfers, SWIFT fee for cross-border transfers (around Rs 200-500).

Overdraft Fee: Charged on a daily basis based on the overdraft amount, with an interest rate of approximately 15%-18%.

ATM Interbank Withdrawal Fee: Approximately INR 10-20 per transaction, free within the MCB network.

Hidden Fee Alert: Some accounts require a minimum balance (e.g. Rs.5000) or a penalty of Rs.50/month will be charged; Early withdrawal of time deposits may result in a loss of interest. Customers are advised to read the terms carefully.

Digital service experience

APP and online banking:

MCB Juice (mobile banking app): Rated 4.2/5 on the iOS App Store and Google Play, it was widely acclaimed. Core features include facial recognition login, real-time transfers, bill payments, credit card management, and investment tracking.

Online banking platform: It supports corporate account management, batch transfer and foreign exchange trading, with an intuitive interface, suitable for small and medium-sized enterprises and individuals.

Technological innovation:

AI customer service: Provide basic intelligent Q&A to handle account inquiries and frequently asked questions.

Open Banking APIs: Support for third-party fintech integrations, such as payment gateways.

Innovation Highlights: MCB is the first bank in Mauritius to launch mobile banking and ATM, and recently partnered with Temenos to upgrade its core banking system and enhance its cloud capabilities. MCB's digital services are known for their convenience and innovation, especially for young and tech-oriented customers.

Customer Service Quality

Service Channels: 24/7 phone support (+230 202 5000), live chat (business hours) and social media responses (Twitter, Facebook, with an average response time of 1 hour).

Complaint Handling: The complaint rate is low, the average resolution time is 3-5 working days, and the user satisfaction rate is about 85% (based on customer feedback). Complaints can be submitted through the official website or Ombudsperson for Financial Services.

Multi-language support: Available in English, French and Creole, with some locations available in Hindi, to meet local and cross-border customer needs. MCB has earned a reputation for efficient and friendly customer service, especially in the local market.

Security Measures

Security of funds: Participation in the Deposit Insurance Scheme with a maximum protection of Rs 500,000. Fraud prevention with real-time transaction monitoring and two-factor authentication (OTP).

Data security: ISO 27001 information security certification, encryption and firewall protection. No publicly reported major data breaches.

Anti-fraud technology: Equipped with abnormal transaction detection system, customers can freeze their accounts instantly through the APP. MCB's security measures are comprehensive, so customers can store their funds and data with confidence.

Featured Services & Differentiation

market segments:

Student Accounts: "Campus Educational Loans" offers low-interest education loans with no account management fees.

Senior Products: Exclusive fixed deposit plan with slightly higher interest rates and health insurance benefits.

Green Finance: Supporting ESG investments and launching green loans (e.g. solar project financing).

High Net Worth Services: Private banking services with a threshold of around Rs 1 million and offering customized portfolios, trust services and global asset allocation. MCB serves through market segments to meet the unique needs of different customer groups.

Market Position & Accolades

Industry Ranking: MCB is the largest bank in Mauritius with assets of approximately US$11 billion, ranking among the highest in the sub-Saharan region of Africa. MCB Group is one of the most valuable companies in the East Africa and Indian Ocean region.

Awards:

Infosys Finacle Innovation Awards 2019 (API Innovation Category).

It has been awarded the title of "Best Bank in Mauritius" by Euromoney on several occasions.

In 2023, it was recognized by Temenos for its digital transformation "Success Story". MCB has a strong reputation in the regional financial community for its market leadership and continuous innovation.