basic bank information

HSBC is a commercial bank, non-state-owned or joint venture, established in 1935 and headquartered at HSBC Centre, 418 Song Ngoc Sang Square, Macau. The bank is wholly owned by HSBC Financial Group, with a majority stake held by the current chairman, Stanley Au. HSBC is strictly regulated by the Monetary Authority of Macao (AMCM) and is required to comply with international financial standards to ensure operational transparency and the safety of customer funds. Their deposits are protected by the Macau Deposit Protection Scheme, and the specific amount of protection needs to be consulted with the bank. Despite being constrained by US sanctions between 2005 and 2020, HSBC demonstrated its resilience by lifting sanctions on 11 August 2020 and resuming normal operations.

Deposit & Loan Products

deposits HSBC offers a wide range of deposit products to meet the savings needs of individual and corporate customers. Demand deposits include checking accounts and savings accounts, with a minimum opening amount of HK$500 or currency equivalent, interest rates vary depending on the market, and you need to consult the bank directly. Fixed deposits support multiple currencies such as HKD, USD, RMB, etc., with tenors ranging from 7 days to 24 months, and the minimum deposit amount is HKD 5,000 or equivalent. Featured products include:

High Yield Savings Account: Offers higher returns than traditional savings accounts and is suitable for income-seeking customers.

Certificates of Deposit (CDs): Flexible deposit tenors for customers with large amounts of funds, and the specific interest rate needs to be checked through online banking or branches. Customers can check the latest "Cloud Interest Rate" offer through HSBC's mobile app or online banking, and some deposit products may share services with banking partners, enhancing the convenience of deposits.

loansHSBC provides a comprehensive range of loan products, covering housing loans, car loans and personal credit loans to meet diversified financing needs:

Car Loans: New and used car financing is available for 12 to 60 months with competitive interest rates.

Personal Line of Credit: Loans are provided without collateral, the amount is based on the customer's credit rating, the range of annual interest rate (APR) is confirmed by the bank, and the application threshold includes a stable source of income and a good credit history.

Flexible repayment options: Mortgages and personal loans support prepayment without penalties and adjustment of repayment schedules, giving customers the flexibility to manage their debts according to their financial situation. All loans are subject to bank approval, credit history and financial documents are required from the customer, and the specific terms are subject to the loan agreement.

Mortgages: Fixed and variable rate mortgages are available for up to 70% of the value of the property and are repaid over a period of up to 30 years. The interest rate is based on the Hong Kong Interbank Offered Rate (HIBOR) or the Prime Rate, and offers incentives such as cash rebates and insurance discounts, subject to bank consultation for specific interest rates.

Digital

service experience

HSBC's mobile banking app, Delta Asia Mobile, is the core of its digital services, which is available for download on iOS and Android platforms and supports 24/7 account management. Core features include:

Face recognition: supports biometric authentication (such as facial recognition) to ensure transaction security.

Instant Transfer: Support free instant transfer between HKD and RMB, with a daily cumulative transaction limit of 100,000 HKD/MOP, and is compatible with Faster Payment System (FPS).

Bill management: Simplify financial management with online bill payment and e-statement services.

Investment Tool Integration: Forex trading and MoneyGram remittance services are supported, and customers can trade instantly through the app. The online banking platform functions similarly to a mobile app and supports multiple browsers, ensuring that customers can manage their accounts anytime, anywhere. User rating information (e.g., App Store or Google Play) is not publicly available, but the app's easy registration and security authentication (e.g., e-token or SMS login) indicate a focus on user experience. Customers can enjoy convenient deposit and transfer services through bank counters, online banking or mobile banking.

Technological innovation

HSBC is actively exploring in the field of fintech, especially through collaboration with partners to enhance its technical capabilities. While there is no explicit mention of the specific implementation of AI customer service or robo-advisors, banks may have introduced robo-agent technology to provide instant support and personalized financial advice. Its mobile app supports forex and investment trading, demonstrating the potential for digitalization in the wealth management sector. HSBC may support open banking APIs for interoperability with other financial services. In addition, the bank offers e-Token and SMS login services to enhance transaction security through two-factor authentication, demonstrating its commitment to technological innovation.

Featured Services & Differentiation

HSBC is known for its localized services and cross-border financial capabilities:

SME financing: Focusing on SMEs, providing customized loan and cash management solutions, Contribute to the local economy.

Wealth Management: Through its partnership with Manulife's insurance, we provide diversified wealth management services, including global securities trading, family office advisory and foreign exchange services.

Secure deposit box: Provide secure storage service, suitable for customers to store valuables.

Cross-border finance: Provide professional services in the Guangdong-Hong Kong-Macao Greater Bay Area, especially to provide flexible financial support for cross-border customers. Banks use regular promotions, such as safe deposit box rental offers, to attract customer engagement and enhance customer stickiness.

Market Position & Accolades

HSBC occupies a strong position in Macau's financial market, with 8 branches and about 150 employees, serving both individual and corporate customers. In 2024, HSBC was awarded the "Best SME Bank in Macau" in recognition of its outstanding performance in customer service and contribution to the local market. In 2022, Fitch Ratings assigned its long-term international credit rating of "BBB+" with a stable outlook, reflecting its financial soundness and market recognition. Despite being constrained by US sanctions between 2005 and 2020, HSBC has successfully resumed operations, demonstrating its resilience and adaptability.

Conclusion

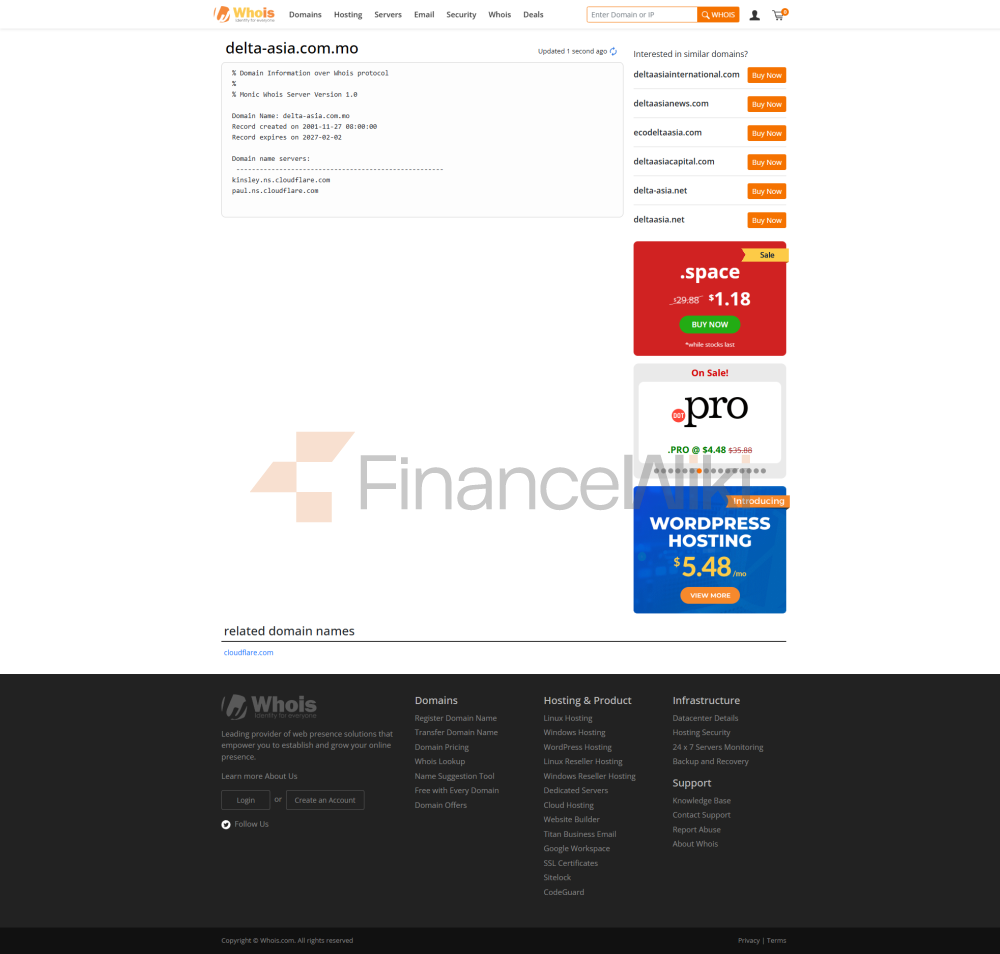

HSBC Bank Limited is a resilient pillar of Macau's financial market, renowned for its nearly 90-year history and focus on SME and cross-border financial services. It offers a wide range of deposit and loan products, including high-yield savings accounts, term deposits, and flexible mortgages and personal loans. In terms of digital services, the Delta Asia Mobile app provides a convenient user experience by supporting instant transfers, bill management, and foreign exchange transactions. Technological innovations, including biometric authentication and possible open banking API support, demonstrate its commitment to digital transformation. With its localised services, cross-border financial capabilities and industry accolades in 2024, HSBC continues to demonstrate strong competitiveness and influence in the financial markets of Macau and the Guangdong-Hong Kong-Macao Greater Bay Area. S.A.R.L.) is a Macau-based bank, now part of Delta Asia Financial Group, and is held by Stanley Au, one of the candidates for the first term of the city's chief executive. The company has operations in Hong Kong and Macau, with a primary focus on investment banking, commercial banking and insurance services.

history

Banco Delta Asia was founded in 1935 by Stanley Au's father, Au Wing Ngok, as Hang Seng Money Exchange Macau (later renamed Hang Seng Bank Macau). In 1962, Stanley Au expanded his business to Hong Kong and established Delta Asia Limited to operate the London gold business, becoming one of the first major gold dealers in Asia. Subsequently, the company was continuously upgraded and was allowed to operate deposits and letters of credit as a non-commercial bank. In 1980, Delta Asia Group took over HBanco Delta Asiaang Seng Bank Macau, and on December 28, 1993, Delta Asia Group officially changed its name to Delta Asia Financial Group, and its Hang Seng Bank Macau was renamed Banco Delta Asia. At present, the head office is located at Nos. 39-41 Shui Hang Mei Street, Central District (i.e. the junction with Pedor Chief's Street), and the administrative center is located in front of Pedro Pedro Square.

North Korean accounts and

runs On 15 September 2005, the United States Department of the Treasury advised the United States company to sever any ties with the bank on allegations that Banco Delta Asia was facilitating money laundering and facilitating the circulation of counterfeit banknotes by assisting North Korean customers in supporting terrorist activities. There was a run on Banco Delta Asia in Macau, with 300 million patacas withdrawn in just two days, accounting for one-tenth of Banco Delta Asia's total deposits, although banks said they had enough cash to meet them. Banco Delta Asia has been trading with North Korea since the 1970s, but has denied U.S. allegations, saying it has a regulatory mechanism in place to prevent money laundering. In the early hours of the next day, the Macao SAR Government issued a statement expressing its great concern over the incident and setting up a task force to investigate. In the evening, the Chief Executive of the Macao Special Administrative Region, Ho Hau Wah, cited the "Legal System of the Financial System" as the reason that "there is a serious irregularity in the withdrawal of funds by customers of Banco Delta Asia", and appointed the General Manager of Banco Nacional Ultramarino Macau Branch, So Yu Lung, and the Deputy Director of the Internal Audit Office of the Monetary Authority of Macao, Li Chin Cheng, to participate in the management of Banco Delta Asia, in order to consolidate public confidence in the financial system. For the first time, the Hong Kong Monetary Authority (HKMA) invoked the Banking Ordinance, which came into effect in 1995, and announced the appointment of Paul Brough, a partner of KPMG, as the manager to take over the services of the Hong Kong side and separate the assets from the parent company.

According to the BBC quoted by Xinhua Australia on February 18, 2006, the lawyer representing Banco Delta Asia said on February 16, 2006 that the bank had cut off all business with the DPRK and improved its anti-money laundering policy. Banco Delta Asia also urged U.S. authorities to halt investigations into the bank's alleged money laundering for the North Korean regime. On March 15, 2007, the United States Department of the Treasury announced that it would sever Banco Delta Asia's ties with the United States financial system within 30 days after it was confirmed that the former was laundering money for North Korea. Subsequently, the Macau SAR government issued a press release stating that "it will continue to take over Banco Delta Asia." No matter what happens, the SAR Government will take the necessary measures to protect the interests of depositors and maintain the stability of the financial system."

On September 28, 2007, at the end of the two-year management period, the Macau SAR Government decided to return the management of Banco Delta Asia to the original shareholders.

On 25 October 2008, the Hong Kong Monetary Authority (HKMA) announced on Friday, 2008 that the Monetary Authority, in consultation with the Financial Secretary, exercised its power under section 53F(1) of the Banking Ordinance ("the Ordinance") to revoke the Delta Asia Credit of Mr. Paul Jeremy Brough of KPMG Appointment of the Manager of Limited. Delta Asia Credit Limited is a deposit-taking company authorized in Hong Kong under the Ordinance and a subsidiary of Banco Delta Asia. The revocation of the appointment of the Manager will take effect on the same day.

Lifting of

sanctionsOn August 11, 2020, the U.S. Department of the Treasury's Financial Crimes Prevention Agency announced the unconditional lifting of sanctions against the bank for up to 15 years and the resumption of U.S. dollar settlement operations.