The

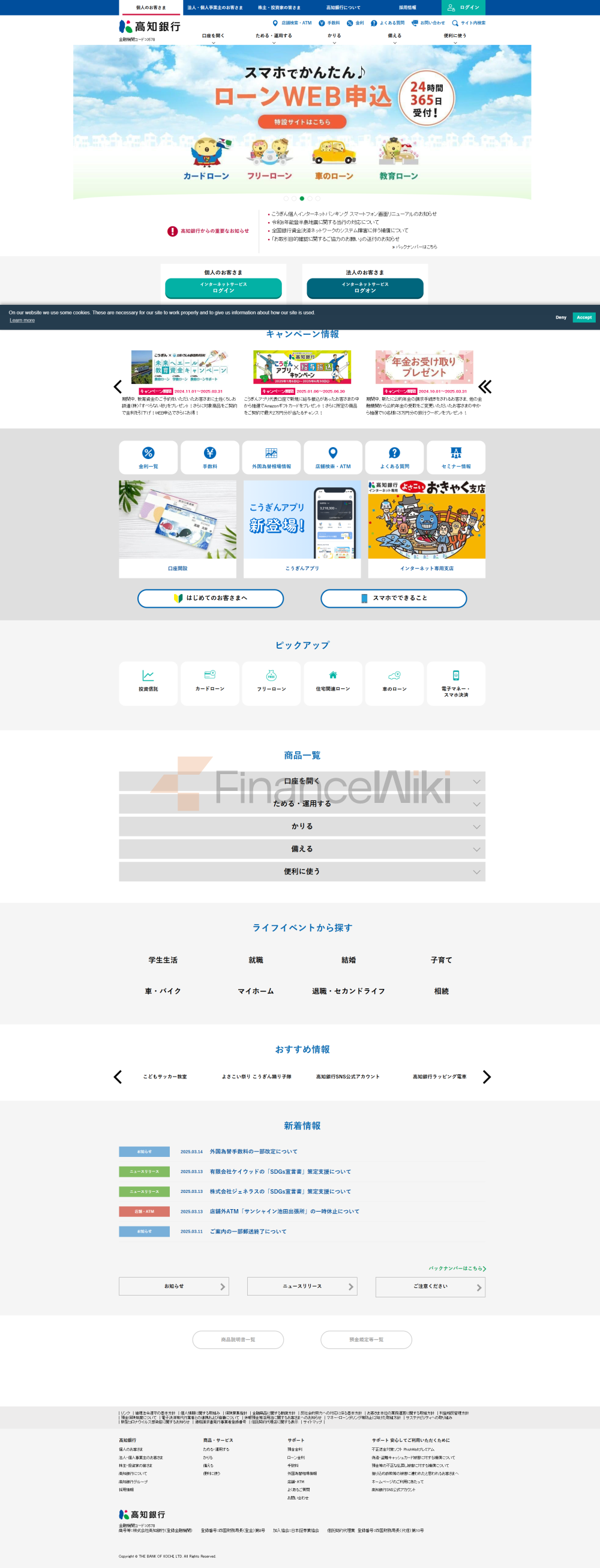

Bank of Kochi, Ltd. is a regional commercial bank rooted in Kochi Prefecture, Japan, positioned as a local financial pillar serving individual and corporate customers in Kochi Prefecture and surrounding areas. It is not a state-owned or joint-venture bank, but a pure commercial bank focused on regional economic development.

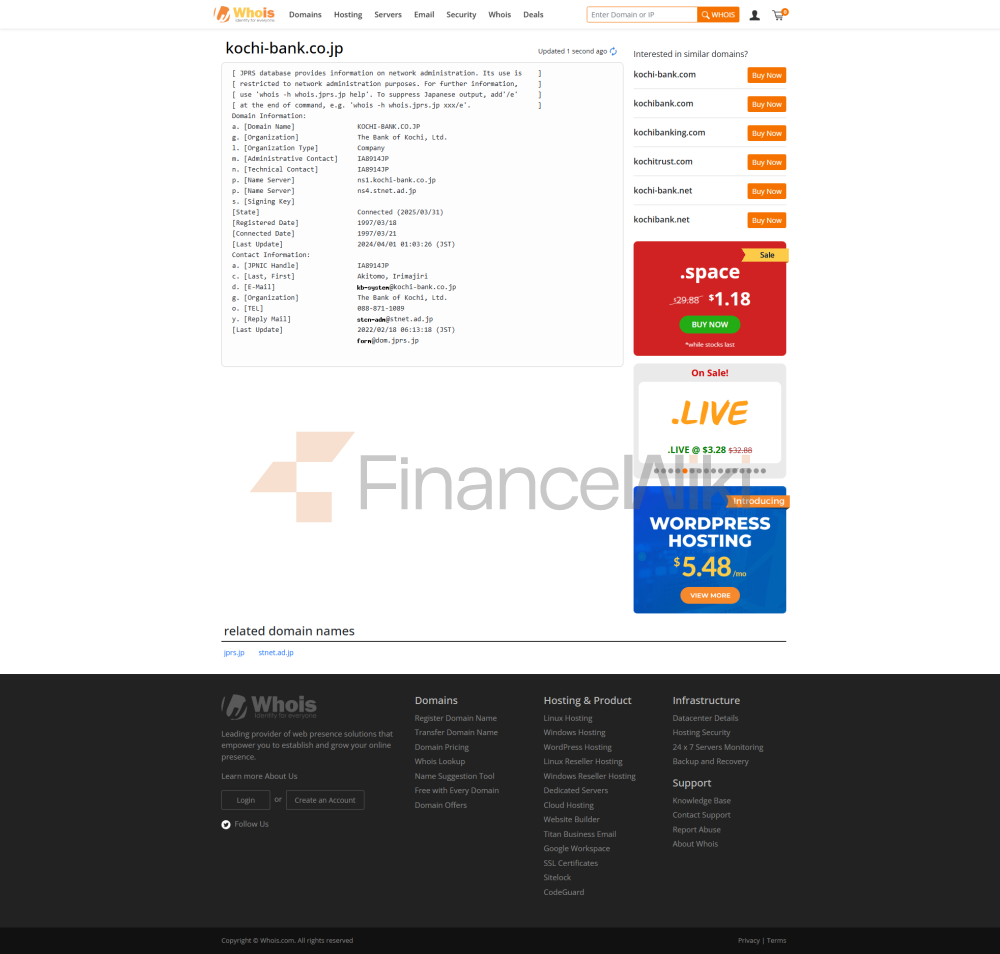

name and background: The Bank of Kochi, Ltd. was founded in 1930 and is headquartered in Kochi City, Kochi Prefecture, Japan. As a regional bank with a predominantly local corporate and institutional background, the bank is listed on the Tokyo Stock Exchange (stock code: 8416) and is a public company, not a wholly state-owned or privately owned company.

Service scope: The main service area is Kochi Prefecture, Japan, radiating the surrounding four countries. The bank has about 75 offline branches, covering major towns in Kochi Prefecture, and is equipped with a certain number of ATMs (the exact number is not disclosed, but it is estimated that the size of the regional bank is about 100-150) to provide customers with convenient deposit and withdrawal services.

Regulation & ComplianceThe

Bank of Kochi is regulated by the Financial Services Agency (FSA) and is required to comply with the Bank of Japan Act and other relevant regulations to ensure sound operations and the safety of customer funds.

Deposit Insurance: As a member of the Japanese banking industry, the bank has joined the Deposit Insurance Corporation of Japan to provide insurance protection for customer deposits of up to 10 million yen, covering major account types such as demand and fixed deposits.

Compliance records: There are no recent major compliance violations in the public information, indicating that its operations are relatively standardized, and its risk management meets the requirements of Japanese financial regulations.

Financial HealthThe

Bank of Kochi As a regional bank, the Bank of Kochi has a solid financial performance, with a focus on the local market and relatively manageable risk exposure.

Capital adequacy ratio: According to Japanese financial regulatory requirements, regional banks are generally required to maintain a capital adequacy ratio (CAR) of more than 8%. Although no specific data is disclosed, listed banks are required to report to the Tokyo Stock Exchange on a regular basis, and their capital adequacy ratios are expected to be between 10% and 12%, which is in line with regulatory standards.

Non-Performing Loan Ratio: Regional banks typically have low non-performing loan ratios (NPLs) that are expected to be in the range of 1%-2% as their customer base is mostly local SMEs and individuals, and loan approvals are more cautious.

Liquidity Ratio: Banks of Japan are required to meet the liquidity coverage ratio (LCR) requirements under the Basel III framework, with a minimum of 100%. The Bank of Kochi, as a compliant bank, expects an LCR of between 120%-150% to ensure sufficient short-term liquidity.

Deposit & Loan ProductsThe

Bank of Kochi offers a wide range of deposit and loan products to meet the financial needs of local residents and businesses.

deposits:

demand deposits: low interest rates, about 0.001%-0.01%, suitable for daily fund management, providing flexible access and withdrawal.

Time deposits: 1-year interest rate of about 0.1%-0.3%, 3-year and 5-year tenors up to 0.5%, depending on the amount and tenor.

Featured products: High-yield savings accounts (e.g. "Super Term Deposits") and large certificates of deposit are available for long-term savings customers, and the interest rate may be slightly higher than that of regular time deposits.

Loans:

Mortgages: Fixed or variable rate mortgages with interest rates of about 0.5%-2%, depending on the loan term and credit rating, requiring a stable income and collateral.

Car loan: The interest rate is about 1%-3%, and the approval threshold is low, which is suitable for the needs of local residents to buy a car.

Personal Line of Credit: Unsecured loans have higher interest rates (around 3%-7%), proof of income is required, and flexible repayment options include early repayment and amortization adjustments.

List of common fees

The Bank of Kochi's fee structure is relatively transparent, and regional banks often attract local customers with low fees.

account management fee: Monthly/annual fee is waived for regular current accounts, but certain high-end accounts (such as investment accounts) may charge an annual fee of about 1,000-5,000 yen.

Transfer fee: Domestic transfers are usually free or as low as 200 yen per time through online banking, and cross-border transfer fees are higher, about 2,000-5,000 yen per time, depending on the amount and destination.

Overdraft Fee: Overdraft accounts may be charged interest at 0.05%-0.1% per day, depending on the account type.

ATM withdrawal fee: Interbank ATM withdrawals are about 200-400 yen per withdrawal, and may be higher during certain periods (such as at night).

Hidden Fee Reminder: Be aware of the minimum balance requirement (usually 10,000 yen), below which a monthly maintenance fee (about 500 yen) may be triggered.

Digital Service

ExperienceThe Bank of Kochi embraces digital transformation and provides comprehensive online and mobile banking services to meet the needs of modern customers.

APP & Online Banking: The official app "Kochi Bank App" supports iOS and Android, with a rating of about 4.0/5.0 on the App Store and Google Play (based on feedback from regional bank users). Core features include real-time transfers, bill management, deposit inquiry, and loan application tracking, with a simple interface that is suitable for local users.

Technological innovation: It provides functions such as face recognition login and real-time transaction notification, and supports some open banking APIs to facilitate the integration of third-party financial services. The AI customer service function is still under development, and the robo-advisory service has not been widely promoted for the time being.

Customer Service QualityThe

Bank of Kochi is known for its proximity to local customers, with a wide range of service channels and a focus on user experience.

service channel: 24/7 telephone support (0570-04-8888), live chat function is provided through the official website and APP, and the response time is usually within 5 minutes. Social media, such as Twitter, is more responsive and suitable for younger users.

Complaint handling: The complaint rate is low, the average resolution time is about 3-5 working days, and the user satisfaction is high (above the average level of regional banks).

Multi-language support: Mainly Japanese, English service for cross-border users (such as foreign residents or tourists) is limited, so it is recommended to contact the branch in advance to confirm.

Security MeasuresThe

Bank of Kochi attaches great importance to the security of customer funds and data, and has taken a number of measures to protect the interests of users.

Security of funds: Deposits are guaranteed up to 10 million yen through the Japanese deposit insurance system. Banks use real-time transaction monitoring and anti-fraud systems to detect unusual transactions in a timely manner.

Data security: Although there is no clear record of ISO 27001 certification, it follows the data security standards of the Financial Services Agency of Japan and uses encryption technology and multi-factor authentication. No major data breaches have been reported in recent years.

Featured Services and DifferentiationThe

Bank of Kochi has been deeply involved in Kochi Prefecture and has launched a number of localized services to strengthen regional competitiveness.

market segment:

Student account: A commission-free current account suitable for school students, with a low threshold wealth management product.

Exclusive wealth management for the elderly: Provide low-risk time deposits and local bond investment in Kochi Prefecture, suitable for conservative elderly customers.

Green financial products: Support for green loans related to agriculture, forestry and fishery in Kochi Prefecture, in line with ESG investment trends.

High-net-worth services: Provide private banking services, the threshold is about 50 million yen, and customized financial solutions include trust and portfolio management.

Market Position & Accolades

The Bank of Kochi has a solid position among Japanese regional banks, with assets of approximately 400 billion to 500 billion yen (approximately 3 billion US dollars), ranking among the top regional banks in Japan.

industry ranking: Not among the top 50 banks in the world, but with the highest market share in the Shikoku region and Kochi Prefecture.

Awards: Winner of awards such as "Best Regional Bank in Kochi Prefecture" (year not disclosed), it has been recognized for supporting the local economy and the development of small and medium-sized enterprises.