Name &

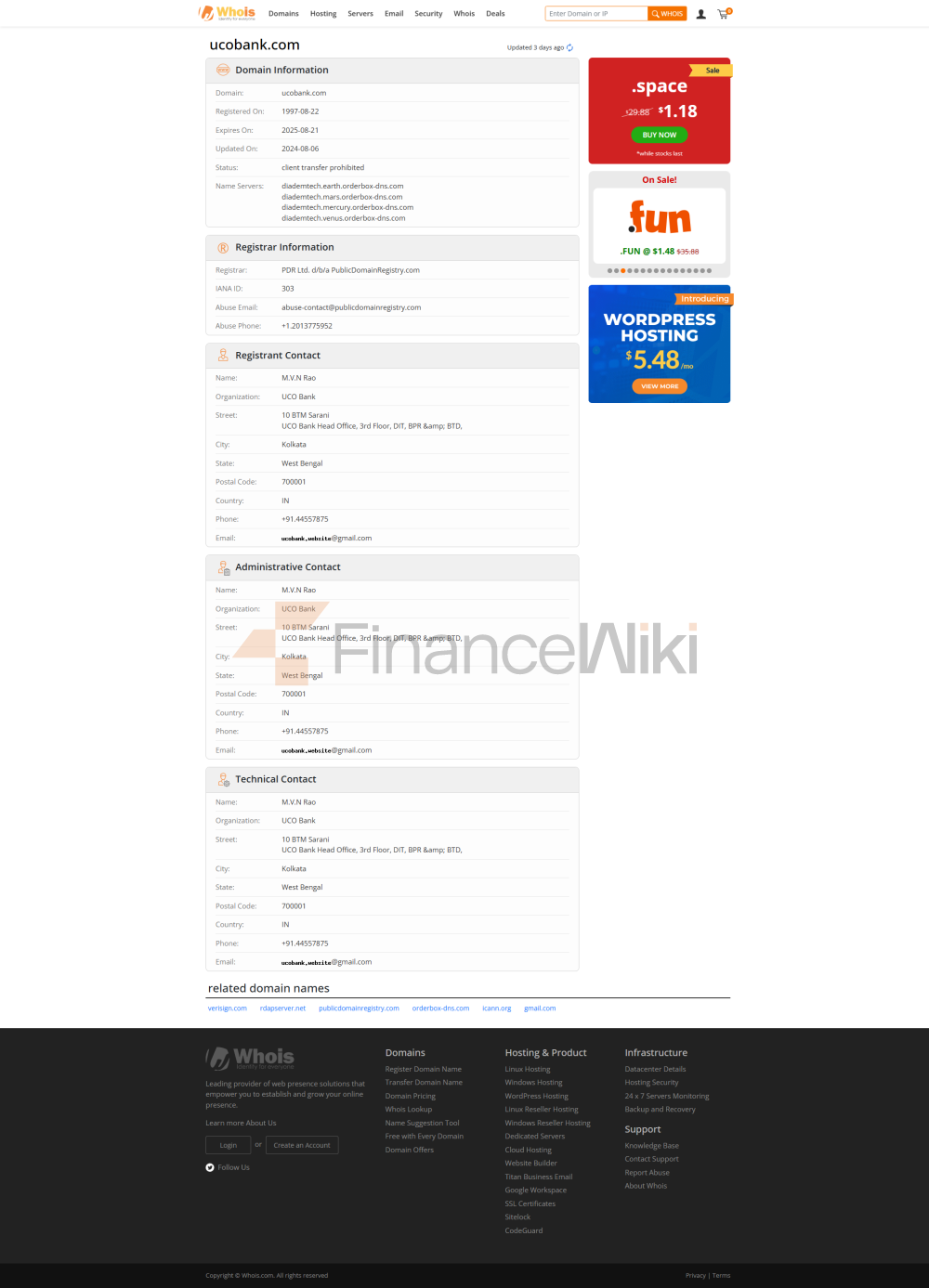

BackgroundUCO Bank Securities is a wholly owned subsidiary of UCO Bank India, founded in 1943 and headquartered in Kolkata, India. UCO Bank itself is a state-owned bank that occupies an important position in the Indian financial system. UCO Bank & Securities is principally engaged in securities brokerage, investment banking, asset management, and other services related to capital markets. UCO Bank Securities is part of India's state-controlled financial conglomerate, backed by strong state-owned banks.

Scope of

ServicesUCO Bank Securities' services are mainly in India, and although it does not have branches worldwide, it has a significant presence in the Indian market. It covers major cities and regional markets in India. As a local state-owned enterprise in India, its outlets and ATMs are mainly concentrated in areas where urban and rural areas are combined, with a focus on serving local investors.

Regulation &

ComplianceUCO Bank Securities is regulated by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). As a wholly owned subsidiary of UCO Bank, it follows all applicable Indian financial regulatory requirements and is subject to prudential regulation by the Financial Services Authority of India. UCO Bank Securities is not publicly affiliated with the Deposit Insurance Program because its business involves capital markets and securities trading, rather than traditional bank deposit services.

UCO Bank Securities, a key indicator of financial health

, has a stable capital adequacy ratio and is continuously improving its liquidity coverage ratio. Its non-performing loan ratio and asset quality have remained relatively low, ensuring its financial health and business sustainability. As a securities company relying on the resources of its parent bank, it has excellent performance in liquidity management and risk control capabilities.

Deposits &

LoansUCO

Bank Securities does not directly provide deposit products as it focuses on securities trading and investment. But parent company, UCO Bank, offers traditional savings accounts, fixed deposits, and other banking products to its customers. Clients can store funds and participate in equity investments through UCO Bank.

LoansUCO

Bank Securities itself does not provide personal loan products, but it has some products related to stock market financing in its financial services, such as equity pledged loans, IPO capital support, etc. Provide flexible financing solutions for customers' investment needs.

A list of common

feesUCO Bank Securities has a transparent fee structure, which includes account management fees (usually annual fees) and commissions for securities transactions. Fees for stock market trading are low, and clients will be required to pay a transfer fee if they make cross-border investments. For high-value and high-frequency trading clients, the bank offers customized fee schemes.

digital service experience

app and the online trading

platform provided by UCO Bank Securities are powerful, and customers can use their online banking and mobile apps to trade stocks, transfer funds, manage portfolios, etc. Its mobile app has high user ratings, supports real-time trading, account management, investment analysis, and more, and ensures security through facial recognition technology. In addition, the platform also provides robo-advisory services to help investors make more accurate decisions.

Technological InnovationAs

a modern securities company, UCO Bank Securities has been exploring technological innovation and has begun to implement artificial intelligence customer service, robo-advisors, and open banking API support. Clients can have a better investment experience with these innovative tools.

Service Quality

Service

ChannelUCO Bank Securities provides 24/7 customer support services, maintaining communication with customers through phone, email, and live chat. Social media platforms are also used for customer support and are more responsive. The company values customer satisfaction and provides rapid response and problem solving services.

Complaint

HandlingUCO Bank Securities has a relatively low complaint rate and a shorter time frame for customer feedback and problem resolution. According to user feedback, the quality of customer service is relatively high, and the process is transparent and efficient.

Security MeasuresSecurity

of Funds

While UCO Bank Securities is not part of a traditional deposit insurance program, the security of its funds is supported by its parent company, UCO Bank. The company uses advanced anti-fraud technology to ensure the security of customer transactions. All transactions are monitored in real-time to prevent misconduct.

Data

SecurityUCO Bank Securities has strengthened its data security management, has been ISO 27001 certified, and has implemented a series of measures to ensure the security of customer data. To date, there have been no data breaches, and the confidentiality of customer data is fully guaranteed.

Featured Services & Differentiated

SegmentsUCO

Bank Securities offers a variety of market-specific services, such as retirement investment plans, young investor accounts, and more. With a particular focus on green finance, it has launched a number of investment products that meet environmental, social and governance (ESG) criteria, attracting investors interested in sustainable development.

High Net Worth ServicesFor

high net worth clients, UCO Bank Securities provides personalized investment advisory services, including asset allocation, wealth management, tax optimization, etc., to help clients carry out comprehensive wealth planning.

Market Position & AccoladesIndustry

RankingsUCO Bank Securities has a certain market share among Indian securities firms. Its parent company, UCO Bank, ranks among the top companies in India's financial sector in terms of assets, and UCO Bank Securities, as its subsidiary, has maintained a steady growth momentum. It also has a good reputation among investors, especially in providing targeted securities trading services.

AwardUCO

Bank Securities has received several industry awards for its excellent customer service, low fees, and innovative digital services. Although it is not among the top 50 banks in the world, its influence and reputation in the Indian securities market are prominent.