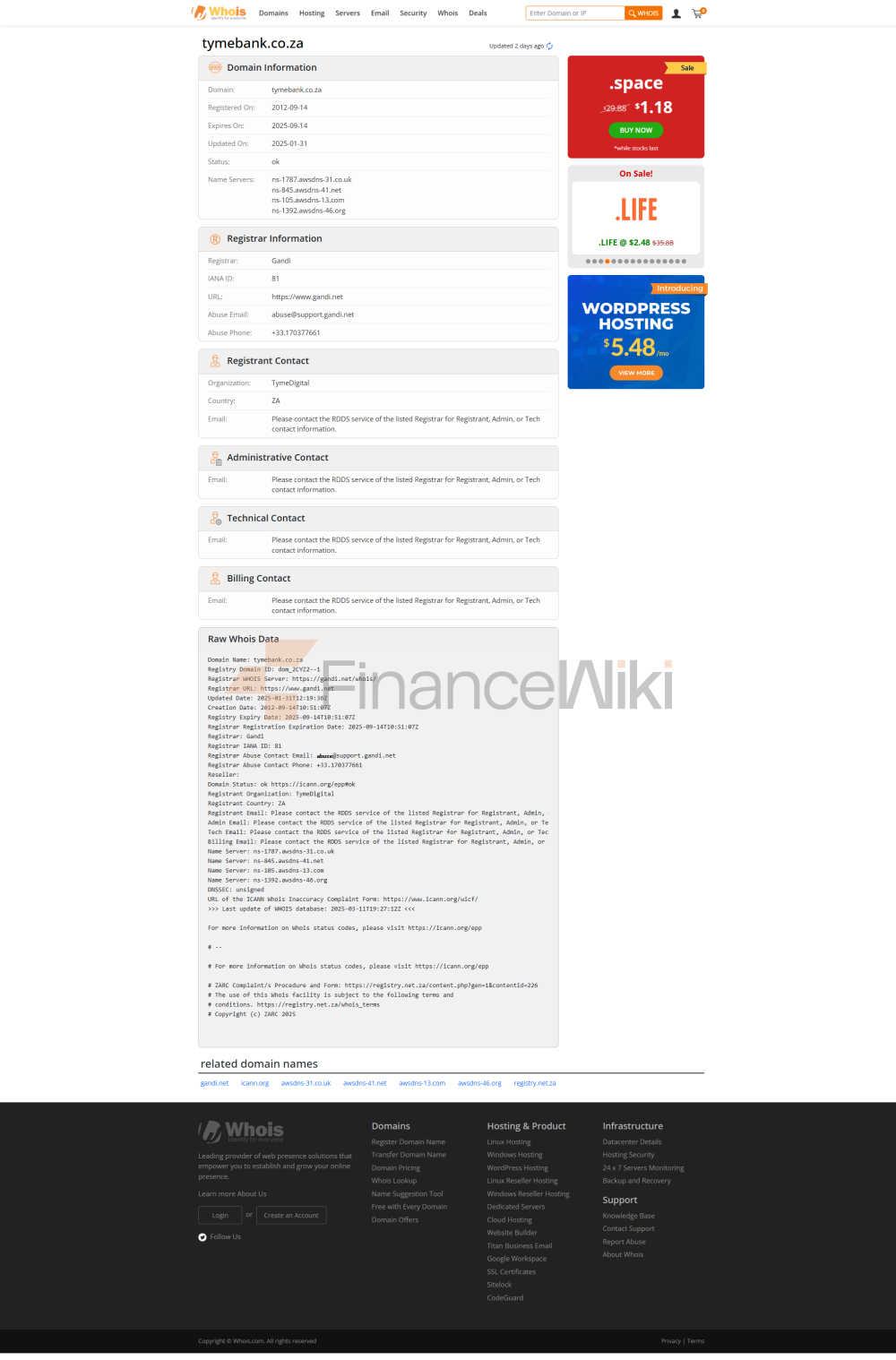

basic information

of the bankBank type: TymeBank is a private digital commercial bank, non-state-owned, non-joint venture.

Founded: Obtained a banking license in 2015 and officially launched in February 2019.

Head Office: 30 Jellicoe Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa.

Shareholder Background: The main shareholder is African Rainbow Capital (ARC), which is controlled by South African billionaire Patrice Motsepe. TymeBank is part of Singapore-based Tyme Group, which also has a presence in emerging markets such as the Philippines and Vietnam.

service

coverage: mainly serving the South African market.

Number of offline branches: No traditional bank branches, through partnerships with retail chains Pick n Pay and Boxer, there are self-service kiosks nationwide to facilitate customers to open accounts and conduct business.

ATM distribution: Customers can use ATMs in South Africa to make withdrawals, with specific fees discussed below.

regulatory and compliance

regulators:

South African Reserve Bank (SARB) Prudential Regulation Authority Authority)

Financial Sector Conduct Authority (FSCA)

National Credit Supervisory Authority (NCR)

Deposit Insurance Scheme: TymeBank customers' deposits are protected by the South African Deposit Insurance Corporation (CODI) up to R100,000.

Recent Compliance Records: To date, no major compliance issues have been identified.

Key Indicators of Financial HealthCapital

Adequacy Ratio: According to the September 2024 Pillar 3 report, TymeBank's capital adequacy ratio is in line with regulatory requirements, as detailed in the official report.

Non-Performing Loan Ratio: As of 2024, TymeBank has a non-performing loan ratio of less than 3%, demonstrating good credit quality.

Liquidity Coverage Ratio (LCR): TymeBank has a liquidity coverage ratio of more than 100% in accordance with Basel III requirements, indicating that it has good short-term solvency.

Deposits &

LoansDeposit products:

GoalSave Savings Account: base rate of 6%, This can be increased to 10% upon completion of certain trading conditions.

Time Deposits:

3-month tenor: 6.96%

6-month tenor: 7.87%

12-month tenor: 8.65

Loans:

Personal loans: up to R120,000 at an interest rate based on the individual's credit profile.

TymeAdvance Payroll: Interest-free payroll advance service to help customers meet short-term funding needs.

list of common expensesAccount

management fee: No monthly or annual fee.

Transfer fee:

ATM withdrawal fee:

randOther fees:

Card replacement fee: 70 Rand

account overdraft fee: No

minimum balance limit: None

Digital Service Experience

APP & Online Banking:

TymeBank provides a comprehensive mobile app and online banking services that support account management, transfers, Features such as bill payment.

Core functions:

face recognition to log in

to real-time transfer

bill management

Technological innovation:

AI customer service

, robo-advisor

, open banking API support

customer service

quality service channel:

24/7 customer service number

Complaint handling:

low complaint rate, short average resolution time, and high user satisfaction.

Multi-language support:

English service is available, please contact customer service for other language support.

security measuresFunds

security:

- deposit

- rand

Data security:

compliance with ISO 27001 information security management standards

, and no major data breaches

Featured and differentiated

market segment services:

student account: fee-free

wealth management products for the elderly

Green Financial Products (ESG Investment)

High Net Worth Customer Service:

customized financial solutions

Market Position & AccoladesIndustry

Ranking:

TymeBank is one of the fastest-growing digital banks in South Africa, with over 10 million customers.

Awards & Accolades:

"Best Digital Bank",

"Most Innovative Bank".