Name & BackgroundFounded

in 1960 and headquartered in Makati City, Philippines, PSBank (Savings Bank of the Philippines) is a commercial bank that primarily provides personal banking services. PSBank is a private bank in the Philippines that is an important part of the Philippine banking industry and is committed to providing consumers with simple and innovative banking solutions. The bank has long earned the trust of its customers through sound operations and has gradually expanded its business in the domestic market. PSBank has not only set up multiple branches in the Philippines, but has also expanded its online customer base by continuously improving its digital services.

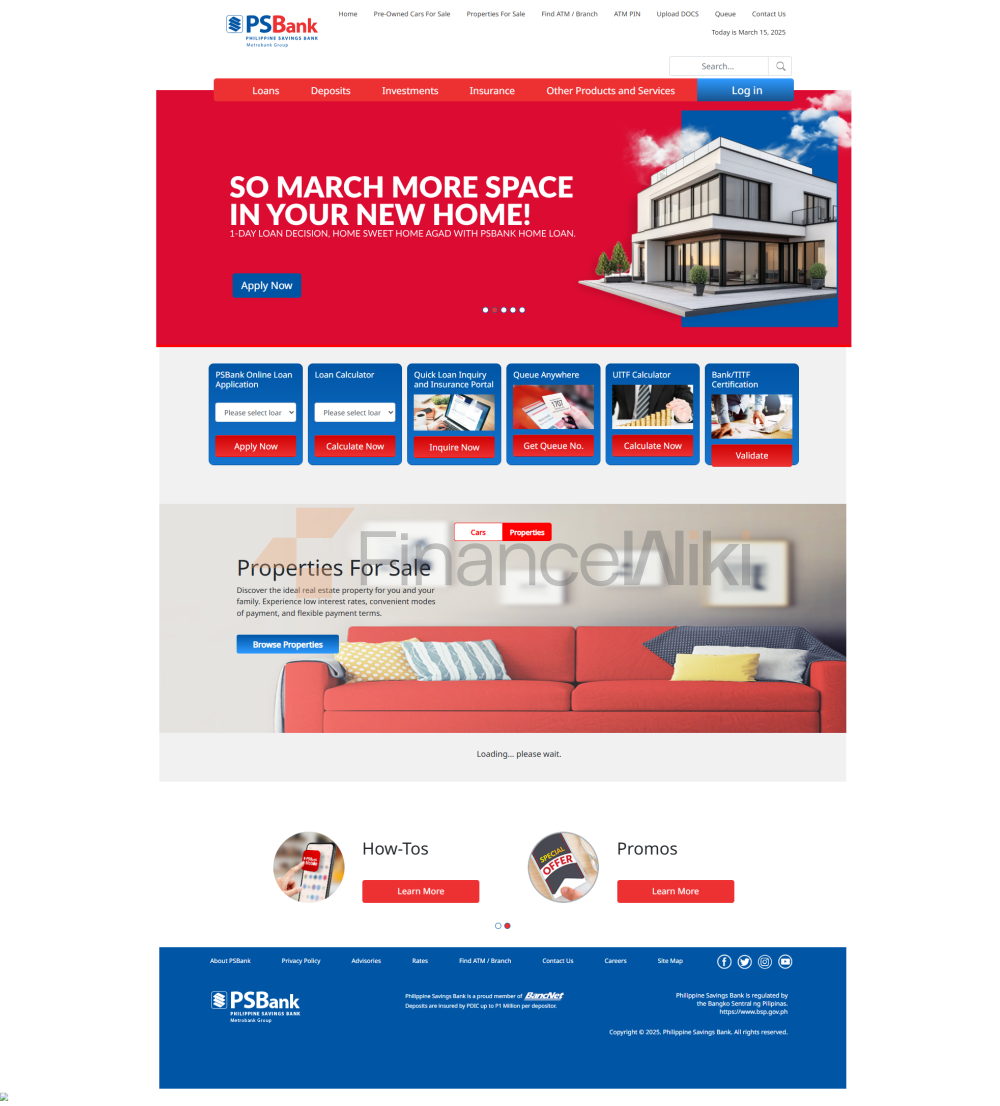

Scope of

ServicesPSBank's services cover the entire territory of the Philippines, with offline outlets in major cities and regions. Its network covers multiple provinces and provides customers with convenient and fast deposit and withdrawal services through a wide range of ATM network services. PSBank's ATMs are located in major cities and towns in the Philippines, making it easy for customers to conduct day-to-day banking operations such as cash deposits and withdrawals across the country. With the advancement of digital transformation, PSBank has also invested more resources in the construction of online service platforms, further strengthening its competitiveness in the field of digital banking.

Regulation &

CompliancePSBank is regulated by Bangko Sentral ng Pilipinas (BSP) and strictly follows the relevant laws and policies of the Philippine financial regulator. As a legally operating bank, PSBank has also joined the Philippines' deposit insurance program to provide additional protection for customer deposits. The bank has a strong compliance track record and strict implementation of policies such as risk management and anti-money laundering to ensure that the bank's operations meet national and international regulatory requirements.

Financial HealthPSBank's

strong capital strength is demonstrated by its strong capital adequacy ratio, which meets the minimum requirements set by the Bangko Sentral ng Pilipinas (BSP). The bank's non-performing loan ratio is relatively low, indicating that its loan quality is good and its risk control measures are effective. PSBank's liquidity coverage ratio also remained at a high level, indicating that the bank is able to cope with the funding needs of daily operations and has good liquidity. Overall, PSBank is financially healthy and resilient to risks.

Deposit & Loan ProductsIn

terms of deposit products, PSBank offers demand deposits, time deposits, and a variety of specialty deposit products. The fixed deposit interest rate is competitive in the Philippine market, and customers can choose different deposit plans with different maturities according to their capital needs. PSBank has also launched a high-yield savings account to provide customers with higher returns on their deposits, especially for those who want to grow their wealth.

In terms of loan products, PSBank provides diversified financial services such as home loans, car loans, and personal lines of credit. Mortgage interest rates are competitive and offer flexible repayment options, allowing customers to choose different repayment options depending on their personal circumstances. The approval process for car loans and personal lines of credit is simple and the barriers to entry are low, and PSBank offers a transparent fee structure during the loan process to ensure customers have a clear understanding of the fees.

List of common feesPSBank's account management fees are more transparent, and there are usually no monthly or annual fees for individual accounts. However, for some specific types of accounts, banks may charge management fees depending on the account type. When transferring money across borders, PSBank charges a fee depending on the destination country. Overdraft fees and ATM interbank withdrawal fees are also common fees for customers, although banks waive these fees for customers with a certain account balance. For some special accounts, PSBank may set a minimum balance requirement, and accounts that do not meet this standard will be charged with relevant management fees.

Digital Service

ExperiencePSBank continues to innovate in the field of digital banking services, launching a feature-rich mobile app and online banking services. Its mobile app has received high scores in user reviews, and users can perform real-time transfers, bill payments, account inquiries and other financial operations through the app. PSBank also enhances the customer experience with smart technologies, such as keeping accounts secure through features such as facial recognition and fingerprint recognition, while providing personalized financial advice.

The bank has also introduced AI customer service and robo-advisory functions to support round-the-clock customer consultation and help customers optimize financial planning and investment decisions. In addition, PSBank's open banking API technology enables it to collaborate with multiple fintech companies and partners, further enhancing the flexibility and reach of its digital banking services.

Customer Service

QualityPSBank offers 24/7 phone support and maintains a quick response across multiple social media platforms. Customers can get help anytime with any account-related issues through the bank's live chat feature. The bank's complaint handling procedures are efficient, the average resolution time is short, and customer feedback is highly satisfied, indicating the high level of professionalism of its service team. PSBank also supports multi-language services, especially English and Filipino for cross-border customers, ensuring that customers with different language backgrounds can receive satisfactory services.

Security

MeasuresPSBank takes the security of customer funds and information very seriously. The bank offers deposit insurance and employs multiple anti-fraud measures, including real-time transaction monitoring and an automated alert system, to ensure the safety of customer funds. When it comes to data protection, PSBank uses ISO 27001 certification, which ensures that it meets the highest global security standards when handling customer information. The fact that the bank has not had a major data breach since its inception is further proof of its excellent management capabilities in information security.

Featured Services & DifferentiationPSBank's

unique services include fee-free account solutions for students and young customers, as well as exclusive wealth management products designed for senior customers. The bank has also launched green financial products to support environmental protection projects and sustainable development investments to meet the needs of a growing number of customers who are highly concerned about environmental and social responsibility. For high-net-worth clients, PSBank provides private banking services to help clients grow and pass on their wealth by providing customized financial solutions tailored to their individual needs.

Market Position & AccoladesPSBank

has a strong market position in the Philippine market, especially in the consumer banking sector. Banks are among the top banks in the Philippines in terms of assets, and their brand influence is gradually increasing in the country. PSBank has received several industry awards for its innovation and service quality in digital banking. Through continuous innovation and service optimization, PSBank continues to strengthen its market position in the Philippine banking industry and aims to further expand its presence in the future.