Bank Basic Information

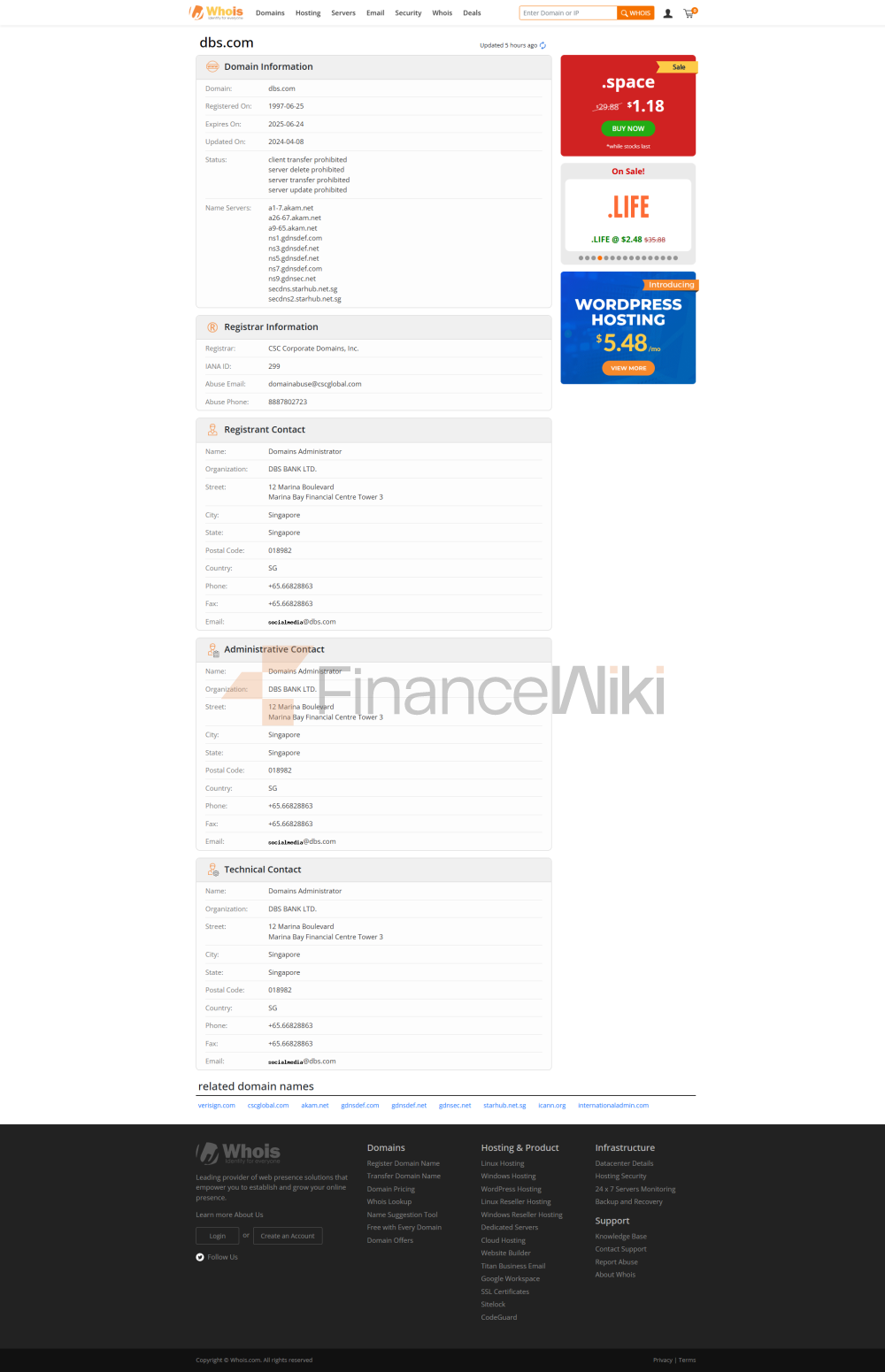

As a leading financial services group in Asia, DBS Bank Limited (DBS Bank Limited) is the largest commercial bank in Singapore, established on 16 July 1968 and headquartered in Singapore's Marina Bay Financial Centre. The bank is 29% owned by the Singapore Government through Temasek Holdings and is listed on the Singapore Exchange (stock code: D05). The service network covers 18 markets around the world, with more than 280 branches in key Asian markets (Singapore, Hong Kong, Chinese mainland, Indonesia, etc.), operating one of the densest ATM networks in Asia, with more than 1,000 self-service kiosks deployed in Singapore alone.

Regulatory & Compliance

DBS Bank is strictly regulated by the Monetary Authority of Singapore (MAS) and its Hong Kong branch is regulated by the Hong Kong Monetary Authority (HKMA). The bank is a member of the Singapore Deposit Insurance Corporation (SDIC) and enjoys deposit protection of up to S$75,000 per depositor. According to the 2023 MAS Regulatory Report, DBS has maintained a record of zero major compliance violations for five consecutive years, and in 2022, it received a special recognition from MAS for upgrading its anti-money laundering system.

Financial health

According to the latest financial report (as of 2023Q4), DBS Bank's capital adequacy ratio reached 14.9%, far exceeding the Basel III requirement of 10.5%; The non-performing loan ratio remained at an excellent level of 1.2%; The liquidity coverage ratio is 135%, which proves that it has strong short-term solvency. Net profit in 2023 reached a record high of S$10.3 billion.

Deposit & Loan Products

In the deposit sector, DBS Multiplier offers tiered interest rates of up to 3.8% (subject to salary crediting + credit card purchases, etc.). Featured products include:

SGD Time Deposit: 3.2% preferential interest rate for 12

monthsDBS Treasures USD Certificates of Deposit for high net worth customers: from US$50,000, 4.5% for 6 months

ESG-themed savings account: The deposit funds are specially used for green projects, and the interest rate plus 0.3%

loan business is provided, and the Hong Kong market mortgage provides a competitive interest rate of H+1.3% (capped at P-2.5%), supporting the "flexible repayment plan" - interest-only repayment for the first three years. The annual interest rate of DBS Cashline personal credit loan is as low as 3.88%, and the approval system can realize online loan disbursement in 10 minutes. It is worth noting that its "special loan for electric vehicles" has a preferential interest rate of 1.5 percentage points compared with traditional car loans.

List of common fees

Smart account management is user-friendly:

DIGI account waives the minimum balance requirement

Inter-bank ATM withdrawal fee: S$2 per transaction in Singapore

Real-time Cross-Border Transfer (DBS Remit) to 13 countries with no fees

Hidden Fees Reminder: 0.75% spreads are required for deposits and withdrawals of foreign currency notesDigital

Service Experience

DBS digibank APP on GooglePlay maintains a high rating of 4.8 (2024 data), and its AI customer service "Jarvis" can handle 85% of common queries. Innovative features include:

voiceprint authentication login system

, real-time supply chain finance platform (DBS RAPID),

digital wealth planning tool (NAV Planner

). Open API has connected more than 200 ecosystem partners

customer service quality

, and theomni-channel service network has performed well:

average response time of telephone customer service is 37 seconds (2023 internal audit data).

The response rate of social media consultation within 2 hours is 98%, the

complaint processing period is compressed to 3.5 working days

, and 11 languages such as Mandarin, Cantonese, and English are provided

dynamic security keypad + biometric two-factor authentication

real-time anti-fraud systemAnalyze 3,000+ transaction characteristics per secondThe

first bank in Asia to achieve ISO 27001:2022 certification

No major data breaches in

unique services and differentiation

Precise layout in market segments:

DBS Live Fresh student account: no account fee + 1% cashback on campus consumption

DBS Altitude Senior Citizen Banking: Large-print APP + Exclusive Health Insurance

Private Banking Threshold: From S$2 Million, Family Office Services AvailableGreen

Certificates of Deposit: Raising Funds for Special Investment in Renewable Energy Projects

Market Position and Accolades

According to Global Finance 2024 Ranking:

5th safest bank in the world

, Asia's best digital bank (8 consecutive years 2016-2023)

Global Systemically Important Bank (G-SIB) member

2023 Awarded the title of "Best SME Bank in ASEAN"

Bank History

DBS Bank Limited (SGX:D05), abbreviated as DBS Bank, is the largest commercial bank in Singapore and has been named "Asia's Safest Bank" by Global Finance magazine.

DBS Bank was originally known as "Development Bank of Singapore" and changed its current name on 21 July 2003 to reflect its changing role as a global bank.

DBS Bank's largest controlling shareholder is Temasek Holdings, Temasek HoldingsIt is Singapore's second largest sovereign wealth fund (after the Government Investment Corporation). As of March 31, 2018, Temasek, owned 29% of DBS Bank.

In 1968, the Development Bank of Singapore, abbreviated as DBS Bank, was established for the initial purpose of developing investment projects.

In November 2000, DBS Bank's

real estate developer, DBS,separated from DBS and merged with Baiteng Land, which was spun off from ST Holdings, to form