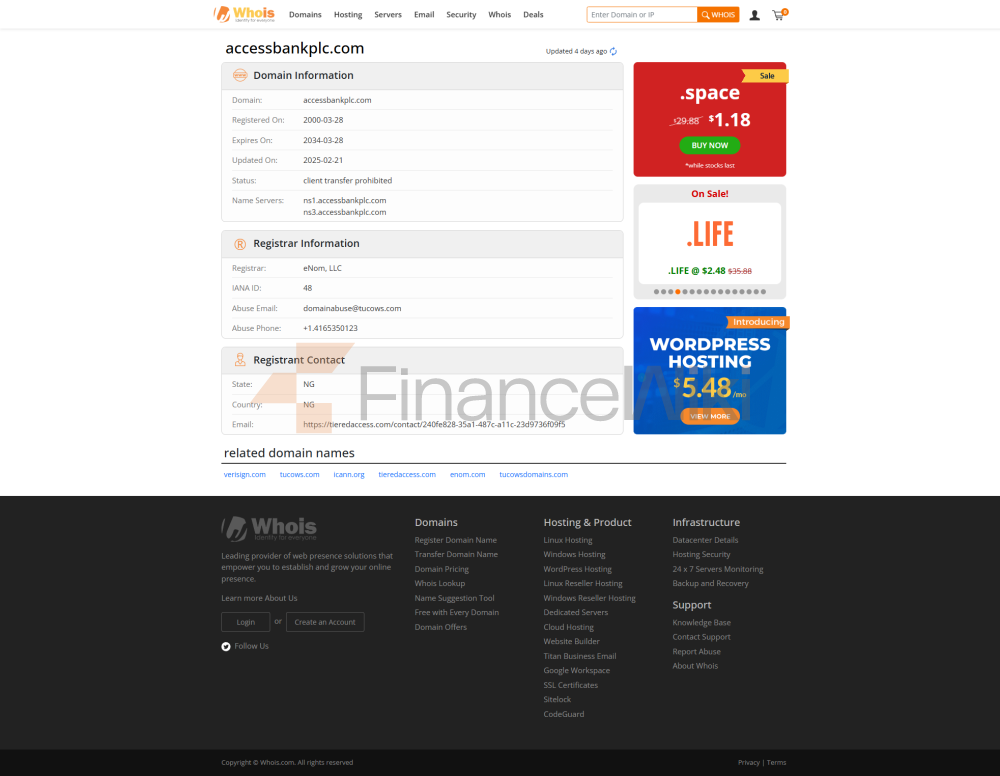

Name & BackgroundAccess

Bank plc, established in 1989 and headquartered in Lagos, Nigeria, is a leading commercial bank in Nigeria. Originally established as a small commercial bank, Access Bank has undergone numerous acquisitions and expansions to become a large global bank. The Bank was admitted to the Nigerian Stock Exchange in 2002 and became a significant member of the Nigerian stock market. As a bank controlled primarily by private shareholders, Access Bank's shareholder background is diverse, including both international investors and local capital.

Scope of

ServicesAccess Bank covers the entire territory of Nigeria and has branches in a number of other African countries, Europe and Asia. The bank has nearly 500 offline outlets in Nigeria and overseas markets, and has more than 1,000 ATMs in the country. In addition, Access Bank also provides cross-border services in multiple countries, ensuring that customers can access their bank accounts and funds anytime, anywhere.

Regulation & ComplianceAccess

Bank is regulated by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC) and complies with all relevant regulations for the Nigerian financial sector. As one of Nigeria's major commercial banks, Access Bank has also joined the Nigerian Deposit Insurance Corporation (NDIC) Deposit Insurance Scheme to safeguard depositors' funds. Access Bank continues to perform well in terms of compliance and conducts regular regulatory reviews to ensure compliance with all international and local compliance standards.

Access Bank's capital adequacy ratio, a key indicator of financial health, is stable and typically above 10%, in line with international banking standards. The bank's non-performing loan ratio is relatively low, controlled below 2%, showing strong risk management capabilities. In terms of liquidity coverage ratio, Access Bank performed well, maintaining a high level of liquidity protection and being able to cope with market volatility and customer withdrawal needs.

Deposits &

LoansAccess

Bank offers a wide range of deposit products, including demand and time deposits. Current deposit rates are more competitive, while time deposits offer flexible interest rates based on the maturity and amount of the deposit. The bank also offers a number of specialty deposit products, such as high-yield savings accounts and large certificates of deposit (CDs). In addition, Access Bank offers customers individual and business regular savings plans to help them achieve their long-term financial goals.

In terms of loan products, Access Bank provides housing loans, car loans and personal credit loans, etc., with competitive interest rates in the local market. The bank provides customers with flexible repayment options, including different repayment terms and instalment plans, to help customers with different needs achieve their loan plans.

List of Common FeesAccess

Bank's account management fees are relatively transparent and offer a variety of different types of account services, some of which are free of monthly fees. Cross-border transfer fees vary depending on the destination and amount, but in most cases, domestic transfers are free. Overdraft fees and ATM interbank withdrawal fees are reasonable. It is important to note that some accounts have a minimum balance limit, and additional fees may be charged if this standard is not met.

Digital Service Experience

App and

Access Bank's mobile banking app have received high user ratings in the market, providing a number of functions including face recognition, real-time transfer, bill management, etc. The core features are designed to enhance the user experience, making it easy for users to make online payments, view account balances, manage investments, and more. The online banking platform also supports a variety of online banking services, ensuring that users can access their accounts anytime and anywhere.

Technological innovationAccess

Bank is also at the forefront of the industry in terms of technological innovation. The bank has launched AI customer service and robo-advisory services to help users quickly solve problems and provide personalized financial advice. In addition, the bank's open banking API enables collaboration with third-party developers, further enriching its ecosystem of digital services.

Customer Service Quality

Service

ChannelsAccess Bank offers 24/7 phone support as well as live chat services through which customers can get help at any time. The bank's social media is responsive, ensuring quick responses to customer questions.

Complaint HandlingAccess

Bank's complaint handling mechanism is mature and user satisfaction is high. The bank's complaint rate and average resolution time are among the best in the industry, further enhancing customers' trust in the bank.

Multi-language supportConsidering

its international business expansion, Access Bank provides multi-language services including English, French, etc., to meet the needs of cross-border customers.

Security

MeasuresFunds Security

Access Bank provides insurance coverage for deposits and employs a number of anti-fraud technologies, such as real-time transaction monitoring, to ensure the safety of customer funds. In addition, the bank conducts regular internal audits and external security reviews to protect the interests of users to the greatest extent.

Data SecurityAccess

Bank has a strong focus on security in terms of data protection and has been ISO 27001 certified to comply with international information security management standards. The bank has not had a major data breach in the past, demonstrating its commitment to customer privacy and data protection.

Featured Services & Differentiated

Market SegmentsAccess

Bank offers special services for different groups, such as fee-free accounts for students and customized financial solutions for seniors. The bank has also launched green financial products to support ESG investment and meet the needs of environmental protection and sustainable development.

High Net Worth

ServicesFor high net worth clients, Access Bank provides private banking services and customised financial solutions for clients. Clients can access exclusive investment and wealth management services based on their personal financial situation and needs.

Market Position &

HonorsIndustry RankingsAccess

Bank ranks highly in the global banking industry, especially in the African market. In Nigeria, Access Bank is firmly in the top tier of the country in terms of assets, making it one of the most competitive banks in the country.

AwardsIn

recent years, Access Bank has received several industry awards, such as the "Best Digital Bank" and "Most Innovative Bank" award, for its excellence in digital services and innovation, which further solidify its leadership position in the financial industry.