Founded

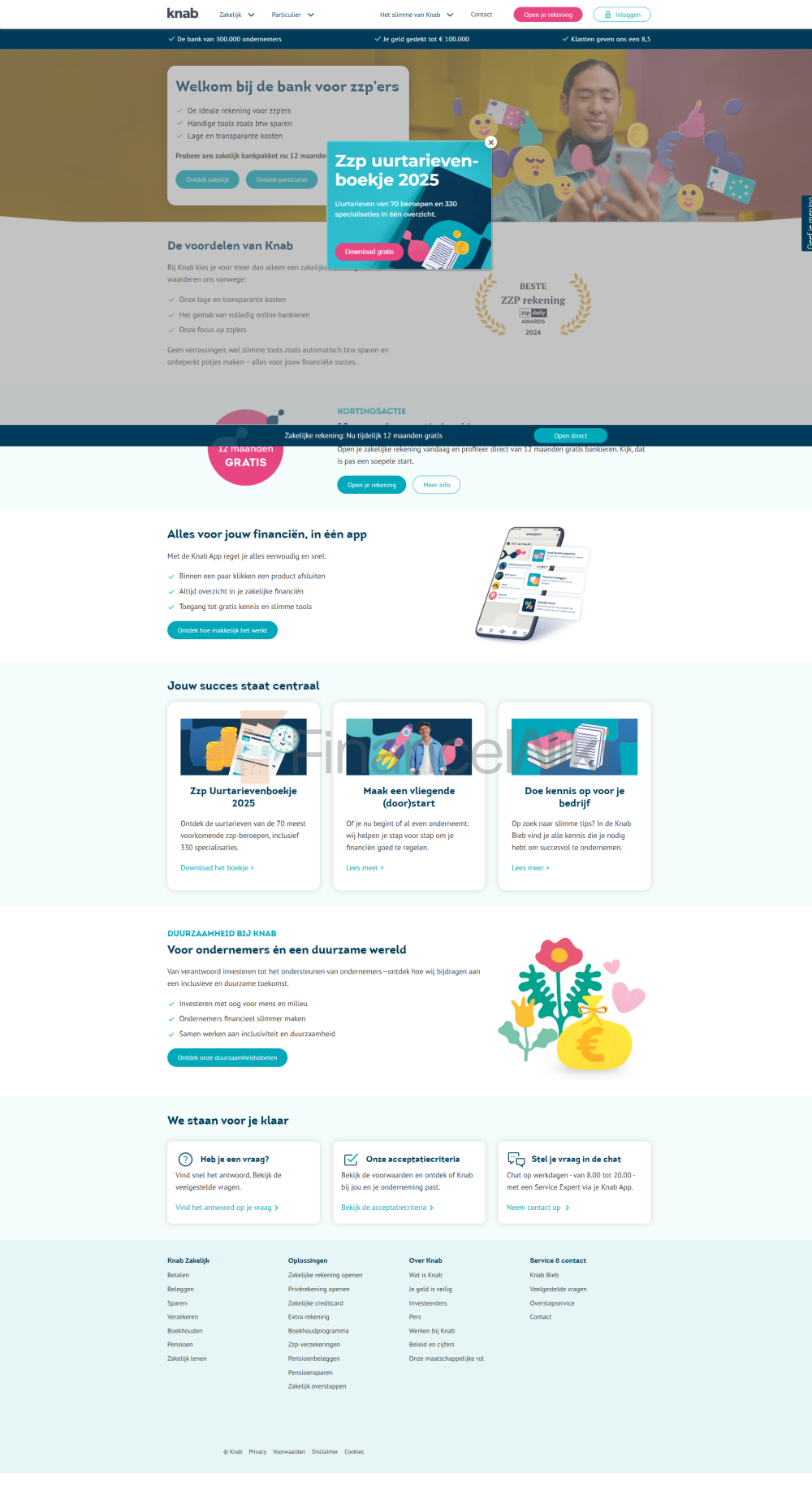

in 2012, Knab Bank is a Dutch online retail bank with the full name of Knab N.V., headquartered in Amsterdam, the Netherlands (Thomas R. Malthusstraat 1, 1066JR). Backed by Dutch insurance and asset management giant Aegon Group, the bank is a joint venture commercial bank that operates mainly through digital channels and has no traditional offline outlets.

its service scope focuses on the local Dutch market, adopts a pure online model, so there are no physical branches or ATMs, and all banking is done through mobile and web terminals.

Scope of Services

Coverage: Knab primarily operates in the Netherlands and provides personal and commercial banking services.

Number of offline branches and distribution of ATMs: Knab is a digital bank that provides its services primarily through online platforms and mobile applications, and does not have traditional offline branches.

Featured products and services: Knab offers a wide range of banking products, including savings accounts, fixed deposits, credit cards, investment accounts and business accounts. Customized banking services especially for freelancers and small businesses.

Regulatory & Compliance

Regulator: Knab is regulated by the Dutch Financial Market Authority (AFM).

Deposit insurance scheme: Knab participates in the Dutch Deposit Protection Scheme, which protects individual deposits of up to €100,000.

Compliance Record: In February 2024, the Dutch Central Bank imposed an administrative fine on Knab for failing to adequately manage credit risk in its consumer and SME loan portfolio between February 11, 2019 and March 25, 2022. This act violates the operational management requirements of the Financial Supervision Act.

Financial Health

Capital Adequacy Ratio: As of June 30, 2023, Knab's total capital adequacy ratio was 23.5%, demonstrating a strong capital base.

Non-performing loan ratio: The specific non-performing loan ratio data is not publicly disclosed.

Liquidity Coverage Ratio: As of June 30, 2023, Knab's liquidity coverage ratio was 187%, indicating that it has sufficient short-term liquidity.

Deposit & Loan Products

Deposit products: Knab offers a variety of deposit products, including demand and term deposits. For example, the interest rate for a 12-month fixed deposit is 2.15%, and the interest rate for a 24-month and 36-month fixed deposit is 1.95%. The interest rate for demand deposits is 1.75% per annum.

Loans: Knab offers products such as home loans, car loans and personal lines of credit. Specific interest rates and conditions may vary depending on the type of loan and the customer's circumstances.

List of fees: Knab account management fees start at 7 euros per month, depending on the type of account and the content of the service. Additional fees may apply for interbank transfers and international transfers. For more information, please refer to the official website of Knab.

Digital service experience

APP and online bankingKnab offers feature-rich mobile applications and online banking platforms through which users can manage their accounts, transfer funds, make payments and more. The ratings on the App Store and Google Play are 4.7/5 and 4.6/5, respectively, showing how highly users rate their digital services.

Technological innovation: Knab integrates several technological innovations into its platform, including facial recognition, real-time transfers, bill management, and investment tools, among others. In addition, Knab is also exploring the application of technologies such as AI customer service and robo-advisors.

Customer Service Quality

service channels: Knab offers a variety of customer service channels, including 24/7 phone support, live chat, and social media. Customers can contact the customer service team through the Knab App or the official website.

Complaint handling: Knab is committed to providing high-quality customer service, and specific complaint handling data and user satisfaction information are not publicly disclosed.

Multilingual support: Knab's services are primarily available in Dutch and English and may be suitable for both native Dutch residents and English speakers. For support in other languages, it is recommended to contact Knab customer service directly to confirm.

Security measures

security of funds: Knab participates in the Dutch deposit protection scheme, which protects personal deposits up to €100,000.

Data security: Knab takes a variety of measures to ensure the security of user data, including encryption technology and security authentication. The details of the security certifications and whether there have been any data breaches have been publicly disclosed.

Featured Services & Differentiation

market segments: Knab has a special focus on freelancers and small businesses, offering customized banking services such as dedicated accounts and financial management tools.

High Net Worth Services: Knab provides private banking services to provide customized financial solutions for high net worth clients.