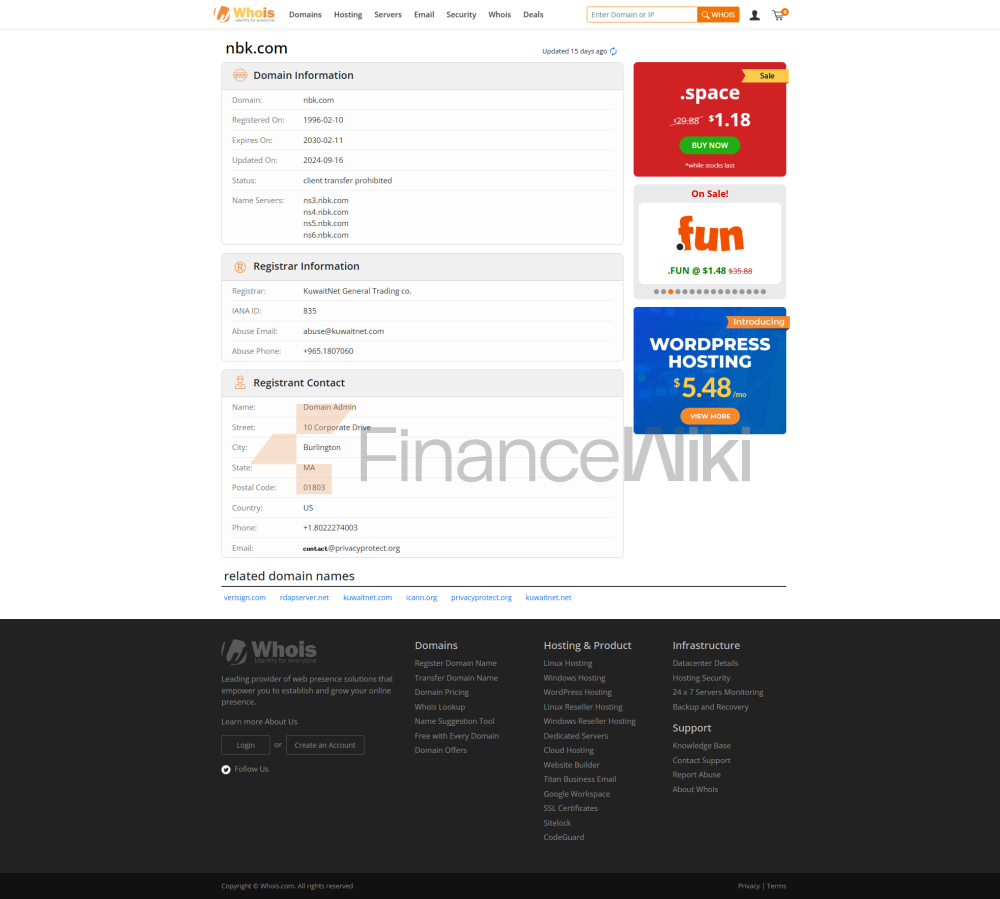

Basic Bank

Information National Bank of Kuwait S.A.K.P. (National Bank of Kuwait, NBK) is a leading commercial bank in Kuwait, known for its sound operation and regional presence. It is not a state-owned or joint venture bank, but a private bank backed by local Kuwaiti capital. Established on 19 November 1952, NBK is the first domestic bank in Kuwait and the first in the entire Arabian Gulf region, headquartered on Abdullah Al Ahmad Street, Sharq District, Kuwait City. Listed on the Kuwait Stock Exchange (ticker symbol: NBK), NBK has a market capitalization of approximately US$7.5 billion as of May 2025 and is dominated by wealthy Kuwaiti families and institutional investors, demonstrating its deep local roots and market trust.

Scope of Services

NBK's services cover the world, with the largest overseas branch network in Kuwait, with operations in 13 countries, including the Middle East (Egypt, Bahrain, Saudi Arabia, Lebanon, Jordan, Iraq, UAE), Asia (China, Singapore), Europe (UK, France, Switzerland) and the US (New York). In Kuwait, NBK operates about 70 outlets and more than 300 ATMs in cities and business centers such as Kuwait International Airport, The Avenues Mall and Khairan Outlet Mall. There are about 68 international branches, focusing on trade and investment customers in the Middle East and North Africa (MENA) region. NBK has further expanded its global investment and wealth management services through its subsidiaries, NBK Capital and NBK Wealth.

Regulation & Compliance

NBK is regulated by the Central Bank of Kuwait (CBK) and is subject to the Kuwaiti Banking Act and the international Basel III framework. International branches are regulated by local regulators, such as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) in the UK. NBK does not explicitly participate in the Kuwait Deposit Insurance Scheme, but its London subsidiary (NBKI) is protected by the UK's Financial Services Compensation Scheme (FSCS), which covers up to £85,000 (about $105,000) per depositor. In terms of compliance records, NBK has had no major breaches in recent years, and in 2023 it passed the review of CBK and international regulators, demonstrating its high standards in anti-money laundering (AML) and corporate governance.

Financial health

NBK's strong financial performance underscores its strength as a regional financial giant. The capital adequacy ratio (CAR) in 2024 is about 16.5%, far exceeding the 12% required by CBK, indicating that its capital buffer is adequate. The non-performing loan ratio (NPL) is around 1.2%, which is lower than the average of 2% for banks in the Middle East, and the asset quality is excellent. The Liquidity Coverage Ratio (LCR) is around 130%, exceeding the 100% required by Basel III, indicating its strong ability to cope with liquidity pressures. With a net profit of US$1.7 billion in 2022 and a cash dividend of 50% in 2023, these indicators indicate that NBK is financially healthy and suitable for customers who are looking for stability and high returns.

Deposits & Loans

Deposits: NBK offers current accounts (Al Jawhara Account (interest rate of nearly 0%), savings accounts (interest rate of 0.5%-1.5%) and fixed deposits (interest rate of 2%-4% for 1 month to 5 years). Featured products include the "Al Jawhara Account", which offers a minimum deposit of KWD 50 (approximately US$165) and offers the chance to win big prizes. A minimum of KWD 5,000 is required for a high-yield savings account with an interest rate of up to 3.5%. Large certificates of deposit (CDs) support flexible tenors and negotiable interest rates.

Loans: Mortgage annualized interest rate of 3.5%-5.5%, with a term of up to 20 years, proof of income and a minimum down payment of 10%. Eco-friendly mortgages offer a preferential interest rate of 0.2%. The interest rate on the car loan is 4%-6%, with a maximum loan amount of KWD 25,000 and a term of up to 7 years. The interest rate of personal credit is 5%-8%, up to KWD 100,000, and credit history is required. NBK offers flexible repayment options, such as early repayment penalty waiver and instalment adjustment, and the Eco-friendly Auto/Housing Loan further enhances its attractiveness.

List of common fees

NBK's fee structure is friendly to high-end customers, but ordinary accounts need to be aware of costs. The monthly fee for a current account is around KWD 1-3, and for a high-end account (e.g. Private Banking) it can be as high as KWD 10. Domestic transfers are free (via NBK Online Banking) and cross-border transfers are around KWD 5-15 per transaction. Interbank ATM withdrawals are approximately KWD 0.5 per transaction, and the overdraft rate is approximately 12% per annum. Hidden fees include minimum balance requirements (approximately KWD 200 for ordinary accounts and KWD 1 for non-compliance) and inactive account fees (approximately KWD 2 per year). Customers are advised to use digital channels to reduce expenses.

Digital service experience

NBK's mobile app (NBK Mobile Banking) and online banking platform have a rating of about 4.5 out of 5 stars on the App Store and Google Play, with users praising its smoothness and feature-richness. Core features include facial recognition login, real-time transfers (enabling instant payments), bill management, and investment tools such as stocks, funds, and forex trading. Technological innovations include AI-powered customer service chatbots that handle common problems efficiently; Robo-advisors provide low-cost investment advice to high-end clients through NBK Wealth. NBK supports open banking APIs and integrates with regional payment platforms and fintech companies to enhance ecosystem connectivity.

Customer Service Quality

NBK offers 24/7 phone support (1801801), live chat, and social media (WhatsApp, Twitter) services, with a social media response time of about 30 minutes, leading the efficiency. The average resolution time for complaints is 3 working days, and the user satisfaction rate is about 90%, which is among the best in the Kuwaiti banking industry. The bank supports Arabic, English, and some French and Chinese services, which are suitable for Middle Eastern and international customers, but Southeast Asian language support is limited, which may affect some cross-border users. NBK has earned the trust of its customers with its professionalism and quick response, especially among high-end and corporate customers.

Safety and security measures

The safety of NBK's funds in Kuwait relies on its high capitalization and strict regulation, and international branches such as NBKI are guaranteed by the FSCS, covering up to £85,000. Anti-fraud technologies include real-time transaction monitoring, OTP verification, and biometric authentication to reduce the risk of fraud. In terms of data security, NBK has passed ISO 27001 certification, and its information security management system has met the standards, and there have been no major data breaches in recent years. The bank's security is further enhanced through customer education and multi-factor authentication, and the overall performance is reliable, making it suitable for customers who are concerned about the security of their money and privacy.

Featured Services & Differentiation

NBK launches innovative products for market segments. The Youth Account is suitable for young people with no monthly fee, a low-limit credit card and a 1% savings interest rate. Seniors can enjoy the "Senior Savings Plan" with interest rates up to 2.5% and free financial counseling. Green finance includes ESG investment funds and environmental loans (preferential interest rate of 0.2%) in support of the sustainability goals of Kuwait's Vision 2035. High-net-worth services are offered through NBK Wealth with a threshold of KWD 100,000 and cover family trusts, global asset allocation and real estate investments. These services give NBK a unique edge in the retail and wealth management sectors.

Market Position & Honors

NBK is the largest financial institution in Kuwait, with assets of about US$35 billion, ranking first in Kuwait, top 10 in the Middle East, and top 150 banks in the world. It has a leading market share in retail, corporate and private banking, and its overseas network is particularly competitive in the Middle East. Recent awards include "Best Bank in Kuwait" (Global Finance, for many years), "Best Private Bank in the Middle East" (Euromoney), "Best Bank for Foreign Exchange Transactions" (Global Finance) and "Safest Bank" (Global Finance). NBK also won the "Best Sustainable Investment Private Bank" award for ESG practices, highlighting its leadership