DZ BANK Aktiengesellschaft (DZ BANK) is the backbone of the German financial market, with a philosophy of "win-win cooperation and sustainable growth", with its philosophy of "win-win cooperation and sustainable growth", demonstrating excellence in the fields of retail banking, corporate finance, investment banking and sustainable finance. Founded in 2001 by the merger of GZB and DG BANK, its roots can be traced back to the founding of the Lafalsen Cooperative Bank in 1895 and its headquarters are located at Taunusanlage 1, Frankfurt, Germany. As the central authority of the Volksbanken Raiffeisenbanken (Volksbanken Raiffeisenbanken) cooperative financial network between the Deutsche Deutsche Deutsche Bank and Laiffeisenbanken, DZ BANK serves around 30 million customers, is rooted in the German community through around 700 local partner banks and 7,200 branches, and is active in the global market as a corporate and investment bank.

Bank Basic

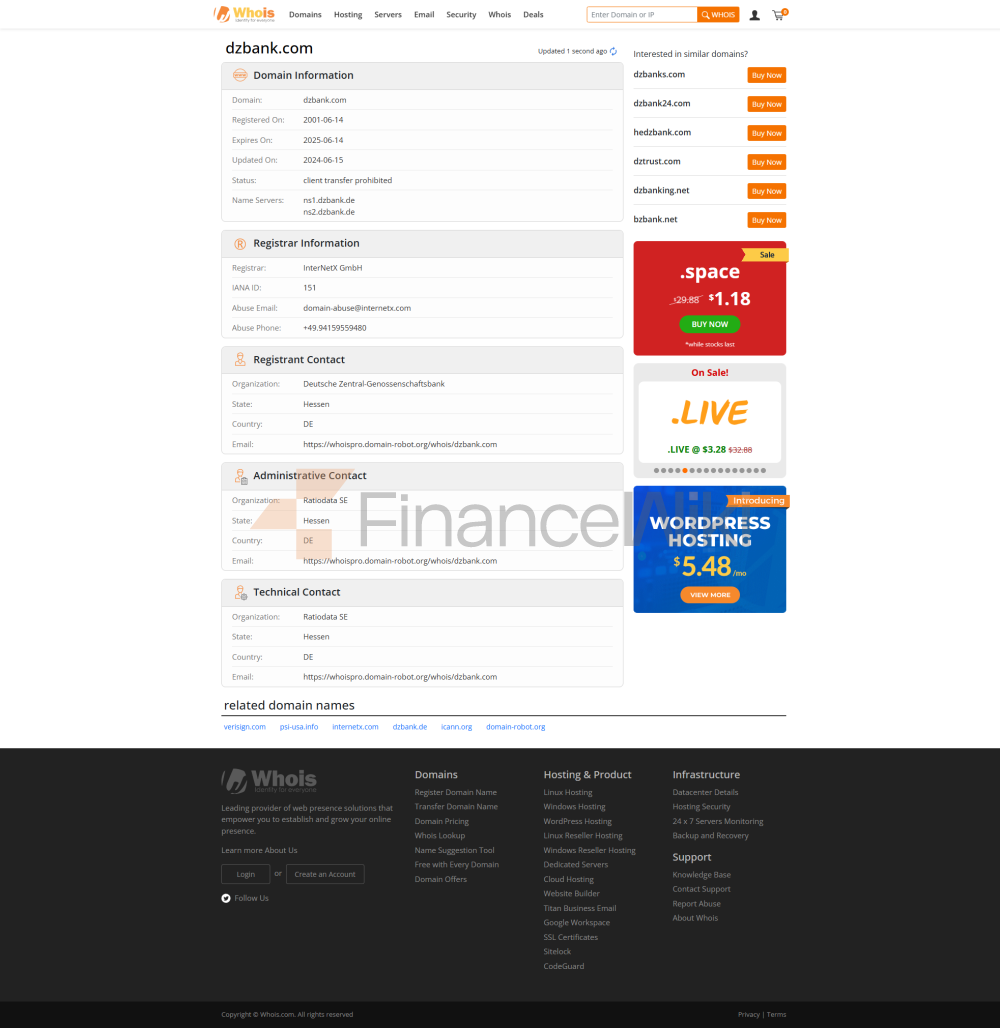

InformationDZ BANK is a commercial bank with a cooperative structure, founded in 2001 and headquartered in Frankfurt, Germany. The bank is jointly owned by the member banks of the German cooperative financial network, and the main shareholders are around 700 local cooperative banks, with no traditional public shareholders. IN 2016, DZ BANK MERGED WITH WGZ BANK TO FURTHER CONSOLIDATE ITS POSITION AS A CENTRAL AUTHORITY. The bank is not directly listed on the Frankfurt Stock Exchange, but its parent company has around 1.2 trillion euros in assets under management in a cooperative financial network. DZ BANK is strictly supervised by the European Central Bank (ECB) and the German Federal Financial Supervisory Authority (BaFin), and is required to comply with the German Banking Act and international financial standards to ensure operational transparency and the safety of customer funds. Its deposits are protected by the German Deposit Protection Scheme, with a maximum protection of €100,000 per depositor. The SWIFT code for the bank is GENODEFF and the Legal Entity Identifier (LEI) is 529900HNOAA1KXQUQ027. DZ BANK has 10 international branches and representative offices around the world, employing approximately 32,000 people (including group subsidiaries).

Deposit & Loan Products

depositsDZ

BANK offers deposit products to individual and corporate customers through local partner banks and subsidiaries (e.g

. DZ Privatbank).demand deposits: including checking accounts and savings accounts, such as "cooperative savings accounts", with a minimum opening amount of €100 and an APY of around 0.01%-0.2%, subject to confirmation of the latest interest rate through branch or online banking. The account supports flexible deposits and withdrawals, which is suitable for daily money management.

Fixed deposits: Support EUR, USD, CNY and other currencies, deposit terms from 1 month to 5 years, the minimum deposit is 1000 euros. In 2025, the interest rate on fixed deposits can reach up to 1.5% (12 months, with a deposit amount of less than 1 million euros), which can be queried through online banking.

Featured products:

High Yield Savings Accounts: e.g. "Preferred Savings Accounts", which offer up to 1.2% p.a. interest rate, maintain a balance of more than €10,000, and have no monthly fees.

Large Certificates of Deposit (CD): Support flexible tenor, suitable for large amount of money customers, the interest rate needs to be queried through the branch or app, and the early withdrawal penalty is 90 to 180 days of interest.

Customers can check the preferential interest rate through the "DZ BANK Mobile" app or online banking, and the deposit products can be opened and calculated instantly, and some accounts can be free of transaction fees.

loansDZ

BANK provides a variety of loan products through local cooperative banks and subsidiaries (e.g., DZ HYP, VR Smart Finanz).

mortgages: Fixed-rate and variable-rate mortgages up to 80% of the value of the property with a repayment period of up to 30 years through DZ HYP. In 2025, the fixed rate is as low as 1.0% (3 years), and the floating rate is based on Euribor (about 2.5%), offering cash rebates. To apply, you need a credit score of 700 or more and an annual income of more than 30,000 euros.

Car loans: New and used car financing with VR Smart Finanz for up to €500,000 with a term of up to 7 years, an annualized interest rate (APR) as low as 1.8%, and a credit score of 660 or more.

Personal Line of Credit: includes VR Smart flexibel (APR as low as 3.5% and amount up to €100,000 and can be applied online) and asset-backed overdraft (up to 95% of the collateral market value) with a minimum monthly salary of €30,000 and a good credit history.

Flexible repayment options: Loans support prepayment without penalty, monthly or bi-weekly repayment plans, and revolving lines of credit for flexible debt management.

All loans are subject to bank approval, and customers are required to provide credit history, proof of income and asset information, subject to the terms of the loan agreement. VR Smart Finanz's "VR Smart Express Eco" provides fast green loans to support electric vehicles and renewable energy investments.

Digital Service

ExperienceDZ BANK's mobile banking app "DZ BANK Mobile" and online banking platform "DZ OnlineBanking" are the core of its digital services, which can be downloaded on iOS 14.0 and above and Android 9.0 and above devices, with an App Store rating of about 4.5, Google The Play rating is around 4.3, with users praising its quick startup (within 2 seconds) and intuitive interface. Core features include:

Face recognition: support for biometric authentication (such as Face ID and Touch ID), combined with strong encryption technology to ensure transaction security.

Real-time transfers: Support instant transfers in euros through SEPA and SWIFT, with a daily limit of up to 1 million euros, and international remittances covering more than 100 countries.

Bill management: Support online bill payment, automatic deduction and e-statement, and classify transaction records in real time.

Investment Tool Integration: Support stocks, funds, bonds, and ETFs trading through the Union Investment platform, providing real-time market data and investment advisory services.

The online banking platform supports multiple browsers, and customers can open an account within 5 minutes through the app or official website. The app supports accessibility features such as dynamic font adjustment and VoiceOver compatibility for visually impaired and hearing-impaired customers. In 2023, 60% of customers complete transactions through digital platforms, significantly improving the user experience.

Technological

innovationDZ BANK excels in the fintech sector, driving technological advancements through its Digital Innovation Center:

AI customer service: Introduce an AI-driven customer service system to analyze transaction behavior, detect fraud risks in real time, automate 80% of customer inquiries by 2023, and plan to launch a virtual assistant in 2025 to support 24/7 inquiries and personalized financial advice.

Open Banking API Support: Compliant with the EU Open Banking Standard (PSD2), integration with third-party service providers, providing account management and financial services interoperability, and supporting 35 enterprise financial services APIs by 2024, especially in the areas of trade finance and cross-border payments.

Blockchain technology: In 2023, we will cooperate with Ripple Custody to launch DLT-based custody services for entrusted bonds and crypto securities to improve transaction efficiency and security.

Other innovations: support for QR code payment, mobile check deposit, and cooperation with AWS to optimize the cloud transaction system; Invest €500 million in 2024 to upgrade cloud technology and data analytics platforms to improve operational efficiency.

Featured Services & DifferentiationDZ

BANK is known for its cooperative model and sustainable financial services:

Cooperative bank support: As the central institution of the cooperative financial network, the bank provides clearing for local cooperative banks, Treasury management and product support, serving about 30 million customers.

Sustainable Finance: Since adopting the Equator Principles in 2013, China has launched green bonds and sustainability-linked loans, with a cumulative sustainable financing of €352 billion in 2023, with a focus on supporting renewable energy and climate change projects.

International trade finance: Through 10 international branches, it supports import and export trade, provides letters of credit and trade loans, and has a trade financing volume of 45 billion euros in 2023.

SME support: Support SMEs with fast loan products such as VR Smart flexibel (up to €100,000, 5-minute approval) through VR Smart Finanz.

Wealth management: Providing asset management services through Union Investment, it has approximately 250.7 billion euros in assets under management in 2023, ranking second in the German institutional investment market.

Market position and accoladesDZ

BANK is the second largest bank in Germany, with total assets of around 1.2 trillion euros in 2024, second only to Deutsche Bank. Banks serve around 30 million customers through a cooperative financial network, accounting for about 20% of the German retail banking market. In 2023, the bank's profit before tax amounted to 1.95 billion euros, demonstrating a solid financial performance. DZ BANK IS A LEADER IN SUSTAINABLE FINANCE AND SME SUPPORT, ISSUING €300 MILLION OF GREEN BONDS IN 2023, WHICH WAS NEARLY TWICE OVERSUBSCRIBED BY INVESTORS. Its international presence covers Europe, the Americas and Asia-Pacific, and it will rank high on the Forbes Global 2000 list in 2023. Key accolades include:

Global Finance's 2023 "Best Sustainable Bond Underwriter" award.

Euromoney "Best SME Bank in Germany" award 2022.

2021 S&P Green Deal Assessment "Environmental Score 86/100".

DZ BANK's cooperative model and sustainable finance innovations have made it a leader in German and global financial markets.

SummaryDeutsche Central Couphane AG has become a solid pillar of the German cooperative financial network with its cooperative tradition, global business layout and innovative financial services. It offers a wide range of deposit and loan products to meet customer needs through local partner banks. The digital service is centered on the "DZ BANK Mobile" app, which provides efficient real-time transfer and investment management functions. Technological innovations, including AI customer service, open banking APIs, and blockchain technology, demonstrate the forward-looking nature of its digital transformation. With its leadership in sustainable finance, support for SMEs and numerous industry accolades, DZ BANK continues to demonstrate its strong competitiveness and influence in the German and global financial markets.

Note<

ul style="list-style-type: disc" type="disc">specific interest rates and product details may vary due to market changes, please contact the official website of DZ BANK or contact the bank directly for the latest information.

The above information is based on 2025 data, ensuring that it is current and accurate.