basic bank information

Gunma Bank is a commercial bank, not a state-owned or joint venture bank. It was founded in 1932 and is headquartered in Maebashi City, Gunma Prefecture, Japan. As a regional bank, its main business is concentrated in and around Gunma Prefecture. Gunma Bank is a publicly traded company whose shares are traded on the Tokyo Stock Exchange, indicating that its ownership belongs to the shareholders and not to the government or a specific private entity. This commercial nature makes it profitable to operate while serving the local economy and community.

name and background

founded in 1932<

span style="font-family: sans-serif; color: black"> headquartered in Maebashi City, Gunma Prefecture, Japan

Shareholder Background: Gunma Bank is a publicly traded commercial bank whose shares are traded on the Tokyo Stock Exchange. Its shareholder structure is made up of investors in the market, and it is not a state-owned bank, nor is it entirely a private enterprise, but operates in the form of public shareholding. This listing background makes it characteristic in terms of transparency and market surveillance.

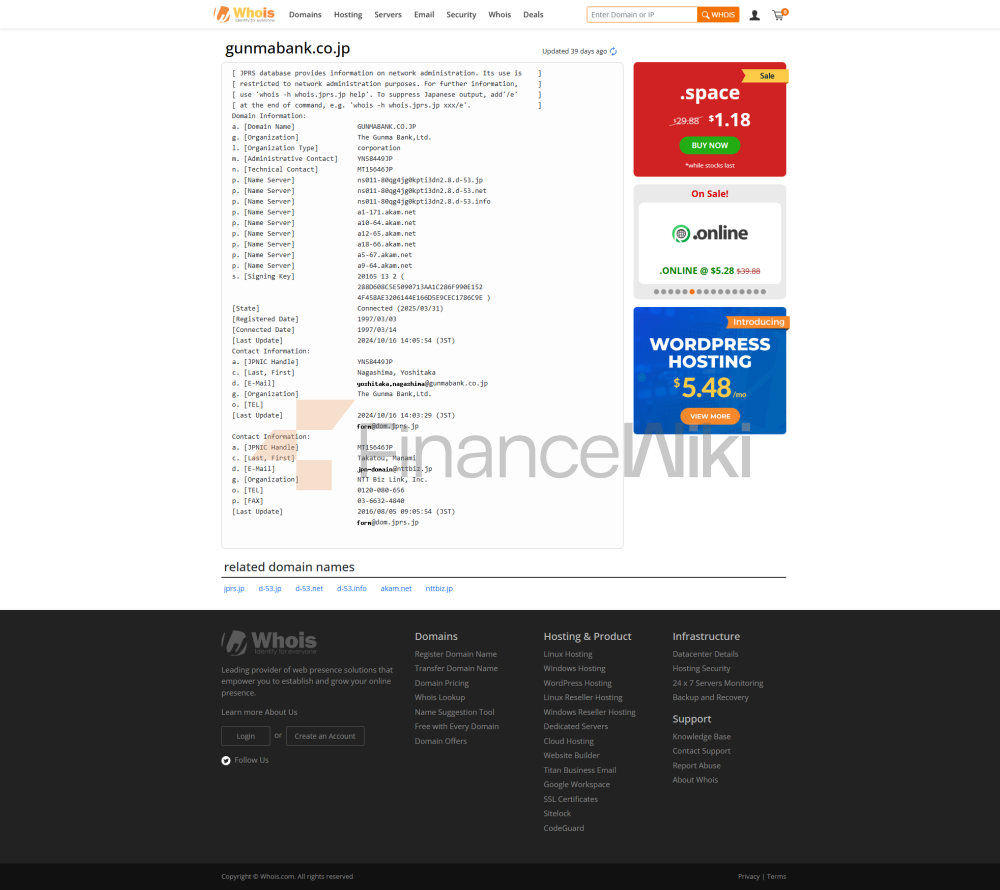

> full name of Bank: The Gunma Bank, Ltd

Gunma Bank has a history of nearly 100 years since its inception, and as a long-established regional bank, it has played an important role in the financial markets of Gunma Prefecture, serving local residents and businesses for a long time.

service scope

Number of offline branches: Gunma Bank has branches in Gunma Prefecture and its surrounding areas, but there is no public data on the exact number of branches. As a regional bank, the size of its branches should match the economic development and population density of the area it serves.

ATM distribution: Gunma Bank's ATM network is mainly located in Gunma Prefecture and its surrounding areas, providing customers with convenient deposit and withdrawal services. Although the exact number of locations is unknown, it can be speculated that the ATM layout is mainly to meet the daily needs of local residents and businesses.

> Coverage Area: Gunma Bank's business is mainly concentrated in and around Gunma Prefecture in Japan, and is a typical regional bank. It is not a global bank, but rather a local market that provides financial services to customers in specific regions.

Due to its regional positioning, Gunma Bank's branches and ATMs serve mainly local customers, with relatively concentrated coverage rather than national or international expansion.

services & products

Gunma Bank, as a traditional regional bank, provides a variety of financial services to meet the different needs of individuals and businesses.

personal service:

savings and checking accounts to help customers manage their day-to-day money.

personal loans, including home loans, car loans, etc., support the needs of customers.

investment products, such as fixed deposits or simple wealth management products, to help customers grow their assets.

enterprise services:

> corporate financing, providing loans and credit support to small and medium-sized enterprises to promote local economic development.

cash management services that help businesses optimize cash flow and payment efficiency.

Although there is no public information on the specific product types and terms and conditions, Gunma Bank's range of services is in line with the general model of regional banks in Japan, focusing on practicality and localization.

regulatory and compliance<

ul style="list-style-type: disc" type="disc">Regulator: Gunma Bank is regulated by the Financial Services Agency (FSA) of Japan. As Japan's banking regulator, the FSA is responsible for ensuring that Gunma Bank's operations comply with national financial regulations, including capital requirements and risk management standards.

Deposit Insurance: Gunma Bank participates in the Deposit Insurance Corporation of Japan, This system provides depositors with a certain amount of protection for their deposits (usually 10 million yen per person plus interest) to increase customer confidence in the bank.

Recent Compliance Record: There is currently no publicly available information indicating that Gunma Bank has a record of major violations or penalties, so it can be assumed that it is in good standing in terms of compliance.

As a highly regulated financial institution, Gunma Bank operates within a legal framework that ensures the integrity of the business and the protection of the interests of its customers.

financial health

key indicators to measure a bank's financial health include capital adequacy ratio, non-performing loan ratio, and liquidity coverage ratio. However, due to the lack of specific financial reports from Gunma Bank, only reasonable speculations based on its background are provided below:

non-performing loan ratio: no specific data. However, regional banks in Japan are generally affected by local economic conditions, and if Gunma Prefecture's economy is stable, their non-performing loan ratios should be manageable.

Liquidity Coverage Ratio: Again, there is a lack of specific data, but Gunma Bank needs to meet the FSA's liquidity requirements to meet potential funding needs.

> capital adequacy ratio: As a Japanese regional bank, Gunma Bank must meet the minimum capital requirements of the FSA (usually based on Basel III standards, such as 8% or more). The exact ratio is unknown, but its listing status and long-term operation indicate that its capital base is relatively solid.

Although precise figures cannot be provided, Gunma Bank, as a long-established listed company, should be financially in line with regulatory standards to support its day-to-day operations and customer service.

customer service<

span style="font-family: sans-serif; color: black" > Gunma Bank's customer service channels are expected to include the following:

e-mail: for non-urgent communications.

Live chat: possible, but the exact implementation is unknown.

>Telephone support: A hotline service for customer inquiries and problem solving.

As a regional bank, Gunma Bank's customer service is characterized by convenience and localization, and aims to provide customers in Gunma Prefecture with help that is close to their needs.

security measures

Gunma Bank, as a formal financial institution, expects to adopt industry-standard security measures to protect customer information and transactions, including:

Two-factor authentication: may be used for online or mobile banking login to enhance account protection.

Data encryption: ensures the security of online transactions and the transmission of personal information.

featured services and differentiation<

span style="font-family: sans-serif; color: black" > there is no specific information at this time that Gunma Bank offers unique financial products or services. As a regional bank, its core competencies may lie in local services and strong ties with the community, such as supporting local SMEs or participating in regional economic projects. However, it doesn't seem to show significant differentiators when it comes to product innovation or technology applications.

summary

Gunma Bank is a commercial bank founded in 1932 and headquartered in Maebashi City, Gunma Prefecture, Japan, with shares listed on the Tokyo Stock Exchange. It primarily serves Gunma Prefecture and its surrounding areas, providing traditional financial services such as savings, loans, investments, and corporate finance, and is regulated by the Financial Services Agency of Japan and participates in a deposit insurance system. Despite the lack of specific financial data and digital service details, Gunma Bank has demonstrated a solid operating foundation with its nearly 100-year history and regional positioning. Its deep presence in the local market has made it an important part of Gunma's financial ecosystem, and although it has not yet performed well in terms of technological innovation and special services, its stability and reliability are sufficient to meet the basic needs of customers.