basic information

of the bankNature of the bank: commercial bank.

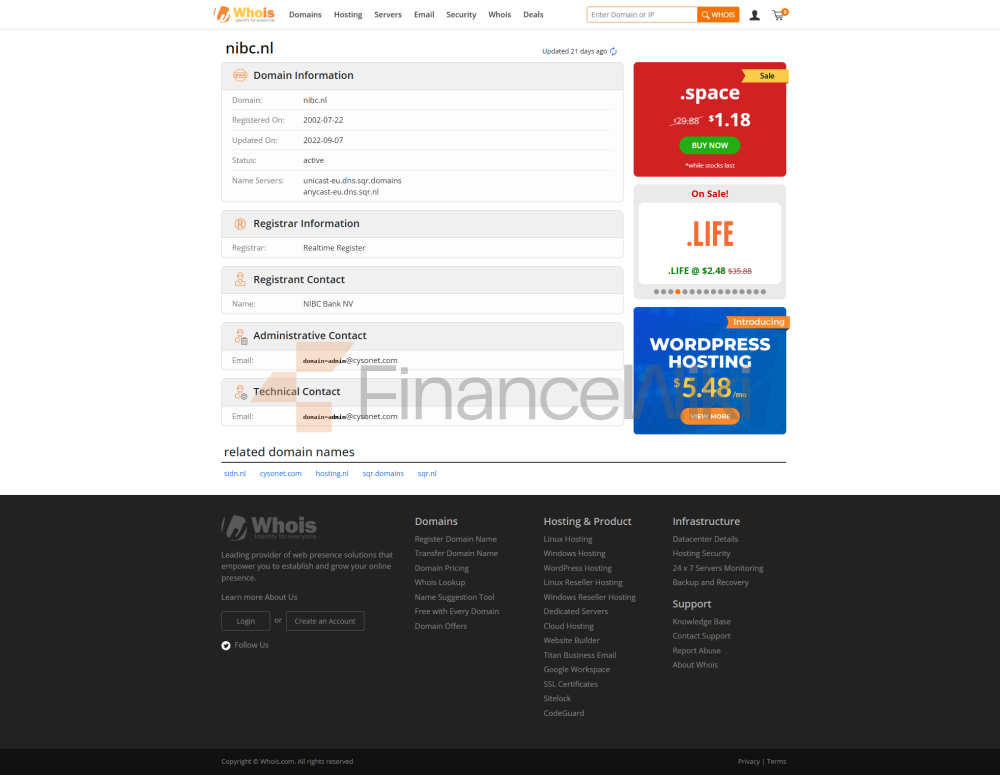

Full name: NIBC Bank N.V

Founded: 1945 as the Maatschappij tot Financiering van Nationaal Herstel to finance the post-World War II economic recovery of the Netherlands.

Head Office: Carnegieplein 4, 2517 KJ The Hague, Netherlands.

Shareholder Background: Currently owned by a consortium of international financial institutions organized by J.C. Flowers & Co., a U.S. private equity firm.

service

coverage: mainly in the Netherlands, Germany and Belgium, with a focus on the northwest European market.

Number of offline outlets: It has its headquarters in The Hague, Netherlands, and branches in Brussels, Frankfurt and London.

ATM Distribution: As a predominantly online bank, NIBC Bank N.V. does not have a widespread ATM network.

regulatory and compliance

regulators:

De Nederlandsche Bank, DNB): Responsible for prudential supervision.

Autoriteit Financiële Markten (AFM): Responsible for conduct regulation.

Deposit Insurance Scheme: Participation in the Dutch Deposit Guarantee Scheme (DGS), which provides deposit protection of up to €100,000 per account holder.

Recent Compliance Records: To date, no major compliance issues have been identified.

Financial healthCapital

adequacy ratio: According to the 2024 report, the common equity tier 1 capital adequacy ratio (CET1) is 17.8%, which is higher than regulatory requirements.

Non-performing loan ratio: As of the end of 2023, the non-performing loan ratio was 0.11%, showing good asset quality.

Liquidity Coverage Ratio: The specific data is not disclosed, but the bank maintains a robust liquidity management.

Deposit & Loan

ProductsDeposit Products:

offers demand and time deposits, with interest rates adjusted according to market conditions.

Featured products include high-yield savings accounts and large certificates of deposit (CDs).

Loan products:

providing mortgages, car loans, and personal lines of credit.

For energy-efficient homes, interest rate discounts of up to 0.10% are offered.

List of common expenses

Account Management Fee: Depending on the account type, a monthly or annual fee may apply.

Transfer fees: Domestic transfers are usually free of charge, while cross-border transfers may incur a fee.

Overdraft fees: Fees may apply if your account is overdrawn.

ATM interbank withdrawal fee: A fee may apply, depending on the ATM network used.

Hidden Fee Alert: Some accounts may have a minimum balance requirement that may be charged if it is not met.

digital service experience

APP and online banking:

provides NIBC Sparen application to support account management, Transaction viewing and fixed deposit operations.

The app is available for download on both Google Play and the App Store.

Core function:

face recognition login.

Real-time transfers.

Billing management.

Investment tool integration.

Technological innovation:

support for open banking APIs.

AI customer service and robo-advisory services are being explored.

customer service

quality service channel:

- provides

phone support and live chat.

Respond to customer inquiries through social media platforms.

Complaint Handling:

has a dedicated complaint handling department dedicated to resolving customer issues quickly.

Multi-language support:

Dutch, English and German are available for cross-border customers.

security measuresFunds

security:

- participate

in the Dutch Deposit Protection Scheme to ensure the safety of customer funds.

Employ advanced anti-fraud technologies such as real-time transaction monitoring.

Data security:

- ISO

27001 certified to ensure information security management.

To date, there have been no major data breaches.

Featured & Differentiated

Segment Services:

- student

accounts are generally waived.

Provide exclusive wealth management products for the elderly.

Launched green financial products to support ESG investment.

High-net-worth services:

providing private banking services and customized financial solutions.

Market Position & AccoladesIndustry

Ranking:

is a mid-sized player in the Dutch banking sector, focused on specific market sectors.

Awards:

- "

Best Digital Bank" and "Most Innovative Bank".