NLB Skladi, full name NLB Skladi, upravljanje premoženja, d.o.o., was founded in 2004. The company's headquarters are located in Ljubljana, the capital of Slovenia (Tivolska cesta 48). It is an asset management company owned by NLB Group, Slovenia's largest banking group, in which NLB Group owns 100% of its shares. The parent company of the NLB Group, Nova Ljubljanska banka d.d., was listed on the stock exchange in 2018 and the Slovenian government holds more than 25% of the shares, so NLB Skladi itself is not listed on the open market, but is fully controlled and operated by the parent company.

Scope of

servicesNLB Skladi is mainly engaged in asset management business in Slovenia and is committed to expanding into the South-Eastern Europe region. The company's products are mainly aimed at individual and corporate investors, especially those with high investable assets. Its fund products are mainly in the form of collective funds, and it manages an "umbrella" fund with 20 sub-funds, while providing personalized asset portfolio management services, and currently manages 8 independent portfolios. There are a variety of fund types, covering different strategies such as equity, bond, and hybrid. For example, its funds include themes such as Asian equities, developed market dynamic equities, healthcare equities, and the Green Transition I fund for sustainable investing. In addition, NLB Skladi also provides products such as life cycle funds for retirement savings to help investors plan for long-term retirement.

In terms of sales channels, NLB Skladi relies on NLB Bank's branch network. Investors can obtain the fund prospectus and handle the subscription and redemption business at NLB Bank outlets. The company's headquarters also provides customer service channels: service hotline (01/4765270), email (info@nlbskladi.si) can be used for consulting services, and has opened a 7×24-hour investment consultation hotline (blue service hotline 080 22 86) to answer customer questions at any time.

Regulation & ComplianceAs

a Slovenian registered asset management company, NLB Skladi strictly adheres to local and EU financial regulations and is regulated by the Slovenian Securities Market Authority (ATVP) and other institutions. The operation of the company requires relevant licenses and filings, and major matters such as cross-border acquisitions need to be approved by the regulatory authorities in advance. For example, NLB Skladi received approval in 2024 to acquire the asset management company Generali Investments in North Macedonia. So far, the company has not had any major compliance violations in its operations, and has maintained a stable and compliant operating state.

According to the latest financial health report, NLB Skladi has assets under management of about 3.05 billion euros and an after-tax profit of about 12.1 million euros. In the Slovenian fund market, the company has a market share of about 40.7% and has maintained a leading position in the domestic fund industry for many years. NLB Skladi is considered to be the largest fund management company in Slovenia and consistently receives the highest share of new money inflows, reflecting good operating performance and investor trust.

Product

InformationNLB Skladi's product line covers open-ended pooled funds and dedicated account investment services. There are 20 sub-funds in its open-end fund (umbrella fund), covering a variety of asset allocation strategies such as stocks, bonds, and hybrids; At the same time, it provides highly customized special account portfolio management services (currently there are 8 managed portfolios) to meet the personalized needs of high-net-worth customers. The company has also launched pension savings products, such as a life-cycle fund for retirement savings (a long-term savings solution that offers tax incentives) and thematic funds that meet ESG criteria (such as the green transition fund "Zeleni prehod I"). In addition, NLB Skladi is constantly designing new products and participating in innovative pilots in the asset management industry in response to market demand.

Fees & Fee

StructureNLB Skladi uses a multi-tiered pricing system for fees. For special account investment management services, the management fee is charged according to the size of the account assets, which is about 0.50% when the assets are small, and 0.20% when the assets exceed 200,000 euros; Additional discounts are available when the total assets under management reach €500,000 or €1,000,000. The subscription and redemption fees of open-end funds are differentiated according to the investment amount and fund type: for example, the fee for a small single subscription of an equity or hybrid fund can reach up to 3.00%, while the fee for a large subscription decreases gradually; The redemption fee is generally in the range of 0.20%–1.00% and can be reduced to 0.25% when the redemption amount exceeds €200,000. Redemption fees are waived for long-term (more than 5 years) fund shares. The annual management fee rate of the fund depends on the fund strategy and fee policy, and is usually between 1% and 2%. For example, a real estate theme fund has a management fee of 2.00%, a maximum subscription fee of 3.00%, and a maximum redemption fee of 1.00%.

Digital

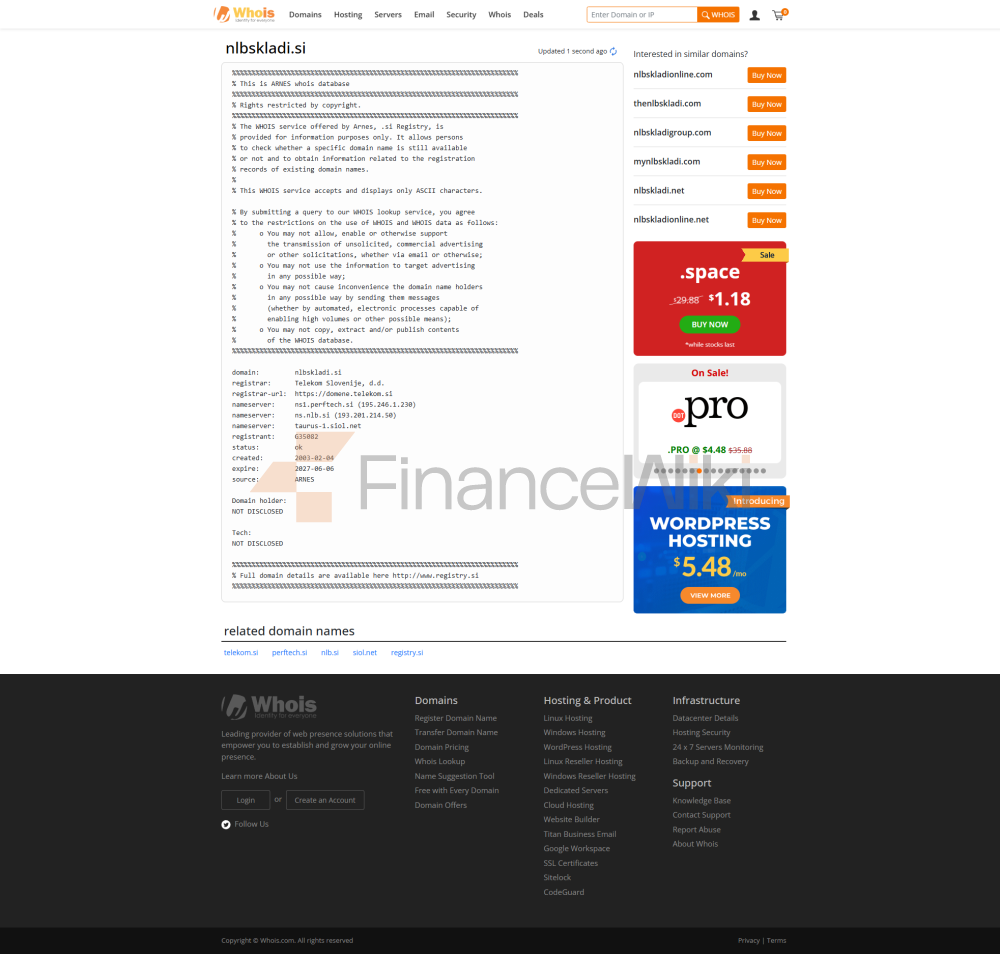

ServicesNLB Skladi provides customers with a complete digital service channel. The company's official website (nlbskladi.si) displays fund product information, performance reports and investment tools; At the same time, a mobile client application has been launched, allowing investors to view the market value of their positions, transaction history, tax simulation and other information at any time, and the app protects the account security through personal PIN and activation code. Customers can also conduct fund transactions (account opening, subscription, switching, etc.) through the online banking or mobile banking platform of the parent company NLB, which improves the convenience of the investment process. The website is available in both Slovenian and English to meet the needs of investors from different linguistic backgrounds.

Customer Service

QualityNLB Skladi focuses on multi-channel customer service. Investors can consult the team by phone, email, and official website form; At the same time, there is a dedicated 24×7 "Blue Hotline" 080 22 86 to provide investment advice and assistance. In terms of face-to-face services, customers can visit all branches of NLB Group to enjoy services such as account opening, fund trading and financial advisory. The Group has also established multiple channels to interact with customers, such as call centers, mobile banking, official websites, social media platforms, ATMs, etc., and has improved service accessibility and user experience through online banking and mobile wallets (NLB Klik, NLB Pay, etc.). On the whole, the customer service system covers all aspects of online and offline, and can respond to the needs of investors in a timely manner.

Security MeasuresAs

a member of the NLB Group, NLB Skladi has implemented strict information security and data protection measures. The Group has established and implemented an ISO 27001 information security management system, covering all business units across the Group. The company regularly conducts internal and external security audits, vulnerability assessments and penetration tests to patch security risks in a timely manner to ensure the safe operation of the system. At the same time, the Group attaches great importance to the confidentiality and privacy protection of customer data, and insists on using customer information in accordance with internal policies and regulations. All employees receive regular security awareness training, continuously improve their prevention skills, and strive to provide customers with a reliable investment service environment.

Featured Services & DifferentiationNLB

Skladi is committed to creating a differentiated competitive advantage. On the one hand, the company focuses on sustainable development and socially responsible investment, and has launched ESG-themed products such as the "Green Transformation I" special fund to meet investors' needs for environmental protection and social benefits. On the other hand, the firm provides customized asset allocation services to high-net-worth clients, meeting their specific needs through a dedicated team of wealth advisors and personalized portfolio management. In addition, NLB Skladi is actively involved in investment education and industry promotion. As a member of the Slovenian Investment Fund Management Association, the company participates in asset management literacy and financial education activities to help improve the public's awareness and skills about fund investment. These features further enhance NLB Skladi's differentiation in the market.

Market Position & AccoladesNLB

Skladi has a long history of leadership in the Slovenian fund industry and has received numerous industry accolades. It has been named "Best Asset Management Company of the Decade", reflecting the high recognition of the industry. For many years, the company has ranked first in domestic capital inflow and leading market share, and has won the trust and praise of investors. In addition, its funds have also been recognized by industry awards and rating agencies, reinforcing its leading position in the local and regional fund market.